What is Audit of Ledger?

An auditor should carry out an Audit of the Ledgers after the books of original entries have been vouched and postings therefrom are fully checked. In business, personal ledgers such as purchases ledger and sales ledgers are maintained to record credit transactions.

Table of Contents

Technically speaking, this presentation is not about auditing so much as it is about month-end accounting. Auditing entails a great deal more than this short presentation could cover. However, when done properly, you are performing a mini-audit each month as you close out your books and prepare financial statements.

This presentation will describe the steps for doing your month-end accounting, including descriptions of the various “audit” procedures you will perform before closing the books and completing your financial statements.

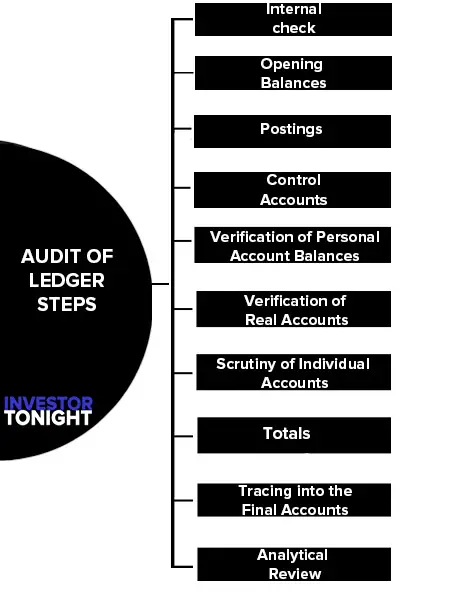

Audit of Ledger Steps

The audit of ledgers normally involves the following steps:

- Internal check

- Opening Balances

- Postings

- Control Accounts

- Verification of Personal Account Balances

- Verification of Real Accounts

- Scrutiny of Individual Accounts

- Totals

- Tracing into the Final Accounts

- Analytical Review

Internal check

Test the quality of internal check-regarding timely and correct entries in the ledger.

Opening Balances

Trace the opening balances from the previous year’s audited balance sheet. In case, the entity is getting its accounts audited for the first time since inception or it was audited in the previous year by some other auditor, follow the procedures given in SA 510 “Initial Engagements – Opening Balances “issued by ICAI.

Postings

Check postings from cash book and other books of prime entry (i.e., purchases book, sales book, journal, purchase returns the book, sales return book, bills receivable book, bill payable book).

Control Accounts

Total up the balances in the subsidiary ledgers. Tally the totals with those in the control accounts.

Verification of Personal Account Balances

Verify personal account balances with statements of account received from the parties or by arranging direct confirmation. The procedure of direct confirmation should be applied in the manner stated in SA 505 External Confirmations issued by ICAI.

Verification of Real Accounts

The real account balances should be verified by:

- Physical verification (as in the case of cash and investments).

- Checking the working papers of physical verification exercise conducted by the management (as in the case of fixed assets and inventories).

- Inspection of documents (as in the case of intangible assets such as patents and trade marks).

- Direct confirmation (as in the case of stocks lying with third parties).

Scrutiny of Individual Accounts

Scrutinize individual accounts. Examine the composition of balances. Examine age analysis of various items outstanding.

Totals

Check totals of ledger accounts, schedules of balances, groupings, etc.

Tracing into the Final Accounts

Trace the balances in individual accounts onto the schedules, from thereon into the groupings and from the groupings into the final accounts.

Analytical Review

Examine the reasonability of balances by applying analytical procedures e.g. comparison with opening balances, debtors turnover ratio, creditors turnover ratio, current ratio, fixed assets turnover ratio, working capital turnover ratio, etc.

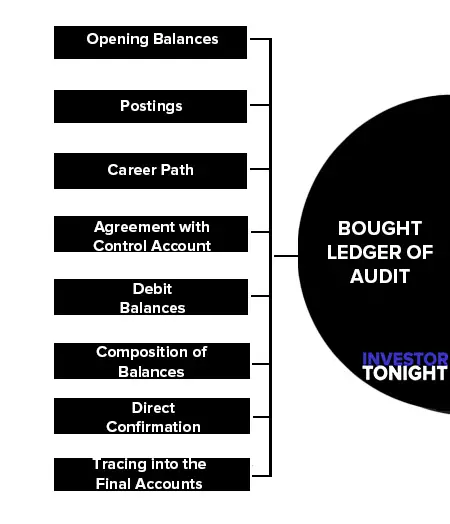

Bought Ledger of Audit

Following is the procedure to the audit the Bought Ledger (Creditor’s Ledger):

- Opening Balances

- Postings

- Totals

- Agreement with Control Account

- Debit Balances

- Composition of Balances

- Direct Confirmation

- Tracing into the Final Accounts

Audit of bought ledger should be taken up only after vouching of Purchase Journal, Purchase Returns Journal, Cash Book and Journal and verification of Bank Reconciliation Statement have been completed and all the queries arising from these have been satisfactorily resolved.

The steps in audit of bought ledger are generally the following:

Opening Balances

Check the opening balances of all supplier’s accounts from the last year’s audited schedule.

Postings

Check the postings from the books of prime entry (i.e., purchase journal, purchase returns journal, cash book, bills payable book, main journal).

Totals

Check the totals of individual accounts of suppliers.

Agreement with Control Account

The total balances of the individual suppliers’ accounts agrees on this total with the control account of sundry creditors in the general ledger.

Debit Balances

Pay special attention to debit balances in suppliers’ accounts. Enquire into the reasons for such debit balances. These may be advances against which supplies are yet to be received or they may represent advances not adjusted against billing.

Another possibility could be that the payment to the supplier has been posted to his debit but the entry for purchases (i.e., by debiting purchases and crediting his account) has been omitted.

Scrutinize advances against which deliveries are pending for a long time. See that these are genuine advances and not merely financial accommodation of a favored party. Whether the advance is a genuine one or merely for financial accommodation should be judged keeping in mind factors such as:

- The value of purchases.

- The proportion of value of purchases given as advance.

- The normal lead time for delivery.

- The normal trade practices.

- Whether the party is a sister concern.

These debit balances should not be netted off from credit balances but shown separately on the Assets side of the Balance Sheet.

Composition of Balances

Scrutinize the composition of balances by matching each credit (for supplies) with the corresponding debit entry (for payment of bills). The unmatched items should be enquired about. If not, there may be cases where the opening balances or earlier credits are unpaid but the later ones are paid.

This may reveal any of the following possibilities:

- Remittances to creditors misappropriated.

- Disputes regarding previous balances.

- (Liability regarding the amount no longer exists.

- Fictitious liability created to suppress profits.

- Payment entry omitted from the books.

Direct Confirmation

The auditor should apply direct confirmation procedures for the creditor’s balances (at least a sample of them) in the manner stipulated in SA 505.

Tracing into the Final Accounts

Trace the balances from the ledger accounts into the schedule of creditors and from thereon to the groupings and then on to the final account.

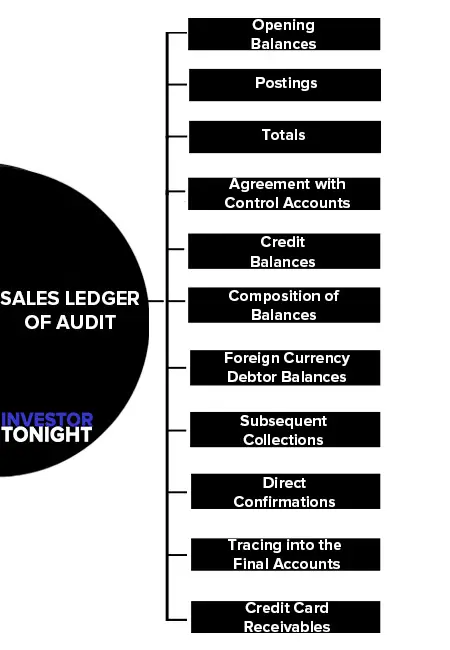

Sales Ledger of Audit

Following is the procedure for conducting the Audit of the Sales Ledger (Customer’s Ledger). The audit of the sales ledger (customer’s ledger) should be taken up only after the books of prime entry i.e., sales day book, sales return book, main journal and cash book have been vouched, Bank Reconciliation Statement has been examined and queries arising out of vouching and examination of BRS have been satisfactorily resolved.

The following steps will be generally required in the audit of the sales ledger:

- Opening Balances

- Postings

- Totals

- Agreement with Control Accounts

- Credit Balances

- Composition of Balances

- Foreign Currency Debtor Balances

- Subsequent Collections

- Direct Confirmations

- Tracing into the Final Accounts

- Credit Card Receivables

Opening Balances

Check the opening balances with the audited balance sheet of last year.

Postings

Check the postings from the sales day book, sales return journal, credit notes register, debit notes register, main journal, and bills receivable book.

Totals

Check totals i.e., castings of accounts of individual customers.

Agreement with Control Accounts

Check the total balances of individual customer’s accounts. Tally this total with the control account in the general ledger.

Credit Balances

Pay special attention to credit balances. It may be such that money has been received in advance from a customer or that the sales entry (debiting customer and creditors: sales) must have been omitted.

Composition of Balances

Match each debit for sales to the customer with the corresponding collection on the credit side. Many customers (particularly big companies) send the remittance advice showing the invoices against which payments have been made.

Refer to these while matching the payments against the respective invoices. Unmatched items should be followed up with management for explanations. Observe the patterns and enquire about any change in it.

For example, a customer who was making payments in full in one stroke is now making part payments. This may reflect that the customer is having financial difficulties or that teeming and the lading are being practiced.

Long Outstanding Balances

This has been listed as a fraud risk factor by SA 240. This could mean any of the following possibilities:

- Bad debts requiring write-offs.

- Fictitious sales booked in previous year to bolster profits.

- Misappropriation of collections.

- Omission of postings for collections.

- In case of closely-held companies or firms, the money has been paid to proprietor, partner or director who has deposited it in his personal account.

Foreign Currency Debtor Balances

See that these are stated in the balance sheet by converting the foreign currency receivable into rupees by applying the closing rate (i.e., the exchange rate on the balance sheet date). The differences arising i.e. exchange differences should be adjusted in the Profit and Loss Account as per AS-11.

Subsequent Collections

Verify the genuineness of the debtor balances by checking whether they have been collected in the following period.

Direct Confirmations

Obtain direct confirmations of debtor balances by sending out confirmation requests in the manner stipulated in AAS-30 External confirmations.

Tracing into the Final Accounts

Trace the debtor’s balances into the schedules of balances from thereon into groupings, from there into final accounts.

Credit Card Receivables

In case the company accepts payment by credit cards, check reconciliation of receivables as per books with credit card company’s statements.

Read More Articles

- What is Accounting?

- Basic Accounting Terminology

- Basic Accounting Concepts

- Accounting Conventions

- Double Entry System

- What is Journal?

- What is Ledger?

- What is Trial Balance?

- What is Activity Based Costing?

- Business, Industry and Commerce

- Shares and Share Capital

- What is Audit of Ledger?

- Forfeiture and Reissue of Shares

- What is Consolidated Financial Statements?

- What are Preference Shares?

- What are Debentures?

- Issue of Bonus Shares

- What is Government Accounting?

- What are Right Shares?

- Redemption of Debentures

- Buy Back of Shares

- Valuation of Goodwill

- What is Valuation of Shares?

- Purchase of Business

- Amalgamation of Companies

- Internal Reconstruction of Company

- What is a Holding company?

- Accounts of Holding Company

- What is Slip System?