What is Internal Reconstruction?

Internal reconstruction means the reorganization of the capital structure of a company without forming a new company and without liquidating the existing company. Internal reconstruction of a company is done to alter the share capital or to reduce the share capital without going into liquidation.

In internal reconstruction, the capital of the company is reduced, and external liabilities such as debenture holders and creditors waive their claims by giving a discount.

Table of Contents

It means the reorganized form of the company will run the business of the existing company. The claims of the shareholders, creditors, and outsiders are adjusted towards the amount of writing off the losses and fictitious assets.

Difference Between Internal and External Reconstruction

Following are differences between internal and external reconstruction:

| Basis | Internal Reconstruction | External Reconstruction |

| Liquidation | The existing company is not liquidated. | The existing company is liquidated. |

| Formation | No new company is formed but only the rights of shareholders and creditors are changed. | A new company is formed to take over the liquidated company. |

| Reduction of Capital | There is a certain reduction of capital and sometimes the outside liabilities like debenture holders may have to reduce their claim. | There is no reduction of capital. In fact, there is a fresh share capital of the company. |

| Legal Position | Internal reconstruction is done as per provisions of section 66 of the Companies Act, 2013. | External reconstruction is regulated by section 232 of the Companies Act, 2013. |

Methods of Internal Reconstruction

For properly deploying the process of internal reconstruction following methods are generally employed or used simultaneously:

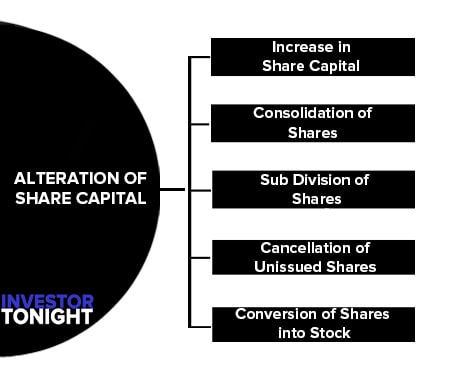

The alteration of share capital involves those cases which do not require any approval from the court. Following are the alterations which a company can carry out if the Articles of the company empower:

- Increase in Share Capital

- Consolidation of Shares

- Sub Division of Shares

- Cancellation of Unissued Shares

- Conversion of Shares into Stock

The share capital of the company can be increased only by the issue of new shares.

It is done by consolidating the existing shares of smaller denominations into shares of higher denominations.

For example, A Ltd. having a share capital of Rs. 30, 00,000 divided into 3, 00,000 shares of Rs. 10 each, resolve to consolidate the shares into 30,000 shares of Rs. 10 each. The following journal entry will be passed:

| Particular | L.F. | Dr. | Cr. |

| Share Capital A/c (Rs. 10) Dr. To Share Capital A/c (Rs. 100) | 30, 00,000 | 30, 00,000 |

As such, the amount of share capital remains the same and the number of shares is reduced with the consolidation.

In this method, the existing shares of the higher denominations are sub-divided into shares of smaller denominations. In this method, if the shares are partly paid-up then care must be taken that the ratio between the face value and the paid-up value should remain the same.

For example, A Ltd. having a share capital of Rs. 30,00,000, divided into 30,000 shares of Rs. 100 each, resolve to sub-divide the shares into 3,00,000 shares of Rs. 10 each. The following journal entry will be passed:

| Particular | L.F. | Dr. | Cr. |

| Share Capital A/c (Rs. 100) Dr. To Share Capital A/c (Rs. 10) | 30, 00,000 | 30, 00,000 |

In this method, the shares which have not been subscribed are cancelled, which leads to a decrease in the unissued capital. However, the company without the sanction of the court cannot cancel the unpaid amount on the already issued shares.

In this method, the fully paid shares are converted into stock or stock is re-converted into fully paid shares. For example, A Ltd. converts its 3, 00,000 shares of Rs. 10 each, into equity stock of Rs. 30, 00,000. The following journal entry will be passed:

| Particular | L.F. | Dr. | Cr. |

| Equity Share Capital A/c Dr. To Equity Stock A/c | 30, 00,000 | 30, 00,000 |

In all the above cases, a special resolution is enough for the alteration of share capital and any sanction from the court is not required.

Reduction of capital can be carried out by a company according to the provisions laid down in Section 100 to 105 of the Companies Act. The reduction of capital can only be made if it is mentioned in the Articles of the company and a special resolution is passed to that effect.

Further, the scheme of reconstruction should be approved by the court and the sanction of the court should be maintained. The scheme is passed by the court only if it thinks fit and the consent of the creditors is obtained, or their claims are settled.

The capital reduction can take place in any of the three forms:

- Reducing the liability in respect of uncalled amount of shares.

- Paying off the unpaid capital which is in excess of the needs of the company.

- Cancelling the paid-up capital which is already lost or not represented by the available assets. Creditors consent is required in case (i) and (ii) because their interests are affected by the reductions.

The following procedure is to be followed for reducing share capital:

- The company cannot reduce its share capital unless it is authorised by its articles of association. However, if the articles do not permit capital reduction, they may be altered by special resolution to enable the company to reduce its share capital.

- The company must pass a special resolution for reduction of capital.

- The company must apply to the court for an order confirming the capital reduction. The court must look after the interest of creditors and shareholders before giving an order confirming the capital reduction. The court may make an order confirming the capital reduction on such terms and conditions as it thinks proper.

If it is satisfied that every creditor of the company entitles to object capital reduction has consented to the reduction or his debt has been discharged or secured by the company. The court may also order the company to add the words “and reduced” to the name of the company for such period as it deems fit.

The court may also order the company to publish reasons for reduction and all other information in regard thereto for public information. - The order of the court confirming the reduction must be produced before the registrar and the certified copy of the order and of the minutes of reduction should be filed with the registrar for registration.

In the following cases, the procedure of reduction of capital is not called for:

- Where the redeemable preference shares are reduced in accordance with the provisions of Section 80.

- Where any shares are forfeited for nonpayment of calls.

- Where there is surrender of shares or a gift is made to a company of its own shares.

- Where the nominal share capital of a company is reduced by cancelling any shares which have not taken or agreed to be taken by any person.

Accounting Procedure under various circumstances

Accounting Procedure under various circumstances is as follows:

Case 1

Reducing the liability in respect of uncalled amount of shares: For example, the capital of A Ltd. which consists of 10,000 shares of Rs. 10 each (Rs. 8 paid up) is now reduced to 10,000 shares of Rs. 8 paid-up. The journal entry will be as follows:

| Particular | L.F. | Dr. | Cr. |

| Equity Share Capital A/c (Rs. 10) Dr. To Equity Share Capital A/c (Rs. 8) | 80,000 | 80,000 |

In this, the shareholders benefit because they are not required to pay Rs. 2 in future.

Case 2

Paying off the unpaid capital which is in excess of the needs of the company. When the company finds that it has excess capital, it may reduce it by returning the excess capital to its shareholders. The entries are as follows:

| Particular | L.F. | Dr. | Cr. |

| Share Capital A/c Dr. To Shareholders A/c (Rs. 8) | 80,000 | 80,000 | |

| Shareholders A/c Dr. To Bank A/c | ——- | ——- |

Case 3

Cancelling the paid-up capital which is already lost or not represented by the available assets: When a company suffers losses continuously, the assets side of the balance sheet contains the accumulated losses and the unwritten balances of the fictitious assets like preliminary expenses, etc.

Sometimes the other assets are also shown at overvalued figures because in the absence of profit proper provisions are not made and in such a case company can’t enjoy goodwill also. In this case, the scheme of capital reduction is adopted to show the capital at its real worth.

The amount so available through capital reduction is utilized to write off all the intangible assets, fictitious assets, and other overvalued assets.

Following journal entries are passed:

For reducing the amount of paid-up share capital

| Particular | L.F. | Dr. | Cr. |

| Share capital A/c Dr. To Reconstruction A/c (Rs. 8) | —— | —— |

If the losses have accumulated to such an extent that a portion of borrowed capital is also lost then the debenture holders and creditors will also sacrifice. The journal entry will be:

| Particular | L.F. | Dr. | Cr. |

| Debenture A/c Dr. Creditors A/c Dr. To Reconstruction A/c | —— | —— |

Utilizing the amount of reconstruction account for writing off past losses, Fictitious and Intangible Assets, and excess value of other assets.

| Particular | L.F. | Dr. | Cr. |

| Reconstruction A/c Dr. To Goodwill A/c To Accumulated Losses A/c To Excess Portion of Assets A/c To Unrecorded Liability A/c | —— | —— |

If reconstruction still shows the credit balance, than it is transferred to capital reserve:

| Particular | L.F. | Dr. | Cr. |

| Reconstruction A/c Dr. To Capital Reserve A/c | —— | —— |

Read More Articles

- What is Accounting?

- Basic Accounting Terminology

- Basic Accounting Concepts

- Accounting Conventions

- Double Entry System

- What is Journal?

- What is Ledger?

- What is Trial Balance?

- What is Activity Based Costing?

- Business, Industry and Commerce

- Shares and Share Capital

- What is Audit of Ledger?

- Forfeiture and Reissue of Shares

- What is Consolidated Financial Statements?

- What are Preference Shares?

- What are Debentures?

- Issue of Bonus Shares

- What is Government Accounting?

- What are Right Shares?

- Redemption of Debentures

- Buy Back of Shares

- Valuation of Goodwill

- What is Valuation of Shares?

- Purchase of Business

- Amalgamation of Companies

- Internal Reconstruction of Company

- What is a Holding company?

- Accounts of Holding Company

- What is Slip System?