What is Financial Planning?

Financial Planning is the process to understand our needs and financial goals, quantifying them and matching them with expected income over a sufficiently long time horizon. The objective of financial planning is to ensure that the right amount of money is available at the right point in the future to achieve an individual’s life goals.

Table of Contents

- 1 What is Financial Planning?

- 2 Concept of Finance and Financial Planning

- 3 Need for Financial Planning

- 4 Financial Planning Process

- 4.1 Establishing Good Relationship With Client

- 4.2 Clarify Your Present Situation by Collecting the Facts

- 4.3 Decide Where You Want to Be, Financially

- 4.4 Identify Financial Problems

- 4.5 Provide a Written Financial Plan and Alternative Plan

- 4.6 Implement Agreed-upon Recommendations From Your Plan

- 4.7 Periodically Review and Revise Your Plan

- 5 Financial Planning Strategy

- 6 Benefits of Financial Planning

Since the needs and goals of each individual are different, financial planning is required to be done for every individual separately. However, there are some basic concepts or fundamental principles which are applicable to all of us.

Concept of Finance and Financial Planning

Concept of Finance

Finance is a broad term that describes activities associated with banking, leverage or debt, credit, capital markets, money, and investments. Basically, finance represents money management and the process of acquiring needed funds.

Finance also encompasses the oversight, creation, and study of money, banking, credit, investments, assets, and liabilities that make up financial systems. The finance field includes three main subcategories: personal finance, corporate finance, and public (government) finance. In this article, we would deal with personal finance.

Financial Planning

Financial Planning provides you with a blueprint that helps you realize all your dreams in life in a very systematic and planned manner without causing you any sleepless nights. Remember, financial planning is a process, not a product.

It gives you the confidence that you know you are on the right track and in safe hands and that you will have the money when you need it – when you want to buy a house or a car or when you want to get your daughter married or send her off for education.

Or when you retire. Financial Planning combines the elements of risk management, investment planning, tax planning and retirement planning to comprehensively plan for your future needs.

Need for Financial Planning

- Need for personal financial planning to look at your complete financial situation, including your assets, liabilities, cash flows, financial goals, risk appetite, life situation, family background, etc.

- To plan systematically for your financial goals and objectives, including life insurance, health insurance, retirement, child planning – education & marriage, house purchase, estate planning, investment planning, etc.

- To make your financial life better and secured for yourself and your family and ensuring that all financial goals are achieved.

- To better understand and learn about your financial situation and understand the reasoning and logic behind all recommendations made. Also, to better understand the different asset classes and financial products and their suitability to you.

- To regularly review the progress of financial plans and/or to revise the financial plans to accommodate any major change in personal life or financial situation.

Who is a Financial Planner?

A financial planner is a qualified investment professional who helps individuals and corporations meet their long-term financial objectives. Financial planners do their work by consulting with clients to analyse their goals, risk tolerance, and life or corporate stages, then identify a suitable class of investments for them.

From there they may set up a program to help the client meet those goals by distributing their available savings into a diversified collection of investments designed to grow or provide income, as desired.

Financial planners may also specialize in tax planning, asset allocation, risk management, and retirement and/or estate planning.

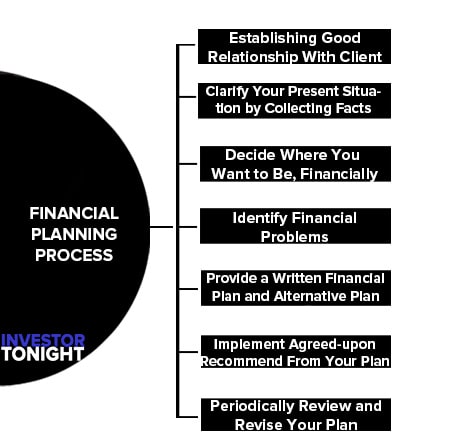

Financial Planning Process

There are steps involved in the financial planning process:

- Establishing Good Relationship With Client

- Clarify Your Present Situation by Collecting the Facts

- Decide Where You Want to Be, Financially

- Identify Financial Problems

- Provide a Written Financial Plan and Alternative Plan

- Implement Agreed-upon Recommendations From Your Plan

- Periodically Review and Revise Your Plan

Establishing Good Relationship With Client

Establishing good relationship with client: The financial planner should have good communication skills and also interpersonal skills so that client can easily share his / her financial information. as this is the basis upon which the further financial plan formation depends. Moreover, high ethical standards should be maintained as per the financial planning board of India (FPBI).

Clarify Your Present Situation by Collecting the Facts

Clarify your present situation by collecting the facts: You will want to assess all relevant personal and financial data such as lists of assets and liabilities, tax returns, records of securities transactions, insurance policies, wills, trusts, pension plans, etc.

The financial goals can be categorised into:

- Short term

- Medium term

- Long term

- Qualitative data

- Quantitative data

- Risk tolerance

- Personal strength and weaknesses

- Wealth accumulation perspective

- Taxation

- Concern for passing of wealth for future generation.

Decide Where You Want to Be, Financially

Decide where you want to be, financially: This will require you to identify both personal and financial goals and objectives for you and your family. These may include family financial planning issues like providing for your children’s college educations, supporting ageing parents, or relieving immediate financial pressures that would help maintain your current lifestyle and provide for retirement. These considerations are as important as what is in your bank account in determining your best strategy.

Identify Financial Problems

Identify financial problems that create barriers to you. Problem areas can include too little or too much insurance, a big tax burden, inadequate cash flow, or current investments that are losing the battle with inflation. These possible problem areas must be identified before solutions can be found.

Provide a Written Financial Plan and Alternative Plan

Provide a written financial plan and also an alternative plan: The length of the financial plan document will vary with the complexity of your individual situation. It should always be structured to meet your needs and objectives for example if the client is young and earning reasonably good then it is advisable to invest more in equity and less in debt as he has a long time horizon with good risk tolerance.

And if the client is a retired person then it is advisable to invest more in debt and income-producing investments as he requires regular income to meet his expenses. Investors can be divided into the following categories depending upon the risk appetite:

Risk Averse

Risk-averse describes the investor who chooses the preservation of capital over the potential for a higher-than-average return. Generally, the return on a low-risk investment will match, or slightly exceed, the level of inflation over time.

Moderate Investor

Moderate investors are generally described as “middle of the road” risk-takers. The goal is to balance out opportunities and risks, and the approach is sometimes described as a balanced approach. Typically use a mixture of stocks and bonds.

They might be roughly 50/50 or 60/40. That is: 60% of their assets might be in stocks (large companies, small companies, overseas stocks, etc) while 40% of assets are in bonds (including government and agency bonds, corporate bonds, high-yield bonds, foreign issues, etc).

Aggressive Investor

Aggressive investor An aggressive investor investment s typically invest in a portfolio that attempts to maximize returns by taking a relatively higher degree of risk. They are the ones who can take higher risks for higher returns. Strategies for achieving higher than average returns typically emphasize capital appreciation as a primary investment objective, rather than income or safety of principal.

Such a strategy would therefore have an asset allocation with a substantial weighting in stocks and possibly little or no allocation to bonds or cash. Aggressive investment strategies are typically thought to be suitable for young adults with smaller portfolio sizes.

Implement Agreed-upon Recommendations From Your Plan

Implement agreed-upon recommendations from your plan: A financial plan is only helpful if the recommendations are put into action. However, the decision to implement, modify, or reject the recommendations presented in your plan remains your sole responsibility.

Periodically Review and Revise Your Plan

Periodically review and revise your plan: A financial plan can be no better than the data upon which it is based. Periodic reviews and revisions of the plan are essential to account for changes in personal and economic changes in life.

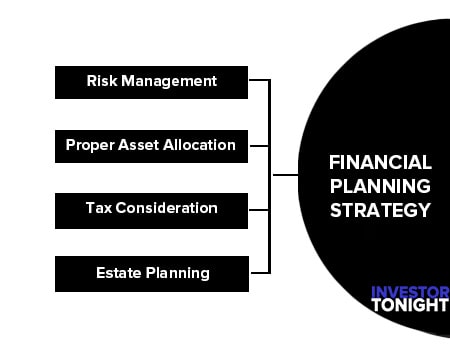

Financial Planning Strategy

A good financial planner should express verbally and in written form the detailed financial plan to the client so that he/she is aware of how that person will achieve his/her financial plan. some of the points of the strategy are as follows:

Risk Management

This involves minimizing the risk involve finances like health insurance, life cover, investment cover, income protection in order to provide income security to oneself and family. Health insurance is medical coverage that helps you meet your medical expenses by offering financial assistance.

Due to the high cost of hospitalization expenses, it is important to have a health insurance plan in place. Moreover, there should be insurance of major assets that protects your asset against any sudden and accidental damage, if required the company will pay the repair cost if unrepairable then replace your asset.

Proper Asset Allocation

This involves investment in the proper assets in order to achieve financial goals like debt, equity, mutual fund, bond, commercial paper. The thumb rule for this is an investment in debt should be equal to one’s age and the remaining amount should be in equity.

For example, a 30yr person should invest 30%in debt and the remaining 70% in equity.it also depends upon the risk appetite and income level of the client. An adequate amount of money should be kept as a liquid assets like cash to meet unexpected expenses.

Tax Consideration

Assessing proper tax planning so as to reduce tax burden effectively. It will help in the accumulation of wealth. Following taxes should be considered:

- Wealth Tax

- Entertainment Tax

- Property Tax

- Income Tax

- Gift Tax

- Corporate Tax

- Security transaction Tax

Debt that attracts more tax should be reduced. All details of the financial plan should be made clear to the client.

Estate Planning

Estate planning is the preparation of tasks that serve to manage an individual’s asset base in the event of their incapacitation or death. The planning includes the bequest of assets to heirs and the settlement of estate taxes.

Most estate plans are set up with the help of an attorney experienced in estate law. Assets that could make up an individual’s estate include houses, cars, stocks, artwork, life insurance, pensions, and debt.

Individuals have various reasons for planning an estate, such as preserving family wealth, providing for a surviving spouse and children, funding children’s or grandchildren’s education, or leaving their legacy behind to a charitable cause. The most basic step in estate planning involves writing a will. Other major estate planning tasks include the following:

- Limiting estate taxes by setting up trust accounts in the names of beneficiaries.

- Establishing a guardian for living dependents.

- Establishing annual gifting to qualified charitable and non-profit organizations to reduce the taxable estate.

- Setting up a durable power of attorney (POA) to direct other assets and investments.

Benefits of Financial Planning

These are benefits of financial planning which are given below:

- Create Your Own Wealth

- Manage Your Income, Cash Flow and Capital

- Secure Your Near and Dear Ones

- Enhance Your Financial Understanding

- Spend Freely

- Healthy Standard of Living

Create Your Own Wealth

Most of us prefer to buy things at the last moment and then pay the interest and principal amount over the course of the next few months. But how many have actually stopped and thought – am I overpaying when I buy things at the last moment? Well, most of the time you do.

If you start planning today for something you want to buy in the near future, your savings will buy that thing in a more cost-effective way than your instalments will ever do. These savings will earn interest for you (as opposed to you paying interest in instalments) and create substantial wealth in the long run if you plan your finances in a phased manner.

Manage Your Income, Cash Flow and Capital

Through planning, it is possible to manage your income in an effective way. It is certainly a plus if you can understand, well in advance, the money you will need to spend for your monthly expenditures, how much taxes you need to pay and ultimately how much you are going to save.

Keep careful track of your spending patterns and expenses. It will help in generating more cash flow for you. Just be cognizant of your spending and budget your money for an increased cash flow, resulting in an increase in capital. All this can help you to invest more for your future.

Secure Your Near and Dear Ones

Your family needs to benefit from any decisions you take, financially or otherwise. By following a meticulous plan for your investments and returns you will be providing them with financial security – a gift of supreme value. Having the correct amount of insurance coverage and policies will provide peace of mind to you and your loved ones.

Enhance Your Financial Understanding

If you have a good grasp of your own finances and how they work for you, you are one happy individual. Financial planning gives you an edge over others by providing a better understanding of financial concepts and helping you to achieve proper control over your investments.

All assets look desirable from a distance. But many of them have unseen liabilities attached to them. The knowledge of the real value of an asset comes with a good grasp of the financial basics. You can plan ahead by considering your objectives, risk appetite and personal preferences and then invest in the right assets to meet your needs and goals in an effective way.

Spend Freely

Who wouldn’t want a lavish life and spend freely over vacations? It is possible if you plan your monthly budget and maintain your expenses on a regular basis. Planning helps in avoiding unnecessary expenses. Plan ahead and spend freely knowing that your savings are not going to be hampered in any way.

Healthy Standard of Living

How do you plan to support your current, if not an improved lifestyle in the future? People who plan ahead and save money as per their requirements are able to accumulate enough wealth to lead a comfortable life. Having a financial goal and a plan which supports your goal will help you grow your money in a logical way.

Read More Articles