What is Public Debt?

Public debt is a source of collecting income by state. Public or local debt is the debt the state collects from the citizens of other countries. When the government borrows then it gives birth to public debt. Government can take debt from banks, businesses or organizations, business houses, and the person.

Table of Contents

- 1 What is Public Debt?

- 2 Classification of Public Debt

- 3 Methods of Repayment of Debt

- 4 Difference Between Private Debt and Public Debt

- 5 Objectives of Public Debt

- 5.1 Income and Revenue

- 5.2 In Times of Depression

- 5.3 To Curb Inflation

- 5.4 To Finance Development Plans

- 5.5 To Finance Public Enterprises

- 5.6 Expansion of Education and Health Services

- 5.7 To Finance War

- 5.8 For the Establishment of Social Society

- 5.9 To Cover the Expenditure on Administrative Work Till Getting Income

- 5.10 To Make the Public Verdict Favourable

- 6 Advantages of Public Debt

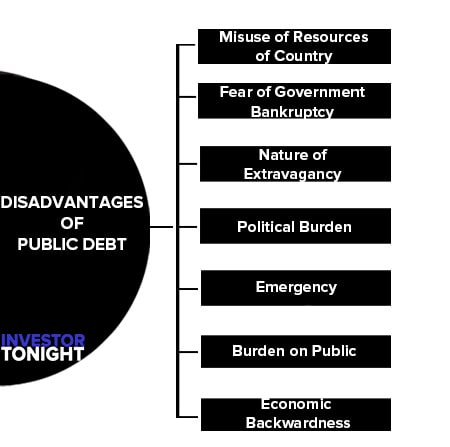

- 7 Disadvantages of Public Debt

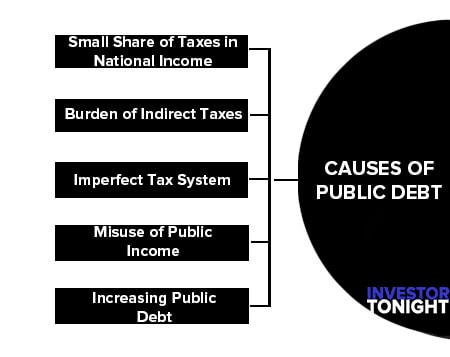

- 8 Causes of Public Debt

- 9 Effect of Public Debt

Government can take debt from inside the country and from outside the country, or from both sides. The public debt normally is in the form of bonds (or if the debt is for short time, then in the form of a fiscal letter).

In these bonds government process that he will not only pay back the money on fix time but also give instalments on a regular gap on complete fix rate or in last in the form of a fixed amount, he will pay interest also. Debt is the last way of income for the government.

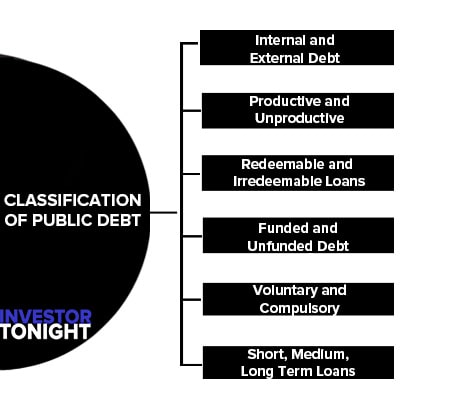

Classification of Public Debt

Following are the classification of public debt:

- Internal and External Debt

- Productive and Unproductive

- Redeemable and Irredeemable Loans

- Funded and Unfunded Debt

- Voluntary and Compulsory

- Short, Medium, Long Term Loans

Internal and External Debt

When the government raises revenue by borrowing from within the country, it is called internal debt. Whereas if the government is borrowing from the rest of the world, it is a case of external debt.

Productive and Unproductive

Productive and Unproductive(Purpose of loans): Loans on Projects yielding income (Construction of plants, railways, power schemes, etc.) are called productive debt. Loans on loan non-income yielding projects are called unproductive loans (war, famine relief, etc.).

Redeemable and Irredeemable Loans

Redeemable and Irredeemable loans (Promise to repay): Redeemable debts refer to the loan which the government promises to pay off at some future date. (principal plus interest) Irredeemable debts are those, the principal amounts of which are never returned by the government but pays interest regularly.

Funded and Unfunded Debt

Funded and unfunded debt (Provision for repayment): Funded debt is long-term or ‘definite period’ debt. A proper agreement and terms and conditions of repayment with the percentage of interest payable are declared. They are used for the creation of permanent assets.

Unfunded debt is for a short term and for an indefinite period. It is paid through the income received from other sources. These are used for meeting current needs.

Voluntary and Compulsory

Voluntary and compulsory (On the basis of legal enhancement): Voluntary debt is the debt that is paid by any legal enforcement. Whereas compulsory debt is legally forced in nature. Here people have no option but to repay the debt.

Short, Medium, Long Term Loans

Short, Medium, Long term loans (Time duration): Short term loans are usually incurred for a period varying from three months to one year. Usually, governments get such loans from the central bank by using treasury bills. These loans are calls ‘ways and means advances.

Medium Term loans are those which are obtained for more than one year but less than ten years.

Long-term loans are those which are obtained for more than ten years. These are used to finance developmental activities.

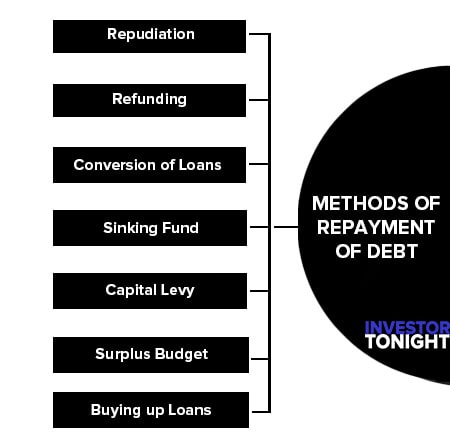

Methods of Repayment of Debt

These are methods of repayment of debt which are given below:

Repudiation

It means refusal to pay a debt by governments. This method was followed by the USA after the civil war and by the USSR after the 1917 Revolution. This method is undesirable and has not been used recently anywhere in the world.

Repudiation shakes the confidence of the people in public debt and many provoke retaliation from creditor countries.

Refunding

Refunding is the process of replacing maturing securities with new securities. In some cases, the bonds may be redeemed before the maturing date when the government intends to rearrange the maturity of outstanding debts or when the current rate of interest is low.

Generally, short-term borrowings are made in anticipation of tax collections for meeting current expenditure. However, the excessive burden of new expenditure does not permit the retirement of the debt by means of revenue newly raised or by means of long-term borrowing.

Thus, there is the necessity of refunding the loans by old lenders and renewing the loans at a lower rate of interest for future periods. The drawback of this method is that the government is tempted to postpone its obligation of debt redemption. This leads to a continuous increase in the burden of public debt in the future.

Conversion of Loans

It is a special type of refund. Conversion of existing securities into new securities before maturity. It is generally resorted to reducing the burden of debt by converting high-interest loans into low-interest loans.

According to Professor Dalton, the conversion does not reduce the burden of public debt on the state; because a reduction in interest rates reduces the ability of the creditors to pay taxes which may mean a loss of income to the government thereby reducing its capacity to repay loans.

Sinking Fund

A sinking fund is a special fund created for the repayment of public debt. There is a theoretical justification for creating this fund because it imposes a requirement on the government to pay the old debts regularly. According to this method, the government sets aside a certain amount out of the budget every year for this fund.

The balances in the funds are also invested and the interest accruing on them is also credited to the fund. The sinking fund is of two types:

- Certain sinking fund here, the governments credit a fixed sum of money annually.

- Uncertain sinking fund the amount is credited when government secures a surplus in the budget.The one danger of this method is that the government may not wait till the end of the period of maturity and utilize the fund for some other purpose than the one for which the fund was created originally.

The practice of sinking funds inspires confidence among lenders and the enhancement of the creditworthiness of governments.

Capital Levy

Capital levy is a special type of “once for all” tax on capital imposed to repay war debts. All capital goods are taxed above a minimum level of assets possessed by residents of the country. Simply, a capital levy refers to a very heavy tax on property and wealth.

This tax was levied immediately after the First World War. This method has been advocated by economists like David Ricardo, Pigou, and Dalton. Professor Dalton has suggested that capital levy is a method of debt redemption with the least real burden on society. It is useful on account of its deflationary character.

Surplus Budget

Quite often, the surplus budget may be used to clear the public debt. But in recent times due to the ever-increasing public expenditure, a surplus budget is a rare phenomenon.

Buying up Loans

Buying up Loans: Governments redeems debt by buying up loans from the market.

Difference Between Private Debt and Public Debt

There are many similarities and dissimilarities between private or (non-government debt) and government debt. A private person and business home use this debt money to get some resources. So, private debt transfers the money from one use to another use.

By this, the meaning of public debt is those productive uses who are liked by no government area, sacrifice for those uses, which the government likes. By this government and non-government debt, are both normally transferred for money from one use to another.

The difference between public and private debt is following:

- For government, there are internal and external both the sources are available but for persons these type of sources are not available.

- The use of debts taken by the government is for the complete society but the money got from private debts are used only for gain of debt taken person.

- As state has a good position, so as comparison to private debt, the rate of interest is law in government debts. Normally, it happens that some corporation got debt on simple rates like government.

- Government can force people to give debt but a person can not.

- Government takes debts normally for production works but a person can take debt for consumption.

- Personal debts are returned by public income, in which public industries income is also included. But a person pays debts from his personal income. So, by public debt, the nature of pressure is different from the nature of private debt’s pressure.

- In the last government can borrow debt in a form of policy, whether he needs money or not. It can be possible that debt helps to bring stability in economic life. In the days of depression, it reduces the quantity of work power in the hands of people, it helps to bring the rates down.

In the days of depression, government is able to do some types of expenditure by debts; it helps to bring the level high for employment and business actions.

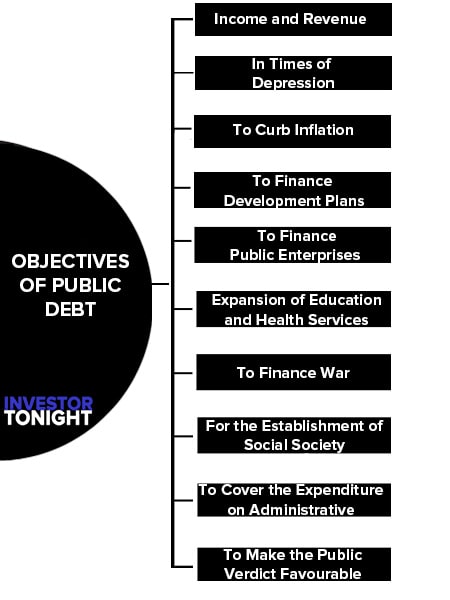

Objectives of Public Debt

These are objectives of public debt:

- Income and Revenue

- In Times of Depression

- To Curb Inflation

- To Finance Development Plans

- To Finance Public Enterprises

- Expansion of Education and Health Services

- To Finance War

- For the Establishment of Social Society

- To Cover the Expenditure on Administrative Work Till Getting Income

- To Make the Public Verdict Favourable

Income and Revenue

The target of public debt normally is to cover the ditch that developed in any year between proposed expenditure and expected revenue.

Whenever because of increased administrative expenditure or flood, feminine, earthquake and communicable diseases like unexpected problem government’s income becomes less because they have to spend it to covers these problems then government cover it by taking Indian and Foreign debts.

This is the government; whose income is different from all the taxes and revenue sources.

In Times of Depression

Depression is the condition when costs reduce, there is a lack of courage in people for spending money on industries and in future, there is no possibility of getting gain. This condition can be removed when there is an increase in the demand for things and services and that is possible when in the country there is an increase in the expenditure of public construction work or most important public use and infrastructure services.

But, the increase in government expenditure is only possible when there is an increase in government income, and an increase in public income is not possible by taxation because it affects unfavorably the incentive to do work and to invest that reduce the effective demand.

So, there is only one way to take debt for the government. Governments mainly take debt from banks so that they can get money for investment and could increase the income or employment and as its result, effective demand could also be increased.

By this, the reduced cost can be stopped and the government is able to bring process and to develop it at the time of economic depression.

To Curb Inflation

Inflation is the name of that condition at the time of increased cost. So, government by taking debt can take back a big quantity of work power from the hands of people but modern economists believe that as a comparison to government tax, taxation is said to be more important will to remove inflation because if the debted government money is never used in productive use.

It increases the responsibility for government to give it back. But waste tax – income can easily be debited in the government fund so the pressure can be removed from production in the economy.

To Finance Development Plans

In an undeveloped economy, there is always a lack. In these countries, the ability to pay the bill is less. So, the government can not take shelter on heavy taxation. But to remove poverty from the country, this is also most needed and important to do arrangements of development plans.

In this condition, the only way is to take public debt. So, the governments of undeveloped countries take debts from within the country or from foreign governments, or from people to do finance arrangements.

To Finance Public Enterprises

The government also takes debts for the arrangement of finance for the commercial enterprises running by itself.

Expansion of Education and Health Services

Government can also take debt for the construction and development of education and health services and other services like this. That helps to increase normal social welfare but does not give any direct finance and that is not productive from the angle of currency.

To Finance War

Government can take debt for the self-defence work. In the present century of increased international pressure and atomic war, there is a need for money in big amounts to save the country from foreign attacks and for self-defence services, and to do the arrangement of modern decoration.

But it is very difficult to collect the money for modern wars only by taxation because it affects production unfavourably. So, to cope up with this type of situation government can take shelter from public debt from inside and outside the country.

For the establishment of a socialist society, the government is doing nationalism of industry and business in the present time and running it themselves, but to run modern industries, there is a need for the big quantity of money the government can only fulfil this by taking debts.

To Cover the Expenditure on Administrative Work Till Getting Income

The income which government got from taxes that is available at the end of the year but expenditure is from the starting of the year so at the beginning of the year government spends money by taking debt and pays the debts when it got the income in the last of the year.

To Make the Public Verdict Favourable

When the citizens are not able to pay the tax then the government has to take debt. Sometimes even then the more capable of the public, the government never increases taxes because the public verdict sticks to favourably.

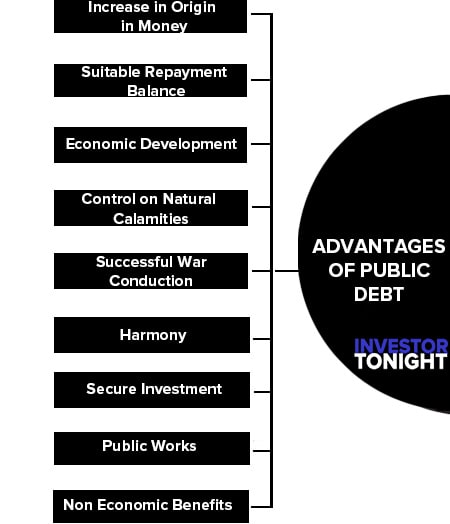

Advantages of Public Debt

The advantage of public debts are as follow:

- Increase in Origin in Money

- Suitable Repayment Balance

- Economic Development

- Control on Natural Calamities

- Successful War Conduction

- Harmony

- Secure Investment

- Public Works

- Non Economic Benefits

Increase in Origin in Money

Increase in Origin in Money: Public debts encourage industries in-country, production increases, national income increases by which the living standard of citizens of the country increases.

Suitable Repayment Balance

Suitable Repayment Balance: Business and repayment balance become in favour of taking debt and the problem of foreign investment solves.

Economic Development

Economic Development: Undeveloped countries become capable to do their economic development by public debts.

Control on Natural Calamities

Control on Natural Calamities: Government takes the help of public debts to control natural calamities.

Successful War Conduction

Successful War Conduction: Wars have become very expensive today. Therefore, taking debt is essential for the conduction of war.

Harmony

Harmony: Equal and suitable distribution debts take place by which harmony and cooperation increase.

Secure Investment

Secure Investment: Public debts are secure sources of investment and every individual considers it profitable to invest money in them.

Public Works

Public Works: With the help of public debts public works and plans like the building of roads, water-electricity, canals, bridges etc. can be implemented by the government.

Non Economic Benefits

Non-Economic Benefits: Friendly relations develop between countries taking and giving debts from public debts.

Disadvantages of Public Debt

These are the disadvantages of public debt given below:

- Misuse of Resources of Country

- Fear of Government Bankruptcy

- Nature of Extravagancy

- Political Burden

- Emergency

- Burden on Public

- Economic Backwardness

Misuse of Resources of Country

Misuse of Resources of Country: Such conditions must be laid while taking public debts that the industries on which debt is used, that must have partial control on the country debtor. Misuse of sources of the country takes place in favour and a big part of the money goes to foreign countries as interest.

Fear of Government Bankruptcy

Fear of Government’s Bankruptcy: If the government receives debt easily then there is a fear that whether the government may receive such a large amount of debt whose repayment may become impossible.

Nature of Extravagancy

Nature of Extravagancy: When public debt begins to receive easily then there is a fear of its extravagance.

Political Burden

Political Burden: Debt-giver country intervenes in the policies of debtor country for the defence of capital of their citizens and debtor country loses its political freedom.

Emergency

Emergency: There is a fear of emergency like political controversy and war from public debts.

Burden on Public

The burden on the Public: When debts are taken for non-productive works then the burden of tax is increased on the public for its repayment.

Economic Backwardness

Economic Backwardness: Foreign debt makes the economy of the country weak and the country begins to depend on others for their economic development.

Causes of Public Debt

These are causes of public debt which are given below:

- Small Share of Taxes in National Income

- Burden of Indirect Taxes

- Imperfect Tax System

- Misuse of Public Income

- Increasing Public Debt

Government can borrow because it can possible that local income was not enough for their expenditure due to incidental expenditure government could have to borrow because it is not possible to increase the tax income at that point. Government can borrow finance arrangement of capital expenditure because current revenue will not be enough to fulfill the target.

At the time of depression, when private demand is not enough then government borrows, the extra savings of people which is not in use and spends it to increase the effective demand and by this gives birth to extra income and employment in the society. These extra amounts from government taxes are supplementary to each other.

After India got independence, there is an increase in national income four times more. In present, there is a part of tax less than 20% in the national income but this percentage in America is 22.42%, in Sweden 26.3%, in Australia 27.9%, in Nederland 29.2% and in England 30.4%.

Except this, in these countries, most parts of income from taxes got from direct taxes and in India, most part of the tax income is from indirect taxes. So, in this condition, fiscal policy cannot be able to help in the increase in the development of Economy.

Burden of Indirect Taxes

In Indian tax system, there is a burden of indirect taxes that is not just. In the economy there is an inflation increase in indirect taxes that the complete tax arrangement has become imbalanced and unjust. Most of the pressure of taxes are from indirect taxes the lower class people who have to face as a comparison to rich section so this increase, economical problems in society.

Regarding this, Prof. K.T. Shah says right, “Even there is more taxability in rich section and there is less tax pressure on them. In its opposite, on the lower section, the tax pressure is equal to the part of a lion and the ability to face is equal to the baby sheep”.

Imperfect Tax System

The Indian tax system is not working perfectly. In India, there is very high tax evasion because our tax system is full of error. According to the idea of Prof. Kaldor, in India, there is tax evasion of ₹ 200 – ₹300/- crore, every year. Except this, the complete part of income tax is never collected.

Misuse of Public Income

In India, a big part of public income misused. A big part is spent on undeveloped plans, except this, some plans are started on the basis of standard. A big quantity is spent on them even public got no gain from these. There is a big quantity spent on government departments where there is corruption, bribe, and red-tapism available and work is completed with very difficult. By this reason, there is a reduction in production.

Increasing Public Debt

To fulfill the five-year plans in India, there is a big quantity of financial resources needed. To fulfil this public debt is to be taken as a help. And there is a regular increase in the pressure of it. Because of most of them depend on foreign debt, there is non-definite plans of economic development.

Effect of Public Debt

These are effects of public debt which we discussed in detail below:

- Revenue Effect

- Expenditure Effect

- Effect on Consumption

- Effect on Production

- Effect on Distribution

- Effect on Private Sector

- Effect on Cost of Production

- Effect on Employment

- Effect on Investment

Read More Articles

- What is Financial Management?

- What is Financial Statements?

- What is Financial Statement Analysis?

- What is Ratio Analysis?

- What is Funds Flow Statement?

- What is Cash Flow Statement?

- What is Working Capital?

- What is Cost of Capital?

- What is Capital Budgeting?

- What is Dividend Policy?

- What is Cash Management?

- What is Depository?

- What is Insurance?

- What is Financial System?

- International Financial Reporting Standards

- Stability of Dividends

- What is Factoring?

- Determinants of Working Capital

- Public Finance

- Public Expenditure

- What is Public Debt?

- Classification of Public Debt

- Federal Finance

- Effect of Public Debt

- Expenditure Cycle