What is Journal?

A journal records all the routine transactions of a business in a chronological order. It is the book in which the transactions are recorded under the double entry system. Thus, a journal is the book of original record. It does not replace but precedes the ledger.

Table of Contents

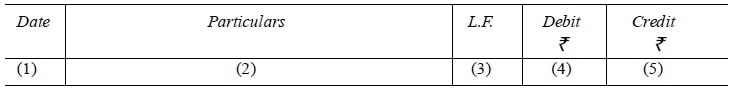

The process of recording transactions in the journal, is termed as journalising. A pro forma of a journal is given in

- Date: The date on which the transaction was entered is recorded here.

- Particulars: The two aspects of the transaction are recorded in this column, i.e.,

the details regarding accounts which have to be debited and credited. - Ledger folio: This stands for ledger folio. The transactions entered in the journal are later on posted to the ledger. The relevant ledger folio is entered here.

- Debit: In this column, the amount to be debited is entered.

- Credit: In this column, the amount to be credited is shown.

Journal is derived from the French word “Jour” which means a day. Journal therefore means day to day transactions which are recorded in the books. It is in the form of debit and credit and is maintained with the help of accounting rules. The process of recording the transactions in a journal is called journalising.

Functions of journal

- To keep a chronological (i.e., date-wise) record of all transactions.

- To analyze each transaction into debit and credit aspects by using double entry system of bookkeeping.

- To provide a basis for posting into ledger.

- To maintain the identity of each transaction by keeping a complete record of each transaction at one place on a permanent basis.

Rules of Debit and Credit

All the transactions in the Journal are recorded on the basis of some rules of debit and credit. For this purpose business transactions have been classified into three categories:

Transactions relating to persons

↓

Transactions relating to properties and assets

↓

Transactions relating to incomes and expenses

The accounts falling under the first heading are called ‘Personal Accounts’. The accounts falling under the second heading are termed ‘Real Accounts’. The accounts falling under the third heading are termed ‘Nominal Accounts’.

Let us discuss the categories of accounts and the relevant rule for ‘debit and credit’.

Personal accounts

Personal accounts include the accounts of persons with whom the business deals. These accounts can be classified into three categories as follows:

Natural personal accounts

The term ‘Natural Persons’ means persons who are the creation of God, for example, Mohan’s Account, Sohan’s Account, Abha’s Account, etc.

Artificial personal accounts

These accounts include accounts of corporate bodies or institutions which are recognized as persons in business dealings; for example, the account of a limited company, the account of a cooperative society, the account of a club, the account of government, the account of an insurance company, etc.

Representative personal accounts

These are accounts that represent a certain person or group of persons, for example, if the rent is due to the landlord, an outstanding rent account will be opened in the books.

Similarly, for salaries due to the employees (not paid), an outstanding salaries account will be opened. The outstanding rent account represents the account of the landlord to whom the rent is to be paid while the outstanding salaries account represents the accounts of the

The rule is:

Debit the Receiver

Credit the Giver

If cash has been paid to Ram, for example, the account of Ram will have to be debited. Similarly, if cash has been received from Keshav, the account of Keshav will have to be credited.

Real accounts

Real account can be of the following types:

Tangible real accounts

Tangible real accounts are those that relate to such things which can be touched, felt, measured, etc. Examples of such accounts are cash account, building account, furniture account, stock account, etc.

It should be noted that a bank account is a personal account; since it represents the account of the banking company—an artificial person.

Intangible real accounts

These accounts represent things that cannot be touched. Of course, they can be measured in terms of money, for example, patents account, goodwill account, etc.

The rule is:

Debit Is What Comes in

Credit Is What Goes Out

If a building, for example, has been purchased for cash, the building account should be debited (since it is coming in the business), while the cash account should be credited (since cash is going out the business).

Similarly, when furniture is purchased for cash, the furniture account should be debited while the cash account should be credited.

Nominal accounts

These accounts are opened in the books to simply explain the nature of the transactions. They do not really exist, for example, in a business, salary is paid to the manager, rent is paid to the landlord, commission is paid to the salesman, cash goes out of the business and it is something real; while salary, rent or commission as such do not exist.

The accounts of these items are opened simply to explain how the cash has been spent. In the absence of such information, it may be difficult for the person concerned to explain how the cash at his disposal was utilized.

Nominal accounts include accounts of all expenses, losses, incomes, and gains. The examples of such accounts are rent, rates lighting, insurance, dividends, loss by fire, etc.

The rule is:

Debit All Expenses and Losses

Credit All Gains and Incomes

Both Real Accounts and Nominal Accounts come in the category of Impersonal Accounts. When some prefix or suffix is added to a Nominal Account, it becomes a Personal Account. Table explains the above rule:

| Nominal Account | Personal Account |

|---|---|

| Rent account | Rent prepaid account, outstanding rent account |

| Interest account | Outstanding interest account, interest received in advance account, prepaid interest account |

| Salary account | Outstanding salaries account, prepaid salaries account |

| Insurance account | Outstanding insurance account, prepaid insurance account |

| Commission account | Outstanding commission account, prepaid commission account |

Advantages of Journal

The advantages of a journal are as follows:

- There is no chance of any transaction being omitted from the books of account as each transaction is recorded as soon as it takes place.

- For each and every transaction, it is clearly written in the journal which of the two concerned accounts will be debited and which account credited. Hence, there is no scope of committing any mistake in writing the ledger.

- Transactions are kept recorded in journal chronologically with narration. Hence, it is easy to ascertain when and why a transaction has taken place.

- Journal displays the complete story of transaction in one entry.

- Journal helps in the detection of any mistake in ledger.

Types of Journal entries

Entries recorded in the journal may be of two types:

- Simple Journal Entry

- Compound Journal Entry

Simple Journal Entry

When a transaction affects only one aspect/ account in the debit and on aspect / account in the credit, it is known as Simple Journal Entry.

Compound Journal Entry

Sometimes, in any business organization, it is possible that there may be several transactions in a day. In such a case, instead of passing different entries pertaining to different accounts, a single journal entry can be passed to record the various transactions. Such an entry is known as a ‘Compound Journal Entry’. It can be recorded in three ways as follows:

- One account can be debited and the other accounts can be credited.

- One account can be credited and the other accounts can be debited.

- Multiple accounts can be debited and similarly, multiple accounts can be credited as well.

Opening Entry

With the start of the new financial year, every organization has to bring forward its assets and liabilities to the current year. This is applicable to proprietorships that have been running over a span of time. To bring forward the assets and liabilities, a journal entry called the ‘Opening Entry’ is recorded.

In this entry, all the assets accounts are debited, and all the liability accounts are credited. If assets are in excess over liabilities, then the same is treated as the proprietor’s capital and is credited to the proprietor’s capital account.

Journalising Process

The process of recording a transaction in the journal with the help of debit-credit rules of the double entry system is called Journalising. The various steps to be followed in journalising business transactions are given below:

- Step 1: Ascertain what accounts are involved in a transaction.

- Step 2: Ascertain what the nature of the accounts involved is.

- Step 3: Ascertain which rule of Debit and Credit is applicable for each of the accounts involved.

- Step 4: Ascertain which account is to be debited and which is to be credited.

- Step 5: Record the date of transaction in the ‘Date column’.

- Step 6: Write the name of the account to be debited, very close to the left hand side i.e. the line demarcating the ‘Date column’ and the ‘Particulars column’ along with the abbreviation ‘Dr.’ on the same line against the name of the account in the ‘Particulars column’, and the amount to be debited in the ‘Debit Amount Column’ against the name of the account.

- Step 7: Write the names of the account to be credited in the next line preceded by the word ‘To’ at a few spaces towards right in the ‘Particulars column’ and the amount to be credited in the ‘Credit Amount Column’ against the name of the account. The modern practice shows inclination towards omitting “Dr.” and “To”.

- Step 8: Write ‘Narration’ (i.e. a brief description of the transaction) within brackets in the next line in the ‘Particulars column’.

- Step 9: Draw a line across the entire ‘Particulars column’ to separate one journal entry from the other.

Read More Articles

- What is Accounting?

- Basic Accounting Terminology

- Basic Accounting Concepts

- Accounting Conventions

- Double Entry System

- What is Journal?

- What is Ledger?

- What is Trial Balance?

- What is Activity Based Costing?

- Business, Industry and Commerce

- Shares and Share Capital

- What is Audit of Ledger?

- Forfeiture and Reissue of Shares

- What is Consolidated Financial Statements?

- What are Preference Shares?

- What are Debentures?

- Issue of Bonus Shares

- What is Government Accounting?

- What are Right Shares?

- Redemption of Debentures

- Buy Back of Shares

- Valuation of Goodwill

- What is Valuation of Shares?

- Purchase of Business

- Amalgamation of Companies

- Internal Reconstruction of Company

- What is a Holding company?

- Accounts of Holding Company

- What is Slip System?