What is Double Entry System?

Double entry system of book keeping refers to particular transactions which are entered in two aspects. It is based on the dual aspect concept. Posting of each transaction in two different accounts on opposite sides for equal value is known as the double entry system of book keeping. Normally it is the most accurate, complete and scientific method of accounting.

It is because of this principle that the two sides of the Balance Sheet are always equal and the following accounting equations will always hold good at any point of time:

Assets = Liabilities + Capital

OR

Capital = Assets – Liabilities

Table of Contents

- 1 What is Double Entry System?

- 2 Double Entry System

- 3 History of Double Entry System

- 4 Features of Double Entry System

- 5 Advantages of Double Entry System

- 5.1 Scientific System

- 5.2 Complete record of transactions

- 5.3 Preparation of Trial Balance

- 5.4 Preparation of Trading and Profit and Loss Account

- 5.5 Knowledge of financial position of business

- 5.6 Knowledge of various information

- 5.7 Lesser Possibility of Fraud

- 5.8 Legal approval

- 5.9 Comparative Study

- 5.10 Helps management in Decision Making

- 5.11 Suitable for all types of Businessman

- 6 Disadvantages of Double Entry System

- 7 Difference Between Single Entry and Double Entry

- 8 Rules of Double Entry System

Meaning of Debit and Credit

Account

An account is a record of all business transactions relating to a particular person or item. In accounting we keep a separate record of each individual, asset, liability, expense or income. The place where such a record is maintained is termed as “Account”. Such as the account of Ram, the account of Rent, the account of Machinery, the account of Salary and likewise.

All accounts are divided into two sides. The left side of an account is arbitrarily or traditionally called Debit side and the right side of an account is called Credit side. In abbreviated form, Debit is written as Dr. and Credit is written as Cr.

Debit-Credit Rules

Debit

Credit rules are globally accepted accounting conventions that facilitate double entry book keeping. The rules are summarized in the table:

| Item | Debit | Credit |

|---|---|---|

| Asset | Increase in Assets | Decrease in Assets |

| Liabilities | Decrease in Liabilities | Increase in Liabilities |

| Capital or Equity | Decrease in Capital or Equity | Increase in Capital or Equity |

| Income or Revenue | Decrease in Income or Revenue | Increase in Income or Revenue |

| Expense or Loss | Increase in Expense or Loss | Decrease in Expense or Loss |

For example, if the Furniture is purchased in the business, Furniture is increased whereas the Cash is decreased. Furniture and cash both are assets for the firm. Thus Furniture account is debited and Cash account is credited.

Double Entry System

William Pickles define “The Double Entry System seeks to record every transaction in money or money’s worth in its double aspect- The receipt of a benefit by one account and the surrender of a like benefit by another account, the former entry being to the debit of the account receiving and the latter to the credit of that account surrendering.”

“Every business transaction has a two-fold effect and that it affects two accounts in opposite directions and if a complete record were to be made of each such transaction, it would be necessary to debit one account and credit another account. It is this recording of the two-fold effect of every transaction that has given rise to the term Double Entry System.” – J. R. Batliboi

History of Double Entry System

Double entry system owes its origin to an Italian merchant named Lucas Pacioli who wrote the first book entitles ‘De Computis et Scripturis’ on double entry accounting in the year 1494. We have seen earlier that every business transaction has two aspects. i.e., when we receive something, we give something else in return.

For example, when we purchase goods for cash, we receive goods and give cash in return; similarly in a credit sale of goods, goods are given to the customer and the customer becomes debtor for the amount of goods sold to him. This method of writing every transaction in two accounts is known as Double Entry System of Accounting.

Of the two accounts, one account is given debit while the other account is given credit with an equal amount. Thus, on any date, the total of all debits must be equal to the total of all credits because every debit has a corresponding credit.

Features of Double Entry System

- Double entry system record twofold aspects of a transaction.

- Equal debit and credit entries are made in two different accounts.

- Full record of all transactions are made under this system.

- Trial balance can be prepared to check the arithmetical accuracy.

- Profit and Loss account can be found by classifying all expenses and revenues.

- Financial position can be ascertained by preparing balance sheet.

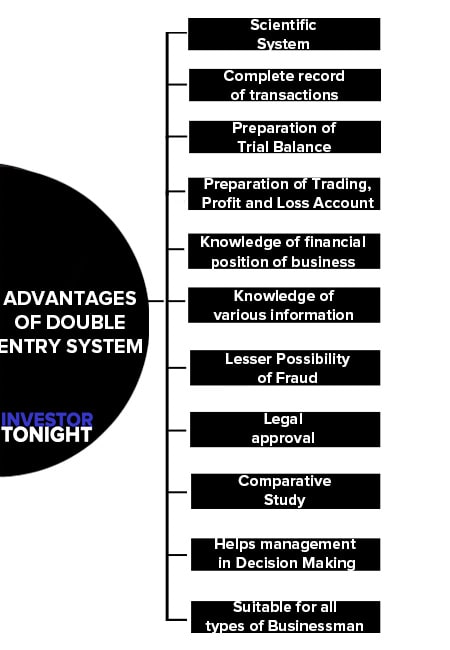

Advantages of Double Entry System

- Scientific System

- Complete record of transactions

- Preparation of Trial Balance

- Preparation of Trading and Profit and Loss Account

- Knowledge of financial position of business

- Knowledge of various information

- Lesser Possibility of Fraud

- Legal approval

- Comparative Study

- Helps management in Decision Making

- Suitable for all types of Businessman

Scientific System

The transactions are recorded according to certain specified rules and as such, the system is more scientific as compared to any other systems of Book-Keeping.

Complete record of transactions

In double entry system, both the debit and credit aspects of a transaction are recorded, so that if the need arises, full details of every transaction can be easily made available at any time in future.

Preparation of Trial Balance

In double entry system, the amount recorded to the debit sides of various accounts will always be equal to the amounts recorded on the credit sides of various accounts. As such, trial balance can be prepared to check the arithmetical accuracy of the accounts.

Preparation of Trading and Profit and Loss Account

With the help of trial balance, a trader can prepare a Trading Account to find out the amount of gross profit or gross loss. Similarly, a profit and loss account can be prepared to find out the net profit earned or loss suffered during a particular period.

Knowledge of financial position of business

In double entry system, separate accounts are opened for each and every asset and liability of the firm and as such, a Balance Sheet can be prepared which is a screen picture of the financial position of a business at a certain moment.

Knowledge of various information

In double entry system, information regarding various items or persons is readily available at any point of time such as:

- Amount of sales, purchase

- Amount due to be received from customers or in other words , the total number of debtors and the amount in each case;

- Amount due to be paid to suppliers or in other words , the total number of creditors and the amount in each case;

- Amount paid on account of each head of expenses separately

- Amount earned on account of each head of income separately

Lesser Possibility of Fraud

This system of book-keeping records each transaction in two accounts, as such, there is hardly any scope of forgery and manipulations as compared to other systems.

Legal approval

Double entry system meets legal requirements and books of accounts maintained under this system are accepted as true and reliable by the Companies Act and various other Acts.

Comparative Study

Under this system, it helps the management to compare the expenditure of the current year with those of the previous years and check the unnecessary expenditure.

Helps management in Decision Making

Under the system, the management can obtain all the requisite information quickly and hence, can use the information for making decisions.

Suitable for all types of Businessman

The system is so flexible that it can be conveniently introduced in small as well as big types of business.

Disadvantages of Double Entry System

- This system requires to maintain wider number of books of accounts, which is not convenient to small concerns.

- There is no guarantee of absolute accuracy of the books of account which are maintained.

- It requires more clerical labor, so the system is costly.

Difference Between Single Entry and Double Entry

The difference between single entry and double entry can be put as follows:

- Recording of transactions: In case of double entry system, the dual aspect concept is completely followed while recording business transactions. In case of single entry system, the dual aspect concept is not followed for all transactions. In case of some transactions both the aspects are recorded, while for some only one aspect is recorded, while in case of some other transactions no recording is at all done.

- Maintenance of books: In case of double entry system, various subsidiary books viz., sales book, purchases book, returns book, cash book etc., are maintained. While in case of single entry system, no subsidiary books except cash book is maintained.

- Maintenance of books of account: In case of double entry system, all major accounts real, nominal and personal are maintained. However, in case of single entry system, only personal accounts are maintained.

- Preparation of trial balance: In case of double entry system, trial balance is prepared to check arithmetical accuracy of the books of account. While in case of single entry system trial balance cannot be prepared. Hence, it is not possible to check the accuracy of books of account.

- Accuracy of profits and financial position: In case of double entry system, Trading and Profit and Loss Account gives the true profit of the business while Balance Sheet shows the true and fair financial position of the business. While in case of single entry system only a rough estimate of profit or loss can be made. The Statement of Affairs prepared in single entry system also does not show the true financial position of the business.

- Utility: Single entry system is used only by very small business units. It has no utility for large business units. As a matter of fact, they have to compulsorily adopt double entry system.

Rules of Double Entry System

There are separate rules of double entry system in respect of personal, real and nominal accounts which are discussed below:

Personal Accounts

These accounts record a business’s dealings with persons or firms or companies. The person receiving something is given debit and the person giving something is given credit.

For example, if Andrew sells goods to Manoj on credit, Raman’s account will be given debit (in Andrew’s books) as he is the receiver of goods and Andrew’s account will be credited (in Manoj’s books) as he is the giver of goods. When Manoj makes the payment for these goods, Andrew’s Account will be debited in Manoj’s books as he is the receiver of cash and Manoj’s Account will be given credit in Andrew’s books as he is the giver of cash.

So, the rules is: debit the receiver and credit the giver

Real Accounts

These are the accounts of assets such cash, stock, goods, furniture, building, plant etc. Asset entering the business is given debit and asset leaving the business is given credit. For example, when goods are sold for cash. Cash Account will be given debit as cash comes in and Goods Account will be credited as goods go out.

So, the rule is: debit what comes in and credit what goes out

Nominal Accounts

These accounts deal with expenses, incomes, gains, profits and losses. Accounts of expenses and losses are debited and accounts of incomes, gains and profits are credited.

For example, when salary is paid to an employee, Salary Account will be debited as it is an expense and Cash Account (real account) will be credited as it goes out. Similarly when dividend is received, Cash Account will be debited as cash is received and Dividend Account will be credited as it is an income.

Thus, the rule is: debit all expenses and losses and credit all incomes and gains

Read More Articles

- What is Accounting?

- Basic Accounting Terminology

- Basic Accounting Concepts

- Accounting Conventions

- Double Entry System

- What is Journal?

- What is Ledger?

- What is Trial Balance?

- What is Activity Based Costing?

- Business, Industry and Commerce

- Shares and Share Capital

- What is Audit of Ledger?

- Forfeiture and Reissue of Shares

- What is Consolidated Financial Statements?

- What are Preference Shares?

- What are Debentures?

- Issue of Bonus Shares

- What is Government Accounting?

- What are Right Shares?

- Redemption of Debentures

- Buy Back of Shares

- Valuation of Goodwill

- What is Valuation of Shares?

- Purchase of Business

- Amalgamation of Companies

- Internal Reconstruction of Company

- What is a Holding company?

- Accounts of Holding Company

- What is Slip System?