What is Financial System?

A financial system is a network of financial institutions, financial markets, financial instruments and financial services to facilitate the transfer of funds. The system consists of savers, intermediaries, instruments and the ultimate user of funds.

The level of economic growth largely depends upon and is facilitated by the state of the financial system prevailing in the economy.

Table of Contents

Definition of Financial System

The system to allocate savings efficiently in an economy to ultimate users either for investment in real assets or for consumption. – Van Horne

Prasanna Chandra defines it as Financial system consists of a variety of institutions, markets and instruments related in a systematic manner and provide the principal means by which savings are transformed into investments.

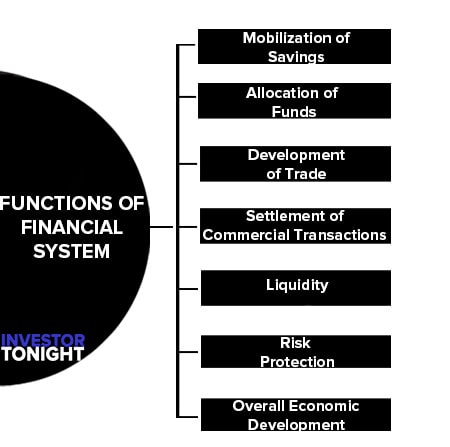

Functions of Financial System

The main functions of financial system are as follows:

- Mobilization of Savings

- Allocation of Funds

- Development of Trade

- Settlement of Commercial Transactions

- Liquidity

- Risk Protection

- Overall Economic Development

Mobilization of Savings

An important function of a financial system is to mobilize savings and channelize them into productive activities. A financial system helps in obtaining funds from the savers or surplus units such as household individuals, business firms, public sector units, central government, and state governments.

Mobilization of savings takes place when savers move into financial assets, whether currency, bank deposits, post office savings deposits, life insurance policies, bills, bonds, equity shares, etc.

Allocation of Funds

Another important function of a financial system is to arrange smooth, efficient, and socially equitable allocation of credit. Money-lenders and indigenous bankers have been providing finance to their borrowers since long. But their finance suffers from several defects.

With modern financial development, new financial institutions, assets and markets have come to be organized, which are playing an increasingly important role in the provision of credit.

Development of Trade

The financial system helps in the promotion of both domestic and foreign trade. The financial institutions finance traders and the financial market helps in discounting financial instruments such as bills. Foreign trade is promoted due to per-shipment and post-shipment finance by commercial banks.

The best part of the financial system is that the sellers or the buyers do not meet each other and the documents are negotiated through the bank. In this manner, the financial system not only helps the traders but also various financial institutions.

Settlement of Commercial Transactions

The financial system facilitates settlement of commercial transactions & financial claims arising out of sale & purchase of goods & services. For this money is used as an instrument which is legally recognized. Therefore values of all transactions including sale & purchase of goods and services are expressed in terms of money only.

Over a period of time, the financial system has evolved other instruments like cheques, demand drafts, credit card etc. for settlement of economic transactions. These instruments are recognized by law as a substitute for money.

Liquidity

In a financial system, liquidity means the ability to convert into cash. The financial market provides investors the opportunity to liquidate their investments, which are in instruments such as shares, debentures and bonds. The price of these instruments is determined daily according to the operations of the market force of demand and supply.

Risk Protection

Financial markets provide protection against life, health- and income-related risks. These risks can be covered through the sale of life insurance, health insurance and property insurance and various derivative instruments.

Overall Economic Development

India is a mixed economy. The Government intervenes in the financial system to influence macro-economic variables like interest rate or inflation. Thus, credits can be made available to corporate at a cheaper rate. This leads to economic development of the nation.

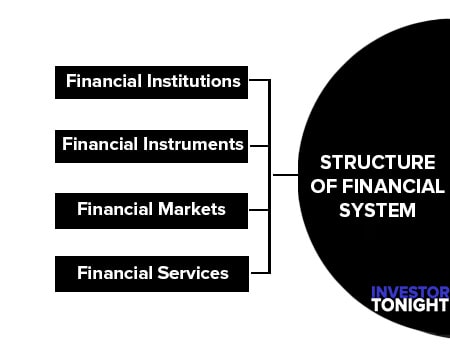

Structure of Financial System

Financial structure refers to shape, components and their order in the financial system. The Indian financial system comprises financial institutions, financial markets, financial instruments and financial services that are continuously monitored by various regulatory authorities, namely, the Reserve Bank of India, Securities and Exchange Board of India and Insurance Regulatory and Development Authority.

The basic structure of Indian Financial System is divided into four components which are

Financial Institutions

Financial institutions are the intermediaries who facilitate smooth functioning of the financial system by making investors and borrowers meet. They mobilize savings of the surplus units and allocate them in productive activities promising a better rate of return.

Financial institutions act as financial intermediaries because they act as middlemen between savers and borrowers. On the basis of the nature of activities, financial institutions may be classified as:

Regulatory and Promotional Institutions

Financial institutions, financial markets, financial instruments and financial services are all regulated by regulators like Ministry of Finance, the Company Law Board, RBI, SEBI, IRDA, Dept. of Economic Affairs, Department of Company Affairs etc.

The two major Regulatory and Promotional Institutions in India are Reserve Bank of India (RBI) and Securities Exchange Board of India (SEBI). Both RBI and SEBI administer, legislate, supervise, monitor, control and discipline the entire financial system. RBI is the apex of all financial institutions in India. The chief regulator of financial institutions in our country is the Reserve bank of India.

Banking Institutions

These institutions mobilize the savings of people. They provide a mechanism for the smooth exchange of goods and services .There are three basic categories of banking institutions are

- Commercial Banks

- Cooperative Banks

- Developmental Banks

Commercial Banks

Commercial bank is an institution that accepts deposit, makes loans and offer related services. These institutions run to make profit.

Commercial banks provide administrations services such as making business advances, offering fundamental investment schemes, encouraging saving deposits, fixed deposits, Issuing bank drafts and bank cheques, giving overdraft facilities, bond investment schemes, cash management, mortgage loans, debit cards, credit cards, etc.

Commercial banking can be further divided into four parts as follows:

- Public Sector banks

- Private Sector banks

- Foreign Banks

- Regional Rural Banks

Public Sector Banks

Public Sector Banks (PSBs) are banks where in the majority stake (i.e. more than 50%) is held by Government of India e.g. State Bank of India, Punjab National Bank, Bank of Baroda etc..

Firstly, the conversion of the then existing Imperial Bank of India into the State Bank of India in 1955, followed by the taking over of the seven state associated banks as its subsidiary banks; secondly, the nationalization of 14 major commercial banks on 19 July 1969 and lastly, the nationalization of 6 more commercial banks on 15 April 1980.

Thus, 27 banks constitute the Public sector in Indian Commercial Banking. The public sector accounts for 90 percent of the total banking business in India.

Private Sector Banks

These banks are registered as companies with limited liability. In 1994, the Reserve Bank of India issued a policy of liberalization to license limited number of private banks, which resulted in new generation tech-savvy banks .At present, Private Banks in India include leading banks, namely, ICICI Bank, ING Vysya Bank, Jammu & Kashmir Bank, Karnataka Bank, Kotak Mahindra Bank.

Private banks subject to an essential part of wealth management for high income groups. They provide services like: assets management, tax advisory, financial brokers, offered solitary relationship manger. Private sector banks are those whose equity is held by private shareholders. Private sector bank plays a major role in the development of Indian banking industry.

Foreign Banks

These banks are registered and have their headquarters in a foreign country but operate their branches in India. Some of the foreign banks operating in India are Hong Kong and Shanghai Banking Corporation (HSBC), Citibank, American Express Bank, Standard Chartered Bank, and Bank of Tokyo Ltd., etc. At present, there are 46 total foreign banks in India as per the RBI (As on 2020).

Regional Rural Banks

Regional Rural Banks (RRBs) were first established in October 2, 1975 and are playing a pivotal role in the economic development of rural India .The main objective of RRB is to develop rural economy. Their borrowers include small and marginal farmers, agricultural labourers , artisans etc.

There were five commercial banks, viz. Punjab National Bank, State Bank of India, Syndicate Bank, United Bank of India, and United Commercial Bank, which sponsored the regional rural banks.

Regional Rural Banks are regulated by National Bank for Agriculture and Rural Development (NABARD). The RRBs were owned by three entities with their respective shares as follows:

- Central Government 50%

- State Government 15%

- Sponsor Bank 35%

Non-banking Institutions

On-banking financial institutions (NBFIs) also mobilize financial resources directly or indirectly from people. They lend funds but do not create credit. Companies such as LIC, GIC, UTI, Development Financial Institutions, Organization of Pension and Provident Funds fall into this category.

Non-banking financial institutions can be categorized as investment companies, housing companies, leasing companies, hire purchase companies, specialized financial institutions (EXIM Bank, etc.), investment institutions, state level institutions, etc., the regulations governing these institutions are relatively lighter as compared to those of banks. Secondly, they are not subject to certain regulatory prescriptions applicable to banks.

Some of the NBFIs are as below :

- Tourism Finance Corporation of India Ltd. (TFCI )

- General Insurance Corporation (GIC)

- Export-Import Bank of India (EXIM)

- National Bank for Agriculture and Rural Development (NABARD)

- National Housing Bank (NHB)

Financial Instruments

Financial instruments are the financial assets, securities and claims. They may be viewed as financial assets and financial liabilities. . Financial assets represent claims for the payment of a sum of money sometime in the future (repayment of principal) and/or a periodic payment in the form of interest or dividend. Financial liabilities are the counterparts of financial assets.

A financial instrument is any contract that gives rise to both a financial asset of one entity and a financial liability or equity instrument of another entity. Financial assets and liabilities arise from the basic process of financing. Some of the financial instruments are tradable/ transferable.

Others are non tradable/non-transferable. Financial assets like deposits with banks, companies and post offices, insurance policies, NSCs, provident funds and pension funds are not tradable. Securities (included in financial assets) like equity shares and debentures, or government securities and bonds are tradable. Hence they are transferable.

Primary or Direct Instruments

Primary instruments or direct securities are issued directly by borrowers to lenders. Equity shares, preference shares and debentures are primary securities. Equity shares are ownership securities and risk capital.

The owners of such securities are residual claimants on income and assets and participate in the management of the company. The holders of such securities have preference rights over equity shareholders with regard to both a fixed dividend and return of capital.

Secondary or Indirect Instruments

Indirect securities are not directly issued by borrowers to lenders. These securities are issued via a financial intermediary to an ultimate lender. Indirect securities include mutual fund units, security receipts, securitized debt instruments.

- Mutual Funds

- Security Receipts

- Securitized Debt Instruments

- Derivatives Instruments

Mutual Funds

Mutual funds are simply a means of combining or pooling the funds of a large group of investors. The buy and sell decisions for the resulting pool are then made by a fund manager, who is compensated for the service provided.

Since mutual funds provide indirect access to financial markets for individual investors, they are a form of financial intermediary. Mutual funds issue units to investors, which represent an equitable right in the assets of the mutual fund.

Security Receipts

Security Receipts are bonds issued by Asset Reconstruction Companies to banks when they buy bad loans from them. Normally, when these companies buy bad assets from banks, they do not pay cash up front. The bonds (SR) are issued up to a maximum period of seven years.

Securitized Debt Instruments

Securitization is a financial process that involves issuing securities that are backed by a number of assets, most commonly debt. The assets are transformed into securities, and the process is called securitization. As of 2010, the most common form of securitized debt is mortgage backed securities, but attempts are being made to securitize other debts, such as credit cards and student loans.

Securitized debt instruments are created when the original holder (e.g. a bank) sells its debt obligation to a third party, called a Special Purpose Vehicle (SPV). The SPV pays the original lender the balance of the debt sold, which gives it greater liquidity.

Derivatives Instruments

Derivatives are instruments whose value is derived from the value of one/more basic variables called the underlying asset. In simpler form, derivatives are financial security such as an option or future whose value is derived in part from the value and characteristics of another an underlying asset. The primary objectives of any investor are to bring an element of certainty to returns and minimize risks.

Derivative contracts can be standardized and traded on the stock exchange. Such derivatives are called exchange-traded derivatives. Or they can be customized as per the needs of the user by negotiating with the other party involved. Such derivatives are called over-the counter (OTC) derivatives.

Derivative contracts are of several types. The most common types are forwards, futures, options and swap.

- Forward contracts are agreements to exchange an asset, for cash, at a predetermined future date today. A forward contract is an agreement between two parties – a buyer and a seller to purchase or sell something at a later date at a price agreed upon today. Any type of contractual agreement that calls for the future purchase of a good or service at a price agreed upon today and without the right of cancellation is a forward contract.

- Future contracts are an agreement between two parties – a buyer and a seller – to buy or sell something at a future date. The contact trades on a futures exchange and is subject to a daily settlement procedure.

- Options Contracts establish a contract between two parties concerning the buying or selling of an asset at a reference price. Options are of two types – calls and puts. Calls give the buyer the right but not the obligation to buy a given quantity of the underlying asset, at a given price on or before a given future date.

- Swaps are private agreements between two parties to exchange cash flows in the future according to a prearranged formula. They can be regarded as portfolios of forward contracts.

Financial Markets

Financial markets are another part or component of financial system. Efficient financial markets are essential for speedy economic development. The vibrant financial market enhances the efficiency of capital formation. It facilitates the flow of savings into investment.

Financial markets are the backbone of the economy. This is because they provide monetary support for the growth of the economy. Financial markets are the centres or arrangements that provide facilities for buying and selling of financial claims and services.

These are the markets in which money as well as monetary claims is traded in. A financial market is a broad term describing any marketplace where buyers and sellers participate in the trade of assets such as equities, bonds, currencies and derivatives.

The financial market has two main components, namely are:

Money Market

This is a market for borrowing and lending of short-term funds. It deals in funds and financial instruments that have a maturity period of one day to one year. It is a mechanism through which short-term funds are loaned or borrowed and through which a large part of the financial transactions of a particular country or of the world is carried out.

This market is dominated mostly by government , banks, and financial institutions. The most important feature of the money market instrument is its liquidity. The following are instruments that are traded in the money market:

- Call and Notice Money Market is short term finance repayable on demand, with a maturity period of one day to fifteen days, used for inter-bank transactions. Call money is a method by which banks borrow from each other to be able to maintain the credit is high.

- Treasury Bill is a promissory note issued by the RBI to meet the short-term requirement of funds. Treasury bills are highly liquid instruments that mean, at any time the holder of treasury bills can transfer of or get it discounted from RBI. These bills are normally issued at a price less than their face value and redeemed at face value.

- Certificate of Deposits (CDs) are unsecured, negotiable, short-term instruments in bearer form, issued by commercial banks and development financial institutions. They can be issued to individuals, corporations, and companies during periods of tight liquidity when the deposit growth of banks is slow but the demand for credit is high. They help to mobilise a large amount of money for short periods.

- The scheme pertaining to CDs was introduced in 1989 by the RBI, to mainly enable commercial banks to raise funds from the market. At present, the maturity period of CDs ranges from 3 months to 1 year. They are issued in multiples of INR 25 lakhs subject to a minimum of INR 1 crore.

- Commercial Papers (CPs) Commercial Papers are unsecured money market instruments issued in the form of promissory notes or in demat form. These were introduced in January 1990. Commercial Papers can be issued by a listed company that has a working capital of not less than INR 5 crores.

Capital Market

Capital market may be defined as a market dealing in medium and long-term funds. It is an institutional arrangement for borrowing medium and long-term funds and which provides facilities for marketing and trading of securities .

So it constitutes all long-term borrowings from banks and financial institutions, borrowings from foreign markets and raising of capital by issue various securities such as shares debentures, bonds, etc . The market where securities are traded known as Securities market.

It consists of two main different segments namely primary and secondary market.

- Primary Market

- Secondary Market

- Foreign Exchange Market

Primary Market

This is a market for new issues or new financial claims. Hence, it is also called a New Issue Market. The primary market deals with those securities that are issued to the public for the first time. In the primary market, borrowers exchange new financial securities for long-term funds. There are three ways by which a company may raise capital in a primary market: (i) Public issue, (ii) Right issue and (iii) Private placement.

Secondary Market

The market in which securities are traded after they are initially offered in the primary market is known as secondary market. The secondary market is also known as the stock market or stock exchange. It is a market for the purchase and sale of existing securities. It helps existing investors to disinvest and fresh investors to enter the market.It also provides liquidity and marketability to existing securities. This market consists of all stock exchanges recognized by the Government.

Foreign Exchange Market

The market in which participants are able to buy, sell, exchange, and speculate on currencies is the foreign exchange market. Foreign exchange markets are made up of banks, commercial companies, central banks, investment management firms, hedge funds, and retail forex brokers and investors.

Financial Services

Financial services may be defined as the products and services offered by financial institutions for the facilitation of various financial transactions and other related activities. The development of a sophisticated and matured financial system in the country, especially after the early 1990s, led to the emergence of a new sector.

This new sector is known as the financial services sector. Its objective is to intermediate and facilitate financial transactions of individuals and institutional investors. There are different types of financial services provided in financial markets.

The financial service industry can be classified into two broad categories are:

Fee-based Financial Services

These services are provided by financial institutions/NBFCs to earn income by way of fee, dividend, commission, discount and brokerage. The major fee-based financial services are as follows:

- Issue Management and Merchant Banking

- Corporate Advisory Services

- Asset securitization

- Credit rating

Fund based financial services

In fund-based services, the financial service firm raises funds through equity, debt and deposits and invests the same in securities or lends this out to those who are in need of capital.The major fund-based services are as follows:

- Leasing and Hire Purchase

- Venture Capital

- Factoring and Forfeiting

The financial services can also be called ‘financial intermediation’. It is the process by which funds are mobilized from a large number of savers and make them available to all those who are in need of it.

Importance of Financial Institutions

Financial institutions are the key institutions that provide funds for economic activities. There are many advantages to having sound and healthy financial institutions in a country. The importance of FI is as follows:

Provide Funds

Provide funds: Financial institutions provide funds for investment and industrial activities.

Infrastructural Facilities

Infrastructural facilities: financial institutions also offer basic infrastructural facilities needed for the development and promotion of lucrative ventures. Infrastructural facilities involve the development of industrial estates tech parks, roads and water etc.

Promotional Activities

Promotional activities: promotional activities are undertaken by the financial institutions to mobilize the funds, reduce the risk of selling financial securities, arrangement of working and long term capital of the business.

Development of Backward Areas

Development of backward areas: apart from the financial activities, financial institutions also take some social responsibilities of developing the backward areas free of cost by offering credit facilities, free education, employment creation etc.

Planned Development

Planned development: financial institutions initiate all planned developments in the view of economic growth of the state. All planned developments are coordinated with the government plan and social welfare.

Accelerating Industrialization

Accelerating industrialization: since the financial institutions are established to earn profit and safeguard the interests of their members, they accelerate industrialization to contribute to industrial growth. They support industries by granting finance, project development and consultancy.

Employment Generation

Employment generation: channelizing the funds for investment, the building of infrastructural facilities, and the acceleration of industries generate employment to the educated and qualified people of the state.

Read More Articles

- What is Financial Management?

- What is Financial Statements?

- What is Financial Statement Analysis?

- What is Ratio Analysis?

- What is Funds Flow Statement?

- What is Cash Flow Statement?

- What is Working Capital?

- What is Cost of Capital?

- What is Capital Budgeting?

- What is Dividend Policy?

- What is Cash Management?

- What is Depository?

- What is Insurance?

- What is Financial System?

- International Financial Reporting Standards

- Stability of Dividends

- What is Factoring?

- Determinants of Working Capital

- Public Finance

- Public Expenditure

- What is Public Debt?

- Classification of Public Debt

- Federal Finance

- Effect of Public Debt

- Expenditure Cycle

Masaallah