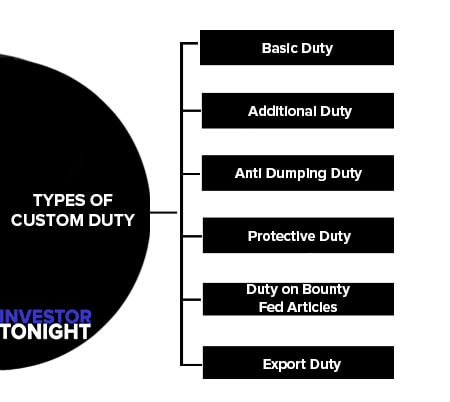

Types of Custom Duty

Under the custom laws, the following are the various types of customs duties that are leviable:

- Basic Duty

- Additional Duty

- Anti Dumping Duty

- Protective Duty

- Duty on Bounty Fed Articles

- Export Duty

Table of Contents

Basic Duty

Basic Customs Duty (As per Sec 12 of the Customs Act, 1962): Goods imported into India are chargeable to basic customs duty (BCD) under Customs Act, 1962. The rates of BCD are indicated in I Schedule (for Imports) of Customs Tariff Act, 1975. Generally, BCD is levied at the standard rate of duty but if certain conditions are satisfied (below), the importer can avail the benefit of the preferential rate of duty on imported goods.

Conditions for availing the benefit of a preferential rate of duty:

- Specific claim for preferential rate must be made by the importer.

- Import must be from preferential area as notified by the Central Government.

- The goods should be produced/manufactured in such preferential area.

Additional Duty

Also known as Countervailing Duty or CVD: This additional duty is levied under section 3(1) of the Customs Tariff Act and is equal to excise duty levied on a like product manufactured or produced in India. If a like product is not manufactured or produced in India.

The excise duty that would be leviable on that product had it been manufactured or produced in India is the duty payable. If the product is leviable at different rates, the highest rate among those rates is the rate applicable. Such duty is leviable on the value of goods plus basic customs duty payable.

For example, if the customs value of goods is 5000 and the rate of basic customs duty is 10% and excise duty on similar goods produced in India is 20%, CVD will be 1100/-. Additional Duty to compensate duty on inputs used by Indian manufacturers.

This Additional Duty is levied under section 3(3) of the Customs Act. It can be charged on all goods by the central government to counterbalance excise duty leviable to raw materials, components and other inputs similar to those used in the production of such goods.

Anti Dumping Duty

Sometimes, foreign sellers abroad may export into India goods at prices below the amounts charged by them in their domestic markets in order to capture Indian markets to the detriment of Indian Industry. This is known as dumping.

In order to prevent dumping, the Central Government may levy additional duty equal to the margin of dumping on such articles, if the goods have been sold at less than normal value. Pending determination of margin of dumping, such duty may be provisionally imposed.

After the exact rate of dumping duty is finally determined, the Central Government may vary the provisional rate of dumping duty. Dumping duty can be imposed even when goods are imported indirectly or after changing the condition of goods.

There are however certain restrictions on imposing dumping duties in the case of countries that are signatories to the GATT or on countries given “Most Favoured Nation Status” under the agreement. Dumping duty can be levied on imports on such countries only if the Central Government proves that import of such goods in India at such low prices causes material injury to Indian Industry.

Protective Duty

If the Tariff Commission set up by law recommends that in order to protect the interests of Indian Industry, the Central Government may levy protective anti-dumping duties at the rate recommended on specified goods.

The notification for levy of such duties must be introduced in the Parliament in the next session by way of a bill or in the same session if Parliament is in session. If the bill is not passed within six months of introduction in Parliament, the notification ceases to have force but the action already undertaken under the notification remains valid.

Such duty will be payable up to the date specified in the notification. Protective duty may be cancelled or varied by notification. Such notification must also be placed before Parliament for approval as above.

Duty on Bounty Fed Articles

In case a foreign country subsidises its exporters for exporting goods to India, the Central Government may import additional import duty equal to the amount of such subsidy or bounty. If the amount of subsidy or bounty cannot be clearly determined immediately, additional duty may be collected on a provisional basis and after final determination, the difference may be collected or refunded, as the case may be.

Export Duty

Such duty is levied on the export of goods. At present very few articles such as skins and leather are subject to export duty. The main purpose of this duty is to restrict exports of certain goods. The Central Government has been granted emergency powers to increase import or export duties if the need so arises.

Such increase in duty must be by way of notification which is to be placed in the Parliament within the session and if it is not in session, it should be placed within seven days when the next session starts. Notification should be approved within 15 days.

Read More Articles