What is a Holding Company?

A company that has one or more subsidiary companies having full control over them. It is formed for the purpose of purchases and owning shares in other companies. Holding a company offers several benefits such as gaining more control, retaining the management of the subsidiary firm, and incurring lower tax liabilities.

Table of Contents

Subsidiary Company

Section 2(87) of the Companies Act, 2013 defines a “Subsidiary Company” as an enterprise that is controlled by another enterprise (known as a holding company). Subsidiary companies are of two types:

Wholly Owned

This is the company in which 100% of the shares and the voting rights are owned by the holding company.

Partly Owned

This is the company in which more than 50 % but less than 100% shares and voting rights are owned by the holding company. In this type of subsidiary, some of the shareholders of the subsidiary do not sell their shares to the holding company and these shareholders are known as minority shareholders.

The interest of the monitory shareholders in the assets of the subsidiary is called the minority interest.

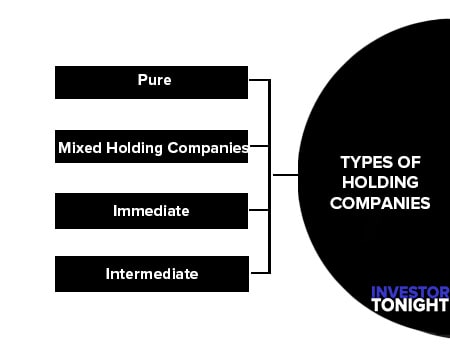

Types of Holding Companies

Following are types of holding companies which given below:

Pure

This refers to those companies which do not participate in another business other than controlling one or more firms. It is formed for the purpose of owning stocks in other companies.

Mixed Holding Companies

Mixed holding companies refer to those companies which do not only control other companies but also engages in their own operations.

Immediate

Immediate refers to that company that retains voting power or control of another company, in spite of the fact that the company itself is already controlled by another entity. It is a company that is already a subsidiary of another.

Intermediate

It is a firm that is both a holding company of another entity and a subsidiary of a large corporation. This type of firm might be exempted from publishing financial records as a holding company of the smaller group.

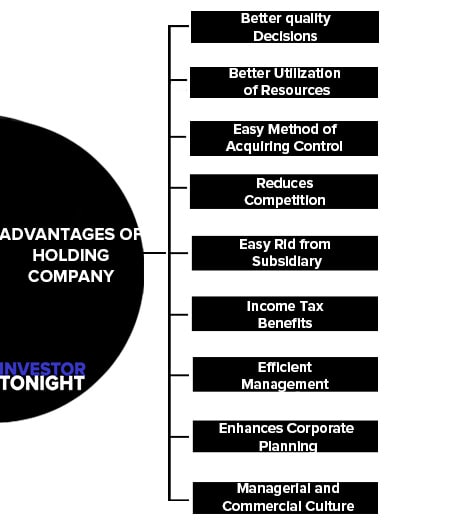

Advantages of Holding Company

The holding company offers several advantages. Let us discuss those advantages in detail:

- Better quality Decisions

- Better Utilization of Resources

- Easy Method of Acquiring Control

- Reduces Competition

- Easy Rid from Subsidiary

- Income Tax Benefits

- Efficient Management

- Enhances Corporate Planning

- Managerial and Commercial Culture

Better quality Decisions

Holding companies allow better quality decisions at all levels of the company. The holding company concentrates on the corporate policies and strategies and the operating levels in the implementation.

Better Utilization of Resources

Holding companies facilitate the better utilization of the financial and the other resources of the companies. The holding company pools the resources of a group of enterprises.

Easy Method of Acquiring Control

Through this method, organizations have to spend less in acquiring the control of the other company.

Reduces Competition

Competition among the two companies is totally eliminated as both of the companies are managed by the same group.

Easy Rid from Subsidiary

If the company wants to get rid of the subsidiary; it can easily do so by selling the shares of the subsidiary in the open market.

Income Tax Benefits

Separate identities are maintained by both the companies so that they can avail themselves of the tax benefits by carrying forward their losses of the previous years.

Efficient Management

It becomes easier to manage both companies as both the companies maintain their separate identities. This increases the efficiency of the management.

Enhances Corporate Planning

The holding company is able to concentrate on corporate planning, acquisition, and update technology, and building of corporate culture on sound business principles.

Managerial and Commercial Culture

The management of the holding company promotes the commercial and managerial culture instead of the bureaucratic culture.

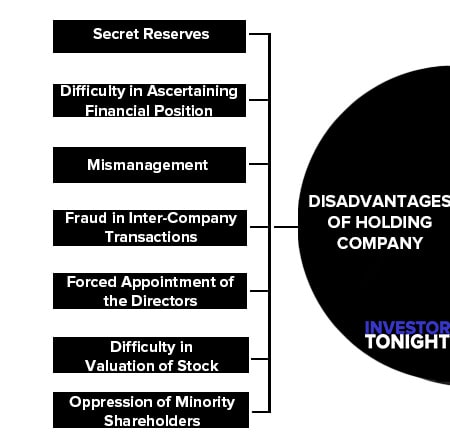

Disadvantages of Holding Company

The holding company suffers from several disadvantages. Let us discuss those disadvantages in detail:

- Secret Reserves

- Difficulty in Ascertaining Financial Position

- Mismanagement

- Fraud in Inter-Company Transactions

- Forced Appointment of the Directors

- Difficulty in Valuation of Stock

- Oppression of Minority Shareholders

Secret Reserves

To the detriment of the minority interest, unscrupulous directors can easily create secret reserves.

Difficulty in Ascertaining Financial Position

The creditors in the subsidiary company and the shareholders in the holding company may not be aware of the true financial position of the company.

Mismanagement

When in the holding company number of constituents is more and there is not equivalent management efficiency, it results in the mismanagement of the operations of the company.

Fraud in Inter-Company Transactions

There are more chances of fraud due to inter-company transactions. This is due to the reason that inter-company transaction are settled at a very high or very low prices according to the requirement of the holding company.

Forced Appointment of the Directors

The subsidiary company is sometimes forced by the holding company to appoint some directors or officers in the company.

Difficulty in Valuation of Stock

It becomes difficult to value the stock as the stock of the company consists of a huge quantity of inter-company goods.

There is always the fear of oppression of minority shareholders as the financial and other resources are totally managed in a way that suits the interest of the holding company.

Consolidated Financial Statements

Financial statements in the context of holding company mean Balance sheets and Profit and Loss Accounts of both the holding company and its subsidiary. Therefore, consolidation of financial statements means consolidation of Balance Sheets and Profit and Loss Accounts of both the holding company and its subsidiary.

Consolidation of Balance Sheet implies the preparation of a single Balance Sheet by aggregating all items of assets and liabilities, appearing in the respective Balance Sheets of both the holding company and its subsidiary company.

Consolidation of Profit and Loss Accounts implies the preparation of a single Profit and Loss Account by aggregating all items of incomes and expenses, etc., appearing in the respective Profit and Loss Accounts of both the holding company and its subsidiary company.

These consolidated financial statements are intended to present financial information about a holding company and its subsidiary(ies) as a single economic entity to show the economic resources controlled by the group, the obligations of the group, and results of the group achieved with its resources.

The various outside parties concerned with the holding company and its subsidiaries may also be interested in the consolidated final accounts.

Advantages of Consolidated Financial Statements

Users of the financial statements of a parent company (holding company) are usually concerned with the financial position and results of operations of not only the enterprise itself but also of the group as a whole. For this purpose, consolidated financial statements are prepared and presented by a parent (holding company).

The following are the advantages of Consolidated Financial Statements (CFS):

- CFS provides financial information about a parent and its subsidiary(ies) as a single economic entity.

- CFS shows the economic resources controlled by the group.

- CFS shows the obligations of the group.

- CFS shows the results the group achieved with its resources.

- CFS meets the information need of the investors for taking investment decisions.

Legal Requirements on Consolidation

A holding company must attach the following documents with its balance sheet in respect of each of its subsidiaries:

- A copy of the balance sheet of the subsidiary.

- A copy of its profit and loss account.

- A copy of the report of its Board of Directors.

- A copy of the report of its auditors.

- A statement showing.

- The extent of the holding company’s interest in the subsidiary at the end of the financial year of the subsidiary company.

- The profits (after deduction of losses of the subsidiary) so far as they concern the holding company separately for the current financial year and for previous financial years and separately for profits already dealt with in the books of the holding company and not so dealt with.

- The term ”profits” refers to profits of a revenue nature and earned by the subsidiary company after the date of acquisition of shares by the holding company.

- The extent of the holding company’s interest in the subsidiary at the end of the financial year of the subsidiary company.

- Where the financial year of the subsidiary company does not coincide with the financial year of the holding company, a statement showing the following:

- Whether and to what extent there has been a change in the holding company’s interest in the subsidiary company since the close of the financial year of the subsidiary company.

- Details of any material changes which have occurred between the end of the financial year of the subsidiary company and at the end of the financial year of the holding company in respect of the subsidiaries fixed assets, its investment, the money lent by it and the money borrowed by it for any purpose other than that of meeting current liabilities.

- Whether and to what extent there has been a change in the holding company’s interest in the subsidiary company since the close of the financial year of the subsidiary company.

Read More Articles

- What is Accounting?

- Basic Accounting Terminology

- Basic Accounting Concepts

- Accounting Conventions

- Double Entry System

- What is Journal?

- What is Ledger?

- What is Trial Balance?

- What is Activity Based Costing?

- Business, Industry and Commerce

- Shares and Share Capital

- What is Audit of Ledger?

- Forfeiture and Reissue of Shares

- What is Consolidated Financial Statements?

- What are Preference Shares?

- What are Debentures?

- Issue of Bonus Shares

- What is Government Accounting?

- What are Right Shares?

- Redemption of Debentures

- Buy Back of Shares

- Valuation of Goodwill

- What is Valuation of Shares?

- Purchase of Business

- Amalgamation of Companies

- Internal Reconstruction of Company

- What is a Holding company?

- Accounts of Holding Company

- What is Slip System?