What is Public Finance?

Public finance is the branch of economics. It is made of two words as public and finance. The term public means government and finance mean the science of management of money. So literally public finance means the study of the allocation of economic resources for achieving the goals of public affairs.

Table of Contents

Thus, public finance is the study of the allocation and management of resources and technology for achieving the goals of public organizations. However, literally, it seems to have a narrow meaning but its scope and definition have been widening and changing through time.

In public finance, we study the finances of the Government. Thus, public finance deals with the question of how the Government raises its resources to meet its ever-rising expenditure. Public finance is the study of the role of the government in the economy.

It is the branch of economics that assesses the government revenue and government expenditure of the public authorities and the adjustment of one or the other to achieve desirable effects and avoid undesirable ones.

As Dalton puts it, “public finance is “concerned with the income and expenditure of public authorities and with the adjustment of one to the other.” Accordingly, the effects of taxation, Government expenditure, public borrowing, and deficit financing on the economy constitute the subject matter of public finance.

Definition of Public Finance

F.E. Taylor defines it as, “Public finance deals with the finance of the public as an organized group under the institution of the government. It, therefore, deals only with the finance of the government. The finance of the government includes the raising and disbursement of government funds. Public finance is concerned with the operation of fiscal science, its policies are fiscal policies, its problems are fiscal problems. Thus, “Public Finance is the part of political economy which discusses the way in which government obtains revenue and manages them”.

According to Findlay Sirras and C.F. Bastable, “Public finance is the science which is concerned with the matter in which public authorities obtain their income and spend it.”

According to C.C. Plehm, “Public finance is the science which deals with the activity of the statesman in obtaining and applying of the materials means necessary for fulfilling the proper functions of the states.”

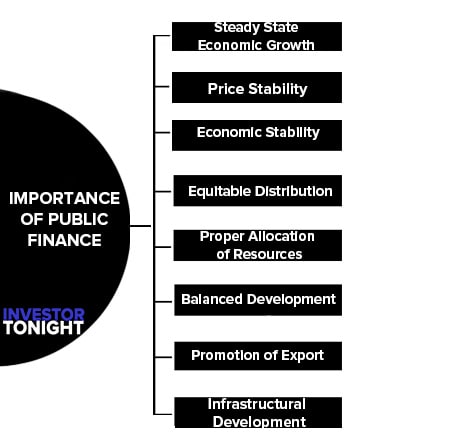

Importance of Public Finance

The major importance of public finance are listed below as:

- Steady State Economic Growth

- Price Stability

- Economic Stability

- Equitable Distribution

- Proper Allocation of Resources

- Balanced Development

- Promotion of Export

- Infrastructural Development

Steady State Economic Growth

Public finance is important to achieve a sustainable high economic growth rate. The government uses fiscal tools in order to bring an increase in both aggregate demand and aggregate supply. The tools are taxes, public debt, and public expenditure, and so on.

Price Stability

The government uses public finance in order to overcome form inflation and deflation. During inflation, it reduces the indirect taxes and general expenditures but increases direct taxes and capital expenditure. It collects internal public debt and mobilizes for investment. In case of deflation, the policy is just reversed.

Economic Stability

The government uses fiscal tools to stabilize the economy. During prosperity, the government imposes more taxes and raises the internal public debt. The amount is used to repay foreign debt and invention. The internal expenditures are reduced. During the recession, the case is just reversed.

Equitable Distribution

The government uses the revenues and expenditures of itself in order to reduce inequality. If there is high disparity it imposes more taxes on income, profit, and properties of rich people and on the goods they consume. The money collected is used for the benefit of poor people through subsidies, allowance, and other types of direct and indirect benefits to them.

Proper Allocation of Resources

Government finance is important for the proper utilization of natural, manmade, and human resources. For it, on the production and sales of less desirable goods, the government imposes more taxes and provides subsidies or imposes taxes lightly on more desirable goods.

Balanced Development

The government uses the revenues and expenditures in order to erase the gap between urban and rural and agricultural and industrial sectors. For it, the government allocates the budget for infrastructural development in rural areas and direct economic benefits to the rural people.

Promotion of Export

The government promotes the export by imposing less tax or exempting from the taxes or providing subsidies to the export-oriented goods. It may supply the inputs at subsidized prices. It imposes more taxes on imports and so on.

Infrastructural Development

The government collects revenues and spends for the construction of infrastructures. It has to keep the peace, justice, and security too. It has to bring socio-economic reformation too. For all these things it uses the revenues and expenditures as fiscal tools.

Difference between Public and Private Finance

The following are the main points of difference between public and private finance:

- Adjustment between Income and Expenditure

- Elasticity of Finance

- Differences in Objectives

- Nature of Expenditure

- Compulsion

- Law of Equi-marginal Utility

- Present Vs Future

- Nature of the Budget

- Nature of Borrowing

Adjustment between Income and Expenditure

An individual determines his expenditure on the basis of his income. He prepares his family budget on his expected income during the month.

On the other hand, the government first estimates its expenditure and then finds out means to raise the necessary income. As pointed out by Bastable, ‘The individual says, I can spend so much, the Finance Minister says, ‘I have to raise so much’.

Elasticity of Finance

Public Finance is more elastic than private finance. There is not much scope for changes in private finance while drastic changes can be made in government finance. For example, a private individual cannot affect any special increase in his income. As against this, the government can increase its income by imposing fresh taxes on the people.

Differences in Objectives

There is a fundamental difference in the objective of private and public finance. The motive of private expenditure is personal benefit whereas the objective of public expenditure is a social benefit. An individual always tries to save and a firm to earn profit.

But there are no such considerations on the part of the government, except the public welfare. However, there are some public enterprises that are run on profits that are utilized for public welfare.

Nature of Expenditure

There are differences in the nature of expenditure between the two”. An Individual’s expenditure is governed by his habits, customs, fashions, etc on the other hand. The government expenditure depends on its economic and social policies, like removing unemployment and poverty, reducing income inequalities, providing’ infrastructure facilities, etc.

Compulsion

There is compulsion in public finance. People have to pay taxes. If they do not pay, they are punished by fine and imprisonment. BA an individual or firm cannot force anybody to pay him money. He can file a suit in court. But even then he may not receive his money back.

The same is the case with loans. The government can force the people to lend it during war or emergency. But an individual cannot compel any person to lend him money.

Law of Equi-marginal Utility

The private individual spends his me on various items in such a manner as to secure equal marginal utilities from them. It is only by equalizing the various marginal utilities that he can secure maximum utility out of his expenditure.

The government, on the contrary, does not give as much importance to this law as a private individual does. Modern governments sometimes incur certain types of expenditure from which they do not derive any advantage, but they o incur this expenditure to satisfy certain sections of the community.

Present Vs Future

An individual is more concerned with his present needs and tries to satisfy them. Life being uncertain and short, he has his immediate gain or profit in view. On the other hand, the government is a permanent organization.

Only the ruling party changes it is concerned not only with the welfare of the present generation but also with future generations. It, therefore, undertakes and spends on those activities which also benefit future generations.

Nature of the Budget

A surplus budget is always good for a private individual. Bin a surplus budget may not be good for the government. It implies two things:

- The government is levying more taxes on the people than is necessary.

- The government is not spending as much on the welfare of the public as it should. Keynes supported a deficit budget to meet the situation created by the depression. Further, the government budget is passed by the parliament. But the budget of an individual or firm is a private affair without any controlling authority.

Nature of Borrowing

In the case of an individual, there can be no internal borrowing”. An individual cannot borrow from himself. He can borrow only from an external agency. The State, however, can borrow both from internal as well as external sources. It borrows not only from its own citizens but also from foreigners.

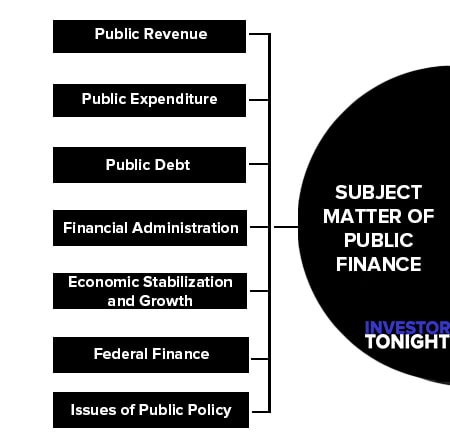

Subject Matter of Public Finance

The subject matters of Public Finance can be broadly classified into five categories:

- Public Revenue

- Public Expenditure

- Public Debt

- Financial Administration

- Economic Stabilization and Growth

- Federal Finance

- Issues of Public Policy

Public Revenue

The income of the states is referred to as Public Revenue. In this branch, we study the various ways of raising revenue by the public bodies. We also study the principles and effects of taxation and how the burden of taxation is shared among the various classes of society etc.

Public Expenditure

It deals with the principles and problems relating to the allocation of public spending. We study the fundamental principles governing the flow of public funds into different channels, classification, and justification of public expenditure; expenditure policies of governments and the measures adopted for the welfare state, etc.

Public Debt

The governments borrow when its revenue falls short of its expenditure. Public debts is a study of various principles and methods of raising debts and their economic effects. It also deals with the methods of repayments and management of public debts.

Financial Administration

It deals with the methods of Budget preparation, various types of Budgets, war Finance, Development Finance, etc. Thus, financial administration refers to the mechanism by which the financial functions are carried on. In other words, financial administration studies the organizing and disbursing of the finances of the State.

Economic Stabilization and Growth

The use of Public revenue and Public expenditure to secure stability in levels of prices by controlling inflationary as well as deflationary pressures is studied. Similarly, the income and expenditure policies adopted by the government so as to attain full employment, optimum use of resources, equitable distribution of income, etc. are also studied.

Federal Finance

The existence of a multilayer (or multi-level) system of government necessitates a corresponding division of functions and resources between different layers as also issues and problems relating to intergovernmental financial flows, financial imbalances, and their rectification.

They also raise issues relating to vertical and horizontal equity and financial balance. Federal finance has, therefore, been an integral part of modern public finance.

Issues of Public Policy

A modern government is expected to deal with a host of socio-economic issues that keep cropping up continuously. Such issues are of diverse nature and have financial implications. They may be treated on a stand-alone basis, or as integral parts of other issues.

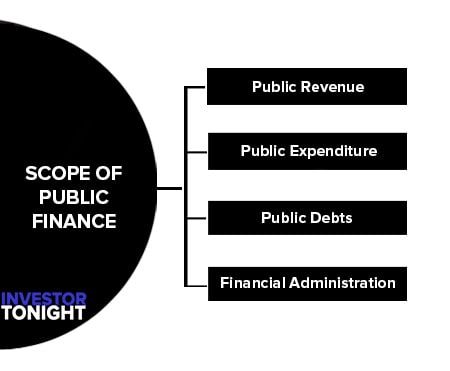

Scope of Public Finance

The scope of public finance into four areas which include public income, Public expenditure public debt, and financial administration:

Public Revenue

The study of various sources of government’s income, the principles guiding the raising of income (e.g. canons of taxation), their relative merits and demerits, and their effects on the economy (e.g. impact and incidence of taxation).

Public Expenditure

The study of the manner in which public expenditure is classified, the principles guiding public expenditure (canons of public expenditure), causes of growth, and effects of public expenditure.

Public Debts

The study of public debt forms a very important part of public finance in modern times as governments are increasingly resorting to debt to meet the growing needs of the people. Public finance studies the sources, burden, and impact of public debt.

Financial Administration

This includes the study of the preparation, passing, and implementation Of the budget, budgetary policies and their socio-economic impact, inter-governmental financial relations, fiscal management, and fiscal responsibility.

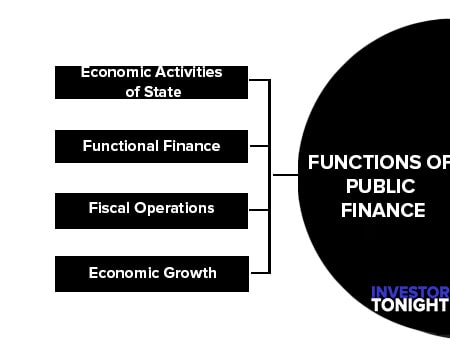

Functions of Public Finance

The functions of public finance all activities with regard to collection of revenue and expenditure on various activities. Earlier theories of public finance narrow the definition of the functions to be carried out by public authorities.

It is clear that the area of state activity has enlarged over the past two decades which increased the functions and scope of public finance:

Economic Activities of State

The scope of public finance was confined to the traditional functions of the state, that is, provision of defense, law and order, justice, and civic amenities.

But with the emergence of welfare states the scope of public finance was broadened public finance now includes the use of the budget as a tool to correct distortion in the economy, mobilize resources, maintain price stability create employment prevent market failure, achieve growth equity and maximize social welfare.

Functional Finance

The government should maintain a reasonable level of aggregate demand at all times by using the budget. Most developed economies followed functional finance policies in order to control trade cycles. Developing countries followed such policies to promote economic growth.

Fiscal Operations

The scope of public finance includes fiscal operations and their objectives. Fiscal operations refer to raising public revenue, spending to achieve certain goals, and financial administration. For such operations, the government uses fiscal tools like taxation, public expenditure, and public debt.

The following are the objectives of fiscal operations:

Allocation of Resources

The most important objectives of fiscal operations is to determine how the Country’s resources will be allocated to different sectors of the economy in order to achieve predetermined goals. The national budget determines how funds are allocated to different heads of expenses.

The policy of public expenditure is used by the government to directly undertake resource allocation for different sectors. On the other hand, the government can use taxation and subsidies to indirectly influence resource allocation.

Distribution

Fiscal operations can be effectively used to affect the distribution of national income and resources Taxation and public expenditure policies are used by the government to reduce inequalities. Progressive direct taxation imposes a heavier burden on the rich than the poor.

Public expenditure on social infrastructure and subsidies on food housing, health, and education help reduce income inequality.

Stabilization

Developed economies experience business cycles. Economic stability implies an absence of sharp cyclical movements in the form of booms and depressions. To bring about such stability, counter-cyclical fiscal operations are adopted.

To counter depression and recession, government expenditure is increased to generate employment and taxes are reduced to encourage consumption and investment. During inflation, public expenditure is reduced and taxes are raised.

Economic Growth

In developing and underdeveloped economies, the objectives of fiscal operations are more promotional in nature. The basic focus of fiscal operations in such economies is the use of budgetary operations to achieve growth and development.

This is done by encouraging capital formation and investments through public expenditure and tax incentives to private sectors.

Read More Articles

- What is Financial Management?

- What is Financial Statements?

- What is Financial Statement Analysis?

- What is Ratio Analysis?

- What is Funds Flow Statement?

- What is Cash Flow Statement?

- What is Working Capital?

- What is Cost of Capital?

- What is Capital Budgeting?

- What is Dividend Policy?

- What is Cash Management?

- What is Depository?

- What is Insurance?

- What is Financial System?

- International Financial Reporting Standards

- Stability of Dividends

- What is Factoring?

- Determinants of Working Capital

- Public Finance

- Public Expenditure

- What is Public Debt?

- Classification of Public Debt

- Federal Finance

- Effect of Public Debt

- Expenditure Cycle