What is Standard Costing?

Standard Costing is a predetermined cost which is calculated from management standards of efficient operations and the relevant necessary expenditure. It may be used as a basis for price fixing and for cost control through variance analysis.

Standard Costing is a concept of accounting for determination of standard for each element of costs. These predetermined costs are compared with actual costs to find out the deviations known as “Variances.” Identification and analysis of causes for such variances and remedial measures should be taken in order to overcome the reasons for variances.

Table of Contents

Standard Costing Definition

ICMA, London defines “Standard Costing is the preparation and use of Standard costs, their comparison with actual costs and analyzing of variances to their causes and points of incidence.”

Wheldon says “Standard costing is a method of ascertaining the costs whereby statistics are prepared to show (a) the standard cost (b) the actual cost (c) the difference between these costs, which is termed the variance.”

Thus the technique of standard cost study comprises of:

- Pre-determination of standard costs;

- Use of standard costs;

- Comparison of actual cost with the standard costs;

- Find out and analyze reasons for variances;

- Reporting to management for proper action to maximize efficiency.

Standard

According to Prof. Eric L.Kohler, “Standard is a desired attainable objective, a performance, a goal, a model”. Standard may be used to a predetermined rate or a predetermined amount or a predetermined cost.

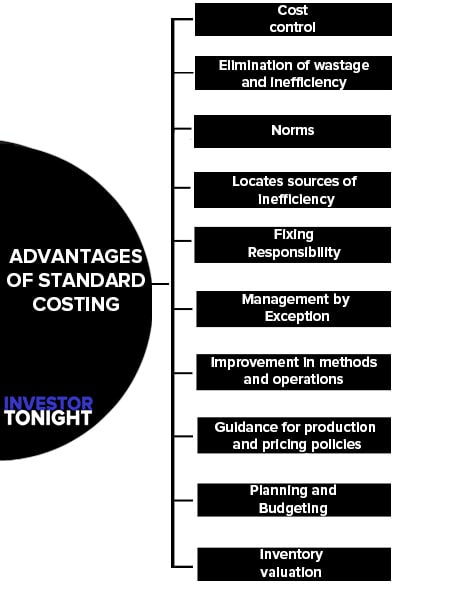

Advantages of Standard Costing

Advantages of standard costing are:

- Cost control

- Elimination of wastage and inefficiency

- Norms

- Locates sources of inefficiency

- Fixing responsibility

- Management by exception

- Improvement in methods and operations

- Guidance for production and pricing policies

- Planning and Budgeting

- Inventory valuation

Cost control

Standard costing is universally recognized as a powerful cost control system. Controlling and reducing costs becomes a systematic practice under standard costing.

Elimination of wastage and inefficiency

Wastage and inefficiency in all aspects of the manufacturing process are curtailed, reduced and eliminated over a period of time if standard costing is in continuous operation.

Norms

Standard costing provides the norms and yard sticks with which the actual performance can be measured and assessed.

Locates sources of inefficiency

It pin points the areas where operational inefficiency exists. It also measures the extent of the inefficiency.

Fixing responsibility

Variance analysis can determine the persons responsible for each variance. Shifting or evading responsibility is not easy under this system.

Management by exception

The principle of ‘management by exception can be easily followed because problem areas are highlighted by negative variances.

Improvement in methods and operations

Standards are set on the basis of systematic study of the methods and operations. As a consequence, cost reduction is possible through improved methods and operations.

Guidance for production and pricing policies

Standards are valuable guides to the management in the formulation of pricing policies and production decisions.

Planning and Budgeting

Budgetary control is far more effective in conjunction with standard costing. Being predetermined costs on scientific basis, standard costs are also useful in planning the operations.

Inventory valuation

Valuation of stocks becomes a simple process by valuing them at standard cost.

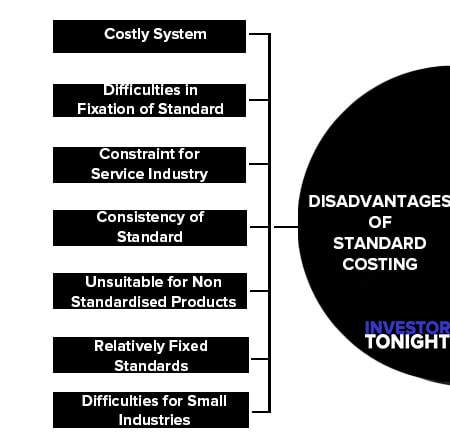

Disadvantages of Standard Costing

Disadvantages of standard costing are:

- Costly System

- Difficulties in Fixation of Standard

- Constraint for Service Industry

- Consistency of Standard

- Unsuitable for Non Standardised Products

- Relatively Fixed Standards

- Difficulties for Small Industries

Costly System

Because the Standard Costing requires highly skillful and competent personnel, it becomes a costly system too. For the same experts are paid high remuneration.

Difficulties in Fixation of Standard

It is always difficult to determine precise standard costs in a given situation which will coincide with actual cost when operations are over. Standard cost are determined partly by the past experience and partly by the cost projections based on advanced statistical techniques. Thus, uncertainties revolve around standards.

Constraint for Service Industry

Standard costing is applied for planning and controlling manufacturing costs. Thus, it cannot be applied in a service industry.

Consistency of Standard

because the standards of marginal costing fluctuate and vary time to time, it is difficult to always sustain and continue the same standards.

Unsuitable for Non Standardised Products

Standard costing is expensive and unsuitable for job manufacturing industries as they manufacture non standardized products such as catering, tailoring, printing, etc.

Relatively Fixed Standards

A business may not be able to keep standards up‐to‐date. In other words, a business may not revise standards to keep pace with the frequent changes in manufacturing conditions. Firms may avoid revising standards as it is a costly affair.

Difficulties for Small Industries

Establishment of standards and their implementation involve initial high costs. Standards have to be revised and new standards be fixed involving larger costs. Thus, small firms find it

Difference Between Standard Cost and Estimated Cost

| Estimated Cost | Standard Cost |

|---|---|

| It is used as statistical data, and leads to a lot of guess work. | It is scientifically used, and it is a regular system of account based upon estimation and time studies. |

| Its objects are to ascertain “What the cost will be” | Its object is to ascertain “what the costs should be” |

| It gives importance to cost ascertainment for fixing sale price. | It is used for effective cost control and to take proper action to maximize efficiency. |

| It is used for a specific use; i.e., fixing sale price. | It is a continuous process of costing, and takes into account all the manufacturing processes. |

| It can be used where costing is in operation. | It can be used where standard costing is in operation. |

| It is not accurate. It is an approximation based on past experience. | As it is based on scientific analysis, it is more accurate than the estimated cost. |

Difference Between Standard Costing and Historical Costing

| Historical Cost | Standard Cost |

|---|---|

| It is an after-production-recorded cost. | It is a predetermined cost. |

| It is, actually, incurred cost. | It is an ideal cost. |

| As it relates to the past, it is not useful for cost control. | It is a future cost. It can be used for cost control. |

| It is used to ascertain the profit or the loss incurred during a period. | It is used for the measurement of operational efficiency of the enterprises. |

Difference Between Standard Costing and Budgetary Control

| Budgetary Cost | Standard Cost |

|---|---|

| It is extensive in its application, as it deals with the operation of department or business as a whole. | It is intensive, as it is applied to manufacturing of a product or providing a service. |

| Budgets are prepared for sales, production, cash etc. | It is determined by classifying recording and allocating expenses to cost unit. |

| It is a part of financial account, a projection of all financial accounts. | It is a part of cost account, a projection of all cost accounts. |

| Control is exercised by taking into account budgets and actuals. Variances are not revealed through accounts. | Variances are revealed through difference accounts. |

| Budgeting can be applied in parts. | It cannot be applied in parts. |

| It is more expensive and broad in nature, as it relates to production, sales, finance etc. | It is not expensive because it relates to only elements of cost. |

| Budgets can be operated with standards. | This system cannot be operated without budgets. |

Read More Articles