What is Financial Statements?

Financial statements contain summarised information about the firm’s financial affairs. It’s main purpose is to present the firm’s financial situation to the users. The financial statements are the end-product of the financial accounting process.

These statements present financial information in concise and capsule form. Financial statements are prepared by top management and these should be prepared in a very careful manner.

Table of Contents

- 1 What is Financial Statements?

- 2 Financial Statement Definition

- 3 Financial Statement Meaning

- 4 Types of Financial Statements

- 5 Objectives of Financial Statements

- 6 Nature of Financial Statements

- 7 Importance of Financial Statements

- 8 Limitations of Financial Statements

- 9 Characteristics of Financial Statements

Financial Statement Definition

John N. Meyer defines financial statements as a summary of the accounts of a business enterprise, the balance sheet reflecting the assets, liabilities and capital as on a certain data and the income statements showing the results of operations during a certain period.

The end product of financial accounting is a set of financial statements prepared by the accountant of a business enterprise that purport to reveal the financial position of the enterprise the result of its recent activities, and an analysis of what has been done with earnings”. (Smith and Ashburn 2017)

Financial Statement Meaning

- Financial Statement is a statement prepared for evaluating past performance and predicting future performance.

- Financial Statements are regarded as indices of business enterprises performance and position.

- The term ‘Financial statement‘ as used in modern accounting refers to two statements, the position statement reflecting the assets, liabilities and capital of a business entity on a particular date called the balance sheet, and the other called the profit and loss account showing the results of the business operations during a given period.

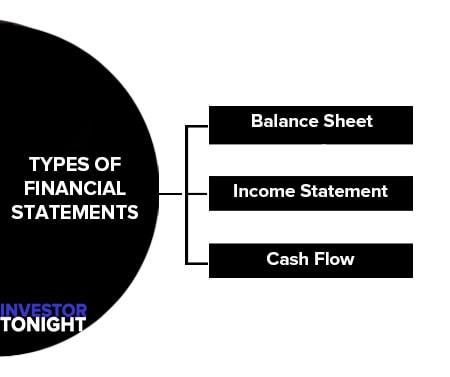

Types of Financial Statements

A methodically work through of the three financial statements in order to assess the financial health of a company.

Balance Sheet

Balance Sheet is a snapshot at a point in time. On the top half you have the company’s assets and on the bottom half its liabilities and Shareholders’ Equity (or Net Worth). The assets and liabilities are typically listed in order of liquidity and separated between current and non-current.

The Balance sheet has 3 main categories:

- Assets

- Expected to be converted into cash in less than 1 year

- Accounts receivable, inventory

- Liabilities

- Will be paid in less than 1 year

- Trade accounts payable

- Equity

- Repayment terms longer than 1 year

- Loan repayable over a 5 year

Income Statement

The income statement covers a period of time, such as a quarter or year. It illustrates the profitability of the company from an accounting (accrual and matching) perspective. It starts with the revenue line and after deducting expenses derives net income.

Income statement has 3 main sections:

- Revenues

- Expenses

- Profit or loss

Cash Flow

The cash flow statement look at the cash position of the company.

Statement of cash flows demonstrates:

- Where cash is being generated

- Where cash is being used in the business

3 component of cash flow are:

- Operating

- Investing

- Financing

Objectives of Financial Statements

Objectives of Financial Statements are:

- To communicate to their interested users , quantitative and objective information, this information is useful in making economic decisions.

- To meet the specialized needs of conscious creditors and investors.

- To provide reliable information about the earnings of business enterprise and its ability to operate at a profit in future.

- To provide financial base for tax assessments.

- To provide valuable information for predicting the future earning power of the enterprise.

- To provide reliable information about the changes in economic resources.

- To provide information about the changes in net resources of the organization.

- To provide reliable information about the changes in net economic resources.

- To provide information about the changes in net resources of the organization that result from profit directed activities.

- To play a very important role in accounting and corporate reporting.

- To regulate equity and debenture issues by companies.

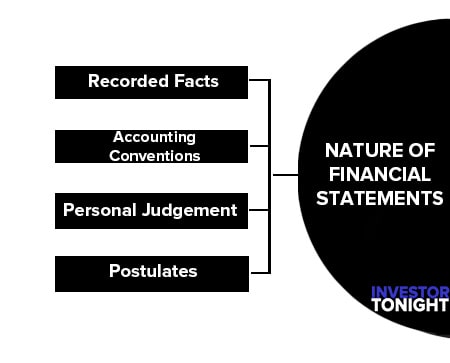

Nature of Financial Statements

American Institute of Certified Public Accountants described the nature of financial statements as follows: “Financial Statements are prepared for the purpose of presenting a periodical review or report on progress by the management and deal with the status of the investment in the business and results achieved during the period under review.

They reflect a combination of recorded facts, accounting conventions, postulates and personal judgements, and the judgements and conventions applied them materially.

Important terms used in the above statements are being described as follows:

Recorded Facts

Recorded facts means the data contained in statement which have been drawn from the accounting records. Such data may be the amount of cash in hand and in bank, the amount due form customers, the cost of fixed assets, the amount payable to creditors, amount of sales etc.

Accounting Conventions

Accounting conventions imply certain assumptions and procedures which have been sanctioned by long usage. Some of the important situations to use the conventions are assets valuation, distribution of expenditure between capital and revenue, method to be followed for calculation of depreciation, valuation of stock etc.

For example, according to convention of conservatism, provision is made for expected losses but expected profits are ignored.

Personal Judgement

According to May George O., “the accounts of a modern business are not entirely statement of fact, but are to a large extent expression of opinion based partly on accounting conventions, partly on assumptions explicit or implicit and partly on Judgement .”

Personal Judgement are taken in deciding to use one of the several methods for the determination of the depreciation, evaluation to inventory at cost or at the cost or market price whichever is less etc.

Postulates

Accountant depends upon some postulates at the time of preparing financial statements.

For example: an accountant assumes that the value of money will remain constant during whole the year, so there will be no difference on transactions of different dates.

Importance of Financial Statements

Financial statements are useful for different related parties as given below:

- Importance to Management

- Importance to Investors

- Importance to Creditors

- Importance to Government

- Importance to Others

Importance to Management

In the words of Gerstenberg Charles W., ‘Management can measure the effectiveness of its own policies and decisions, determine the advisability of adopting new policies and procedures and document to owners the result of their managerial efforts’.

For effective and controlling the company’s activities, management can get necessary data from financial statements.

Importance to Investors

Investors are mainly interested with the safety of their investment and to earn profit from these investments with the help of financial statements. Investors create their opinion about the company before investing.

For example, some factors they considered are price earning ratio, earning per share, future earning potential, trend of sales of past years, financial strength of the company etc.

Importance to Creditors

Creditors lent their money for short period and they are keen interested in the company’s ability to repay the loan amount on time.

A creditor can compute various ratios like current ratio, quick ratio etc. to know the company’s ability to repay. If a company earns less than paid amount of interest, it is not safe to lend money to this company.

Importance to Government

Various ratios like turnover ratios, earning ratios indicate the health of the company. To regulate various economic activities, government analyse the various ratios of companies in one industry.

Importance to Others

Other related parties like labour, stock exchanges, economists, news agencies, trade unions etc. are interested in analysis of financial statements to know the detail position about the company and industry.

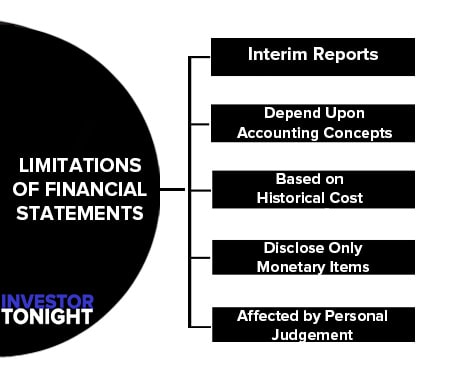

Limitations of Financial Statements

Financial statements are prepared to present a report on:

- Status of the investments in the business

- Results achieved during the review period.

The above objectives suffer from the following limitations of financial statements:

- Financial Statements are only Interim Reports

- Depend Upon Accounting Concepts and Conventions

- Based on Historical Cost

- Disclose Only Monetary Items

- Affected by Personal Judgement and Knowledge

Financial Statements are only Interim Reports

According to this, it can be said that financial statements can not be final because exact amount of profit or loss of a business can be determined after closing down the business. So profit depicted by Profit and Loss account and financial position shown by Balance Sheet is not exact.

So, it is necessary to prepare financial statement at relatively short accounting period. But this cutting off the balance sheet dates gives the problem of allocation of cost and income. Financial statement data can not afford to remain exact under such conditions.

Depend Upon Accounting Concepts and Conventions

Financial statements are prepard on the basis of certain accounting concepts and conventions. Financial position presented by these statements may not be real.

For example, the value of an asset represents the amount of asset which is valued on the basis on “going concern concept”. This means value of fixed assets may not be same which can be realise after the sale of asset.

Based on Historical Cost

The financial statements are based upon historical cost. They do not give present value of business and any information regarding the future.

Disclose Only Monetary Items

Financial statements do not give true picture of the business because they do not show those items which can not be expressed in monetary terms.

For example, goodwill of the firm, health of workers, efficiency of management etc.

Affected by Personal Judgement and Knowledge

Many items of financial statements are affected by personal judgement and knowledge of accountant. Some of items e.g. stock valuation methods, method of depreciation, capital and revenue expenditure are decided by personal decision.

Characteristics of Financial Statements

- Financial statements must be in simple and attractive manner to understand and draw conclusion easily from them.

- The figures related with previous year must be given for comparison of financial statements

- Financial statements must give perfect information to present true picture of the concern.

- Irrelevant informations should be ignored.

- Various required tables, footnotes, appendices must be given in financial statements

- The financial statements must be in brief and summarised manner.

Read More Articles

- What is Financial Management?

- What is Financial Statements?

- What is Financial Statement Analysis?

- What is Ratio Analysis?

- What is Funds Flow Statement?

- What is Cash Flow Statement?

- What is Working Capital?

- What is Cost of Capital?

- What is Capital Budgeting?

- What is Dividend Policy?

- What is Cash Management?

- What is Depository?

- What is Insurance?

- What is Financial System?

- International Financial Reporting Standards

- Stability of Dividends

- What is Factoring?

- Determinants of Working Capital

- Public Finance

- Public Expenditure

- What is Public Debt?

- Classification of Public Debt

- Federal Finance

- Effect of Public Debt

- Expenditure Cycle