What is Working Capital?

Working Capital is the amount of funds necessary to cover the cost of operating the enterprises. Working capital means the funds (capital) available and used for day-to-day operations (working) of an enterprise. It consists broadly of that portion of assets of a business that are used in or related to its current operations.

It refers to funds which are used during an accounting period to generate a current income of a type which is consistent with major purpose of a firm existence.

Working Capital is also called as “short term capital” “Liquid Capital”, “Circulating or revolving capital”,

Working Capital Formula

The working capital formula is:

Working capital = Current Assets – Current Liabilities

Table of Contents

- 1 What is Working Capital?

- 2 Working Capital Formula

- 3 Working Capital Definition

- 4 Concept of Working Capital

- 5 Working Capital Management

- 6 Nature of Working Capital

- 7 Types of Working Capital

- 8 Determinants of Working Capital

- 9 Importance of Working Capital

- 10 Disadvantages of Working Capital

- 11 Factors Determining Working Capital

- 12 Working Capital Investment Policies

Working Capital Definition

Working capital refers to the circulating capital required to meet the day-to-day operations of a business firm. Working capital may be defined by various authors as follows:

Working capital refers to a firm’s investment in short term assets, such as cash amounts receivables, inventories etc. – Weston & Brigham

Working capital means current assets. – Mead, Baker and Malott

The sum of the current assets is the working capital of the business. – J.S.Mill

Concept of Working Capital

There are two concepts of working capital viz . quantitative and qualitative. Some people also define the two concepts as gross concept and net concept.

Quantitative Concept

According to quantitative concept, the amount of working capital refers to ‘total of current assets’. Current assets are considered to be gross working capital in this concept.

Qualitative Concept

The qualitative concept gives an idea regarding source of financing capital. According to qualitative concept the amount of working capital refers to “excess of current assets over current liabilities.”

L.J. Guthmann defined working capital as “the portion of a firm’s current assets which are financed from long–term funds.”

The excess of current assets over current liabilities is termed as ‘Net working capital’. In this concept “Net working capital” represents the amount of current assets which would remain if all current liabilities were paid.

Both the concepts of working capital have their own points of importance. “If the objectives is to measure the size and extent to which current assets are being used, ‘Gross concept’ is useful; whereas in evaluating the liquidity position of an undertaking ‘Net concept’ becomes pertinent and preferable.

Working Capital Management

Working capital management is also one of the important parts of financial management. It is concerned with the short-term finance of the business concern which is a closely related trade between profitability and liquidity. Efficient working capital management leads to improve the operating performance of the business concern and it helps to meet the short-term liquidity.

Hence, the study of working capital management is not only an important part of financial management but also are overall management of the business concern

Nature of Working Capital

The nature of working capital is as discussed below:

- It is used for purchase of raw materials, payment of wages and expenses.

- It changes form constantly to keep the wheels of business moving.

- Working capital enhances liquidity, solvency, creditworthiness and reputation of the enterprise.

- It generates the elements of cost namely: Materials, wages and expenses.

- It enables the enterprise to avail the cash discount facilities offered by its suppliers.

- It helps improve the morale of business executives and their efficiency reaches at the highest climax.

- It facilitates expansion programmes of the enterprise and helps in maintaining operational efficiency of fixed assets.

Types of Working Capital

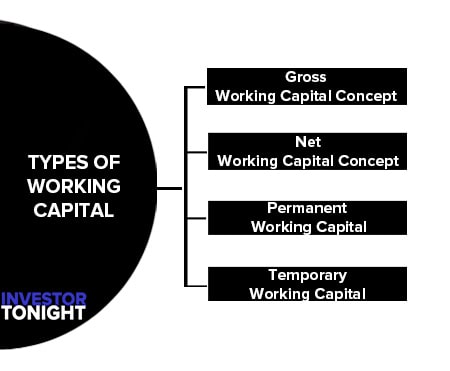

There are basically 4 types of working capital:

- Gross working capital concept

- Net working capital concept

- Fixed or permanent working capital

- Temporary or variable working capital

On the basis of Concept

Gross Working Capital Concept

Gross working capital refers to total investment in current assets. The current assets employed in business give the idea about the utilization of working capital and idea about the economic position of the company. Gross working capital concepts is popular and acceptable concept in the field of finance.

Gross working capital = Total current assets.

Net Working Capital Concept

Net working capital means current assets minus current liabilities. The difference between current assets and current liabilities is called the net working capital. If the net working capital is positive, business is able to meet its current liabilities. Net working capital concept provides the measurement for determining the creditworthiness of company.

Net Working capital = Current Assets – current Liabilities

On the basis of Time

Permanent Working Capital

This type of working capital is known as Fixed Working Capital. Permanent working capital means the part of working capital which is permanently locked up in the current assets to carry out the business smoothly. The minimum amount of current assets which is required to conduct the business smoothly during the year is called permanent working capital.

For example, investments required to maintain the minimum stock of raw materials or to cash balance. The amount of permanent working capital depends upon the size and growth of company. Fixed working capital can further be divided into two categories as under:

Temporary Working Capital

The term variable working capital refers that the level of working capital is temporary and fluctuating. Variable working capital may change from one assets to another and changes with the increase or decrease in the volume of business

Determinants of Working Capital

In order to determine the proper amount of working capital of a firm, the following factors should be considered carefully;

- Seasonal nature of the firm

- Firm’s credit policy

- Size of Business

- Nature of business

- Rate of growth of business

- Business cycle

- Duration of operating cycle

- Change in terms of purchase and sales.

The amount of working capital required depends upon a large number of other factors like political stability, means of transport, co-ordination of activities, rate of industrial development, speed of circulation of working capital, profit margin etc.

The above determinants should be considered, because no certain criterian to determine the amount of working capital needs that may be applied to all firms.

Importance of Working Capital

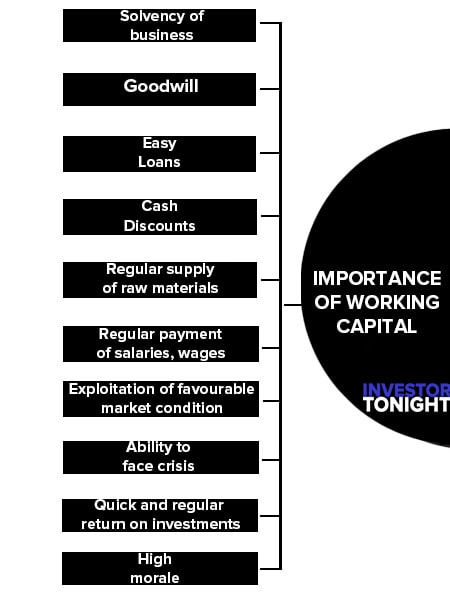

Working capital is the lifeblood and nerve center of a business. No business can run successfully without and adequate amount of working capital. The main advantage of working capital is as follow:

- Solvency of business

- Goodwill

- Easy Loans

- Cash discounts

- Regular supply of raw materials

- Regular payment of salaries, wages

- Exploitation of favourable market condition

- Ability to face crisis

- Quick and regular return on investments

- High morale

Solvency of business

Adequate working capital helps in maintaining solvency of the business by providing uninterrupted flow of production.

Goodwill

Sufficient working capital enables a business concern to make prompt payments and hence helps in creating and maintaining goodwill.

Easy Loans

A concern having adequate working capital, high solvency and good credit standing can arrange loans from banks and other on easy and favourable terms.

Cash discounts

Adequate working capital also enables a concern to avail cash discounts on the purchases and hence it reduces costs.

Regular supply of raw materials

Sufficient working capital ensures regular supply of raw materials and continuous production.

Regular payment of salaries, wages

A company which has ample working capital can make regular payment of salaries, wages and other day-to-day commitments which raises the morale of its employees, increases their efficiency, reduces wastages and costs and enhances production and profits.

Exploitation of favourable market condition

Only concern with adequate working capital can exploit favourable market conditions such as purchasing its requirements in bulk when the prices are lower and by holding its inventories for higher prices.

Ability to face crisis

Adequate working capital enables a concern to face business crisis in emergencies such as depression because during such periods, generally, there is much pressure on working capital.

Quick and regular return on investments

Every investor wants a quick and regular return on his investments. Sufficiency of working capital enables a concern to pay quick and regular dividends to its investors as there may not be much pressure to plough back profits. This gains the confidence of its investors and creates a favourable market to raise additional funds ion the future.

High morale

Adequacy of working capital creates an environment of security, confidence, and high morale and creates overall efficiency in a business.

Disadvantages of Working Capital

Following are the disadvantages of working capital:

- If management is not utilising its current resources than it indicate inefficient management.

- Excess working capital means, there is a defective credit policy and collection policy.

- There may be more change of holding excess inventory, if there is excess working capital such situation results upon companies profitability and efficiency in using its resources.

- Excess working capital results, the low rate of return, and it will causing dissatisfaction among shareholders.

- Due to idle funds the efficacy of firm to earn profits is effected, hence due to more interest liability, it reduces the amount of profits.

Hence, if can be concluded that excess working capital reduces return on investment while adequate working capital increase the firms profitability as-well-as goodwill.

Factors Determining Working Capital

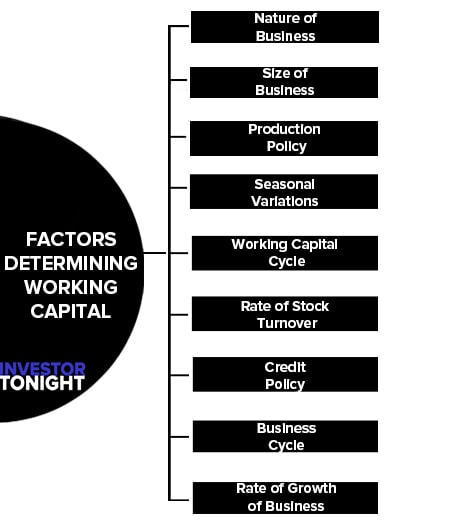

The factors determining working capital requirements are as follows:

- Nature of Business

- Size of Business

- Production Policy

- Seasonal Variations

- Working Capital Cycle

- Rate of Stock Turnover

- Credit Policy

- Business Cycle

- Rate of Growth of Business

Nature of Business

Public utility undertakings like electricity, water supply and railways need very limited working capital because they offer cash sales only and supply services not products.

On the other hand, trading and financial firms require less investment in fixed assets but have to investment large amount in current assets like inventories, receivables etc.

Size of Business

Greater the size of business unit, generally larger will be the requirement of working capital. In some case even a smaller concern need more working capital due to high overhead charges, inefficient use of resources etc.

Production Policy

The production could be kept either steady by accumulating inventories during slack periods with a view to meet high demand during the peak season or the production could be curtailed during the slack season and increased during peak season.

If the policy is to keep the production steady by accumulating inventories it will require higher working capital.

Seasonal Variations

In certain industries, raw material; is not available throughout year. They have to buy raw material in bulk during the season to ensure an uninterrupted flow and process them during the entire year.

A huge amount is blocked in the form of material inventories during such season, which give rise to more working capital.

Working Capital Cycle

In manufacturing concern, the working capital cycle starts with the purchase of raw material and ends with the realization of cash from the sales of finished products.

This cycle involves purchase of raw material and starts, its conversion into stock of finished goods through work in progress with progressive increment of labor and service costs, conversion of finished stock into sales, Debtor and receivables and ultimately realization of cash and this cycle continues again from cash to purchase of raw material so on.

Rate of Stock Turnover

There is high degree of inverse co relationship between the quantum of working capital and the velocity or speed with which the sales are affected. A firm with having a high rate of stock turnover will need lower amount of working capital as compared to the firm having a low rate of turnover.

Credit Policy

A concern that purchases its requirement on credits and sells its products / services on cash require lesser amount of working capital.

On the other hand, concern buying its requirement for cash and allow credit to its customers, will need larger amount of working capital as very huge amount of funds are bound to be tied up in debtors or bills receivables.

Business Cycle

Business Cycle refers to alternate expansion and contraction in general business activity. In period of boom i.e. when the business is prosperous, there is need for larger amount of working capital due to increase in sales, rise in prices, and expansion of business.

On the contrary in the times of depression i.e., when there is down swing of cycle, the business contracts, sales decline, difficulties are faced in collection from debtors and firms may have a large amount of working capital lying idle.

Rate of Growth of Business

For the fast growing concern, larger amount of working capital is required.

Working Capital Investment Policies

Read More Articles

- What is Financial Management?

- What is Financial Statements?

- What is Financial Statement Analysis?

- What is Ratio Analysis?

- What is Funds Flow Statement?

- What is Cash Flow Statement?

- What is Working Capital?

- What is Cost of Capital?

- What is Capital Budgeting?

- What is Dividend Policy?

- What is Cash Management?

- What is Depository?

- What is Insurance?

- What is Financial System?

- International Financial Reporting Standards

- Stability of Dividends

- What is Factoring?

- Determinants of Working Capital

- Public Finance

- Public Expenditure

- What is Public Debt?

- Classification of Public Debt

- Federal Finance

- Effect of Public Debt

- Expenditure Cycle