What is Customs Duty?

Customs duty is a type of indirect tax levied on goods imported into India or exported out of the Country. Customs law is a duty or tax which is levied by the Central Government on the import of goods into and export of goods from India.

Table of Contents

Quantum of Customs duty depends upon the provisions of Customs Act 1962 and Customs Tariff Act 1975 and related Customs Rules, Notifications, Circulars, case Laws and Annual Union Finance Acts. Customs Act 1962 is the main Act governing custom duty.

Customs Tariff Act 1975 contains two Schedules. Schedule 1 gives classification and rates of duties for imports of goods into India. Schedule 2 gives classification and rates of duties for the export of goods from India. Section 156 of the Customs Act empowers the Central Government to make rules in this regard consistent with provisions of the Act.

Types of Duties

Basic Customs Duty

Basic Customs Duty (As per Sec 12 of the Customs Act, 1962): Goods imported into India are chargeable to basic customs duty (BCD) under Customs Act, 1962. The rates of BCD are indicated in I Schedule (for Imports) of Customs Tariff Act, 1975. Generally, BCD is levied at the standard rate of duty but if certain conditions are satisfied (below), the importer can avail the benefit of the preferential rate of duty on imported goods.

Conditions for availing the benefit of a preferential rate of duty:

- Specific claim for preferential rate must be made by the importer.

- Import must be from preferential area as notified by the Central Government.

- The goods should be produced/manufactured in such preferential area.

Integrated Goods and Services Tax (IGST)

IGST (Integrated Goods and Services Tax) is a component under GST law, which is levied on goods being imported into India from another country. It has subsumed various customs duties including Countervailing Duty (CVD) and Special Additional Duty of Customs (SAD).

In the GST regime, IGST will be levied on imports by virtue of sub-section (7) of Section 3 of the Customs Tariff Act, 1975. IGST wherever applicable would be levied on cargo that would arrive on or after 1st July 2017. It may also be noted that IGST would also be levied on cargo that has arrived prior to 1st July but a bill of entry is filed on or after 1st July 2017.

Similarly, an ex-bond bill of entry filed on or after 1st July 2017 would attract IGST, as applicable. In the case where cargo arrival is after 1st July and an advance bill of entry was filed before 1st July along with the payment of duty, the bill of entry may be recalled and reassessed by the proper officer for levy of IGST as applicable.

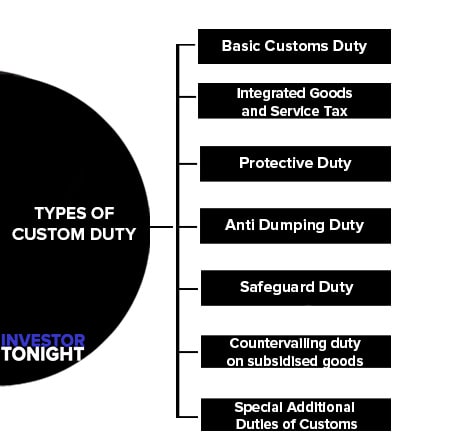

Types of Custom Duty

These are the different types of customs duty:

- Basic Customs Duty (BCD)

- Integrated Goods and Service Tax (IGST)

- Protective Duty

- Anti Dumping Duty

- Safeguard Duty

- Countervailing duty on subsidised goods (CVD)

- Special Additional Duties of Customs (SAD)-SAD)

Basic Customs Duty (BCD)

Basic Customs Duty (BCD): This is levied on imported items that are part of Section 12 of the Customs Act, 1962. The tax rate is levied as per First Schedule to Customs Tariff Act, 1975. Basic Customs Duty is calculated on Assessable Value’ of goods imported or exported.

Integrated Goods and Service Tax (IGST)

Integrated Goods and Service Tax (IGST): IGST is one form of GST which has subsumed various custom duties including countervailing Duty (CVD), additional customs duty (ACD) and Special Additional Duty (SAD) w.e.f. 01. 07. 2017.

IGST is imposed on/levied on goods imported into India from other countries being a deemed interstate supplies. The rate of IGST should not be more than 40% on the value of imported goods determined u/s 3(8) of Customs Tariff.

Protective Duty

Protective Duty: This is levied for the purpose of protecting indigenous businesses and domestic products against overseas imports. The rate is decided by the Tariff Commissioner.

Anti Dumping Duty

Anti-dumping Duty: This is levied if a particular good is being imported is below the fair market price.

Safeguard Duty

Safeguard Duty: This is levied if the customs authorities feel that the exports of a particular good can damage the economy of the country.

Countervailing duty on subsidised goods (CVD)

Countervailing duty on subsidised goods (CVD) –is an additional import duty imposed on imported products (by the importing country) when such products enjoy benefits like export subsidies and tax concessions in the country of their origin (ie., where it is produced and exported).

Special Additional Duties of Customs (SAD)-SAD)

Special Additional Duties of Customs (SAD)-SAD) has levied the reason that imports are cheap compared to prices charged by local manufacturers. Thus to ensure both the imports and local prices are equal special additional duty is levied,

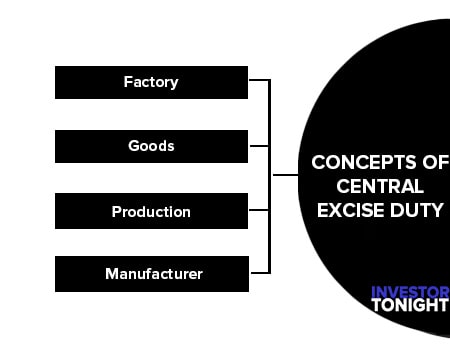

Concepts of Central Excise Duty

Central Excise Law is levied on the manufacturer or production of goods. The liability of paying the central excise is on the manufacturer.

So let us examine the concepts of central excise duty in detail:

Factory

Factory means any premises where any part of the excisable goods other than salt are manufactured or any manufacturing process is carried out.

Goods

Goods have not been defined in Central Excise Act. As per Article 366(12) of the Constitution of India, Goods includes all material commodities and articles. Sale of Goods Act defines that “Goods” means every kind of movable property other than actionable claims and money; and includes stocks and shares, growing crops, grass and things attached to or forming part of the land which are agreed to be severed before sale or under the contract of sale

Goods must be: (i) Movable; and (ii) Marketable

Movable means goods, which can be shifted from one place to another place, e.g., motor car, mobile phone, computer etc. The goods attached to earth are immovable goods, such as Dams, Roads, and Buildings etc.

Movable Goods are manufactured or produced but immovable goods are constructed. Goods produced for free distribution, as sample, gifts, or replacement during warranty period is also liable of excise duty.

Excisable Goods are those goods, which are mentioned in the items of tariff defines “Excisable Goods as goods specified in the schedule of CETA 1985 as being subject to a duty of excise and includes salt.

Production

According to Section 2(f) of the Central Excise Act “manufacture” includes any process:

- Incidental or ancillary to the completion of a manufactured product.

- Which is specified in relation to any goods in the Section or Chapter Notes of the Schedule to the Central Excise Tariff Act, 1985 as amounting to manufacture.

- Which, in relation to goods specified in the third schedule to the CEA, involves packing or repacking of such goods in a unit container or labelling or relabelling of containers or declaration or alteration of retail sale price or any other treatment to render the product marketable to the consumer?

Clauses (ii) and (iii) are called deemed manufacture. Thus, the definition of ‘manufacture’ is inclusive and not exhaustive.

The word ‘Manufacture’ as specified in various Court decisions shall be called only when new and identifiable goods emerge having a different name, character, or use; e.g., the manufacture has taken place when the table is made from wood or of pulp is converted into base paper, or sugar is made from sugarcane.

- CETA specifies some processes as ‘amounting to manufacture’. If any of these processes are carried out, goods will be said to be manufactured, even if as per Court decisions, the process may not amount to ‘manufacture’ [Section 2(f) (ii)].

- In respect of goods specified in third schedule of Central Excise Act, repacking, relabelling, putting or altering retail sale price etc. will be ‘manufacture’. The goods included in Third Schedule of Central Excise Act are same as those on which excise duty is payable u/s 4A on basis of MRP printed on the package. [Section 2(f) (iii)].

Production: Production has also not been defined in CEA but production is used to cover items like coffee, tea, tobacco, etc. which are called to have been manufactured nut produced.

Assembly: Assembly of various parts and components amount to manufacture provided it results in movable goods which have a distinctive identity, use, character, name etc. e.g., assembly of computer is manufacture.

Manufacturer

A manufacturer is a person who actually manufactures or produces excisable goods. A person who gets the production of other and sell it after putting its own brand then he will not be called manufacturer, e.g., if Khaitan company gets the fans made from some person and sell it after putting their brand name, the Khaitan company will not be the manufacturer. The person actually making the fans will be called the manufacturer.

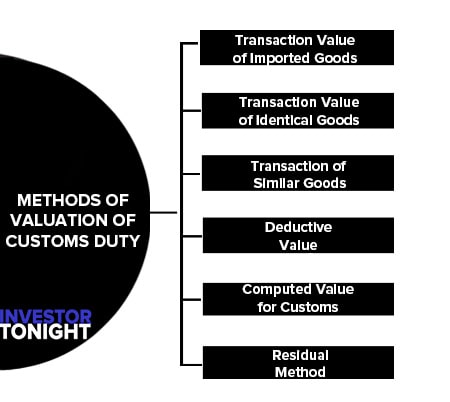

Methods of Valuation of Customs Duty

The Valuation Rules, 1988 based on WTO valuation Agreement, consists of rules providing six methods of valuation. These methods are explained as follows:

- Transaction Value of Imported Goods

- Transaction Value of Identical Goods

- Transaction of Similar Goods

- Deductive Value

- Computed Value for Customs

- Residual Method

Transaction Value of Imported Goods

The price actually paid or payable for the goods when imported to India, adjusted in accordance with the provision of rule 9. As per rule 9, various additions like the cost of containers, cost of packing, cost of materials, components etc. or services supplied by the buyer; royalties payable etc. are includible, if these do not already form part of the transaction value.

Transaction Value of Identical Goods

The transaction value of identical goods: ‘Identical goods’ (similar goods) are defined under rule 2(1)(C) as those goods which fulfil all the following conditions:

- Goods should be same in all aspects except minor appearnce.

- Goods should have been produced in the same country.

- They should be produced by same manufacturer.

Rule 5 of Customs valuation Rules provide that if valuation on the basis of ‘transaction value’ is not possible, the ‘Assessable Value’ will be decided on basis of the transaction value of identical goods imported to India.

Transaction of Similar Goods

Transaction of similar goods: If the first and second method of valuation of the transaction cannot be used, rule 6 provide for valuation on the basis of the Transaction Value of similar goods.

Deductive Value

Rule 7 of Customs Valuation Rules says that ’. This method should be applied if the transaction value of identical goods or similar goods is not available, but products are imported to India. Assessable value is calculated by reducing post importation costs and expenses, from this selling price.

This is called deductive value. (deduction means arrive at by inference by making suitable additions, subtractions from a known price to arrive at required Customs Value’).

Computed Value for Customs

If the valuation is not possible by deductive method, rule 7A provides that if the importer requests the customs officer to approves, this method’.

- In this method, value is the sum of Cost of the value of materials and fabrication or other processing employed in producing the imported goods.

- An amount for profit and general expenses equal to that usually reflected in sales of goods of the same class or kind.

- The cost or value of all other expense under rule 9(2) i.e. transport, insurance, loading, unloading and handling charges.

Residual Method

It is also often termed as fall back method. This method is used in cases where ‘ Assessable value’ cannot be determined by any of the preceding methods. While deciding assessable value under this method, rules provides that valuation should be on the basis of data available in India.

Read More Articles