What Is Direct Tax?

A Direct tax is a kind of charge, which is imposed directly on the taxpayer and paid directly to the government by the persons (juristic or natural) on whom it is imposed. A direct tax is one that cannot be shifted by the taxpayer to someone else.

Table of Contents

If tax is levied directly on the income or wealth of a person, then, it is a direct tax e.g. Income-tax. Direct taxation is defined as the tax which is directly levied on the citizens of a country. All individuals and business concerns have to pay direct taxes to the government on a regular basis. These direct taxes are calculated on every source of income that accrues to the business of an individual.

Difference Between Direct Taxes and Indirect Tax

Tax, of which incidence and impact fall on the same person, is known as Direct Tax, such as Income Tax. On the other hand, tax, of which incidence and impact fall on two different persons, is known as Indirect Tax, such as GST, etc.

It means, in the case of Direct Tax, tax is recovered directly from the assessee, who ultimately bears such taxes, whereas, in the case of Indirect Tax, tax is recovered from the assessee, who passes such burden to another person & is ultimately borne by consumers of such goods or services.

Difference Between Direct Taxes and Indirect Tax

| Direct Taxes | Indirect Tax |

| Direct tax is imposed on | Indirect tax is imposed on goods and services. |

| Income or wealth. | The burden of tax can be shifted in the case of indirect taxes. |

| The burden of tax cannot be shifted in the case of direct taxes. | Examples of indirect tax are GST, Customs Duty etc. |

| An example of direct tax is Income Tax. | Indirect tax is regressive in nature i.e., all persons equally bear the burden of tax, irrespective of their ability to pay. |

| Direct tax is progressive in nature- higher rates of tax are levied on higher income. | Rates of taxes do not differ from person to person. |

| Rates of taxes may differ from person to person. | The revenue collected through indirect taxes is shared between the Central Government and the State Governments of India. |

| The revenue collected through direct taxes goes to the Central Government of India. |

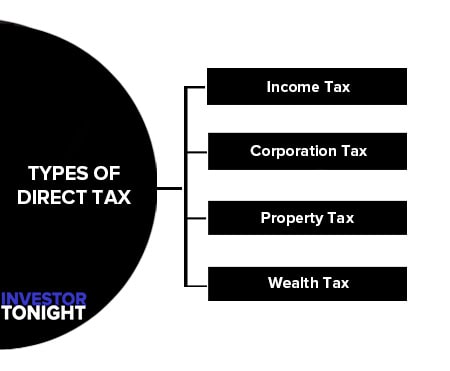

Types of Direct Tax

These are important types of direct tax which are discussed below briefly:

Income Tax

Income tax is paid by an individual based on his/her taxable income in a given financial year. Under the income tax Act, the term ‘individual’ also includes Hindu Undivided Families (HUFs) Co-operative Societies, Trust and any artificial judicial person. Taxable income refers to the total income minus applicable deductions and exemptions.

Income Tax Act, 1961 imposes a tax on the income of the individuals or Hindu undivided families or firms or co-operative societies (other than companies) and trusts (identified as bodies of individuals associations of persons) or every artificial juridical person.

The inclusion of a particular income in the total incomes of a person for income-tax in India is based on his residential status. There are three residential statuses:

Resident & Ordinarily Residents (Residents) (ii) Resident but not Ordinarily Residents and (iii) Non Residents. There are several steps involved in determining the residential status of a person. All residents are taxable for all their income, including income outside India.

Non-residents are taxable only for the income received in India or income accrued in India. Not ordinarily residents are taxable in relation to income received in India or income accrued in India and income from business or profession controlled from India.

Corporation Tax

Corporate tax is paid by companies and businesses operating in India on income earned worldwide in a given financial year. The rates of taxation vary based on whether the company is incorporated in India or abroad.

The companies and business organizations in India are taxed on the income from their worldwide transactions under the provision of the Income Tax Act, 1961. A corporation is deemed to be resident in India if it is incorporated in India or if its control and management are situated entirely in India.

In the case of non-resident corporations, tax is levied on the income which is earned from their business transactions in India or any other Indian sources depending on the bilateral agreement of that country.

Property Tax

Property tax or ‘house tax’ is a local tax on buildings, along with appurtenant land, and imposed on owners. The tax power is vested in the states and it is delegated by law to the local bodies, specifying the valuation method, rate band, and collection procedures.

The tax base is the annual ratable value (ARV) or area-based rating. Owner-occupied and other properties not producing rent are assessed on cost and then converted into ARV by applying a percentage of cost, usually six percent. Vacant land is generally exempted from the assessment.

The properties lying under the control of Central are exempted from taxation. Instead, a ‘service charge’ is permissible under the executive order. Properties of foreign missions also enjoy tax exemption without an insistence for reciprocity.

Wealth Tax

Wealth tax is applicable to individuals, HUFs or companies on the value of their assets in a given financial year on the date of valuation. It is taxed at the rate of 1% of the net wealth of any assesse exceeding Rs 30, 00, 000.

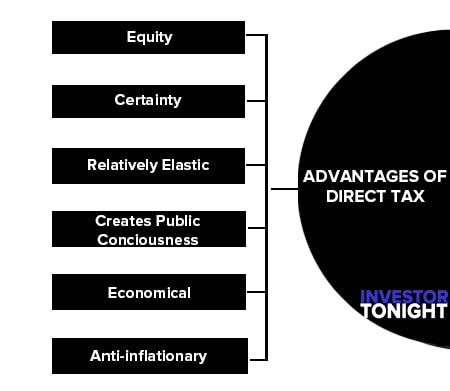

Advantages of Direct Tax

Following are the important advantages of direct taxes:

Equity

There is social justice in the allocation of the tax burden in the case of direct taxes as they are based on the principle of ability to pay. Persons in a similar economic situation are taxed at the same rate. Persons with different economic standing are taxed at a different rate.

Hence, there is both horizontal and vertical equity under direct taxation. Progressive direct taxation can reduce income inequalities and bring about adequate social & economic justice.

Certainty

As far as direct taxes are concerned, the taxpayer is certain as to how much he is expected to pay, as tax rates are decided in advance. The Government can also estimate the tax revenue from direct taxes with fair accuracy. Accordingly, the Government can make adjustments in its income and expenditure.

Relatively Elastic

The direct taxes are relatively elastic. With an increase in income and wealth of individuals and companies, the yield from direct taxes will also increase. Elasticity also implies that the government’s revenue can be increased by raising the rates of taxation. An increase in tax rates would increase the tax revenue.

Creates Public Conciousness

They have educative value. In the case of direct taxes, the taxpayers are made to feel directly the burden of taxes and hence take a keen interest in how public funds are spent. The taxpayers are likely to be more aware of their rights and responsibilities as citizens of the state.

Economical

Direct taxes are generally economical to collect. For instance, in the case of personal income tax, the tax can be deducted at source from the income or salaries of the individuals. Therefore, the government does not have to spend much on tax collection as far as personal income tax is concerned. However, in the case of indirect taxes, the government has to set up elaborate machinery to collect taxes.

Anti-inflationary

Direct taxes can help to control inflation. During inflationary periods, the government may increase the tax rate. With an increase in the tax rate, the consumption demand may decline, which in turn may reduce inflation.

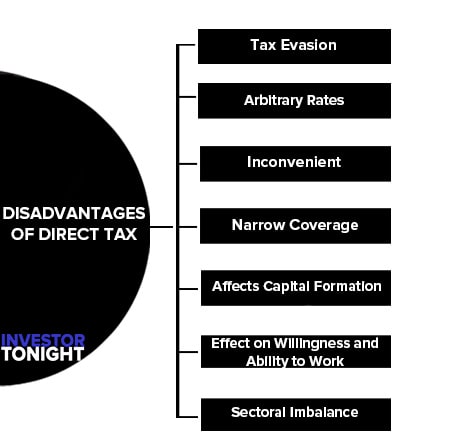

Disadvantages of Direct Tax

Through direct taxes possess the above-mentioned merits, they have criticised them on the following grounds:

- Tax Evasion

- Arbitrary Rates

- Inconvenient

- Narrow Coverage

- Affects Capital Formation

- Effect on Willingness and Ability to Work

- Sectoral Imbalance

Tax Evasion

In India, there is a good amount of tax evasion. Tax evasion is due to High tax rates, Documentation and formalities, Poor and corrupt tax administration. It is easier for businessmen to evade direct taxes. They invariable suppress correct information about their incomes by manipulating accounts and evade tax on it. In less developed countries like India, the high rate of progressive tax evasion & avoidance are extensive and led to rising in black money.

Arbitrary Rates

Direct taxes tend to be arbitrary. Critics point out that there cannot be any objective basis for determining tax rates of direct taxes. Also, the exemption limits in the case of personal income tax, wealth tax, etc., are determined in an arbitrary manner. A precise degree of progression in taxation is also difficult to achieve. Therefore direct taxes may not always fulfil the canon of equity.

Inconvenient

Direct taxes are inconvenient in the sense that they involve several procedures and formalities in the filing of returns. For most people payment of direct tax is not only inconvenient, it is psychological painful also. When people are required to pay a sizeable part of their income as a tax to the state, they feel very much hurt and their propensity to evade tax remains high.

Further, everyone who is required to pay a direct tax has to furnish appropriate evidence in support of the statement of his income & wealth & for this he has to maintain his accounts in proper form. Direct tax is considered inconvenient by some people because they have to nuke few lump-sum payments to the governments, whereas their income receipts are distributed over the whole year.

Narrow Coverage

In India, there is a narrow coverage of direct taxes. It is estimated that only three per cent of the population pay personal income tax. Due to low coverage, the government does not get enough funds for public expenditure. Estate duty & wealth tax are equally narrow-based and thus revenue proceeds from these taxes are invariably small.

Affects Capital Formation

Direct taxes can affect savings and investment. Due to taxes, the net income of the people gets reduced. This in turn reduces savings. Reduction in savings results in low investment. The low investment affects capital formation in the country.

Effect on Willingness and Ability to Work

Highly progressive direct taxes reduce people’s ability and willingness to work and save. This in turn may have a negative impact on investment and productive capacity in the economy. If the tax burden is high, people’s consumption level gets adversely affected and this has an impact on their ability to work and save. High taxes also discourage people from working harder in order to earn and save more.

Sectoral Imbalance

In India, there is a Sectoral imbalance as far as direct taxes are concerned. Certain sectors like the corporate sector are heavily taxed, whereas, the agriculture sector is 100% tax-free. Even the large rich farmers are exempted from payment of personal income tax.

Read More Articles