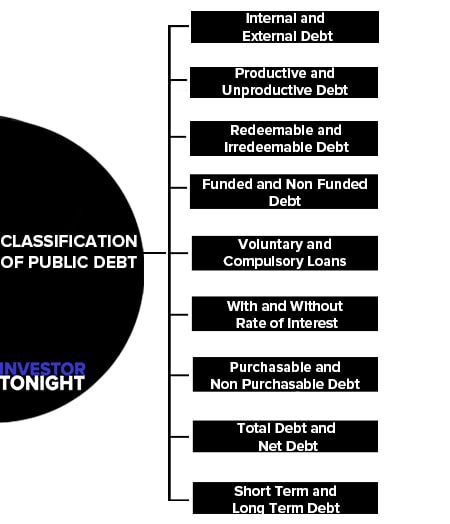

Classification of Public Debt

Economists have divided debt on the basis of use, target, time limit and terms of payment. The different types of public debt are following:

- Internal and External Debt

- Productive and Unproductive Debt

- Redeemable and Irredeemable Debt

- Funded and Non Funded Debt

- Voluntary and Compulsory Loans

- Voluntary Debt

- With Rate of Interest and Without Rate of Interest

- Total Debt and Net Debt

- Short Term and Long Term Debt

Table of Contents

- 1 Classification of Public Debt

- 1.1 Internal and External Debt

- 1.2 Productive and Unproductive Debt

- 1.3 Redeemable and Irredeemable Debt

- 1.4 Funded and Non Funded Debt

- 1.5 Voluntary and Compulsory Loans

- 1.6 With Rate of Interest and Without Rate of Interest

- 1.7 Purchasable and Non Purchasable Debt

- 1.8 Total Debt and Net Debt

- 1.9 Short Term and Long Term Debt

Internal and External Debt

Internal Debt

Internal debts are those public debts taken from the country inside, but external debt is a debt taken from foreign governments. Foreign people and international organizations, In Dalton’s words, “A debt is internal if given by those people or organizations living in that area that is controlled by the local office of taking debt.

External Debt

A debt is external if given by those people and organizations living outside of that area”. By the payment of interest on foreign debt, there is a reduction in net income of debtor country because their income’s big part goes to the foreign country, but it doesn’t affect at the time of paying interest on internal debts.

Whether the interest on internal debts leave on taxpayers or taken from them and paid as a form of interest on war debts, it does not affect the national income of the country, which becomes stable like before. This is a form of the method by which money is taken from the taxpayer one pocket is been debt in another pocket.

Productive and Unproductive Debt

This classification depends upon the use of public debt. Debts can be used for production works and unproductive debt. Productive debts are those debts that are used in those plans which provide income, like railway, plans of electricity and the plans of irrigation.

The income got from these plans can be used for the payment of yearly interest and for the payment of Principle. So, productive or reproductive debts are those debts where are same costs or the assets of more cost kept. By this, productive debt never put pressure on the government and taxpayers.

On the other side, unproductive debts are those debts used in that plans, no income is provided, for example, war. So, unproductive debts are those debts, no assets are in the back. The main reason for unproductive debt is not only in war but at some point the losses of interest is also the reason.

Redeemable and Irredeemable Debt

Redeemable Debt

Redeemable debts are those debts the government promises that he will pay back the debt on a fixed date. These debts are also called terminable debt.

Irredeemable Debt

Irredeemable Debts are those debts that are without any promise they are called irredeemable or perpetual debt. When debts are not returned then the governments have to do the same arrangement to pay back the debt.

If the government decides that these debts will be paid back from the tax income, which is the best way in almost all the situations for this work they have to put new taxes. So in the condition of redeemable debts government have to pay both interest and principal amount on a fixed future coming date.

Funded and Non Funded Debt

Government debt can also be divided into the form of funded and non-funded debt:

Funded Debts

Funded debts are long term debts. Payment of these debts can be done within one year or it can be possible, not to give any promise regarding this in other words funded debts are those debts, in which the payments are given within one year.

Unfunded Debts

Treasury bonds are unfunded debts because these debts are given for three or six months and their time period is not more than one year. Even then, this is clear that in the condition of funded debts, government is responsible to pay the regular payment of interest to the debt payer; yes, their basic money payment is totally left on the government.

Voluntary and Compulsory Loans

Voluntary Debt

Voluntary Debt: Government debts are normally of voluntary nature and to persons and organizations controlled by the government bonds are voluntary.

Compulsory Loans

Compulsory Loans: – Today compulsory loans are not much popular but in the condition of war, the government are can put pressure on people to give loans. Government can also help in the condition of depression so that work power from the hands of people could be reduced and stop the increasing rates.

With Rate of Interest and Without Rate of Interest

On loans with a rate of interest, the government gives interest on a fixed rate to the loan taker after a fixed time period, but without a rate of interest, loans government don’t have to pay any interest.

Purchasable and Non Purchasable Debt

In purchasable debts, it includes government securities; whose sale and purchase is not possible independently. On the opposite, those securities are included in non-purchasable debts, whose sale and purchase is not possible in the open market and can only be given back to the government at a fixed rate.

Total Debt and Net Debt

On a fixed time whatever debts governments have, the total of all is called total debt. If the government collects any fund to pay back the debts then the amount of that fund is subtracted from the total debt and whatever is left is called net debt.

Short Term and Long Term Debt

When government takes debt for a short period, then this is called short term debt. These debts are paid back in the time period within a year that is to be taken to complete the tenure of debts. When governments take debt for a very long period then this is called long term debt.

The time of giving it back is not fixed. At that time the debt is paid back, the debt giver got regular interest.

Read More Articles

- What is Financial Management?

- What is Financial Statements?

- What is Financial Statement Analysis?

- What is Ratio Analysis?

- What is Funds Flow Statement?

- What is Cash Flow Statement?

- What is Working Capital?

- What is Cost of Capital?

- What is Capital Budgeting?

- What is Dividend Policy?

- What is Cash Management?

- What is Depository?

- What is Insurance?

- What is Financial System?

- International Financial Reporting Standards

- Stability of Dividends

- What is Factoring?

- Determinants of Working Capital

- Public Finance

- Public Expenditure

- What is Public Debt?

- Classification of Public Debt

- Federal Finance

- Effect of Public Debt

- Expenditure Cycle