What is Budgetary Control?

Budgetary control is the establishment of budgets relating to the responsibilities of executives to the requirement of a policy and continuous comparison of actual with budget results, either to secure by individual action of objectives of that policy to provide a solid basis for its revision.

Table of Contents

- 1 What is Budgetary Control?

- 2 Budgetary Control Definition

- 3 Objectives of Budgetary Control

- 4 Advantages of Budgetary Control

- 4.1 Definite Objectives

- 4.2 Reduction in Cost of Production

- 4.3 Coordination

- 4.4 Maximum Profits

- 4.5 Reduces Uncertainty

- 4.6 Determining Weaknesses

- 4.7 Economy

- 4.8 Adoption of Standard Costing

- 4.9 Optimum use of Resources

- 4.10 Effective Control

- 4.11 Successful Planning

- 4.12 Inculcates the feeling cost consciousness

- 4.13 Introduction of Incentive schemes

- 5 Disadvantages of Budgetary Control

- 6 Budgetary Control System

Budgetary Control is an important tool for the management to make optimum use of limited business resources and to maximize the profits of business. In order to maximize the profits of business effective control on cost is must. In budgetary control, plans are made in advance for various business activities like purchases, sales and productions, etc.

These plans are termed as budget and the actual results are compared with the budgets and the variance are discussed and analyzed.

Budgetary Control Definition

Budgetary control is the planning in advance of the various functions of a business so that the business as a whole can be controlled. – Wheldon

According to J. Batty “budgetary control is a system which uses budgets as a means of planning and controlling all aspects of producing and /or selling commodities and services.

Budget Definition

Budget is a financial and/or quantitative statement, prepared prior to defined period of time, of the policy to be pursued during that period for the propose of attaining a given objective. It may include income, expenditure and the employment of capital.

Objectives of Budgetary Control

Following are the main objectives of budgetary control:

- To define the goal of the enterprise.

- To provide long and short period plans for attaining these goals.

- To co-ordinate the activities of different departments.

- To operate various cost canters and departments with efficiency and economy.

- To eliminate waste and increase the profitability.

- To estimate capital expenditure requirements of the future.

- To centralize the control system.

- To correct deviations from established standards.

- To fix the responsibility of various individuals in the organization.

- To ensure that adequate working capital is available for the efficient operation of the business.

- To indicate to the management as to where action is needed to solve problems without delay.

Advantages of Budgetary Control

Advantages of budgetary control are:

- Definite Objectives

- Reduction in Cost of Production

- Coordination

- Maximum Profits

- Reduces Uncertainty

- Determining Weaknesses

- Economy

- Adoption of Standard Costing

- Optimum use of Resources

- Effective Control

- Successful Planning

- Inculcates the feeling cost consciousness

- Introduction of Incentive schemes

Definite Objectives

Under budgetary control, every department is given a target to be achieved. The efforts are made to achieve the specific aims.

Reduction in Cost of Production

In budgetary control, the various departments prepare the budgets and this results in reduction in cost of production. Moreover, every businessmen tries to reduce the cost of production and opts for more profitable combinations of products.

Coordination

The working of different departments is properly coordinated and a ‘Master Budget is prepared for effective coordination and cooperation among various departments of the organisation.

Maximum Profits

Under budgetary control, the resources are utilised efficiently in an organisation as each person is aware of his task and the best way by which it is to be performed,

Reduces Uncertainty

Under budgetary control, the managers are forced to map out future courses of action clearly. Thus, uncertainty is reduced to minimum.

Determining Weaknesses

The deviations in budgeted and actual performance will enable the determination of weak spots. By pin-pointing responsibility for inefficient performance, budgetary control helps managers trace weak spots early and take remedial steps.

Economy

The planning of expenditure will be systematic and there will be economy in spending. The resources are used to the best advantage. The benefits derived for the enterprise will ultimately extend to industry and then to national economy.

Adoption of Standard Costing

The use of performance standards in financial matters and operational activities help the adoption of standard costing.

Optimum use of Resources

The resources of the organisation are used to the best advantage as the objectives are clear and each level of management is aware of its task. It directs enterprise activity towards maximisation of efficiency, productivity and profitability.

Effective Control

It is a very important tool for effective control because under it the actual performance is compared with the budgets and remedial steps are taken in case of deviation, if any.

Successful Planning

Budgets are based on plans and all the departmental managers are informed about the expectations from them. The extent of expenditure that they can incur is [aid down in the budget along with the expected profits of their department. The departmental managers make their utmost effort to achieve the target and thus much help is obtained in the success of the plans.

Inculcates the feeling cost consciousness

Budgetary control inculcates the feeling of cost consciousness among workers. Thus, it increases productivity and operating economy.

Introduction of Incentive schemes

Budgetary control system also enables the introduction of incentives schemes of remuneration. The comparison of budgeted and actual performance will enable the use of such schemes. Thus, efficient workers become more efficient and inefficient workers start becoming efficient.

Thus it can be said that “Budgetary control improves planning, aids in coordination and helps in having comprehensive control.

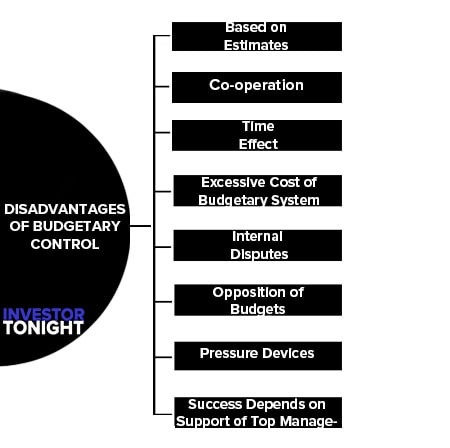

Disadvantages of Budgetary Control

Disadvantages of budgetary control are:

- Based on Estimates

- Co-operation

- Time Effect

- Excessive Cost of Budgetary System

- Internal Disputes

- Opposition of Budgets

- Pressure Devices

- Success Depends Upon the Support of Top Management

Based on Estimates

Budgets are based on estimates regarding an event the success of budget depends upon experience and estimates. Thus, these estimates cause the failure of budgetary control system.

Co-operation

The success of the budgetary control system depends upon the co-operation and co-ordination among the various levels of the management. The lack of co-ordination and co-operation at the operating level results into failure of budgetary control.

Time Effect

The world is changing everyday like change in price, change in demand, change in government policies, create problems in achieving the budgetary targets. So, budget needs revision for their success but this revision is a very costly affair.

Excessive Cost of Budgetary System

To apply and implement budgetary control system successfully needs heavy expenditure, which may not be possible for small scale organisations.

Internal Disputes

Each and every departmental head wants more and more financial outlay for their respective departments which becomes a cause of contention (dispute) among the various departments of the organisation.

Opposition of Budgets

Employees and Managerial personnel are of the view that budgetary control will reveal their efficiency and inefficiency a t the various levels and hence because of fear of inefficiency they oppose the implementation of budgetary control system.

Pressure Devices

Budgets are perceived by the work force as pressure devices imposed by top management. This can have an adverse effect on labour relations.

Success Depends Upon the Support of Top Management

If the top management is dynamic and enthusiastic then it will bring success to the budgetary control. On the other hand, if the top management is dull and lethargic then the system will collapse.

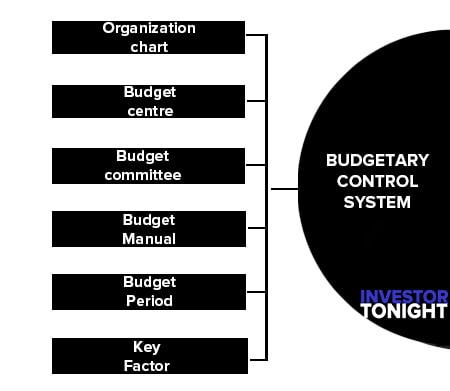

Budgetary Control System

While installing budgetary control system, the following are the main steps should be taken in to account:

Organization chart

There should be a well defined organization chart for budgetary control. This will show the authority and responsibility of each executive.

Budget centre

A budget centre is that part of the organization for which the budget is prepared. A budget centre may be a department, or a section of the department. (e.g., production department or purchase section). The establishment of budget centre is essential for covering all parts of the organization.

The budget centers are also necessary for cost control purpose. The evaluation of performance becomes easy when different centers are established.

Budget committee

In small companies, the budget is prepared by the cost accountant. But in big companies, the budget is prepared by the committee. The budget committee consists of the chief executive or managing director, budget officers and the mangers of various departments.

The managers of various departments prepare their budgets and submit them to this committee. The committee will make necessary adjustments, co-ordinate all the budgets and prepare a Master Budget.

Budget Manual

Budget Manual is a look which contains the procedure to be followed by the executive’s concerned with the budget. It guides the executives in preparing various budgets. It is the responsibility of the budget officer to prepare and maintain this manual.

Budget Period

The Budget Manual may contain the following particulars: A budget period is the length of time for which a budget is prepared and employed. It may be different in the same industry or business.

Key Factor

It is also known as limiting factor or governing factor or principal budget factor. A key factor is one which restricts the volume of production. It may arise due to the shortage of material, labour, capital, plant capacity or sales. It is a factor which affects all other budgets.

Therefore the budget relating to the key factor is prepared before is prepared before other budgets are framed.

Read More Articles