A bonus issue, also known as a scrip issue or a capitalization issue, is an offer of free additional shares to existing shareholders. A company may decide to distribute further shares as an alternative to increasing the dividend payout. For example, a company may give one bonus share for every five shares held.

Table of Contents

Bonus issues are given to shareholders when companies are short of cash and shareholders expect a regular income. Shareholders may sell the bonus shares and meet their liquidity needs. Bonus shares may also be issued to restructure company reserves.

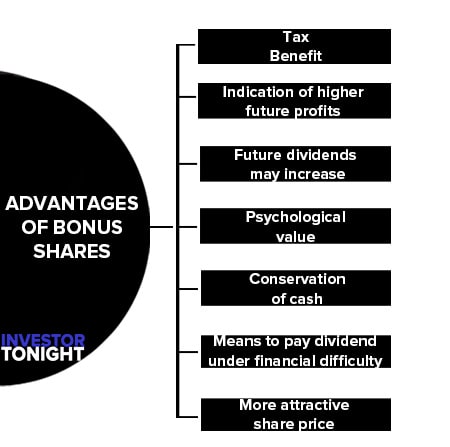

Following are the advantages of bonus shares:

- Tax benefit

- Indication of higher future profits

- Future dividends may increase

- Psychological value

- Conservation of cash

- Only means to pay dividend under financial difficulty

- More attractive share price

Tax benefit

One of the advantages to shareholders in the receipt of bonus shares is the beneficial treatment of such dividends with regard to income taxes. When a shareholder receives cash dividend from company, this is included in his ordinary income and taxed at ordinary income tax rate. But the receipt of bonus shares by the shareholder is not taxable as income.

Further, the shareholder can sell the new shares received by way of the bonus issue to satisfy his desire for income and pay capital gain taxes, which are usually less than the income taxes on the cash dividends. The shareholder could sell a few shares of his original holding to derive capital gains.

But selling the original shares are considered as a sale of asset by some shareholders. They do not mind selling the shares received by way of the bonus shares as they consider it a windfall gain and not a part of the principal.

Note that in India as per the current law investors do not pay any taxes on dividends but they have to pay tax on capital gains. Hence, Indian law makes bonus shares less attractive than dividends.

Indication of higher future profits

The issue of bonus shares is normally interpreted by shareholders as an indication of higher profitability. When the profits of a company do not rise, and it declares a bonus issue, the company will experience a dilution of earnings as a result of the additional shares outstanding.

Since a dilution of earnings is not desirable, directors usually declare bonus shares only when they expect rise in earnings to offset the additional outstanding shares. Bonus shares, thus, may convey some information that may have a favorable impact on value of the shares. But it should be noticed that the impact on value is that of the growth expectation and not the bonus shares per see.

Future dividends may increase

If a company has been following a policy of paying a fixed amount of dividend per share and continues it after the declaration of the bonus issue, the total cash dividends of the shareholders will increase in the future.

For example, a company may be paying a Re 1 dividend per share and pays 1:1 bonus shares with the announcement that the cash dividend per share will remain unchanged. If a shareholder originally held 100 shares, he will receive additional 100 shares.

His total cash dividend in future will be ₹200 (1× 200) instead of ₹100 (1 × 100) received in the past. The increase in the shareholders’ cash dividend may have a favorable effect on the value of the share. It should be, however, realised that the bonus issue per se has no effect on the value of the share; it is the increase in earnings from the company’s invests that affects the value.

Psychological value

The declaration of the bonus issue may have a favourable psychological effect on shareholders. The receipt of bonus shares gives them a chance to sell the shares to make capital gains without impairing their principal investment. They also associate it with the prosperity of the company.

Because of these positive aspects of the bonus issue, the market usually receives it positively. The sale of the shares, received by way of the bonus shares, by some shareholders widens the distribution of the company’s shares. This tends to increase the market interest in the company’s shares; thus supporting or raising its market price.

- Conservation of cash

- Only means to pay dividend under financial difficulty

- More attractive share price

Conservation of cash

The declaration of a bonus issue allows the company to declare a dividend without using up cash that may be needed to finance the profitable investment opportunities within the company. The company is, thus, able to retain earnings and at the same time satisfy the desires of shareholders to receive dividend.

We have stated earlier that directors of a company must consider the financial needs of the company and the desires of shareholders while making the dividend decision. These two objectives are often in conflict. The use of bonus issue represents a compromise that enables directors to achieve both these objectives of a dividend policy. The company could retain earnings without declaring bonus shares issue.

But the receipt of bonus shares satisfies shareholders psychologically. Also, their total cash dividend can increase in future, when cash dividend per share remains the same. Note that in India, bonus shares cannot be issued in lieu of dividends; hence the cash conservation argument for issuing bonus shares is not a strong argument.

Only means to pay dividend under financial difficulty

In some situations, even if the company’s intention is not to retain earnings, the bonus issue (with a small amount of dividend) is the only means to pay dividends and satisfy the desires of shareholders. When a company is facing a stringent cash situation, the only way to replace or reduce cash dividend is the issue of bonus shares.

The declaration of the bonus issue under such a situation should not convey a message of the company’s profitability, but financial difficulty. The declaration of the bonus issue is also necessitated when the restrictions to pay the cash dividend are put under loan agreements.

Thus, under the situations of financial stringency or contractual constrain in paying a cash dividend, the bonus issue is meant to maintain the confidence of shareholders in the company.

Sometimes the intention of a company in issuing bonus shares is to reduce the market price of the share and make it more attractive to investors. If the market price of a company’s share is very high, it may not appeal to small investors.

If the price could be brought down to the desired range, the trading activity would increase. Therefore, the bonus issue is used as a means to keep the market price of the share within the desired trading range. As we shall discuss below, this objective can also be achieved by a share split.

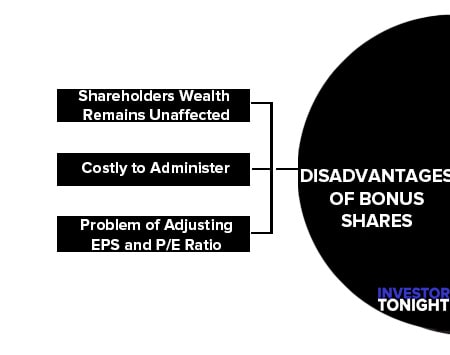

Following are the disadvantages of bonus shares:

Bonus shares are considered valuable by most shareholders. But they fail to realize that the bonus shares do not affect their wealth and therefore, in itself it has no value for them.

The declaration of bonus shares is a method of capitalizing on the past earnings of the shareholders. Thus, it is a formal way of recognizing something (earnings), which the shareholders already own. It merely divides the ownership of the company into a large number of share certificates.

Bonus shares represent simply a division of corporate pie into a large number of pieces. In fact, the bonus issue does not give any extra or special benefit to a shareholder. His proportionate ownership in the company does not change.

The chief advantage of the bonus share issue is that it has a favorable psychological impact on shareholders. The issue of bonus shares gives an indication of the company’s growth to shareholders. Shareholders welcome the distribution of bonus shares since it has informational value.

Costly to Administer

The disadvantage of bonus issues from the company’s point of view is that they are more costly to administer than a cash dividend. The company has to now print certificates and post them to thousands of shareholders.

Problem of Adjusting EPS and P/E Ratio

The bonus issue can be disadvantageous if the company declares periodic small bonus shares. The investment analysts do not adjust the earnings per share for small issues of bonus shares. They adjust only the significant issues of bonus shares.

When the earnings per share are not adjusted, the measured growth in the earnings per share will be less than the true growth based on the adjusted earnings per share. As a result the price-earnings ratio would be distorted downwards.

Issue of bonus shares is machinery for capitalizing profits. Capitalization of profits and reserves means the plowing back or utilization of profit for internal use of the company so that the profits are not distributed as dividends, that is, funds are not drained out of the company. Issuing bonus shares does not involve cash flow. It increases the company’s share capital but not its net assets.

Capitalization of profits/reserves can be done by a company if its articles so provide. It should be noted that a company cannot issue partly paid-up bonus shares. However, it can utilize the bonus declared in making partly paid-up shares fully paid up subject to the provisions of the Act. Conditions to be fulfilled for the Issue of Bonus Shares: [Sec 63(2)]

The following conditions must be fulfilled by a company before issuing Bonus Shares:

- The Articles of Association must permit such issue of Bonus Shares.

- The issue must be recommended by the Board of Directors approved by the shareholders in the general meeting.

- The company has not defaulted in payment of interest or principal in respect of fixed deposits or debt securities issued by it.

- The Company has not defaulted in respect of payment of statutory dues of the employees such as contribution to provident fund, gratuity and bonus.

- The partly-paid shares, if any, outstanding on the date of allotment are made fully paid-up.

- Provisions of the Companies Act regarding the issue of Bonus Shares must be complied with.

- The company must also comply with the SEBI guidelines for issue of Bonus Shares.

The following are the objectives of the issue of bonus shares by a company:

- Bonus shares are issued to expand the capital base of the company.

- Bonus shares are issued to attract more trading in the company’s shares.

- The issue of bonus shares helps the company to retain cash.

- Bonus shares are issued to bring parity between share capital and fixed assets which is an indication of financial soundness.

- Bonus shares are issued to reflect the actual capital employed by the company.

The advantages of the issue of bonus shares may be discussed as below:

- Since bonus shares are issued out of retained earnings, the liquidity position of the company is not affected.

- On capitalization of reserves through the issue of bonus shares, the capital structure of the company becomes more realistic.

- On account of bonus issue, the number of shares held by the shareholders increases, without any payment, which helps the shareholders to increase their future earnings.

- The shares of the companies which make bonus issues can be easily sold and thereby realise cash. They may also make gain called capital gains. The shareholders can sale the bonus shares in the market and can realise cash immediataly.

- The shareholders feel happy and contented with the company on account of the issue of bonus shares as it is an indication of progress of the company.

- Issue of bonus shares are not treated as dividend income in the hands of shareholders since there is no distribution in the form of cash. Therefore, a shareholder is not required to pay any income tax on the value of bonus shares received.

The following are the disadvantages of the issue of bonus shares:

- Issue of bonus shares may encourage speculation in the share market.

- The rate of return per share would decline because dividends would have to be paid on the increased number of shares unless the profits increase considerably in the future. It would have a negative impact on the minds of the prospective investors.

- There is a procedural difficulty relating to the issue of bonus shares. The bonus issue is subject to the prior approval of the Securities and Exchange Board of India (SEBI).

Accounting treatment relating to issue of bonus shares may be discussed under the following heads:

- (A) Where Bonus is utilised in making partly paid up shares fully paid up.

- (B) Where Bonus is utilised in issuing fully paid up shares.

- Making the final call due.

- Declaration of Bonus.

- Utilisation of bonus towards the payment of Final Call.

The following journal entries are required to be passed for carrying out the above accounting steps:

(i) For making the final call due:

| Date | Particulars | Debit (Rs.) | Credit (Rs.) |

| -/–/– | ………Share Final Call A/c Dr. To ….. Share Capital A/c | —- | —- |

(ii) For declaration of bonus:

| Date | Particulars | Debit (Rs.) | Credit (Rs.) |

| –/–/– | Profit & Loss Account Dr. General Reserve Account Dr. Capital Reserve Account Dr. To Bonus to Shareholders Account | —- | —- |

(iii) Utilisation of bonus towards the payment of Final Call:

| Date | Particulars | Debit (Rs.) | Credit (Rs.) |

| –/–/– | Bonus to Shareholders Account Dr. To ….. Share Final Call Account | —- | —- |

In this case bonus share may be issued (a) at Par, or (b) at a Premium. Therefore, the entry for utilization of bonus for the issue of shares will be as under:

The following journal entries are required to be passed for carrying out the above accounting steps:

(i) For declaration of bonus:

| Date | Particulars | L.F. | Debit (RS.) | Credit (RS.) |

| Capital Redemption Reserve Account or Dr. Securities Premium Account or Dr. Capital Reserve Account or Dr. Any other Reserve Account or Dr. Profit & Loss Account or Dr. General Reserve Account or Dr. To Bonus to Shareholders Account | —— | —– |

A listed company proposing to issue bonus shares shall comply with the following requirements under the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2009:

- The articles of association of the company must contain a provision for capitalisation of reserves, etc; – If there is no such provision in the articles the company must pass a resolution at its general meeting making provision in the articles of association for capitalization.

- The company has not defaulted in payment of interest or principal in respect of fixed deposits and interest on existing debentures or principal on redemption.

- The company has not defaulted in payment of statutory dues of the employees such as contribution to provident fund, gratuity etc.

- The partly-paid shares, if any, outstanding on the date of allotment are required to be made fully paid-up.

- (a) No company shall, pending conversion of FCDs/PCDs, issue any by way of bonus unless similar benefit is extended to the holders of such FCDs/though reservation of shares in proportion to such convertible part of FCDs or PCDs. (b) The shares so reserved may be issued at the time of conversion(s) of such debentures on the same terms on which the bonus issues were made.

- The bonus issue shall be made out of free reserves built out of the genuine profits or securities premium collected in cash.

- Reserves created by revaluation of fixed assets shall not be capitalised.

- The declaration of bonus issue, in lieu of dividend, shall not be made.

- A company which announces its bonus issue after the approval of the Board of directors must implement the proposal within a period of 15 days from the date of such approval (if Shareholders’ approval is not required) or 2 months (if Shareholders’ approval is required).

- Once the decision to make a bonus issue is announced, the same cannot be withdrawn.