What is Dividend Policy?

Dividend policy refers to the payout policy that management follows in determining the size and the pattern of distribution to shareholders over time. The key stress of the dividend policy of a firm is centered upon the percentage of earnings that a firm should payout. The dividend Pay-out ratio is a percentage of earnings paid to shareholders in cash.

Table of Contents

- 1 What is Dividend Policy?

- 2 Meaning of Dividend Policy

- 3 Dividend Models and Value of Firm

- 4 Determinants of Dividend Policy

- 4.1 Capital Market Considerations

- 4.2 Dividend Payout Ratio

- 4.3 Legal, Contractual and Internal Constraints and Restrictions

- 4.4 Inflation

- 4.5 Age of Corporation

- 4.6 Stability of Earnings

- 4.7 Requirement of Additional Capital

- 4.8 Liquidity of Funds

- 4.9 Trade Cycles

- 4.10 Government Policies

- 4.11 Taxation Policy

- 4.12 Policy of Control

- 4.13 Legal Requirements

- 5 Objectives of Dividend Policy

- 6 Types of Dividend Policy

- 7 Types of Dividend

- 8 Dividend Models

- 9 Stability of Dividends

Meaning of Dividend Policy

For the financial manager of a company, it is crucial to take a decision regarding dividend because s/he have to determine the amount of profit to be distributed among the shareholders and the amount of retained earnings. The amount of dividend and retained earnings have a reciprocal relationship.

The market value of shares depends on the payout ratio. While taking the dividend decision the management takes into account the effect of the decision on the shareholders’ wealth.

A dividend policy is a company’s approach to distributing profits back to its owners or stockholders. If a company is in a growth mode, it may decide that it will not pay dividends, but rather re-invest its profits (retained earnings) in the business.

If a company does decide to pay dividends, it must then decide how often to do so, and at what rate. Large, well-established companies often pay dividends on a fixed schedule, but sometimes they also declare “special dividends.”

The payment of dividends impacts the perception of a company in financial markets, and it may also have a direct impact on its stock price. A company takes three major decisions i.e. Investments, financing and dividend. Dividend decision is most significant decision in all of these.

Dividend Models and Value of Firm

The value of the firm can be maximized if the shareholders’ wealth is maximized. There are conflicting views regarding the impact of dividend decisions on the valuation of the firm. According to one school of thought, a dividend decision does not affect the shareholders wealth and hence the valuation of the firm. On the other hand, according to the other school of thought, dividend decision materially affects the shareholders’ wealth and also the valuation of the firm.

We will discuss below the views of the two schools of thought under two groups:

- The Irrelevance Concept of Dividend or Theory of Irrelevance

- The Relevance Concept of Dividend or Theory of Relevance

Determinants of Dividend Policy

The main determinants of dividend policy of a firm can be classified into:

- Capital Market Considerations

- Dividend Payout Ratio

- Legal, Contractual and Internal Constraints and Restrictions

- Inflation

- Age of Corporation

- Stability of Earnings

- Requirement of Additional Capital

- Liquidity of Funds

- Trade Cycles

- Government Policies

- Taxation Policy

- Policy of Control

- Legal Requirements

Capital Market Considerations

Capital market consideration is also a determinant of dividend policy. If the company has easy access to the capital market in such case company should follow a liberal dividend policy and if company has limited access to capital market, it can opt a low dividend payout ratio.

Such companies rely on retained earnings as a major source of financing for future growth.

Dividend Payout Ratio

Dividend payout ratio refers to the percentage of the net earnings distributed to the shareholders as dividends. On the basis of dividend policy owners of the company takes the decision to pay out earnings or to retain them for reinvestment in the firm. A sufficient amount of dividend creates satisfaction among the shareholders and the retained earnings constitute a source of finance.

So, it is necessary that dividend policy should maintain a balance between current dividends and future growth which maximizes the price of the firm’s shares and

The dividend payout ratio of a firm should be optimum so that firm can able to maximize the wealth of the firm’s owners and providing sufficient funds to finance growth.

Legal, Contractual and Internal Constraints and Restrictions

A company is not legally bounded for declaration of dividend but, they have to specify the conditions under which dividends must be paid.

Such conditions pertain to capital impairment, net profits and insolvency. It may be that a company accepts important contractual restrictions (when the company obtains external funds) in respect of payment of dividends.

These restrictions may cause the firm to restrict the payment of cash dividends until a certain level of earnings has been achieved or limit the amount of dividends paid to a certain amount or percentage of earnings.

Internal constraints are unique to a firm and include liquid assets, growth prospects, financial requirements, availability of funds, earnings stability and control.

Inflation

In case of situation of inflation, the funds generated from depreciation may not be sufficient to replace obsolete equipments and machinery. In such situation, a company should rely upon retained earnings as a source of fund to replace those assets. Thus, dividend payout ratio negatively affected due to inflation.

Age of Corporation

A newly establish company will invest their earning for expansion and plant improvement and may adopt a rigid dividend policy. But if company is well established, it can frame a more consistent policy in respect of dividend. So, we can say that dividend policy is also affected by the age of the corporation.

Stability of Earnings

If a company having stability of earnings, such company can maintain consistency in its dividend policy. Stability of earnings depends on nature of business e.g. firms dealing in luxurious or fancy goods can earn more profits. So, we can say that the nature of business has an important bearing on the dividend policy.

Requirement of Additional Capital

In case of small companies, they face the difficulties of additional finance for expansion programs. Every company retains a part of their profits for strengthening their financial position. Thus, such Companies distribute dividend at low rates and retain a big part of profits.

Liquidity of Funds

If a company decides to pay dividend in cash then it may be only if company has sufficient funds. So, availability of cash and sound financial position is equally affected to dividend policy. Payment of dividend represents a cash outflow. More availability of funds and good liquidity position of company show the better ability to pay dividend. If cash position is weak, stock dividend will be distributed and if cash position is good, company can distribute the cash dividend.

Trade Cycles

Business cycles also exercise influence upon dividend Policy. Dividend policy is adjusted according to the business oscillations. During the boom, prudent management creates food reserves for contingencies which follow the inflationary period.

Higher rates of dividend can be used as a tool for marketing the securities in an otherwise depressed market. The financial solvency can be proved and maintained by the companies in dull years if the adequate reserves have been built up.

Government Policies

Fiscal, industrial, taxation etc. affect to the earnings capacity of the enterprise. The dividend policy has to be modified according to the changes in government policies.

Taxation Policy

Taxation policy of government also affects the decision of distribution of dividend. In case of high taxation rate a major part of earnings will be paid to government by way of tax, hence rate of dividend will be lowered down. In case of low taxation, the company will be able to pay dividend at higher rate.

Policy of Control

Policy of control is another determining factor is so far as dividends are concerned. If the directors want to have control on company, they would not like to add new shareholders and therefore, declare a dividend at low rate.

Because by adding new shareholders they fear dilution of control and diversion of policies and programs of the existing management. So they prefer to meet the needs through retained earnings.

If the directors do not bother about the control of affairs they will follow a liberal dividend policy. Thus control is an influencing factor in framing the dividend policy.

Legal Requirements

The companies’ act 1956 prescribes guidelines in respect of declaration and payment of dividend. These guidelines issued in order to protect the interest of creditors e.g. a company is required to provide for depreciation on its fixed and tangible assets before declaring dividend on shares. It proposes that Dividend should not be distributed out of capita, in any case.

Objectives of Dividend Policy

A firm’s dividend policy has the effect of dividing its net earnings into two parts: retained earnings and dividends.

The retained earnings provide funds to finance the firm’s long-term growth. It is the most significant source of financing a firm’s investments in practice. Dividends are paid in cash. Thus, the distribution of earnings uses the available cash of the firm.

A firm which intends to pay dividends and also needs funds to finance its investment opportunities will have to use external sources of financing, such as the issue of debt or equity.

Dividend policy of the firm, thus, has its effect on both the longterm financing and the wealth of shareholders. As a result, the firm’s decision to pay dividends may be shaped by the following two possible viewpoints.

Firm’s Need for Funds

When a dividend decision is treated as a financing decision, the net earnings of the firm may be considered as a source of long-term funds. With this approach, dividends will be paid only when the firm does not have profitable investment opportunities. The firm grows at a faster rate when it accepts highly profitable investment projects.

External equity could be raised to finance investments. But retained earnings are preferred because, unlike external equity, they do not involve any flotation costs. The distribution of cash dividends causes a reduction in internal funds available to finance profitable investment opportunities and consequently, either constrains growth or requires the firm to find other costly sources of financing.

Thus, firms may retain their earnings as a part of long-term financing decision. The dividends will be paid to shareholders when a firm cannot profitably reinvest earnings. With this approach, dividend decision is viewed merely as a residual decision.

One may argue that capital markets are not perfect; therefore, shareholders are not indifferent between dividends and retained earnings. Because of the market imperfections and uncertainty, shareholders may prefer the near dividends to the future dividends and capital gains.

Thus, the payment of dividends may significantly affect the market price of the share. Higher dividends may increase the value of the shares and low dividends may reduce the value. It is believed by some that, in order to maximise wealth under uncertainty, the firm must pay enough dividends to satisfy investors.

Investors in high tax brackets, on the other hand, may prefer to receive capital gains rather than dividends. Their wealth will be maximised if firms retain earnings rather than distributing them.

The management of a firm, while evolving a dividend policy, must strike a proper balance between the above-mentioned two approaches. When the firm increases the retained portion of the net earnings, shareholders’ current income in the form of dividends decreases. But the use of retained earnings to finance profitable investments will increase the future earnings.

On the other hand, when dividends are increased, shareholders’ current income will increase, but the firm may have to forego some investment opportunities for want of funds and consequently, the future earnings may decrease.

Management should develop a dividend policy, which divides the net earnings into dividends and retained earnings in an optimum way to achieve the objective of maximizing the wealth of shareholders.

The development of such policy will be greatly influenced by investment opportunities available to the firm and the value of dividends as against capital gains to the shareholders. The other possible aspects of the dividend policy relate to the stability of dividends, the constraints on paying dividends and the forms of dividends.

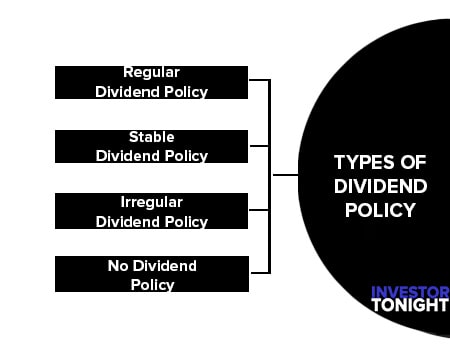

Types of Dividend Policy

Dividend policy depends upon the nature of the firm, type of shareholder and profitable position. On the basis of the dividend declaration by the firm, the dividend policy may be classified under the following types:

Regular Dividend Policy

Dividend payable at the usual rate is called as regular dividend policy. This type of policy is suitable to the small investors, retired persons and others.

Stable Dividend Policy

Stable dividend policy means payment of certain minimum amount of dividend regularly. This dividend policy consists of the following three important forms:

Constant dividend per share Constant payout ratio Stable rupee dividend plus extra dividend.

Irregular Dividend Policy

When the companies are facing constraints of earnings and unsuccessful business operation, they may follow irregular dividend policy. It is one of the temporary arrangements to meet the financial problems. These types are having adequate profit. For others no dividend is distributed.

No Dividend Policy

Sometimes the company may follow no dividend policy because of its unfavourable working capital position of the amount required for future growth of the concerns.

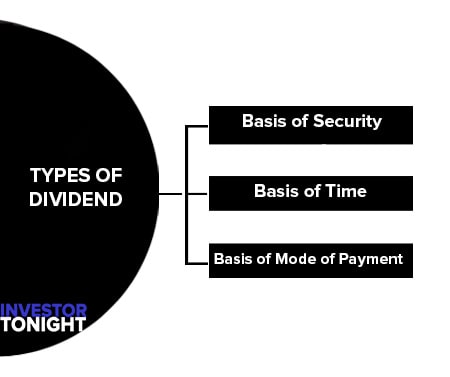

Types of Dividend

3 types of dividend are:

- Dividend on the Basis of Security

- Dividend on the Basis of Time

- Dividend on the Basis of Mode of Payment

Dividend on the Basis of Security

There are two types of securities on which company pays dividend i.e. preference shares & Equity shares.

Company pays following two types dividend on these securities:

- Preference Dividend: On preference Share Company pays dividend at fix rate. At the time of issue of preference shares, company declares the rate of dividend on these shares. Since dividend on these shares is fixed, so, mostly discussion on dividend policy is relates to the equity dividend.

- Equity Dividend: In case of equity shares the rate of dividend cannot be pre determined. Dividend on equity shares is paid at the rate recommended by the board of directors and approved by the shareholders in Annual General Meeting (AGM). The board of directors has the right in respect of payment of dividend, the rate of dividend and the medium of dividend.

Dividend on the Basis of Time

On the basis of time, there are two types of dividend

- Interim Dividend: When a company earns huge profits or we can say that abnormal profits during any particular year and directors wish to distribute these profits among the shareholders, then company declares dividend at any time between two AGM.

It is called interim dividend. In other words, we can say that interim dividend is the dividend which can be declare and distribute at any time within the financial year. Interim dividend may be declare if, Article of association permits for it.

Interim dividend is an extra dividend paid in cash within the year without requirement of approval in AGM. - Regular Dividend: It is annual dividend declares after approval in AGM. This dividend pays by the company after completion of financial year. The rate of dividend depends on the financial performance of the company in particular year.

Dividend on the Basis of Mode of Payment

On the basis of mode of payment, dividend may be classified in following three categories

- Cash Dividend: Mostly, shareholders are interested in cash dividend. When company pays dividend in cash, it indicates outflows of cash from company to its shareholders. Company pays cash dividend out of current sources available in the company or by taking short term loans from banks and other financial institutions.

A company may take decision of cash payment of dividend, when sufficient funds are available and liquidity position of company is sound. Cash dividend is most desirable mode of payment of dividend. It built confidence and faith in investor’s mind about company. - Stock Dividend: If any company has a huge amount of reserves & surplus but suffering from problem of shortage of liquidity of funds. In such case, if company wants to distribute reserves & surplus among the shareholders, then the company issue new shares to existing shareholders at free of cost. Shareholders receive shares In place of cash dividend.

Such shares are known as “Bonus shares” or “Stock dividend”. In this process whole or a part of profits converts into share capital, so, it also called as “Capitalization of profits”. - Scrip or Bond Dividend: If any company is facing a financial crisis, in such circumstances company pays dividend in the form of shares and debentures of other companies. This form of dividend is called as scrip or bond dividend. The main difference of scrip dividend and bond dividend is of time period.

In case of scrip dividend, securities belong to short term securities and in case of bond dividend it is long term securities.

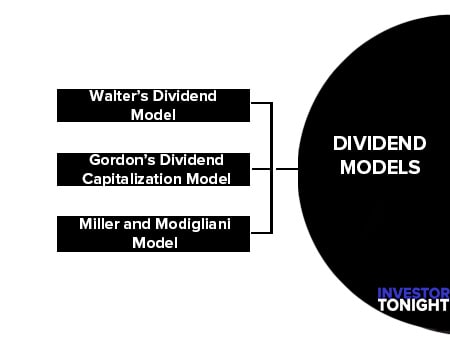

Dividend Models

- Theory of Relevance

- Theory of Irrelevance

Walter’s Dividend Model

Walter’s model supports the principle that dividends are relevant. The investment policy of a firm cannot be separated from its dividend policy and both are inter-related. The choice of an appropriate dividend policy affects the value of an enterprise.

Gordon’s Dividend Capitalization Model

Gordon’s dividend model contends that dividends are relevant. This model is of the view that dividend policy of a firm affects its market value of shares.

Miller and Modigliani Model (MM Model)

Miller and Modigliani Model assume that the dividends are irrelevant. Dividend irrelevance implies that the value of a firm is unaffected by the distribution of dividends and is determined solely by the earning power and risk of its assets.

Under conditions of perfect capital markets, rational investors, absence of tax discrimination between dividend income and capital appreciation, given the firm’s investment policy, its dividend policy may have no influence on the market price of the shares, according to this model.

Stability of Dividends

The stability of dividends is considered a desirable policy by the management of most companies in practice. Shareholders also seem generally to favor this policy and value stable dividends higher than the fluctuating ones. All other things being the same, the stable dividend policy may have a positive impact on the market price of the share.

Stability of dividends also means regularity in paying some dividends annually, even though the amount of dividend may fluctuate over years, and may not be related to earnings. There are a number of companies, which have records of paying dividends for a long, unbroken period. More precisely, the stability of dividends refers to the amounts paid out regularly.

Forms of Stability of Dividends

- Constant Dividend Per Share or Dividend Rate

- Constant Payout

- Constant Dividend Per Share Plus Extra Dividend

Read More Articles

- What is Financial Management?

- What is Financial Statements?

- What is Financial Statement Analysis?

- What is Ratio Analysis?

- What is Funds Flow Statement?

- What is Cash Flow Statement?

- What is Working Capital?

- What is Cost of Capital?

- What is Capital Budgeting?

- What is Dividend Policy?

- What is Cash Management?

- What is Depository?

- What is Insurance?

- What is Financial System?

- International Financial Reporting Standards

- Stability of Dividends

- What is Factoring?

- Determinants of Working Capital

- Public Finance

- Public Expenditure

- What is Public Debt?

- Classification of Public Debt

- Federal Finance

- Effect of Public Debt

- Expenditure Cycle