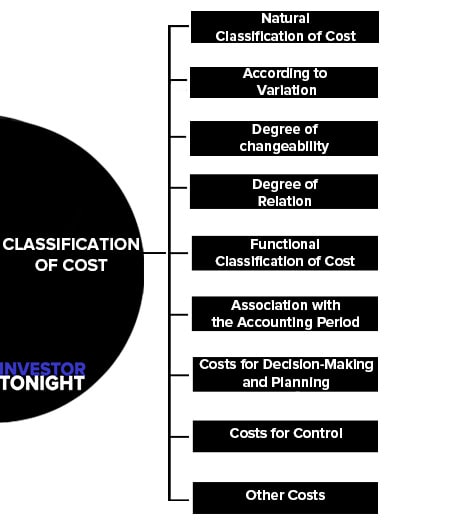

Classification of Cost

- Natural Classification of Cost

- According to Variation

- Degree of changeability

- Degree of Relation

- Functional Classification of Cost

- Association with the Accounting Period

- Costs for Decision-Making and Planning

- Costs for Control

- Other Costs

Classification is the process of grouping costs according to their common characteristics or features. There are various methods of classifying costs on the basis of requirements.

Table of Contents

Natural Classification of Cost

- Direct Material Cost

- Indirect Material Cost

- Direct Labour Cost

- Indirect Labour Cost

- Direct Expenses Cost

- Indirect Expenses Cost

Direct Material Cost

Direct Costs are those, which are incurred for and may be conveniently identified with a particular cost center or cost unit. Materials used and labour employed in manufacturing an article or in a particular process of production are common examples of direct costs.

Indirect Material Cost

Indirect costs are those cost which cannot be conveniently identified with a particular cost center or cost unit. Examples of indirect cost include rent of building, management salaries, machinery deprecation etc.

Direct Labour Cost

Direct labour is known as the wage of those workers who are involved in the production process whose time can be efficiently and economically traceable to units of products e.g. wages paid to compositors in a printing press, labour of machine operators and assemblers.

Indirect Labour Cost

Some workers does not engage directly in conversion of output but contribute indirectly. Labour is paid for the objective of carrying tasks incidental to goods or service provided. It cannot be practically traced to particular units of output e.g. wages of store-keepers, foremen, time-keepers, supervisors, Inspectors etc.

Direct Expenses Cost

Direct Expenses Cost is also defined as chargeable expenses. These direct expenses are incurred directly on a particular product, Job or cost units and recognizable with the cost units.

Indirect Expenses Cost

Those expenses which cannot be directly, conveniently and fully charged to cost units are known as indirect expenses.

According to Variation

Fixed Cost

Fixed Cost is a cost which does not vary in total for a given time period in spite of wide fluctuation in production or volume of activity. These costs are also termed as standby costs, capacity costs or period costs.

Variable Cost

Variable Cost is those costs that change directly and accordingly with the production. There is a fixed ratio between the variation in the cost and variation in the level of output. Direct materials cost and direct labour cost are the costs which are generally variable costs.

Mixed Cost

Mixed Cost are costs made up of fixed and variable items. They are a combination of semi-variable costs and semi-fixed costs. Because of the variable element, they vary with volume; because of the fixed element, they do not fluctuate in direct proportion to output.

Semi-fixed costs are those costs which remain fixed up to a certain level of production after which they become variable.

Degree of changeability

Direct Cost

Direct Cost it may be defined as the term of direct materials, direct labour and direct overheads. That means it is a cost which can be directly identified to a unit of output or the segment of a business operation. It output units are the objects of costing, then direct cost represent cost and resources that can be traced to or identified with the finished product.

Indirect Cost

Indirect Cost are those costs which cannot be associated with or chargeable to a single product because they are incurred for more products. Indirect costs, often related to as overheads, have to be apportioned to various products.

Degree of Relation

Product Cost

Product Cost are those costs that are included in the cost of manufacturing a product.

Period Cost

Period Cost are those costs which are not identified with product or activity during the period in which they are evolved. They are not carried forward as a part of value of stock to the next accounting period. These costs are required to generate revenues but they cannot be directly related with units of product.

Functional Classification of Cost

Manufacturing Cost

Manufacturing Cost are all production cost incurred to manufacture the products and to bring them to a saleable condition, including direct materials, direct labour and indirect manufacturing (or factory overhead) costs.

Selling and Distribution Cost

Selling and Distribution Cost may be assumed as expenses when incurred or charged to prepaid expense accounts such as prepaid insurance.

Association with the Accounting Period

Capital Cost

A capital expenditure provides benefit to future periods and is classified as an asset. Capital expenditure will flow into the cost stream as an expense when the asset is applied up or written off.

Revenue Cost

A revenue expenditure is treated to benefit the current period and is classified as an expense.

The difference between capital and revenue expenditures is vital to the accurate matching of costs and revenue and to the right measurement of periodic net income.

Costs for Decision-Making and Planning

- Opportunity Cost

- Sunk Cost

- Relevant Cost

- Differential Cost

- Imputed Cost

- Out of Pocket Cost

- Fixed, Variable and Mixed Costs

- Shut Down Cost

Opportunity Cost

Opportunity cost is the cost of opportunity lost. Opportunity cost is the cost of choosing one item of action in terms of the opportunities which are given up to carry out that course of action.

Opportunity cost is the profit lost by avoiding the best competing alternative to the one chosen. The benefit lost is normally the net earnings or profits that might have been earned from the rejected alternative.

Sunk Cost

Sunk cost is past or historical cost which has already been incurred. It may be known as unavoidable cost, it refers to all past costs since these amounts cannot be changed once the cost is incurred. They are the costs which have been created by a decision in the past and cannot be altered or neglected by any decision that is made in the future.

Examples of sunk costs are the book values of existing assets, such as plant and equipment, inventory, investment in securities, etc.

Relevant Cost

Relevant costs are related to future, which differ between alternatives. Relevant costs may also be termed as the costs which are influenced and changed by a decision. On the other hand, irrelevant costs are not influenced by the decision, whatever alternative is selected.

Differential Cost

Differential cost is the increase or decrease in total costs between any two alternatives due to change in activity or a particular management decision.

Imputed Cost

Imputed costs are those costs which do not involve actual cash outlay. These costs are not actually incurred in some transaction but which are relevant to the decision as they pertain to a particular situation. These costs do not enter into traditional accounting system or in financial records.

Interests on internally generated funds, rental value of company owned property and salaries of owners of a single proprietorship or partnership are some examples of imputed costs.

Out of Pocket Cost

Out of pocket cost involves the cash outflows due to a particular management decision activity. Non-cash costs such as depreciation are not involved in out-of-pocket costs. This cost concept is important for management in deciding whether or not a particular project will at least return the cash expenditures related with the project choosen by management.

Fixed, Variable and Mixed Costs

These costs have been defined in the previous classifications.

Shut Down Cost

Shut Down Cost are those costs which have to be arise under all conditions in the case of stopping manufacture of a product or closing down a department or a division. Shut down costs are always fixed costs.

Costs for Control

Controllable and Uncontrollable Cost

Controllable cost is that cost which is subject to direct control at some level of managerial supervision.

Standard Cost

Standard Cost are those costs which are planned or pre-determined cost estimates for a unit of output in order to get a basis for comparison with actual costs. It is evaluated at assuming a particular level of efficiency in utilization of material, labour and indirect services.

Other Costs

Joint Cost

Joint Cost is the cost of two or more products that are not identifiable as individual types of products until a particular stage of production known as the split-off point (point of separation) is reached.

For example, kerosene, fuel oil, gasoline and other oil products are derived from crude oil. Joint costs are total costs incurred up to the point of separation. Joint costs can be apportioned to different products only by means of some suitable bases of apportionment.

Common Cost

Common Cost are those which are incurred or charged for more than one product, job or any other certain costing object. These costs are not easily recognizable with individual product and therefore are normally apportioned.

Common costs are common to products, processes, functions, responsibilities, customers, sales territories, costing units and period of time.

Read More Articles