What is Trial Balance?

A Trial Balance is a statement, prepared with the debit and credit balances of the ledger accounts to test the arithmetical accuracy of the books.

All the businessmen after completion of postings from Journal or Subsidiary Books to the Ledger, want to verify accuracy of the posting. On the basis of principal of accounting we know that for every debit there will be an equal credit.

If the sum of all debits equal the sum of all credits, it is presumed that the posting to the ledger in terms of debit and credit amounts is accurate. The trial balance is a tool for verifying the correctness of debit and credit amounts.

It is an arithmetical check under the double entry system which verifies that both aspects of every transaction have been recorded accurately.

Table of Contents

Trial Balance Meaning

A Trial Balance is prepared after having posted the journal entries into the Ledger and balancing the accounts. The balance of an account is the difference between the total of the debit side and the total of the credit side.

It is called a ‘Debit Balance’, if the debit side total is greater. vice versa, it is called a ‘Credit Balance’, if the total of credit side is greater.

A Trial Balance is a statement showing the balances, or total of debit and credit sides of all the accounts in the Ledger with a view to verifying the arithmetic accuracy of posting into the Ledger accounts.

Trial Balance is an important statement in the accounting process, which shows final position of all accounts and helps to prepare the final statements.

Trial Balance Definition

Trial Balance is the list of debit and credit balances, taken out from ledger. It also includes the balances of cash and bank taken from cash book. – Carter

The statement prepared with the help of ledger balances, at the end of financial year (or at any other date) to find out whether debit total agrees with credit total is called Trial Balance. – William Pickles

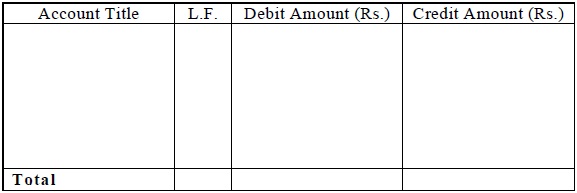

Format of Trial Balance

Trial Balance of ………… as on March 31, 2021

- Trial Balance is prepared on a particular date which should be written on the top.

- In the first column, the name of the account is written.

- In the second column, Ledger folio, i.e., the page number of the Ledger where the balance appears.

- In the third column, the total of the debit side of the account concerned or the debit balance, if any is entered.

- In the fourth column, the total of credit side or the credit balance is written.

- The two columns are totaled at the end.

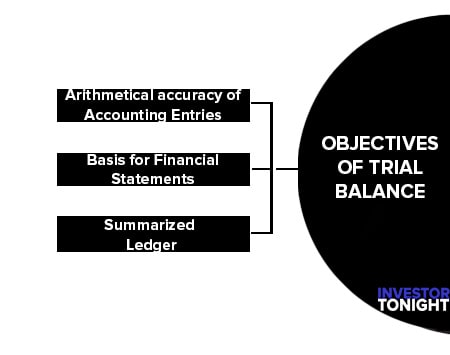

Objectives of Trial Balance

The main objectives of trial balance are mentioned below:

Arithmetical accuracy of Accounting Entries

As discussed earlier, a trial balance helps in knowing the arithmetical accuracy of the accounting entries. This is because according to the ‘dual aspect’ concept for every debit, there must be an equivalent credit.

Trial balance represents a summary of all ledger balances and, therefore, if the two sides of the trial balance tally, it is an indication that the books of account are arithmetically accurate.

Of course, there may be certain errors in the books of account in spite of an agreed trial balance.

If a transaction, for example, is completely omitted from the books of account then the two sides of the trial balance will still tally, in spite of the books of account being wrong. This has been discussed in detail, later in a separate unit.

Basis for Financial Statements

Trial Balance forms the basis for preparing financial statements, such as the income statement and the balance sheet. It represents all transactions related to different accounts in a summarized form for a particular period.

In case, the trial balance is not prepared, it is almost impossible to prepare financial statements as stated above in order to know the profit or loss made by the business during a particular period or its financial position on a particular date.

Summarized Ledger

As already stated, a trial balance contains the ledger balances on a particular date. Thus, the entire ledger is summarized in the form of a trial balance. The position of a particular account is judged simply by looking at the trial balance. The ledger is checked only when details regarding the accounts are required.

Advantages of Trial Balance

The advantages of a trial balance may be summarized as follows:

- It summarizes the result of all transactions during a period

- It proves the arithmetical accuracy of accounting entries in the ledger

- It supplies in one place ready reference of all the balances of all the ledger accounts

- If any error is found, it can easily be rectified

- It is a basis, on which the final accounts of a firm can be prepared.

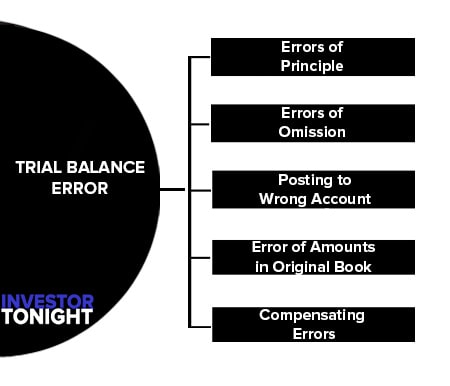

Trial Balance Error

Trial balance errors are errors that cannot be detected by the trial balance sheet in the accounting process.

- Errors of Principle

- Errors of Omission

- Posting to Wrong Account

- Error of Amounts in Original Book

- Compensating Errors

Errors of Principle

An error of principle is an error which violates the fundamentals of book-keeping. For instance, purchase of furniture is debited to Purchase Account, instead of Furniture Account; Wages paid for the erection of plant is debited to Wages Account, instead of Plant Account; the amount spent on extension of building is debited to Repairs Account instead of Building Account etc.

These types of errors do not affect the total debits and total credits but affect the principle of book-keeping.

Errors of Omission

If a transaction is completely omitted, there will be no effect on the Trial Balance. When a transaction goes completely unrecorded in both aspects or a transaction after being recorded in the books of primary entry is not at all posted in the ledger, the error is an error of omission.

For instance, if a credit purchase is omitted to be recorded in the Purchase Day Book, then it will be omitted to be posted both in the Purchase Account and the Supplier’s Account. This error will not, however, result in the disagreement of Trial Balance.

Posting to Wrong Account

Posting an item to wrong account, but on the correct side. For instance, if a purchase of 200 from Ramu has been credited to Raman, instead of Ramu and this error will not affect the agreement of Trial Balance. Thus, Trial Balance will not detect such an error.

Error of Amounts in Original Book

If an invoice for 632 is entered in Sales Book as 623, the Trial Balance will come out correctly, since the debit and credit have been recorded as 623. The arithmetical accuracy is there, but in fact there is an error.

Compensating Errors

If one account in the ledger is debited with 500 less and another account in the ledger is credited 500 less, these errors cancel themselves. That is, one error is neutralized by similar error on the opposite side.

Preparation of Trial Balance

Two types of trial balance prepare method are:

Total Method

In case of total method after totaling each side of the ledger account, the respective debit and credit totals of the ledger accounts are transferred to the respective debit and credit totals of the ledger accounts are transferred to the respective sides of the trial balance.

Thus, in case of total method, the trial balance can be prepared soon after totaling various accounts and the time taken in balancing the account is saved to that extent. This method is not generally followed since it does not help in preparation of financial statements.

Balance Method

According to balanced method, every ledger account is balanced and only the balance of the ledger account is carried forward to the trial balance. This method is generally used since the preparation of the financial statements where only balances are to be taken.

Total and Balance Method

This method combines the first two methods explained above. In case of this method, the trial balance contains both the totals of both sides of the respective accounts as well as their final balances.

This method has the advantage that it helps in immediate location of a mistake incurred, if any in the balancing the account. However, it has disadvantage of increasing the workload of the staff.

Difference between Balance Method and Totals Method

| Balance Method | Totals Method |

|---|---|

| It can be prepared after all the Ledger accounts have been balanced | It can be prepared immediately after the completion of posting from books of original entry to the Ledger. |

| It shows the balances of all the accounts in the Ledger | It shows the total amounts of the debit and credit sides in each Ledger Accounts. |

| It considers only those accounts which show a balance. If an account shows no balance, it will not be considered. | It considers all accounts of the Ledger. |

Read More Articles

- What is Accounting?

- Basic Accounting Terminology

- Basic Accounting Concepts

- Accounting Conventions

- Double Entry System

- What is Journal?

- What is Ledger?

- What is Trial Balance?

- What is Activity Based Costing?

- Business, Industry and Commerce

- Shares and Share Capital

- What is Audit of Ledger?

- Forfeiture and Reissue of Shares

- What is Consolidated Financial Statements?

- What are Preference Shares?

- What are Debentures?

- Issue of Bonus Shares

- What is Government Accounting?

- What are Right Shares?

- Redemption of Debentures

- Buy Back of Shares

- Valuation of Goodwill

- What is Valuation of Shares?

- Purchase of Business

- Amalgamation of Companies

- Internal Reconstruction of Company

- What is a Holding company?

- Accounts of Holding Company

- What is Slip System?