There are no set rules or formulae to determine the working capital requirements of firms. A large number of factors, each having a different importance, influence working capital needs of firms. The importance of factors also changes for a firm over time.

Therefore, an analysis of relevant factors should be made in order to determine total investment in working capital. The following is the description of factors which generally influence the working capital requirements of firms.

Table of Contents

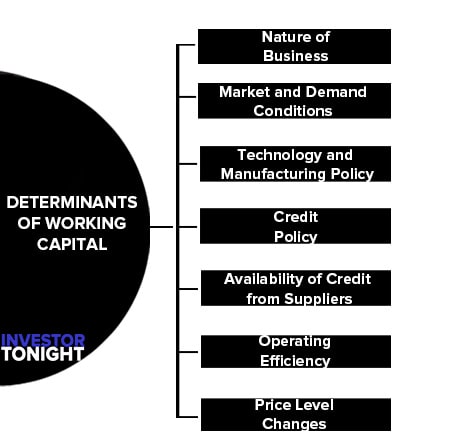

Determinants of Working Capital

- Nature of Business

- Market and Demand Conditions

- Technology and Manufacturing Policy

- Credit Policy

- Availability of Credit from Suppliers

- Operating Efficiency

- Price Level Changes

Nature of Business

Working capital requirements of a firm are basically influenced by the nature of its business. Trading and financial firms have a very small investment in fixed assets, but require a large sum of money to be invested in working capital. Retail stores, for example, must carry large stocks of a variety of goods to satisfy varied and continuous demands of their customers.

A large departmental store like Wal-Mart may carry, say, over 20,000 items. Some manufacturing businesses, such as tobacco manufacturers and construction firms, also have to invest substantially in working capital and a nominal amount in fixed assets. In contrast, public utilities may have limited need for working capital and have to invest abundantly in fixed assets.

Their working capital requirements are nominal because they may have only cash sales and supply services, not products. Thus, no funds will be tied up in debtors and stock (inventories).

For the working capital requirements most of the manufacturing companies will fall between the two extreme requirements of trading firms and public utilities. Such concerns have to make adequate investment in current assets depending upon the total assets structure and other variables.

Market and Demand Conditions

The working capital needs of a firm are related to its sales. However, it is difficult to precisely determine the relationship between volume of sales and working capital needs. In practice, current assets will have to be employed before growth takes place. It is, therefore, necessary to make advance planning of working capital for a growing firm on a continuous basis.

Growing firms may need to invest funds in fixed assets in order to sustain growing production and sales. This will, in turn, increase investment in current assets to support enlarged scale of operations. Growing firms need funds continuously. They use external sources as well as internal sources to meet increasing needs of funds.

These firms face further problems when they retain substantial portion of profits, as they will not be able to pay dividends to shareholders. It is, therefore, imperative that such firms do proper planning to finance their increasing needs for working capital.

Technology and Manufacturing Policy

The manufacturing cycle (or the inventory conversion cycle) comprises the purchase and use of raw materials and the production of finished goods. Longer the manufacturing cycle, larger will be the firm’s working capital requirements. For example, the manufacturing cycle in the case of a boiler, depending on its size, may range between six to twenty-four months.

On the other hand, the manufacturing cycle of products such as detergent powder, soaps, chocolate etc. may be a few hours. An extended manufacturing time span means a larger tie-up of funds in inventories. Thus, if there are alternative technologies of manufacturing a product, the technological process with the shortest manufacturing cycle may be chosen.

Once a manufacturing technology has been selected, it should be ensured that manufacturing cycle is completed within the specified period. This needs proper planning and coordination at all levels of activity. Any delay in manufacturing process will result in accumulation of work-in-process and waste of time.

In order to minimise their investment in working capital, some firms, specifically those manufacturing industrial products, have a policy of asking for advance payments from their customers. Non-manufacturing firms, service and financial enterprises do not have a manufacturing cycle.

Credit Policy

The credit policy of the firm affects the working capital by influencing the level of debtors. The credit terms to be granted to customers may depend upon the norms of the industry to which the firm belongs. But a firm has the flexibility of shaping its credit policy within the constraint of industry norms and practices. The firm should use discretion in granting credit terms to its customers.

Depending upon the individual case, different terms may be given to different customers. A liberal credit policy, without rating the credit-worthiness of customers, will be detrimental to the firm and will create a problem of collection later on. The firm should be prompt in making collections. A high collection period will mean tie-up of large funds in debtors. Slack collection procedures can increase the chance of bad debts.

Availability of Credit from Suppliers

The working capital requirements of a firm are also affected by credit terms granted by its suppliers. A firm will needless working capital if liberal credit terms are available to it from suppliers. Suppliers’ credit finances the firm’s inventories and reduces the cash conversion cycle. In the absence of suppliers’ credit the firm will have to borrow funds for bank.

The availability of credit at reasonable cost from banks is crucial. It influences the working capital policy of a firm. A firm without the suppliers’ credit, but which can get bank credit easily on favourable conditions, will be able to finance its inventories and debtors without much difficulty.

Operating Efficiency

The operating efficiency of the firm relates to the optimum utilisation of all its resources at minimum costs. The efficiency in controlling operating costs and utilising fixed and current assets leads to operating efficiency. The use of working capital is improved and pace of cash conversion cycle is accelerated with operating efficiency.

Better utilisation of resources improves profitability and, thus, helps in releasing the pressure on working capital. Although it may not be possible for a firm to control prices of materials or wages of labour, it can certainly ensure efficient and effective use of its materials, labour and other resources.

Price Level Changes

The increasing shifts in price level make the functioning of the financial manager difficult. She should anticipate the effect of price level changes on working capital requirements of the firm. Generally, rising price levels will require a firm to maintain higher amount of working capital.

Same levels of current assets will need increased investment when prices are increasing. However, companies that can immediately revise their product prices with rising price levels will not face a severe working capital problem. Further, firms will feel effects of increasing general price level differently as prices of individual products move differently. Thus, it is possible that some companies may not be affected by rising prices while others may be badly hit.