What is Capital Budgeting?

Capital budgeting is long term planning for making and financing proposed capital outlay. It is a process by which available resources are allocated among competitive long term investment opportunities so as to promote the greatest profitability of a firm over a period of time. It refers to the total process of generating, evaluating, selecting and following up on capital expenditure alternatives.

Table of Contents

- 1 What is Capital Budgeting?

- 2 Introduction to Capital Budgeting

- 3 Definition of Capital Budgeting

- 4 Need for Capital Budgeting

- 5 Characteristics of Capital Budgeting

- 6 Importance of Capital Budgeting

- 6.1 Long Term Planning

- 6.2 Optimum use of Funds

- 6.3 Analysis of Risk

- 6.4 Replacement Decisions

- 6.5 Selection of Best Proposal

- 6.6 Maximization of Profit

- 6.7 Arrangement of Funds

- 6.8 Helps in Cash Budgeting

- 6.9 Protection from Losses

- 6.10 Control over Capital Expenditure

- 6.11 Helps in Formulation of Depreciation Policy

- 7 Capital Budgeting Process

Introduction to Capital Budgeting

Capital budgeting is the process of making investment decisions in capital expenditures. A capital expenditure may be defined as an expenditure the benefit of which are expected to be received over period of time exceeding one year.

Capital budgeting deals exclusively with major investment proposals which are essentially long term projects and is concerned with the allocation of firm’s scarce financial resources among the available market opportunities.

It is many sided activity which includes a search for new and more profitable investment proposals and the making of an economic analysis to determine the profit potential of each investment proposal. Capital budgeting is also known as capital expenditure decisions. Long term investment decisions, management of fixed assets etc.

Definition of Capital Budgeting

Some important capital budgeting definitions are as follows:

Capital budgeting is long term planning for making and financing proposed capital outlay. – Charles T. Horngren

Capital budgeting consists in planning the development of available capital for the purpose of maximising the long term profitability (return on investment) of the firm. – R. M. Lynch

Capital budgeting involves the planning of expenditures for assets, the returns from which will be realised in future time periods. – Milton H. Spencer

Capital budgeting is concerned with the allocation of the firm’s scarce financial resources among the available market opportunities. The consideration of investment opportunities involves the comparison of the expected future streams of earnings from a project, with the immediate and subsequent expenditures for it. – G.C. Phillippats

The capital budgeting is essentially a list of what management relieves to be worth while projects for the acquisition of new capital assets together with the estimated cost of each project. – Robert N. Anthony

The capital expenditure budget represents the plans for the appropriations and expenditures for fixed assets during the budget period. – Keller & Ferrara

Need for Capital Budgeting

Before discussing about what is capital budgeting?, we will acquaint our self why we need capital budgeting. Capital budgeting decisions are vital to any business as they include the decisions as to:

- Whether or not funds should be invested in long-term projects such as setting of an industry, purchase of plant and machinery etc.

- Analyse the proposal for expansion or creating additional capacities;

- To decide the replacement of permanent assets;

- To decide whether to invest and/ or how much to be invested in research and development.

- Finally, most importantly, capital budgeting is required to make financial analysis of various proposals regarding capital investments so as to choose the best out of many alternative proposals.

For the above discussions, we are sure about that capital budgeting are vital for not only for expansion even for survival of business firms.

Characteristics of Capital Budgeting

The main characteristics of capital budgeting are as follows:

- Capital budgeting is concerned with expenditure of capital nature.

- Capital budgeting deals with benefits over a number of years future.

- Capital expenditure plans involve a huge investment in I assets.

- Capital expenditure once approved represents long I investment that can not be reversed or withdrawn without sub staining a loss.

- Any error in evaluation of investment projects may lead to sum consequences.

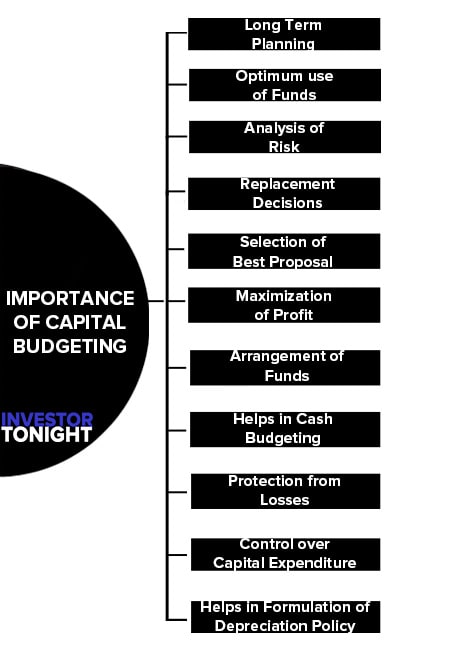

Importance of Capital Budgeting

Capital budgeting decisions are of paramount importance in financial decision making. These decisions are related with fixed assets which in generating earnings of the firm. These decisions are the most crucial and critical and they have significant impact on the profitability aspect of the firm.

Significance of Capital Budgeting are:

- Long Term Planning

- Optimum use of Funds

- Analysis of Risk

- Replacement Decisions

- Selection of Best Proposal

- Maximization of Profit

- Arrangement of Funds

- Helps in Cash Budgeting

- Protection from Losses

- Control over Capital Expenditure

- Helps in Formulation of Depreciation Policy

Long Term Planning

Capital expenditure is a strategic investment :of some magnitude and is of a non-routine nature. It has economic life and its benefits continue over series of years.

Optimum use of Funds

Capital investment decisions require an amount of funds. Capital is a scarce resource of business. So it is essential to utilize capital in such a manner so that wealth of l shareholders may be increased Capital budgeting ensures optimum utilization of larger the business.

Analysis of Risk

Capital budgeting helps in analysing the risk involved in various projects under consideration. Capital expenditure involve a greater risks as they require huge investment.

Replacement Decisions

Capital budgeting helps in taking decisions regarding replacement of old asset by a new one. The new asset may be useful and profitable for the business. A comparative study is made between these options and profitable decisions may be taken.

Selection of Best Proposal

Capital budgeting suggest the best proposal available. This is done by using various modern techniques of capital budgeting.

Maximization of Profit

Fixed assets generate earnings and require huge investment. Capital budgeting decisions ensure the best utilization of fixed assets. Cost control and reduction in cost ensure maximization of profit of the business.

Arrangement of Funds

There are many sources for collecting funds and each has its own cost and merits and demerits. Capital budgeting decision helps in determining economic source of capital.

Helps in Cash Budgeting

Capital budgeting helps in preparing cash budget of the firm. It is helpful in forecasting of cash requirements.

Protection from Losses

Capital expenditure decisions are not reversible. A wrong decision may be cause of business failure. Capital budgeting protects from such: may occur due to lack of knowledge.

Control over Capital Expenditure

Capital budgeting helps in controlling the capital expenditures. Actual performance may be compared with budgeted results and necessary actions may be taken by management.

Helps in Formulation of Depreciation Policy

Capital budgeting helps in determining depreciation policy of fixed assets. A proper method of depreciation should be adopted to calculate correct cost of product and also to reduce tax liability.

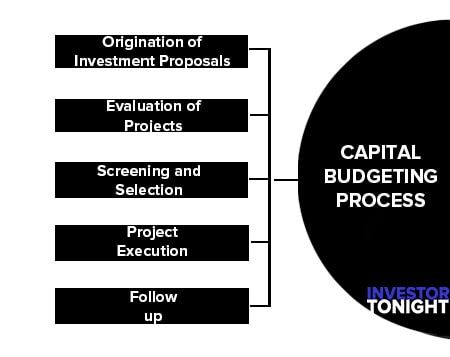

Capital Budgeting Process

- Origination of Investment Proposals

- Evaluation of Projects

- Screening and Selection

- Project Execution

- Follow up

Origination of Investment Proposals

The first step in capital budgeting process is the conception of a profit making idea. The idea may originate from the top management level taking for longer view in the interest of the company.

A periodic review and comparison of earnings, cost, procedures and product line should be made by the management to facilitate the origination of such idea.

Evaluation of Projects

Appraisal of capital projects is important aspect of capital budgeting. Capital appraisal is concerns with evaluating the costs involved in a capital investment proposal and benefits that accrual from it.

The costs and benefits are estimated in the form of cash outflows and cash inflows. This step also involves the selection of an appropriate criterion for judging the desirability of the projects.

Screening and Selection

Capital expenditure requests should be properly screened. The budget committee screens the requests in order to weed out those projects which are obviously undesirable, the projects which are under consideration are divided into three categories

- Most essential projects

- Projects which should be accepted

- Desirable and deferrable projects

After screening the projects selection is made on the basis of criteria of the firm. Such criteria should encompass the supply and cost of capital the expected returns from alternative investment opportunities.

Project Execution

The funds are appropriated for capital expenditure after the final selection of investment proposals. The project execution committee must ensure that the funds are spent in accordance with appropriations made in the capital budget.

Follow up

Systematic procedure should be developed to review the performance of project during their life and also after completion, follow up comparison of actual performance with original estimates not only ensures better forecasting but also helps sharpen the technique; improving future forecasts.

Such an evaluation also has advantage of forcing department heads to be made realistic and careful.

Read More Articles

- What is Financial Management?

- What is Financial Statements?

- What is Financial Statement Analysis?

- What is Ratio Analysis?

- What is Funds Flow Statement?

- What is Cash Flow Statement?

- What is Working Capital?

- What is Cost of Capital?

- What is Capital Budgeting?

- What is Dividend Policy?

- What is Cash Management?

- What is Depository?

- What is Insurance?

- What is Financial System?

- International Financial Reporting Standards

- Stability of Dividends

- What is Factoring?

- Determinants of Working Capital

- Public Finance

- Public Expenditure

- What is Public Debt?

- Classification of Public Debt

- Federal Finance

- Effect of Public Debt

- Expenditure Cycle