What is Redemption of Debentures?

The money raised through the issue of debentures is a loan to the company and must be repaid on the specified date and in a specified manner. Normally the time and mode of repayment are indicated in the prospectus at the time of issue of debentures by the company. The repayment of the number of debentures is called the redemption of debentures.

Table of Contents

Redemption of debentures means repayment of the number of debentures issued by a company. It refers to the discharge of liability in respect of the debentures of a company. According to Section 71 (1) of the Companies Act, 2013, a company may issue debentures with an option to convert such debentures into shares, either wholly or partly at the time of redemption.

Provided that the issue of debentures with an option to convert such debentures into shares, wholly or partly, should be approved by a special resolution.

According to Rule 18 of the Companies (Share Capital and Debentures) Rules, 2014, the company shall not issue secured debentures, unless it complies with the following conditions, namely:- An issue of secured debentures may be made, provided the date of its redemption shall not exceed ten years from the date of issue.

Provided that a company engaged in the setting up of infrastructure projects may issue secured debentures for a period exceeding ten years but not exceeding thirty years. Therefore, for secured debentures, the date of Redemption of debentures shall not exceed 10 years from the date of issue.

A company engaged in the setting up of infrastructure projects may issue secured debentures up to a redemption period of thirty years. From the above discussion, we have come to know that the debentures issued by a company may be redeemed after a fixed number of years or any time after a certain number of years has elapsed since their issue.

Debenture Redemption Reserve (DRR)

Section 71(4) provides that where debentures are issued by a company under this section, the company shall create a debenture redemption reserve account out of the profits of the company available for payment of dividend and the amount credited to such account shall not be utilized by the company except for the redemption of debentures.

Such an arrangement would ensure that the company will have sufficient funds/ reserves for the redemption of debentures.

Rule 18(7) of Companies (Share Capital and Debentures) Rules, 2014 prescribes the following conditions regarding the creation of Debenture Redemption Reserve for the purpose of redemption of debentures:

- The Debenture Redemption Reserve shall be created out of the profits of the company available for payment of a dividend.

- The company shall create Debenture Redemption Reserve (DRR) in accordance with following conditions:

- No DRR is required for debentures issued by All India Financial Institutions (AIFIs) regulated by Reserve Bank of India and Banking Companies for both public as well as privately placed debentures.

For other Financial Institutions (FIs) within the meaning of clause (72) of section 2 of the Companies Act, 2013, DRR will be as applicable to NBFCs registered with RBI. - For NBFCs registered with the RBI under Section 45-IA of the RBI (Amendment) Act, 1997, ‘the adequacy’ of DRR will be 25% of the value of debentures issued through public issue as per present SEBI (Issue and Listing of Debt Securities) Regulations, 2008, and no DRR is required in the case of privately placed debentures.

- For other companies including manufacturing and infrastructure companies, the adequacy of DRR will be 25% of the value of debentures issued through public issue as per present SEBI (Issue and Listing of Debt Securities), Regulations 2008 and also 25% DRR is required in the case of privately placed debentures by listed companies.

For unlisted companies issuing debentures on private placement basis, the DRR will be 25% of the value of debentures.

- No DRR is required for debentures issued by All India Financial Institutions (AIFIs) regulated by Reserve Bank of India and Banking Companies for both public as well as privately placed debentures.

- Every company required to create Debenture Redemption Reserve shall on or before the 30th day of April in each year, invest or deposit, as the case may be, a sum which shall not be less than fifteen percent, of the amount of its debentures maturing during the year ending on the 31st day of March of the next year, in any one or more of the following methods, namely:

- In deposits with any scheduled bank, free from any charge or lien.

- In unencumbered securities of the Central Government or of any State Government.

- In unencumbered securities mentioned in sub-clauses (a) to (d) and (ee) of section 20 of the Indian Trusts Act, 1882.

- In unencumbered bonds issued by any other company which is notified under sub-clause (f) of section 20 of the Indian Trusts Act, 1882.

- The amount invested or deposited as above shall not be used for any purpose other than for redemption of debentures maturing during the year referred above: Provided that the amount remaining invested or deposited, as the case may be, shall not at any time fall below fifteen per cent of the amount of the debentures maturing during the year ending on the 31st day of March of that year.

- In deposits with any scheduled bank, free from any charge or lien.

- In case of partly convertible debentures, Debenture Redemption Reserve shall be created in respect of non-convertible portion of debenture issue in accordance with this sub-rule.

- The amount credited to the Debenture Redemption Reserve shall not be utilised by the company except for the purpose of redemption of debentures.

Debenture Redemption Reserve Investment

The fund deposited in the Debenture Redemption Reserve can be invested in corporate or Government Bonds or deposited in a scheduled bank and such investment is termed as Debenture Redemption Reserve Investment.

Any income earned from these investments is reinvested together with the fixed appropriated amount for the purpose in subsequent years.

At the time of redemption of debentures, the fund invested through Debenture Redemption Reserve Investment is encashed and the amount so obtained is used for the redemption of debentures. Any profit or loss made on the encashment of Debenture Redemption investments is transferred to Debenture Redemption Reserve.

Balance in Debenture Redemption Reserve

The balance to the credit of Debenture Redemption Reserve, in certain circumstances, may either be more or less as compared to the number of debentures that are proposed to be redeemed.

- If it is in excess, the amount is transferred to the Capital Reserve.

- On the other hand, if it is short, the deficit is made up by the transfer from Profit and Loss A/c.

Terms of Redemption of Debentures

The debentures may be redeemable:

At Par

At Par Debentures are redeemed par i.e. at face value; face value of the debentures will be repaid on redemption.

At Premium The debentures may be redeemable at premium. In such case at time of redemption debenture hold will be paid face value of debentures plus premium on redemption of debentures. For example, a debenture of face value of Rs.100 may be redeemable at Rs.110 such premium payable on redemption is a capital loss for the company. Such premium on redemption must be provided as a liability at the time of issue of debenture.

At discount

At discount: At the time of redemption of debentures, the debenture-holders are paid something less than the face value of the debenture practically such debenture are not issued by any company. However the company may purchased it own debentures in open market when debentures are traded at less than face value, and redeemed own debentures at discount.

The amount to be paid to debentures holders depends upon the terms of issue. According to the terms of issue, the debentures may be redeemable fully in one lump sum at a given time or in installment or by drawing lots.

Journal Entries of Debenture Redemption

The necessary journal entries passed in the books of a company are given below:

| S.No./Date | Particulars | Debit | Credit |

| 1. | At the end of 1st Year (a) For setting aside the fixed amount of profit for redemption: Profit and Loss A/c Dr. To Debenture Redemption Reserve A/c (b) For investing the amount set aside for redemption: Debenture Redemption Reserve Investment A/c Dr. To Bank A/c | ——- | —— |

| 2. | At the end of second year and subsequent years other than last year (a) For receipt of interest on Debenture Redemption Reserve: Investments Bank A/c Dr. To Interest on Debenture Redemption Reserve Investment A/c (b) For transfer of Interest on Debenture Redemption Reserve Investment (DRRI) to Debenture Redemption Reserve Account Interest on Debenture: Redemption Reserve Investment A/c Dr. To Debenture Redemption Reserve A/c (c) For setting aside the fixed amount of profit on redemption: Profit and Loss A/c Dr. To Debenture Redemption Reserve A/c (d) For investments of the amount set aside for redemption and the interest earned on DRRI: Debenture Redemption Reserve Investment A/c Dr. To Bank A/c | —— | —— |

| 3. | At the end of last year (a) For receipt of interest: Bank A/c Dr. To Interest on Debenture Redemption Reserve Investment A/c (b) For transfer of interest on Debenture: Redemption Reserve Investment to Debenture Redemption Reserve Investment A/c Dr. Interest on Debenture Redemption Reserve Investment A/c Dr. To Debenture Redemption Reserve A/c (c) For setting aside the fixed amount of profit for redemption: Profit and Loss A/c Dr. To Debenture Redemption Reserve A/c (d) For encashment of Debenture Redemption Reserve Investments: Bank A/c Dr. To Debenture Redemption Reserve Investment A/c (e) For the transfer of Profit/Loss on realisation of Debenture Redemption Reserve Investments: (i) In case of Profit Debenture Redemption Reserve Investment A/c Dr. To Debenture Redemption Reserve A/c Or (ii) In case of Loss Debenture Redemption Reserve A/c Dr. To Debenture Redemption Reserve Investment A/c (f) For amount due to debentureholders on redemption: Debenture A/c Dr. To Debentureholder A/c (g) For payment to debentureholders: Debentureholders A/c Dr. To Bank A/c | ——- | ——- |

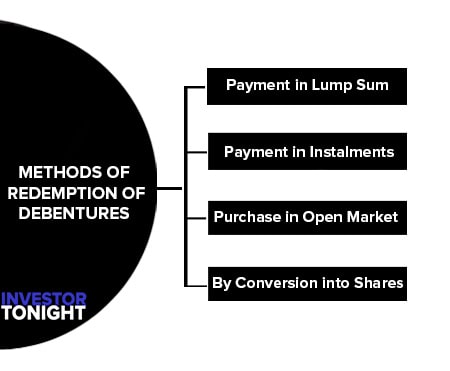

Methods of Redemption of Debentures

Redeemable debentures are redeemed either at par or at a premium and there are four methods of redemption of debentures. These are:

Payment in Lump Sum

The company redeems the debentures by paying the amount in lump sum to the debenture holders at the maturity thereof as per terms of issue.

Payment in Instalments

Under this method, normally redemption of debentures is made in instalments on the specified date during the tenure of the debentures.

The total amount of debenture liability is divided by the number of years. It is to note that the actual debentures redeemable are identified by means of drawing the requisite number of lots out of the debentures outstanding for payment.

Purchase in Open Market

When a company purchases its own debentures for the purposes of cancellation, such an act of purchasing and cancelling the debentures constitutes redemption of debentures by purchase in the open market.

A company may issue convertible debentures giving option to the debenture holders to exchange their debentures for equity shares or preference shares in the company. The debenture holders are given the right on certain dates or before a specified date to exchange the debentures for the shares.

A certain number of shares are offered for each debenture. When the debenture-holders exercise this option and the company issues the shares, it is referred as redemption by conversion.

Read More Articles

- What is Accounting?

- Basic Accounting Terminology

- Basic Accounting Concepts

- Accounting Conventions

- Double Entry System

- What is Journal?

- What is Ledger?

- What is Trial Balance?

- What is Activity Based Costing?

- Business, Industry and Commerce

- Shares and Share Capital

- What is Audit of Ledger?

- Forfeiture and Reissue of Shares

- What is Consolidated Financial Statements?

- What are Preference Shares?

- What are Debentures?

- Issue of Bonus Shares

- What is Government Accounting?

- What are Right Shares?

- Redemption of Debentures

- Buy Back of Shares

- Valuation of Goodwill

- What is Valuation of Shares?

- Purchase of Business

- Amalgamation of Companies

- Internal Reconstruction of Company

- What is a Holding company?

- Accounts of Holding Company

- What is Slip System?