What is Federal?

Federation may be defined as a form of political association in which two or more states constitute a political unity with a common government but in which the member states retain a measure of internal autonomy. We can notice some important definitions of federal finance by experts.

Table of Contents

- 1 What is Federal?

- 2 Definition of Federal

- 3 Principles of Federal Finance

- 3.1 Principle of Independence and Responsibility

- 3.2 Principle of Adequacy and Elasticity

- 3.3 Administrative Economy and Efficiency

- 3.4 Principle of Uniformity and Equity

- 3.5 Principle of Accountability

- 3.6 Principle of Fiscal Access

- 3.7 Principle of Transfer of Resources

- 3.8 Principle of Federal Supervision

- 3.9 Principle of Integration and Coordination

- 4 Problems of Federal Finance

- 5 Types of Fiscal Imbalances

The federal system is a kind of political union under which two or more two states together form a government, but these state members keep their internal protection maintained. Federal is a kind of government whose main principle is to make central government together with two or more than two states for some permanent objectives.

Definition of Federal

These are some of the definitions of federal by professors:

A Federation is a form of government in which sovereignty or political power is divided between the Central and Local Governments so that each of them within its own sphere is independent of the other. Sir Robert Gorson

The federal principle is the method of dividing the powers so that the general and regional governments are each within their own sphere, co-ordinate and independent. Kenneth C. Wheare

Federalism is a special kind of decentralization where the division of powers ensuring safeguards of the units of the federation is constitutionally protected. Thus, the decision making at a particular level of government is based on the delegation or constitutionally guaranteed authority. Wallace E.Oates

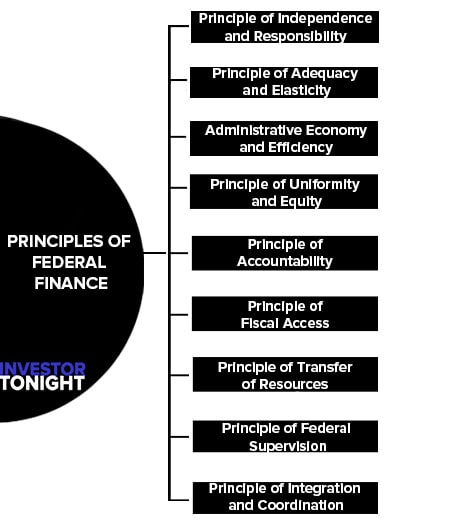

Principles of Federal Finance

These are principles of federal finance explained below:

- Principle of Independence and Responsibility

- Principle of Adequacy and Elasticity

- Administrative Economy and Efficiency

- Principle of Uniformity and Equity

- Principle of Accountability

- Principle of Fiscal Access

- Principle of Transfer of Resources

- Principle of Federal Supervision

- Principle of Integration and Coordination

Principle of Independence and Responsibility

The first principle for the efficient and smooth functioning of the federal financial system is that each government should have independent financial resources and should be responsible for raising resources for meeting its obligations.

Financial independence and responsibility are two fundamental requisites for the success of fiscal federalism. According to Professor. Adarker,” full freedom of financial operations must be extended to both Federal as well as State Governments in order that they may not suffer from a feeling of cramp in the discharge of their normal activities and in the achievement of their legitimate aspirations for the promotion of social and economic advancement.”

In other words, national and sub-national governments should be financially independent within their own sphere. Besides, each government should take the responsibilities of taxing, borrowing and raising resources in their spheres for performing their functions.

The authority which has the pleasing job of spending money should also do the unpleasant job of taxing it. Thus, “taxing autonomy and spending autonomy go hand in hand.”

Principle of Adequacy and Elasticity

The principle of adequacy means that the resources of the federal government and local governments should be adequate so that each layer of government can discharge its obligations laid upon it. The principle of elasticity means that there must be feasibility to expand its resources in response to its requirements especially during the period of internal and external crisis.

Administrative Economy and Efficiency

The administrative cost of finances should be a minimum and there should be no tax evasion. Administrative efficiency can be achieved if the resources are allocated properly between the Centre and the state governments.

Principle of Uniformity and Equity

The principle of Uniformity means that there should not be any discrimination among different units in a federation while distributing resources among various states. Thus, the contribution of each state in federal taxes should be according to ability or economic considerations.

Similarly, in order to achieve equity in taxation, a proper balance between direct and indirect taxes should be maintained. Therefore, there should be a proper adjustment between federal and state taxation to make the tax burden on all the citizens equitable as far as possible.

Principle of Accountability

Freedom and democracy are interwoven in a federal system. Therefore, the government in a federation should be accountable to its own legislature for its spending and collecting revenue decisions.

Principle of Fiscal Access

This implies that there should not be a bar on federal and state governments in tapping new sources of revenue within their own prescribed areas to meet the growing financial needs. That is, resources should grow with the expansion of responsibilities.

Principle of Transfer of Resources

This means that there should be provisions for transferring the resources from one state to the other. The ideal allocation of resources between federation and states should be in accordance with the principle of national minimum which can be achieved through the transfer of resources from rich countries to poor regions in a federal set-up.

Principle of Federal Supervision

There should be supervised by the federal government to ensure whether state governments follow the rules and regulations with regard to taxation and expenditure laid down by it from time to time.

Principle of Integration and Coordination

According to this principle, the whole financial system of a federation should be well-integrated and coordinated. Integration of financial systems of the federal government and state governments is essential in contemporary federations.

Similarly, coordination is essential for the smooth and efficient functioning of the federal financial system.

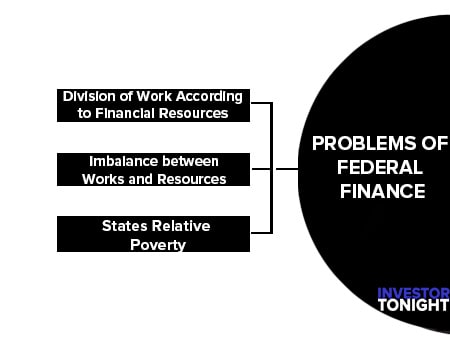

Problems of Federal Finance

This is the main problem problems of federal finance. These factors can be cleared on the following basis:

- Division of Work According to Financial Resources

- Imbalance between Works and Resources

- States Relative Poverty

Division of Work According to Financial Resources

According to the federal system, the centre and state have been given independent work in the constitution. So, it is necessary that every government will require financial resources in abundance for fulfilling their work, they will be provided resources in abundance, the tasks of national favour like security, international and foreign trade, postage and communication, railways etc.

Are given in the constitution, whereas state governments have been given tasks of local or regional favour such as education, health, social services, internal law system etc. have been given.

Economic resources must be available according to all these tasks and in which centre, state and local government should be independent to obtain their income and to spend. But, here this is important to mention that independent and coordinated level can not be maintained intensively between centre and states in any federal system.

Imbalance between Works and Resources

There is one more problem in federal finance that interference is created due to changes in social and technical between services and resources. It has been seen in the federal system that the sources of income in central government increases gradually, but, neither sources increase according to tasks of states, but their freedom is also at stake.

There has been enough increase in tasks of states from the concept of the welfare state in present, but they did not get money in abundance. In that condition such a system is required which can redistribute and coordinate resources in changing contribution and by providing more part to states in central tax revenue, establishing concurrent powers.

States Relative Poverty

Some state relative poverty produces a source of the financial problem. Due to differences in economic development and natural resources, all the states are not at an equal level so their financial problems are also different. Because of this difference, their social and administrative problems also differ from each other.

It is essential to remove all these differences which can be solved by giving grants to the states by the centre. Poor states should be given more grants as compare to other states. In our country, the finance committee recommends tax revenue and grant on a general-purpose per person income basis.

Types of Fiscal Imbalances

There are two types of fiscal imbalances in a federal nation. They are:

Vertical Fiscal Imbalance

The important characteristic of the federation is the co-existence of two main levels of governments having the capacity to raise revenues and responsibility to carry out various functions. The ideal situation a federation is to have a state of vertical balance.

That is a matching of expenditure responsibilities and taxing powers, enabling each level of government to be financially sufficient. The imbalance in this regard is termed as a vertical fiscal imbalance. That is, vertical fiscal imbalance refers to the difference between expenditures and revenues at different levels of government.

Vertical fiscal imbalance arises when one level of government financial resources exceeding its needs, whilst the other lacks sufficient resources to carry out its functions. This is a common feature of all multi-level governments.

A common solution to tackle this type of imbalance is a scheme of intergovernmental grants as a corollary to the allocation of taxing powers.

Horizontal Fiscal Imbalance

Horizontal Fiscal Imbalance is referred to as the existence of economic inequalities among the states such that, if they were all to have equal standards to public expenditure from their own revenue sources, some of them would have to set their taxes and other charges at a higher overall level to severity than others- a state of affair which is convenient to describe as inequalities of fiscal capacity.

In other words, horizontal fiscal imbalance refers to the mismatch between revenues and expenditures of governmental units within a level of government. Such an imbalance is related to horizontal economic imbalance.

It refers to inter-state economic disparities resulting from differences in area, climate, topography, soil and mineral resources, factor endowments etc. That is why, horizontal fiscal imbalances are not exogenous to the States’ fiscal management and do not, by themselves, provide a rationale for intergovernmental transfers.

Read More Articles

- What is Financial Management?

- What is Financial Statements?

- What is Financial Statement Analysis?

- What is Ratio Analysis?

- What is Funds Flow Statement?

- What is Cash Flow Statement?

- What is Working Capital?

- What is Cost of Capital?

- What is Capital Budgeting?

- What is Dividend Policy?

- What is Cash Management?

- What is Depository?

- What is Insurance?

- What is Financial System?

- International Financial Reporting Standards

- Stability of Dividends

- What is Factoring?

- Determinants of Working Capital

- Public Finance

- Public Expenditure

- What is Public Debt?

- Classification of Public Debt

- Federal Finance

- Effect of Public Debt

- Expenditure Cycle