What is Cost of Capital?

Cost of Capital is the rate that must be earned in order to satisfy the required rate of return of the firm’s investors. It can also be defined as the rate of return on investments at which the price of a firm’s equity share will remain unchanged.

Table of Contents

Each type of capital used by the firm (debt, preference shares and equity) should be incorporated into the cost of capital, with the relative importance of a particular source being based on the percentage of the financing provided by each source of capital.

Using of the cost a single source of capital as the hurdle rate is tempting to management, particularly when an investment is financed entirely by debt. However, doing so is a mistake in logic and can cause problems.

Cost of Capital Definition

‘Cost of Capital’ is a concept having manifold meanings. Cost of capital, for an investor is the measurement of disutility of funds in the present as compared to the return expected in the future. From the firm’s point of view, its meaning is somewhat different.

The cost of capital is the minimum required rate of earnings or the cut off rate for capital expenditure. – Solomon Ezra

The cost of capital is the rate of return a company must earn on an investment to maintain the value of the company. – M.J. Gorden

Cost of capital is the rate of return, the firm requires from investment in order to increase the value of the firm in the market rate. – John J. H.

The cost of capital is the minimum rate of return which a firm requires as a condition for undertaking an investment. – Milton H. Spencer

The cost of capital represents a cut off rate for the allocation of capital to investment of projects. It is the rate of return on a project that will leave unchanged the market price of the stock. – James C. Van Home

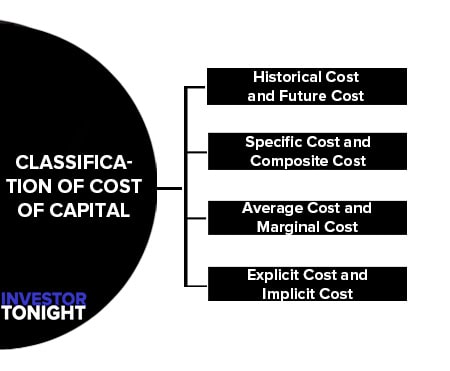

Classification of Cost of Capital

4 Classification of Cost of Capital are:

- Historical Cost and Future Cost

- Specific Cost and Composite Cost

- Average Cost and Marginal Cost

- Explicit Cost and Implicit Cost

Historical Cost and Future Cost

Historical cost are those which are calculated on the basis of existing capital structure. Future cost relates to the cost of funds intended to finance the expected project, historical costs are useful for analyzing the existing capital structures.

Future costs are widely used in capital budgeting and capital structure designing decisions.

Specific Cost and Composite Cost

The cost of individual source of capital is referred to as the specific cost and the cost of capital of all the sources combined is termed as composite cost. It is, thus the weighted cost of capital.

Average Cost and Marginal Cost

The average cost is the average of the various specific costs of the different components of capital structure at a given time. The average cost is relevant for overall investment decision as on enterprise employs a mix of different sources.

The marginal cost of capital is that average cost which is concerned with the additional funds raised by the firm. It is very important in capital budgeting decisions. Marginal cost tends to increase proportionately as the amount of debt increases.

Explicit Cost and Implicit Cost

An explicit cost is the discount rate which equates the present value of cash inflows with the present value of cash outflows. In other words, it is the internal rate of return of cash flows.

Implicit cost is also known as opportunity cost. It may be defined as the rate of return associated with the best investment opportunity for the firm. It is generally said that cost of retained earnings is an opportunity cost in the sense that it is the rate of return at which the shareholders could have invested these funds had they been distributed among them.

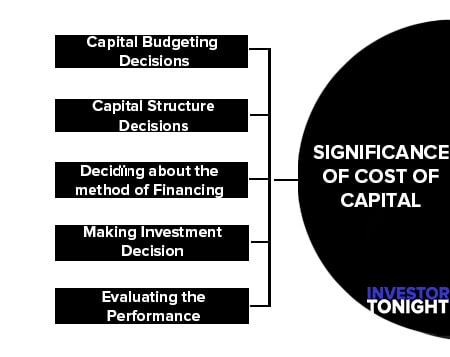

Significance of Cost of Capital

The cost of capital is very important concept in financial management. Prior to the development of the concept of cost of capital the problem was ignored or by passed.

- Capital Budgeting Decisions

- Capital Structure Decisions

- Deciding about the method of Financing

- Making Investment Decision

- Evaluating the Performance

Capital Budgeting Decisions

- Cost of capital may be used as the measuring road for adopting an investment proposal.

- The firm naturally, will choose the project which gives a satisfactory return on investment which would in no case be less than the cost of capital incurred for its financing.

- In various methods of capital budgeting, cost of capital is the key factor in deciding the project out of various proposals pending before the management.

- It measures the financial performance and determines the acceptability of all investment opportunities.

Capital Structure Decisions

- The cost of capital is significant in designing the firm’s capital structure.

- The cost of the capital is influenced by the chances in capital structure.

- A capable financial executive always keeps an eye on capital market fluctuations and tries to achieve the sound and economical capital structure for the firm.

- He may try to substitute the various methods of finance in an attempt to minimise the cost of capital so as to increase the market price and earning per share.

Deciding about the method of Financing

- A capable financial executive must have knowledge of the fluctuations in the capital market and should analyze the rate of interest on loans and normal dividends and normal dividend rates in the market from time to time.

- Whenever company requires additional finance, he may have a better choice of the source of finance which bears the minimum cost of capital.

- Although cost of capital is an important factor in such decisions, but equally important the considerations of relating control and of avoiding risk.

- Performance of Top Management

- The cost of capital can be used to evaluate the financial performance of the top executives.

- Evaluation of the financial performance will involve a comparison of actual profitability of the projects and taken with the projected overall cost of capital and an appraisal of the actual cost incurred in raising the required funds.

Making Investment Decision

- Cost of capital is used as discount factor in determining the net present value.

- Similarly, the actual rate of return of a project is compared with the cost of capital of the firm.

- Thus the cost of capital has a significant role in making investment decisions.

Evaluating the Performance

- Cost of capital is the benchmark of evaluating the performance of different departments.

- The department is considered the best which can provide the highest positive met present value to the firm.

- The activities of different departments are expanded or dropped out on the basis of their performance.

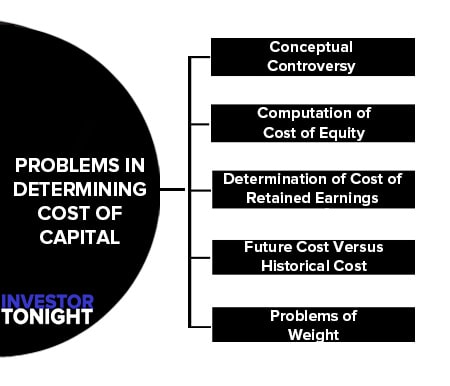

Problems in Determining Cost of Capital

The determination of cost of capital is not an easy task. The financial manager is confronted with a large number of problems.

These problems can briefly be summarized as follows:

- Conceptual Controversy

- Computation of Cost of Equity

- Determination of Cost of Retained Earnings

- Future Cost Versus Historical Cost

- Problems of Weight

Conceptual Controversy

There is major controversy whether or not the cost of capital is dependent upon the method and level of financing by the company.

According to traditional theorists, a firm can change its overall cost of capital by changing debt-equity mix. On the other hand, the modern theorists, reject the traditional view and holds that cost of capital is independent of the method and level of financing.

Computation of Cost of Equity

Determination of cost of equity is a difficult task because the equity shareholders value the equity shares of company on the basis of a large number of factors, financial as well as psychological.

Determination of Cost of Retained Earnings

The cost of retained earnings is determined according to the approach adopted for computing the cost of equity shares which is it self a controversial problem.

Future Cost Versus Historical Cost

It is argued that for decision making purposes, the historical cost is not relevant. The future cost should be considered. It, therefore, creates another problem whether to consider marginal cost of capital or average cost of capital.

Problems of Weight

The assignment of weights to each type of funds is a complex. The finance manager has to make a choise between the book value to each source of funds and the market value of each source of funds. The result would be different in each case.

Read More Articles

- What is Financial Management?

- What is Financial Statements?

- What is Financial Statement Analysis?

- What is Ratio Analysis?

- What is Funds Flow Statement?

- What is Cash Flow Statement?

- What is Working Capital?

- What is Cost of Capital?

- What is Capital Budgeting?

- What is Dividend Policy?

- What is Cash Management?

- What is Depository?

- What is Insurance?

- What is Financial System?

- International Financial Reporting Standards

- Stability of Dividends

- What is Factoring?

- Determinants of Working Capital

- Public Finance

- Public Expenditure

- What is Public Debt?

- Classification of Public Debt

- Federal Finance

- Effect of Public Debt

- Expenditure Cycle