What is Depository?

A depository is an organisation that holds securities (like shares, debentures, bonds, government securities, mutual fund units etc.) of investors in electronic form at the request of the investors through a registered Depository Participant. It also provides services related to transactions in securities. (SEBI).

Table of Contents

What is Depository System?

A depository is a firm wherein the securities of an investor are held in electronic form and who carries out the transactions of securities by means of book entry. The depository acts as a de facto owner of the securities lodged with it for the limited purpose of transfer of ownership.

It functions as a custodian of securities of its clients. The name of the depository appears in the records of the issuer as the registered owner of securities. Depository system is also known as the “Scripless Trading System”.

It is an organization that holds the securities of a shareholder in the form of electronic accounts (dematerialized form), in the same way, a bank holds the money. A custodian of its client’s securities. Interfaces with its investors through its agents called “depository participants”.

Constituents of Depository System

The depository system comprises of:

Depository

Depository functions like a securities bank, where the dematerialized physical securities are traded and held in custody. This facilitates faster risk-free and low-cost settlement. The depository is much like a bank and performs many activities that are similar to a bank depository:

- Enables surrender and withdrawal of securities to and from the depository through the process of ‘demat’ and ‘remat.

- Maintains investors’ holdings in electronic form.

- Effects settlement of securities traded in depository mode on the stock exchanges.

- Carries out settlement of trades not done on the stock exchanges (off market trades).

In India, a depository has to be promoted as a corporate body under the Companies Act, 1956. It is also to be Registered as a depository with SEBI. It starts operations after obtaining a certificate of commencement of business from SEBI.

It has to develop automatic data processing systems to protect against unauthorised access. A network to link up with depository participants, issuers and issuer’s agent has to be created. Depository, operating in India, shall have a net worth of rupees one hundred crore and instruments for which depository mode is open need not be security as defined in the Securities Contract (Regulations) Act 1956.

The depository, holding securities, shall maintain ownership records in the name of each participant. Despite the fact that legal ownership is with a depository, it does not have any voting right against the securities held by it. Rights are intact with investors. There are two depositories in India at present i.e. NSDL and CDSL.

Depository Participants (DP)

A DP is investors’ representative in the depository system and as per the SEBI guidelines, financial institutions/banks/custodians/stockbrokers etc. can become DPs provided they meet the necessary requirements prescribed by SEBI. DP is also an agent of depository which functions as a link between the depository and the beneficial owner of the securities.

DP has to get itself registered as such under the SEBI Act. The relationship between the depository and the DP will be of a principal and agent and their relationship will be governed by the bye-laws of the depository and the agreement between them.

Application for registration as DP is to be submitted to a depository with which it wants to be associated. The registration granted is valid for five years and can be renewed. As depository holding the securities shall maintain ownership records in the name of each DP, DP in return as an agent of the depository shall maintain ownership records of every beneficial owner (investor) in book-entry form.

A DP is the first point of contact with the investor and serves as a link between the investor and the company through depository in the dematerialisation of shares and other electronic transactions. A company is not allowed to entertain a Demat request from investors directly and investors have to necessarily initiate the process through a DP.

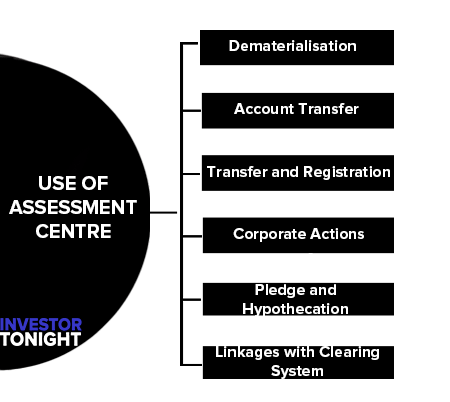

Functions of Depository

These are the functions of depository which are given below:

- Dematerialisation

- Account Transfer

- Transfer and Registration

- Corporate Actions

- Pledge and Hypothecation

- Linkages with Clearing System

Dematerialisation

One of the primary functions of a depository is to eliminate or minimise the movement of physical securities in the market. This is achieved through the dematerialisation of securities. Dematerialisation is the process of converting securities held in physical form into holdings in book-entry form.

Account Transfer

The depository gives effects to all transfers resulting from the settlement of trades and other transactions between various beneficial owners by recording entries in the accounts of such beneficial owners.

Transfer and Registration

A transfer is the legal change of ownership of a security in the records of the issuer. For affecting a transfer, certain legal steps have to be taken like endorsement, execution of a transfer instrument and payment of stamp duty.

The depository accelerates the transfer process by registering the ownership of shares in the name of the depository. Under a depository system, transfer of security occurs merely by passing book entries in the records of the depositories, on the instructions of the beneficial owners.

Corporate Actions

A depository may handle corporate actions in two ways. In the first case, it merely provides information to the issuer about the persons entitled to receive corporate benefits. In the other case, depository itself takes the responsibility of distribution of corporate benefits.

Pledge and Hypothecation

The clients may use the securities held with NSDL as collateral to secure loans and other credits. In a manual environment, borrowers are required to deliver pledged securities in physical form to the lender or its custodian. These securities areverified for authenticity and often need to be transferred in the name of lender.

This has a time and money cost by way of transfer fees or stamp duty. If the borrower wants to substitute the pledged securities, these steps have to be repeated. Use of depository services for pledging/ hypothecating the securities makes the process very simple and cost effective.

The securities pledged/hypothecated are transferred to a segregated or collateral account through book entries in the records of the depository.

Linkages with Clearing System

Whether it is a separate clearing corporation attached to a stock exchange or a clearinghouse (department) of a stock exchange, the clearing system performs the functions of ascertaining the pay-in (sell) or payout (buy) of brokers who have traded on the stock exchange.

Actual delivery of securities to the clearing system from the selling brokers and delivery of securities from the clearing system to the buying broker is done by the depository. To achieve this, depositories and the clearing system should be electronically linked. Having understood the depository system, let us now look at the organisation and functions of National Securities Depository Limited (NSDL).

National Securities Depository Limited

National Securities Depository Limited is the first depository to be set-up in India. It was incorporated on December 12, 1995. The Industrial Development Bank of India (IDBI) – the largest developmentbank in India, Unit Trust of India (UTI).

The largest Indian mutual fund and the National Stock Exchange (NSE) – the largest stock exchange in India, sponsored the setting up of NSDL and subscribed to the initial capital. NSDL commenced operations on November 8, 1996:

- Ownership

- Management of NSDL

- Bye-Laws of NSDL

- Business Rules of NSDL

- Functions

- Services Offered by NSDL

- Fee Structure of NSDL

- Inspection, Accounting and Internal Audit

- Settlement of Disputes

- Technology and Connectivity

Ownership

NSDL is a public limited company incorporated under the Companies Act, 1956. NSDL had a paid-up equity capital of Rs. 105 crore. The paid up capital has been reduced to Rs. 80 crore since NSDL has bought back its shares of the face value of Rs. 25 crore in the year 2000. However, its net worth is above the Rs. 100 crore, as required by SEBI regulations.

Management of NSDL

NSDL is a public limited company managed by a professional Board of Directors. The Chairman & Managing Director (CMD) conducts the day-today operations. To assist the CMDin his functions, the Board appoints an Executive Committee (EC) of not more than 15 members. The eligibility criteria and period of nomination, etc. are governed by the Byelaws of NSDL in this regard.

Bye-Laws of NSDL

Byelaws of National Securities Depository Limited have been framed under powers conferred under section 26 of the Depositories Act, 1996 and approved by Securities and Exchange Board of India. The Byelaws contain fourteen chapters and pertain to the areas listed below:

- Short title and commencement.

- Definitions

- Board of Directors

- Executive Committee

- Business Rules

- Participants

- Safeguards to protect interest of clients and participants.

- Securities

- Accounts/transactions by book entry.

- Reconciliation, accounts and audit.

- Disciplinary action.

- Appeals.

- Conciliation.

- Arbitration

Amendments to NSDL Bye-Laws require the approval of the Board of Directors of NSDL and SEBI.

Business Rules of NSDL

Amendments to NSDL Business Rules require the approval of NSDL Executive Committee and filing of the same with SEBI at least a day before the effective date for the amendments.

Functions

NSDL performs the following functions through depository participants:

- Enables the surrender and withdrawal of securities to and from the depository.

- Dematerialisation and rematerialisation.

- Maintains investor holdings in the electronic form.

- Effects settlement of securities traded on the exchanges.

- Carries out settlement of trades not done on the stock exchange (off-market trades).

- Transfer of securities.

- Pledging/hypothecation of dematerialised securities.

- Electronic credit in public offerings of companies or corporate actions.

- Receipt of non-cash corporate benefits like bonus rights, etc. in electronic form.

- Stock Lending and Borrowing.

Services Offered by NSDL

NSDL offers a host of services to the investors through its network of DPs:

- Maintenance of beneficiary holdings through DPs.

- Dematerialisation.

- Off-market Trades.

- Settlement in dematerialised securities.

- Receipt of allotment in the dematerialised form.

- Distribution of corporate benefits.

- Rematerialisation.

- Pledging and hypothecation facilities.

- Freezing/locking of investor’s account.

- Stock lending and borrowing facilitie.

Fee Structure of NSDL

NSDL charges the DPs and not the investors directly. These charges are fixed. The DPs inturn, are free to charge their clients, i.e., the investors for their services. Thus, there is a two-tierfee structure.

Inspection, Accounting and Internal Audit

NSDL obtains audited financial reports from all its DPs once every year. NSDL also carries out periodic visits to the offices of its constituents – R&T agents, DPs and clearing corporations – to review the operating procedures, systems maintenance and compliance with the Byelaws, Business Rules and SEBI Regulations.

Additionally, DPs are required to submit to NSDL, internal audit reports every quarter. Internal audit has to be conducted by a chartered accountant or a company secretary in practice. The Board of Directors appoints a Disciplinary Action Committee (DAC) to deal with any matter relating to DPs clients, Issuers and R&T agents.

The DAC is empowered to suspend or expel a DP, declare a security as ineligible on the NSDL system, freeze a DP account and conduct inspection or call for records and issue notices. If a DP is aggrieved by the action of the DAC, it has the right to appeal to the EC against the action of the DAC.

This has to be done within 30 days of the action by DAC. The EC has to hear the appeal within two months from the date of filing the appeal. The EC has the power to stay the operation of the orders passed by the DAC. The information on all such actions has to be furnished to SEBI.

Settlement of Disputes

All disputes, differences and claims arising out of any dealings on the NSDL, irrespective of whether NSDL is a party to it or not, have to be settled under the Arbitration and Conciliation Act 1996.

Technology and Connectivity

Account holders (investors) open account with the DPs. The account details, entered in a computer system maintained by Depository Participants called DPM, are electronically conveyed to the central system of NSDL called DM.

Companies who have agreed to offer demat facility to their shareholders use a computer system called DPM (SHR) to connect to the NSDL central system. DPM (SHR) may be installed by the company itself or through its R&T Agent. This system is used to electronically receive demat requests, confirm such requests or to receivebeneficial owner data (Benpos) from the depository.

Read More Articles

- What is Financial Management?

- What is Financial Statements?

- What is Financial Statement Analysis?

- What is Ratio Analysis?

- What is Funds Flow Statement?

- What is Cash Flow Statement?

- What is Working Capital?

- What is Cost of Capital?

- What is Capital Budgeting?

- What is Dividend Policy?

- What is Cash Management?

- What is Depository?

- What is Insurance?

- What is Financial System?

- International Financial Reporting Standards

- Stability of Dividends

- What is Factoring?

- Determinants of Working Capital

- Public Finance

- Public Expenditure

- What is Public Debt?

- Classification of Public Debt

- Federal Finance

- Effect of Public Debt

- Expenditure Cycle