What is Ledger?

Ledger may be defined as a summary statement of all the transactions relating to a person, asset, expenses or income which have taken place during a given period of time and show their net effect.

Table of Contents

Ledger Definition

According to V.G. Vickery, “Ledger is a book of account which contains in a suitably classified form, the final and permanent record of trader’s transactions”.

It is essentially a collection of five types of accounts – Assets, Liabilities, Capital, Revenue and Expenses.

According to William Pickles – “A Ledger is a most important book of account and is the destination of the entries made in the subsidiary books.”

Thus, Ledger is a book which contains records of all transactions permanently in a summarized and classified form. It is the book of final entry and is the principal book of accounts.

Need for Ledger

A Journal fails to give complete information regarding an account at a glance at a particular point of time because of the scattered entries of the transactions in different pages. This need gives birth to ledger.

The ledger brings together these dispersed entries regarding an account from the Journal to a place in a condensed and summarized form and gives a complete picture including its final position at a glance.

The necessity of obtaining summarized and condensed information in respect of each class of transactions at a particular point in the need of a ledger. All information regarding any account which is available from Ledger is called the king of all books.

Subdivision of Ledger

Subdivision of Ledger are divided into two parts:

Personal Ledger

The Personal Ledger is a ledger which contains the accounts of persons or organizations is called Personal Ledger. These Accounts are relating to persons or organizations whom goods are bought or to whom goods are sold on credit.

The Personal Ledger is again subdivided into:

Debtors Ledger

Debtors Ledger contains the accounts of debtors to whom goods are sold on credit. It is also known as Sales or Sold Ledger.

The name “Debtors Ledger” is more appropriate than Sales or Sold Ledger as it contains Debtors’ Accounts and not the Sales Accounts.

Creditors Ledger

Creditors Ledger contains the accounts of creditors from whom goods are bought on credit. It is also known as Purchases or Bought Ledger.

The name “Creditors Ledger” is more appropriate as it contains the Creditors’ Accounts, Purchases Account.

General Ledger

General ledger also known as the is the main accounting record of a business which uses double-entry bookkeeping. It will usually include accounts for such items as current assets, fixed assets, liabilities, revenue and expense items, gains and losses.

General ledger is subdivided into:-

Impersonal Ledger

Impersonal Ledger contains the accounts relating to Assets, Expenses, Incomes, Cash Book and Petty Cash Book.

Private Ledger

It contains the accounts of confidential nature like Capital, Drawing and Profit and Loss Accounts.

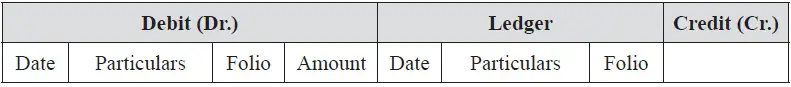

Format of Ledger

Ledger can be divided into two parts:

- Left hand side called debit side (Dr)

- Right hand side called credit side (Cr)

Debit side starts with ‘To’ and credit side starts with ‘By’.

Ledger Posting

The process of preparation of accounts from the journal into ledger is called posting in the ledger. Examples of ledger accounts include sales account, purchase account, sales returns account, cash account, and so on.

Postings are made using the word ‘To’ and ‘By’ as a prefix on the debit side and credit side respectively. The aim of posting is to make a classified and summarized record of all business transactions under appropriate account heads.

Basic Points Regarding Ledger Posting

- Opening of Separate Accounts

- One account for each Kind of Transactions

- Accounting period

- Same account heads in both the books

- Postings made conveniently

Opening of Separate Accounts

Separate accounts should be opened for different ‘account heads’ in the ledger for posting the different transactions recorded in the journal. For Example; Cash A/c, Salary A/c, Purchases A/c etc.

One account for each Kind of Transactions

One account should be opened for each kind of transaction. Transactions taking place during an accounting period relating to that particular account should be posted to that account only. If more than one account is opened for one kind of transactions, the object of summarization of transactions of similar nature will not be achieved.

For example, it may be found that in the journal, Cash A/c has been debited during a week, say on six different dates and the same account has been credited on four different dates.

For recording in Cash A/c, only one Cash A/c will be opened for transactions taking place on all the days and posting of all entry relating to Cash A/c will be made in that account only.

Accounting period

All recording in the Journal and post in the ledger is done for a particular ‘Accounting Period’. For every accounting period separate set of books should be maintained. Posting of all transactions taking place in a particular accounting period must be made in one set of books.

Same account heads in both the books

Posting in the ledger should be made in the same account heads as appearing in the journal. No change in the name of the ‘account head’ should be made.

Postings made conveniently

Posting may be done at any time but it should be completed before the end of the accounting period. For example the accounts up to date, posting should be made immediately after recording the transactions in the journal.

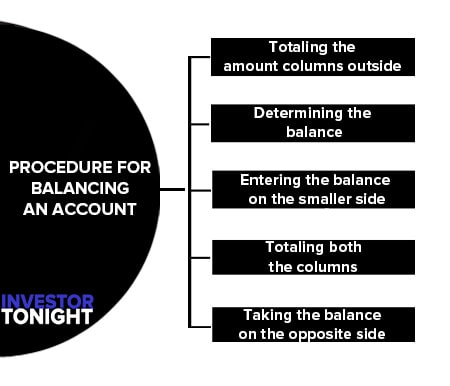

Procedure for Balancing an Account

Balancing of an account implies the process of ascertaining the net difference of an account after totaling of both sides – viz. debit side and credit side.

Balancing is done periodically, i.e., weekly, monthly, quarterly, half-yearly or yearly, depending on the requirements of the business.

A computerized system will usually print the balance of the account after each transaction, but in a manual system we must calculate the balance. The balance of an account shows the position of an account on the particular day.

- Totaling the amount columns outside

- Determining the balance

- Entering the balance on the smaller side

- Totaling both the columns

- Taking the balance on the opposite side

Totaling the amount columns outside

On a rough sheet of paper, the total of the amount column of two sides of the account concerned are to be ascertained.

Determining the balance

The difference of the total of two sides, called balance is then found out.

Entering the balance on the smaller side

If the total of the debit side is more, the difference is to be put in the amount column on the credit side, by writing the words ‘By Balance c/d’ in particulars column.

If the total of the credit side is more, the difference is to be put in the amount column on the debit side by writing the words ‘To Balance c/d’ in particulars column.

This will be done on the date of balancing and the date will be entered in the date column.

Totaling both the columns

After putting the difference in the appropriate side of the account, both sides of the account is to be totaled. The total of both the sides will be equal. A thin line above the total and two parallel lines below the total are to be drawn.

Taking the balance on the opposite side

Lastly, on the next day of the balancing, the debit balance will be written on the debit side by writing the words ‘To Balance b/d’ in the particulars column.

Similarly, the credit balance will be brought down on the credit side by writing the words ‘By Balance b/d’ in the particulars column. If the Balance b/d (brought down) appears on the debit side, it indicates that the account has a Debit Balance.

On the other hand, if the balance b/d (brought down) appears on the credit side, it indicates that the account has Credit Balance.

Read More Articles

- What is Accounting?

- Basic Accounting Terminology

- Basic Accounting Concepts

- Accounting Conventions

- Double Entry System

- What is Journal?

- What is Ledger?

- What is Trial Balance?

- What is Activity Based Costing?

- Business, Industry and Commerce

- Shares and Share Capital

- What is Audit of Ledger?

- Forfeiture and Reissue of Shares

- What is Consolidated Financial Statements?

- What are Preference Shares?

- What are Debentures?

- Issue of Bonus Shares

- What is Government Accounting?

- What are Right Shares?

- Redemption of Debentures

- Buy Back of Shares

- Valuation of Goodwill

- What is Valuation of Shares?

- Purchase of Business

- Amalgamation of Companies

- Internal Reconstruction of Company

- What is a Holding company?

- Accounts of Holding Company

- What is Slip System?