What is Public Expenditure?

Public expenditure refers to the expenses incurred by the government for the maintenance of the government and to preserve the welfare of society as a whole.

Table of Contents

In other words, it refers to the expenses made by the public authorities, i.e. Central Government, State Government, and Local bodies to satisfy the common wants of the people. Public expenditure is not merely a financial mechanism but it also aims at securing social objectives.

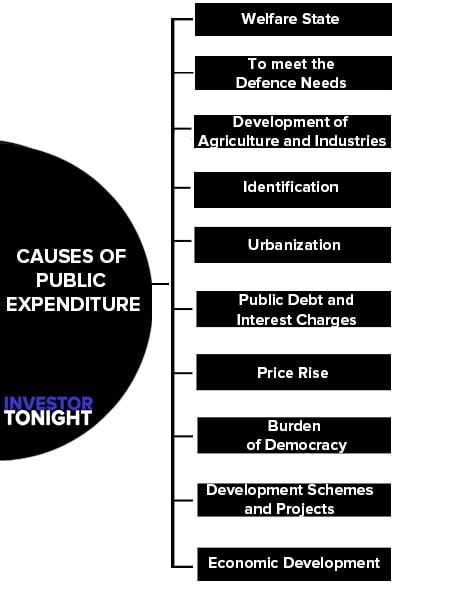

Causes of Public Expenditure

Following are the main causes of Public Expenditure:

- Welfare State

- To meet the Defence Needs

- Development of Agriculture and Industries

- Rising Population

- Urbanization

- Public Debt and Interest Charges

- Price Rise

- Burden of Democracy

- Development Schemes and Projects

- Economic Development

Welfare State

Modern states are no more police states. They have to look into the welfare of the masses for which the state has to perform a number of functions. They have to create and undertake employment opportunities, social security measures, and other welfare activities. All these require enormous expenditure.

To meet the Defence Needs

Every country pays greater attention to its defence preparedness against foreign attacks. The manufacture of modern nuclear weapons, training and planning of the army is a very costly affair. As Adam Smith also said long ago, “Defence is better than opulence.” So public expenditure on defence is essential.

Development of Agriculture and Industries

In developing countries like India, the development of agriculture and small-scale industries is the key factor of the progress of the economy. Every year, government spend a huge amount for the disbursement of loans, providing subsidised fertilisers and pesticides at minimum prices to farmers.

In addition to it, the government also take measure to provide consumer goods and services at a reduced cost. This led naturally to a greater share of Public expenditure .

Rising Population

The increase in population accounts for better health and medical facilities resulting in increase public expenditure on roads, railways, hospitals, schools, colleges, etc. Apart from that, the state also has to bear the additional responsibility of solving problems such as food, unemployment, housing, sanitation etc.

Urbanization

With the growth of population, there is the migration of population from rural to urban areas in search of employment. Existing cities expand and new cities come up. These require the huge public expenditure in providing civic amenities like water, lighting, roads, transport, schools, parks, houses, etc.

Simultaneously, the expenditure on civil administration also increases.

Public Debt and Interest Charges

The state borrows both internally and externally to meet its ever-increasing public expenditure. This further raises public expenditure in the form of repayment of loans and interest charges.

Price Rise

In modern times, prices have a tendency to rise continuously with the increase in the growth rate of the economy. As a result, the government expenditure on goods and services increases. The rise in the cost of living further exaggerates the government expenditure.

Burden of Democracy

Modern governments are democratic in nature. Countries are run on a multi-party system with elections after four or five years. This tends to increase Public expenditure . Further, there are “pressure groups” and “interest groups” within the parliament that want the allocation of government funds for providing public services in their constituencies.

Development Schemes and Projects

Modern government incurs a huge amount for the development of both rural and urban folks, apart from gender equity. Schemes, such as Digital India, Make in India, Ayushman Bharat, PM-KISAN, PM Garib Kalyan Yojana (PMGKY) have rendered huge expenditures on the part of the government.

Economic Development

Modern governments are engaged in the development of their economies. They spend large sums on infrastructural facilities, on research and development in various fields, development of the public sector, increasing national income, uplifting marginalized sections etc.

This has led to an increase in Public expenditure .

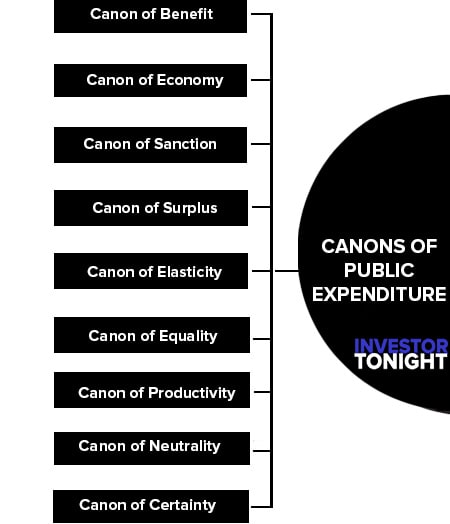

Canons of Public Expenditure

The canons or principles of public expenditure are the fundamental rules which should govern the expenditure policy of the state authority.

In fact, the principles of public expenditure determine the efficiency and propriety of the expenditure itself:

- Canon of Benefit

- Canon of Economy

- Canon of Sanction

- Canon of Surplus

- Canon of Elasticity

- Canon of Equality

- Canon of Productivity

- Canon of Neutrality

- Canon of Certainty

Canon of Benefit

The canon of benefit also known as the canon of maximum social advantage or benefit. It encompasses that the public money should not be utilized for the benefit of an individual or particular group rather it should equitably confer benefits on the entire society.

Thus, public authorities should distribute its resources in such a manner that marginal utility from all uses should be equal.

Canon of Economy

This canon implies that the state should be economical in spending money and that the wasteful and extravagant expenses should be avoided. Public expenditure must be productive and efficient. The state should not spend more than the necessary amount on the items of expenditure.

Canon of Sanction

This canon refers to the proper procedure of formulating the policy of public expenditure. As such, it implies that no public expenditure should be incurred without the sanction of proper authority. The objective is to avoid the possibility of unwise spending and assure that the sanctioned money is properly utilized.

Public accounts should be audited at the end of financial year.

Canon of Surplus

It means that the public authority must earn its living and pay its way like ordinary citizens. Balanced budgets, as in private expenditure, should be the order of the day. It also aims at surpluses in the government’s budget and avoid deficits.

In other words, public authorities must have sufficient revenues not to meet their current expenditure but must have surplus for unforeseen future.

Canon of Elasticity

According to this principle state’s expenditure policy should be like this that it can change according to the situation it can be possible to increases or decreases in public expenditure.

Actually the objective of this principle is to maintain elasticity in the public expenditure so that in the case of emergency like war or overall development finance arrangement cannot become unsuccessful. In other words the arrangement of public expenditure should be like that.

If in emergency mutual transfers of resources take place then the country’s economic life should not get effected for example, in war time there should not be any difficulty if expense done on war instead of house construction.

Canon of Equality

This principle states that public expenditure should be done in such a way so that the difference of the distribution of income is low. In other words public expenditure gives satisfaction of equitable distribution of income between different sectors of society.

This aim can only be achieved when the more gain reaches to the poor people by public expenditure. This gain can be given in the form of medical help, education, house construction and old age pension. This principle is more beneficial in those countries where a huge disparities is found in income distribution.

This is the reason that this principle is implemented in developing countries like India implementing economic activities and tregory policies of states.

Canon of Productivity

According to this principle expenditure and policy of state should encourages country’s production. It is clear that according to this principle maximum public expences should be done for production and development work.

Underdeveloped countries can gain a lot from this principle because in these countries, “For the increment in social and government services and for consume facilities of community public expenditure has to be elaborated, “ so the objectives of public expenditure are to provide maximum employment production and income.

Canon of Neutrality

Public expenditure should not worsen the production-distribution-exchange relationship instead of improving it. Public expenditure should result in increased production and productivity, reduced inequality of income and wealth and increased economic activity and exchange relationship.

Canon of Certainty

The public authorities should clearly know the purposes and extent of public expenditure to be incurred. This anon explains the preparation of public budgets.

Effects of Public Expenditure on Production

The effects of public expenditure on production can be evaluated by examining its effects on the following:

- Ability to Work Save and Invest

- Willingness to Work Save and Invest

- Diversion of Resources Between Different Uses and Areas

Ability to Work Save and Invest

Public expenditure may tend to influence the ability of the people to work, save and invest. This is described as ‘efficiency effect’. Public expenditure designed to increase the efficiency of the people will certainly improve their ability to work.

When a person’s ability to work is increased, his earnings will also increase. As a consequence his ability to save also improves.

Willingness to Work Save and Invest

Public expenditure may tend to affect the willingness of the people to work, save and invest which is described as ‘incentive effect’.As far as the will to, save and invest is concerned, it depends to great extent on the character of public expenditure and public policy of the governments.

Diversion of Resources Between Different Uses and Areas

Public expenditure can significantly influence the level and pattern of production through the diversion of economic resources between different uses and areas.

Therefore, the government has to incur public expenditure in those areas and regions which would secure maximum national production and maximum social advantage.

Effects of Public Expenditure on Distribution

One of the important modern state policies, especially in developing countries and socialistic countries, is reduction of inequalities in the distribution of income and wealth. Public expenditure plays vital role in realising this objective.

According to Dalton, “The system of public expenditure is the best, which has the strongest tendency to reduce inequality of income.” Public expenditure which is in the form of money grants, supply of social goods and services, social security measures, subsidies etc. certainly affects the distribution of income in a country in socially desirable way.

Expenditures carried out for benefiting the poor people such as those on social services like free medical treatment, free education, unemployment benefit etc. will enhance the benefit of the poor section than the rich.

This will help in reducing the gulf between the rich and the poor in the distribution of income and wealth, thus bringing about justice in the economy.

Read More Articles

- What is Financial Management?

- What is Financial Statements?

- What is Financial Statement Analysis?

- What is Ratio Analysis?

- What is Funds Flow Statement?

- What is Cash Flow Statement?

- What is Working Capital?

- What is Cost of Capital?

- What is Capital Budgeting?

- What is Dividend Policy?

- What is Cash Management?

- What is Depository?

- What is Insurance?

- What is Financial System?

- International Financial Reporting Standards

- Stability of Dividends

- What is Factoring?

- Determinants of Working Capital

- Public Finance

- Public Expenditure

- What is Public Debt?

- Classification of Public Debt

- Federal Finance

- Effect of Public Debt

- Expenditure Cycle