What is Forfeiture?

Forfeiture means the loss of a right, claim, or property as a result of failure to meet legal obligations. In accounting for share, it assumes special meaning. Forfeiture of a share means cancellation of the shares held by the defaulting member in a company.

Table of Contents

After an applicant is allotted shares, a contract is entered into between the company and the shareholder. The shareholder is bound to contribute to the capital of the company to the extent of the price of shares he has agreed to take.

Where the amount of share money is payable in installments, the shareholders are under obligation to pay the installments as and when he/ she is asked to pay by the company.

If he/she fails to pay allotment/call money within the time mentioned in the allotment/call letters, his /her shares may be forfeited by the directors if authorized by the Articles of Association.

Now let us discuss what will be the effect of share forfeiture. First, the directors must observe strictly all the legal formalities required by the Articles of Association, before forfeiting the shares. When the directors forfeit the shares, the person loses his membership in the company.

Further, the amount already paid by him/her towards the share capital is also forfeited. Therefore, on forfeiture of shares, the name of the member is removed from the Register of Members. In the financial books of the company also necessary entries are passed, canceling the shares allotted to the member.

The amount already paid by the defaulting member is not refunded and is transferred to an appropriate account. Summarily the following are the effects of forfeiture:

- Termination of membership of the shareholder.

- Seizure of money paid by the shareholder.

- Ownership of forfeited shares lies with the company.

- The money received on the forfeited shares becomes the property of the company.

- The defaulting shareholder shall remain liable to pay the amount in respect of his/ her shares, till the company receives the payment in full of such shares.

- On forfeiture of shares, the share capital account is reduced to the extent of amount called up on account of capital till the forfeited shares are reissued.

Disclosure in the Balance Sheet: The balance of the Forfeited Shares Account is shown as an addition to the total paid-up share capital of the company under the head “Share Capital” under title “Equity and liabilities” of the Balance Sheet till the forfeited shares are reissued.

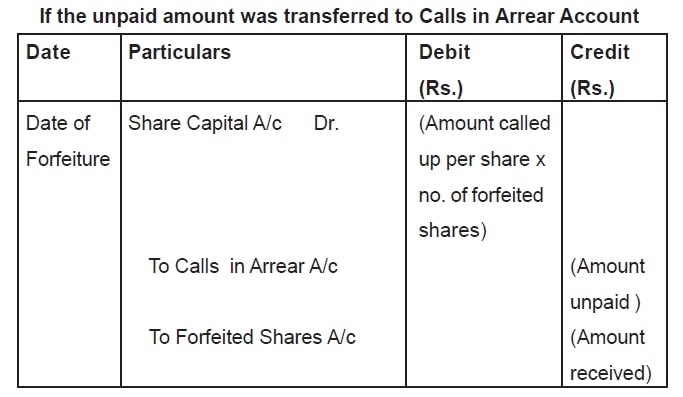

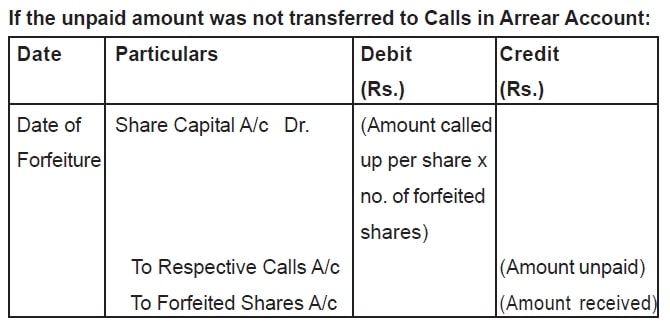

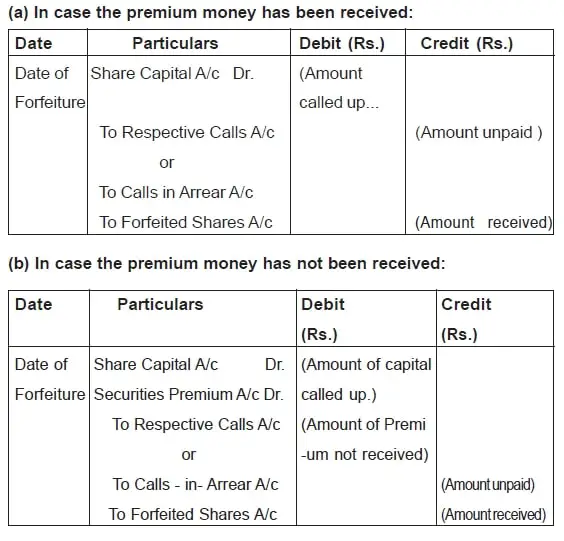

The accounting treatment relating to the forfeiture of shares may be discussed under the following heads:

- Forfeiture of Shares Issued at Par

- Forfeiture of Shares Issued at a Discount

- Forfeiture of Shares Issued at a Premium

Forfeiture of Shares originally issued at par:

Note: Instead of using the term Forfeited Shares A/c, Shares Forfeited A/c or Share Forfeiture Account may also be used.

Note: Respective Calls mean if there were arrears only on Allotment, Allotment Account will be credited.

If there were arrears both on Allotment and First Call, both the Allotment Account and First Call Account will be credited and again if the arrears were on Allotment, First Call and Second Call, then the Allotment Account, First Call Account and Second Call Account will be credited and so on.

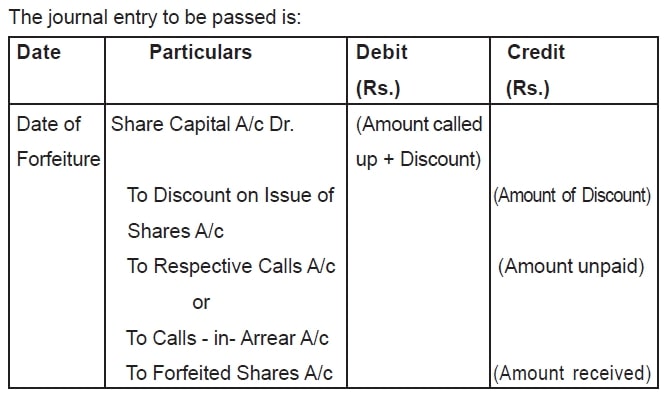

If shares to be forfeited were issued at a discount, the discount applicable to such shares shall be cancelled at the time of forfeiture of such shares.

Journal entries to be passed are:

Shares are forfeited because only a part of the due amount of such shares is received and the balance remains unpaid. On forfeiture the membership of the original allottee is cancelled. He/she cannot be asked to make payment of the remaining amount. Such shares become the property of the company.

Therefore company may sell these shares. Such sale of shares is called ‘reissue of shares’. Thus reissue of shares means issue of forfeited shares. Once the Board of directors has forfeited the shares, the defaulting share holder is asked to return the share certificate which is cancelled thereafter.

The board of directors passes a resolution allotting the forfeited shares to the new purchaser/ purchasers of such shares. In case of reissue of shares neither a prospectus is issued nor any offer is otherwise made to the general public.

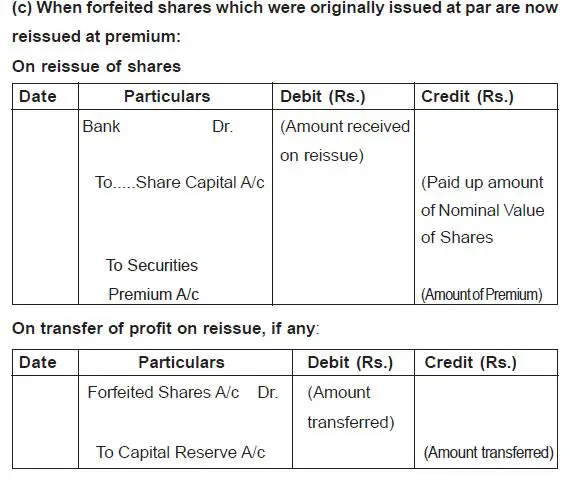

Though the amount of such shares may be called in more than one installment but usually the entire amount is called in one installment i.e. lump sum. The board of directors of the company while reissuing the shares decide the price of reissue. These shares can be reissued at par, at premium or at discount.

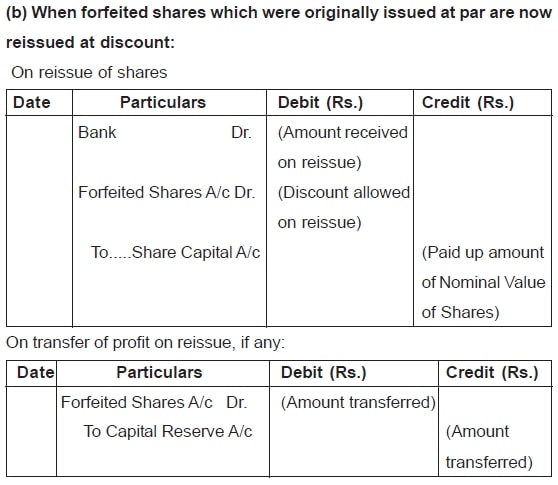

Generally, these shares are reissued at a discount i.e. at a price which is less than its nominal value. The amount of discount allowed at the time of reissue in no case should be more than the amount forfeited on such shares.

Question arises at what price the forfeited shares can be reissued?There is no limit of the price at which it can be reissued if price charged is more than the price of issue at the time of their forfeiture.

But then there is a limit below which price cannot be charged or we can say that there is a minimum price below which the company cannot reissue its forfeited shares. We can look at it from another angle i.e. the company cannot give discount more than a particular amount while reissuing the forfeited shares.

The maximum permissible discount at the time of reissue of forfeited shares is ascertained in different situations in the following manner:

- Shares Originally Issued at Par

- Shares Originally Issued at Premium

- Shares Originally Issued at Discount

- Accounting Treatment on Reissue of Forfeited Shares

When the shares are originally issued at par, the maximum permissible discount for reissue of shares is equal to the amount forfeited on such shares.

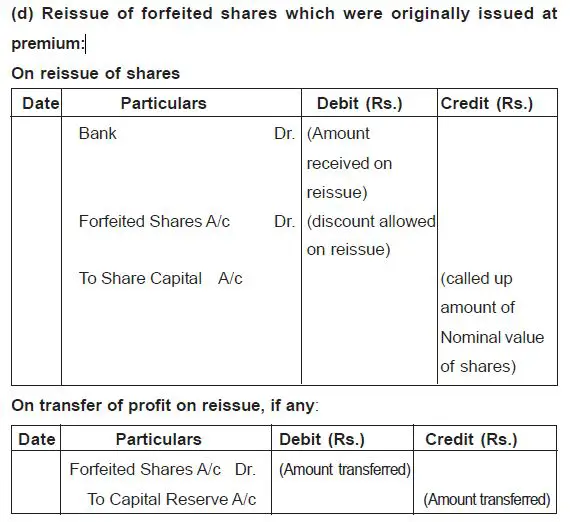

In case of shares originally issued at premium, there can be two situations:

- Premium has not been received on the forfeited shares.

- Premium has been received on such shares. The amount forfeited is the amount that has been received including the amount of premium if it has been received and the maximum discount that can be allowed on reissue of such shares is the amount so forfeited.

In this case the actual amount received becomes the forfeited amount. But the maximum permissible discount on reissue of shares will be equal to the amount forfeited plus the amount of discount initially allowed on these shares at the time of their original issue.

The accounting entries for reissue of forfeited shares will depend on the terms of original issue of the forfeited shares. Therefore, the entries for reissue are discussed under the following heads:

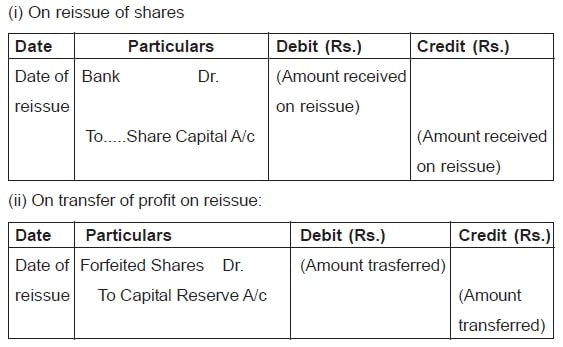

When forfeited shares which were originally issued at par are also reissued at par:

Note: When all the forfeited shares have been reissued at par, the whole of the balance of the forfeited shares account represents profit on reissue and transferred to Capital Reserve account, being a capital profit.

Read More Articles

- What is Accounting?

- Basic Accounting Terminology

- Basic Accounting Concepts

- Accounting Conventions

- Double Entry System

- What is Journal?

- What is Ledger?

- What is Trial Balance?

- What is Activity Based Costing?

- Business, Industry and Commerce

- Shares and Share Capital

- What is Audit of Ledger?

- Forfeiture and Reissue of Shares

- What is Consolidated Financial Statements?

- What are Preference Shares?

- What are Debentures?

- Issue of Bonus Shares

- What is Government Accounting?

- What are Right Shares?

- Redemption of Debentures

- Buy Back of Shares

- Valuation of Goodwill

- What is Valuation of Shares?

- Purchase of Business

- Amalgamation of Companies

- Internal Reconstruction of Company

- What is a Holding company?

- Accounts of Holding Company

- What is Slip System?