What is Financial Management?

Financial Management is the planning, organising, directing and controlling of the procurement and utilization of funds and safe disposal of profit to the end that individual, organizational and social objectives are accomplished.

Production, marketing and finance are three important line functions of an organisation but finance is the most important function which is treated as the life blood of any organisation. Without effective utilization of finance, no business can survive long.

Table of Contents

Introduction to Financial Management

Financial Management is the application of the general management principles in the area of financial decision-making, namely in the areas of investment of funds, financing various activities, and disposal of profits.

Meaning of Financial Management can be best described by the words ‘Effective Utilization of Funds. Financial Management is mainly a part of general management which utilizes available financial funds in optimum way for smooth functioning of business. It starts with planning, administration and control of funds.

Financial management also takes into account the future requirement of funds and keeps proper arrangements in present for the same. Hence the financial management is the study of income, expenses, capital investments, capital issues etc.

Financial Management Definition

Financial Management is concerned with the efficient use of an important economic resource, namely capital fund.

Ezra Soloman

Financial Management is an area of financial decision making harmonizing individual motives and enterprise goals.

Weston and Brigham

Financial Management is the operational activity of a business that is responsible for obtaining and effectively utilizing the funds necessary for efficient operations.

Joseph L. Massie

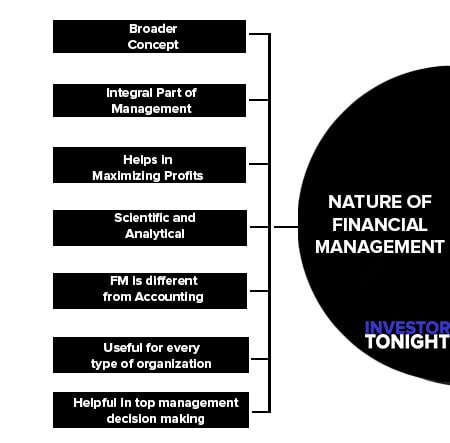

Nature of Financial Management

With the help of the following points we can understand the nature of financial management:

- Broader Concept

- Integral Part of Management

- Maximizing Profits

- Scientific and Analytical

- Different from Accounting

- Useful for every type of organization

- Decision Making

Financial Management is Broader Concept

It is not just about accounting of finance. It starts with procurement of funds as per the requirement and their best allocation. Financial planning is required till the business survive. It is an essential part of the business.

Integral Part of Management

Financial planning is the part of top level Management. Financial policies are drafted by top level mangers and then it is executed by other levels.

Helps in Maximizing Profits

Financial management helps in selecting the best alternate available. Funds are raised in a perfect combination of debt and equity which bears less cost of capital and are invested in best profitable avenues for higher returns.

It is Scientific and Analytical

It is scientific and analytical as it starts right from the beginning of business and continues till its survival. Financial management works on certain basic principles.

It helps in selecting the best method of financing with less risk and higher returns. It helps in understanding the behavior and pattern of finance.

Financial Management is different from Accounting

In accounting only collection of financial and related data is done whereas in financial management, analysis and decision making are main functions.

Useful for every type of organization

Financial Management is useful in every organization whether it is sole proprietorship or corporate, manufacturing or service It is applicable in non – profit organization also.

Helpful in top management decision making

Financial Management is helpful for top management in decision making.

Objectives of Financial Management

The main objective of a business is to maximize the owner’s economic welfare. Financial management provides a framework for selecting a proper course of action and deciding a commercial strategy.

Objectives of Financial Management are categories into two types:

Profit Maximization

Profit earning is the main aim of every economic activity. A business being an economic institution must earn profit to cover its cists and provide funds for growth. No business ca survives without earning profit. Profit is a measure of efficiency of a business enterprise. Profit also serves as a protection against risks which cannot be ensured.

Arguments in favor of Profit Maximization

- When profit earning is the aim of the business then the profit maximization should be the obvious objective.

- Profitability is the barometer for measuring the efficiency and economic prosperity of a business enterprise, thus profit maximization is justified on the ground of the rationality.

- Profits are the main source of finance for the growth of the business. So a business should aim at maximization of the profits for enabling its growth and development.

- Profitability is essential for fulfilling the social goals also. A firm by pursuing the objectives of profits maximization also maximizes the socio economic welfare.

- A business may be able to survive under unfavorable condition only if it had some past earnings to rely upon.

Arguments against of Profit Maximization

- It is precisely defined. It means different things for different people. The term ‘Profit’ is vague and it cannot be precisely defined. It means different things for different people.

Should we mean:- Short term profit or long term profit?

- Total profit or earning per share?

- Profit before tax or after tax?

- Operating profit or profit available for the shareholders?

- It ignores the time value of money and does not consider the magnitude and the timing of earnings.

It treats all the earnings as equal though they occur in different time periods. It ignores the fact that the cash received today is more important than the same amount if cash received after, say, three years. - It does not take into consideration the risk of the prospective earning stream. Some projects are more risky than others.

Two firms may have same expected earnings per share, but if the earning stream in one is more risky the market share of its share will be comparatively less. - The effect of the dividend policy on the market price of the shares is also not considered in the objective of the profit maximization.

In case, earnings per share is the only objective then the enterprise may not think of paying dividends at all because it retains profits in the business or investing them in the market may satisfy this aim.

Wealth Maximization

Wealth maximization is the appropriate objective of an enterprise. According to financial theory, wealth maximization is the single substitute for a stockholder’s utility.

When the firm maximizes the stockholder’s wealth, the individual stockholder can use this wealth to maximize his individual utility. Thus, by maximizing stockholder’s wealth the firm is maximizing stockholder’s utility.

A stockholder’s current wealth in the firm is the product of the number of shares owned, multiplied with the current stock price per share:

Stockholder’s current wealth in a firm = (Number of shares owned) × (Current stock price per share)

Symbolically, W0 =NP0

This means that higher the stock price per share, the greater will be the stockholder’s wealth. Therefore, rather than seeking maximization of profits a firm should aim at maximizing its current stock price. This objective will help in increasing the value of shares in the market. The price of the share serves as a performance index of the firm.

Arguments in favor of Wealth Maximization

- It serves the interests of owners as well as other stakeholders in the firm.

- It is consistent with the objective of owner’s economic welfare.

- The objective of wealth maximization implies long-run survival and growth of the firm.

- It takes into consideration the risk factor and the time value of money as the current present value of any particular course of action is measured.

- The effect of dividend policy on market price of shares is also considered as the decisions are taken to increase the market value of the shares.

- The goal of wealth maximization leads towards maximizing stockholder’s utility or value maximization of equity shareholders through increase in stock price per share.

Arguments against of Wealth Maximization

- The idea of wealth maximization is prescriptive idea.

- The objective of wealth maximization is not necessarily socially desirable.

- There is some controversy as to whether the objective is to maximize the stockholders wealth or the wealth of the firm which includes other financial claimholders such as debenture holders, preferred stockholders, etc.

- The objective of wealth maximization may also face difficulties when ownership and management are separated as is the case in most of the large corporate form of organizations.

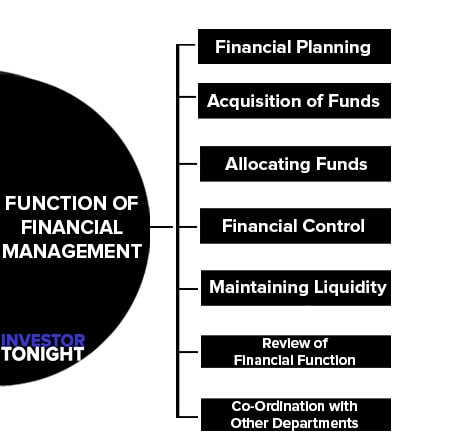

Function of Financial Management

Financial management includes performance of finance function which is divided into three main functions for the sake of convenience of study

These functions are divided on the basis, type and nature of function and duties they involve. Various activities like decision making, activities of non-recurring nature, strategic nature etc. are involved in these functions.

Details of these various functions are as below:

Primary Function

As the name itself speaks, this function is of executive nature and requires lot of skills and expert advice. It generally perform activities like preparation of financial plans, acquiring and allocation of funds, making arrangements for short term and long term requirements and controlling financial activities. Let us study each activity performed in detail.

Financial Planning

As financial plans is of primary nature and form base for other departments. Finance manager has to draft financial plans for the enterprise. If the business is new, a sound financial plan should be formulated keeping in mind the present and future financial requirements. If the enterprise is on going old plans must be reviewed.

These plans should be flexible enough to be changed according to the dynamic environment. After analyzing need for finance, finance manger plans as to which source should be opted for acquisition of funds. How much should be borrowed from outside financial institutions and how much from internal sources.

A perfect combination of debt and equity mix is carried out by financial manager which bears less cost of capital. Financial plans are to be reviewed from time to time according to the market situation and need of the business.

Acquisition of Funds

This is the crucial stage of financial planning. Funds are acquired from various sources which were decided in the primary function. All the formalities of acquiring funds are one under this. Every source has its own cost which is to be looked upon.

Allocating Funds

After acquiring funds, they are allocated to various assets, activities, projects etc. This is very important function because only after allocating funds project work will get started. Improper allocation may cause wastage of funds. Financial manager should ensure that none activity get more funds than they need otherwise resources will not be utilized in optimum way.

Financial Control

Financial control over various financial activities is necessary for smooth execution of activities. It is very important function of financial management. Finance manager make records, store information and make reports of various activities. This enables to make comparative statements with past performances and finance manager can take corrective functions if he feels so.

Subsidiary Function

After performing primary functions, come subsidiary functions. Details are as follows:

Maintaining Liquidity

Liquidity means firms financial position to meet its current liability. This is the subsidiary function to maintain adequate liquidity of the business. Business should be strong enough to meet its short term liabilities. Cash inflows and outflows should be balanced properly to maintain liquidity.

Review of Financial Function

Financial performance should be reviewed and presented in front of the board. This activity helps in taking corrective measures if require. Such reports made base for comparison with past performances like inter-firm comparison, trend analysis, ratio analysis, and cost-volume profit analysis.

Co-Ordination with Other Departments

Finance is required in each and every activity. Hence, finance function is related with every other department. It is the duty of the finance manager to make a balance between activities of every department. Additional finance required by other departments is also looked by finance department.

Routine Function

Finance is also required in day to day routine business. These functions are necessary or supplementary to other primary or subsidiary functions. Commonly performed routine functions are:

- Maintaining cash receipts, payments and checking cash balances.

- Maintaining accounts and keeping records

- Conducting internal audit

- Making public relation

- Keeping in mind the present governmental regulations.

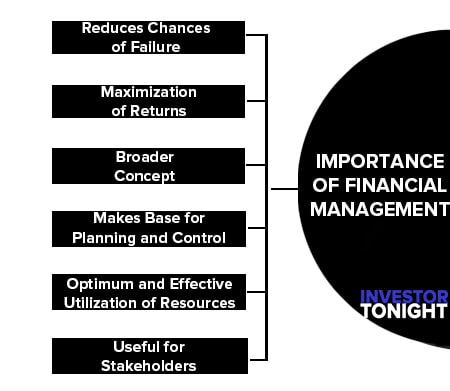

Importance of Financial Management

Maximum utilization of financial resources to earn maximum profit is the main aim of financial management. The success of every business depends upon sufficient finance as per its requirement.

The study of financial management is indispensable for both profit earning and non – profit earning organizations. Even the industrial progress of the country depends upon effective financial management.

Importance of Financial Management is being discussed under the following points:

- Reduces Chances of Failure

- Maximization of Returns

- Broader Concept

- Makes Base for Planning and Control

- Optimum and Effective Utilization of Resources

- Useful for Stakeholders

Reduces Chances of Failure

Implementation of proper system of financial management brings financial discipline in the organization. Every project is overlooked and carried out by detailed investigation which reduces chances of failure. Strong financial position ensures smooth functioning of the business.

Maximization of Returns

Good financial planning maximizes returns on investment as financial management is of scientific and analytical nature. Under modern approach of financial management, main objective is of wealth maximization. These keep shareholders and other stakeholders satisfy.

Broader Concept

Study of financial management has its applicability to each type of business from sole proprietorship to large business enterprises. It covers each and every financial activity in the business.

Makes Base for Planning and Control

Financial planning forms base for planning of other departments. As it is noted that each departments depends upon financial department to starts their functioning. Various budget plans are drafted on the basis of financial availability.

Optimum and Effective Utilization of Resources

Financial planning ensures optimum utilization of financial resources. Each and every stage is carefully planned under this beginning from generating funds to allocation and disposal of profits. Higher returns are expected for smooth functioning and survival of the business which can be only achieved by properly managing funds.

Useful for Stakeholders

Various stakeholders like business managers, investors, financial institutions, economist, politicians etc. are always interested in knownig financial position of the company as they maintain financial relation with business in some way.

Limitations of Financial Management

Besides its above importance, it has some limitations which are as follows

- Sometimes it becomes difficult to compute the effect of financial decisions on various other departments. It is very complex procedure which requires careful analysis.

- It requires deep knowledge of finance to perform various finance functions. No professional can be expert in each and every aspect of finance behavior which limits its skills.

- In India, financial management is still in its developing stage. We lack in expertise knowledge which limits the full use of the subject.

- Sometimes financial decisions may get affected by the personal point of view of the finance officer. It is human nature which sometimes gets biased which may sometimes adversely affect the financial decision.

- Proper implementation of financial management is of expensive nature. It is not possible for the small enterprise to appoint and get services of experts nor they implement proper system of financial management

Read More Articles

- What is Financial Management?

- What is Financial Statements?

- What is Financial Statement Analysis?

- What is Ratio Analysis?

- What is Funds Flow Statement?

- What is Cash Flow Statement?

- What is Working Capital?

- What is Cost of Capital?

- What is Capital Budgeting?

- What is Dividend Policy?

- What is Cash Management?

- What is Depository?

- What is Insurance?

- What is Financial System?

- International Financial Reporting Standards

- Stability of Dividends

- What is Factoring?

- Determinants of Working Capital

- Public Finance

- Public Expenditure

- What is Public Debt?

- Classification of Public Debt

- Federal Finance

- Effect of Public Debt

- Expenditure Cycle