What is Credit Rating?

Credit rating is an opinion of a rating agency about a debt instrument. The opinion is expressed through symbols which indicate the degree of risk associated with repayment of principal and payment of interest on debt instruments. Credit rating agency gets a fee for their services from corporate entities which approach for a rating of their instruments.

Credit rating is not mandatory to all corporate sectors except for certain instruments. The financial position of the corporations is reviewed frequently and the ratings are revised by the credit rating agency.

Table of Contents

- 1 What is Credit Rating?

- 2 Brief History of Credit Rating

- 3 Evolution of Credit Rating in India

- 4 ABCs of Credit Rating Scales

- 5 Features of Credit Rating

- 6 Types of Credit Rating

- 7 Advantages of Credit Rating

- 7.1 Helps in Investment Decision

- 7.2 Freedom of Investment Decisions

- 7.3 Assurance of safety

- 7.4 Choice of Instruments

- 7.5 Dependency on Rating

- 7.6 Continuous Monitoring

- 7.7 Easy to Raise Fund

- 7.8 Good Corporate Image

- 7.9 Lower the Cost of Public Issue

- 7.10 Easy and Lowers Cost of Borrowing

- 7.11 Help Non-popular Companies

- 7.12 Rating Facilitates Growth

- 8 Disadvantages of Credit Rating

- 9 Users of Credit Rating

- 10 Process of Credit Rating

- 11 Rating Methodology

- 12 Credit Rating Agency in India

Brief History of Credit Rating

- 1841 – Louis Tappan established the first mercantile credit agency in New York.

- 1849 – John Bradstreet set up a rating agency which published a rating book in 1857.

- 1924 – Fitch Publishing was set up.

- 1933 – Robert Dun & John Bradstreet was merged to form Dun & Bradstreet , which later became the owner of Moody’s Investor Service in 1962.

- 1941 – Standard & Poor’s corporation started credit rating operations.

- 1970 – Number of credit agencies set up world wide.

- 1987 – CRISIL (Credit Rating and Information Services of India Ltd.) was setup in India

Evolution of Credit Rating in India

- 1987 – CRISIL (Credit Rating and Information Services of India Ltd.) was setup as the first rating agency.

- 1991 – ICRA Ltd. ( Investment Information & Credit Rating Agency of India Ltd.) came into existence.

- 1994 – CARE ( Credit Analysis and Research Ltd.) was setup.

ABCs of Credit Rating Scales

S&P Global rating credit rating symbols provide a simple, efficient way to communicate creditworthiness and credit quality.

A general summary of the opinions reflected by our ratings

Investment Grade

- AAA – Extremely strong capacity to meet financial commitments. Highest rating

- AA – Very strong capacity to meet financial commitment

- A – Strong capacity to meet financial commitments, but somewhat susceptible to adverse economic conditions and changes in circumstances

- BBB – Adequate capacity to meet financial commitments, but more subject to adverse economic conditions

- BBB – Considered lowest investment-grade by market participants

Speculative Grade

- BB+ – Considered highest speculative grade by market participants

- BB – Less vulnerable in the near-term but faces major ongoing uncertainties to adverse business, financial and economic conditions

- B – More vulnerable to adverse business, financial and economic conditions but currently has the capacity to meet financial commitments

- CCC – Currently vulnerable and dependent on favorable business, financial and economic conditions to meet financial commitments

- CC – Highly vulnerable; default has not yet occurred, but is expected to be a virtual certainty

- C – Currently highly vulnerable to non-payment, and ultimate recovery is expected to be lower than that of higher rated obligations

- D – Payment default on a financial commitment or breach of an imputed promise; also used when a bankruptcy petition has been filed or similar action taken

Ratings from ‘AA’ to ‘CCC’ may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the major rating categories.

Features of Credit Rating

- Facilitate investment decisions

- Assess credit worthiness of an individual, corporation or country

- Increase investor confidence

- Healthy financial discipline

- Allocate capital efficiency

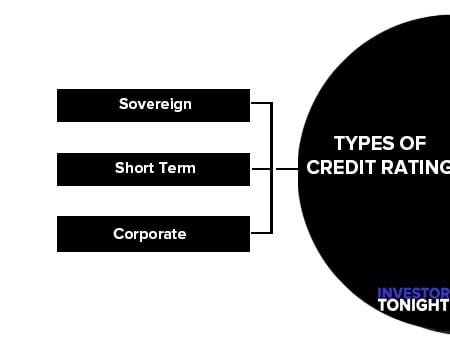

Types of Credit Rating

Following are the different types of credit ratings:

Sovereign Credit Rating

Sovereign credit rating is the credit rating of a sovereign entity like a national government. A country may be rated whenever a loan is to be extended or some major investment is to be made in it by international investors.

A number of factors such as growth rate, industrial and agricultural production, government policies, inflation, fiscal deficit etc. are taken into consideration to arrive at such rating.

Short Term Credit Rating

Short term rating is a probability factor of an individual going in to default within a year. Now a day’s short term rating is very common.

Corporate Credit Rating

Corporate credit rating is the rating of financial instruments issued by corporate entities. The credit rating of a corporation is a financial indicator to potential investors of debt securities such as bonds. Investor looks at the credit rating of instrument and issuer before investing.

Advantages of Credit Rating

Following are the advantages of credit rating:

- Helps in Investment Decision

- Freedom of Investment Decisions

- Assurance of safety

- Choice of Instruments

- Dependency on Rating

- Continuous Monitoring

- Easy to Raise Fund

- Good Corporate Image

- Lower the Cost of Public Issue

- Easy and Lowers Cost of Borrowing

- Help Non-popular Companies

- Rating Facilitates Growth

Benefits to the Investor

Following are the benefits of credit rating to the investor:

- Helps in Investment Decision

- Freedom of Investment Decisions

- Assurance of safety

- Choice of Instruments

- Dependency on Rating

- Continuous Monitoring

Helps in Investment Decision

Credit rating gives an idea of the creditworthiness of the issuing company and the risk associated with a particular security. Depending upon the credit rating investor can decide whether to invest in such company or not.

Freedom of Investment Decisions

For common people it is very difficult to take investment decisions. Before taking investment decisions they seek advice from the stock brokers, merchant bankers or portfolio managers. Credit rating service makes the task easy by attaching rating symbols to a particular security.

Rating symbol assigned to a particular instrument suggests the creditworthiness of the instrument and indicates the degree of risk involved in it.

Assurance of safety

A high rating assures the investor about the safety of the instrument. Companies having high ratings of their instruments maintain healthy financial discipline.

Choice of Instruments

By rating the securities, credit rating agencies enables an investor to select a particular instrument from many alternatives available.

Dependency on Rating

The ratings assigned to the instruments are authentic and reliable. The rating firms are independent of issuing company and have no business connection with. Hence, they give a fair rating to the instruments. This brings confidence among the investors.

Continuous Monitoring

Credit rating agencies not only assign rating symbols but also continuously monitor them. The Rating agency downgrades or upgrades the rating symbols depending upon performance and position of the company.

Following are the benefits of credit rating to the company:

- Easy to Raise Fund

- Good Corporate Image

- Lower the Cost of Public Issue

- Easy and Lowers Cost of Borrowing

- Help Non-popular Companies

- Rating Facilitates Growth

Easy to Raise Fund

It become very easy for a company to raise fund from the market if the instruments issued by the company are highly rated. A high rating gives confidence to the investors. Many investors always like to make investments in such instrument, which ensure safety and easy liquidity rather than high rate of return.

Good Corporate Image

High credit rating of securities helps in improving the corporate image of a company. A high credit rating increases the level of confidence among the investors. This helps in creating a good corporate image of the company.

Lower the Cost of Public Issue

A company with highly rated instruments has to make least efforts in raising funds through public issue. A good credit rating gives good publicity to the company. Companies with highly rated instruments enjoy better goodwill and corporate image in the eyes of customers, shareholders, investors and creditors.

Investors feel secured of their investments and creditors are assured of timely payments of interest and principal.

Easy and Lowers Cost of Borrowing

A company with highly rated debt instruments has to make least efforts in raising funds from the market. A high rating indicates low risk. High rated instrument will enable the company to offer low rate of interest. The investors will accept low interest because of low risk involvement.

High credit rating gives the company wider spectators for borrowing. It can easily approach financial institutions, banks, investing companies, public etc. for borrowings.

Help Non-popular Companies

Good credit rating gives exposure to the company. If the instruments issued by a company get publicity, the company with low publicity gets popularity. It will now become easy for the company to raise fund from the market.

Rating Facilitates Growth

Rating motivates the management of the company to undertake expansion of their operations or diversify their production activities thus leading to the growth of the company in future.

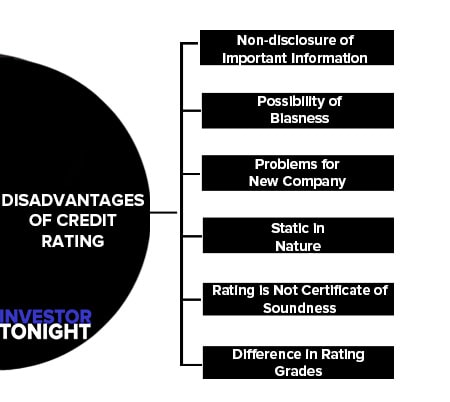

Disadvantages of Credit Rating

Following are the disadvantages of credit rating:

- Non-disclosure of Important Information

- Possibility of Biasness

- Problems for New Company

- Static in Nature

- Rating is Not Certificate of Soundness

- Difference in Rating Grades

Non-disclosure of Important Information

The firm being rated may not furnish all material or important information to the credit rating agency. Any decision taken in absence of such important information may put investors at a loss.

Possibility of Biasness

The rating given by credit rating agency is based on the information collected from the company. The information collected by the rating agency may be subject to personal bias of the rating team.

Problems for New Company

Rating agencies give ratings on the basis of information supplied by the company. But, a new company may not be able to provide sufficient information to prove its financial soundness. Therefore, it may get lower credit rating. A low credit rating may create problem in raising funds from the market.

Static in Nature

Rating is done on the basis of a static study of present and past data of the company at one particular point of time. There are numbers of political, economical, social and environmental factors which have direct bearings over the affairs of the company. Any changes after the rating may defeat the very purpose of rating.

Rating is Not Certificate of Soundness

Rating grades by the rating agencies are only an opinion about the capability of the company to meets its interest obligations. Rating symbols do not pinpoint towards financial soundness or quality of products or management or staff etc. In other words rating does not give a certificate of the complete soundness of the company.

Difference in Rating Grades

Same instrument may be rated differently by different rating agencies because of many factors. This may create confusion among the investors.

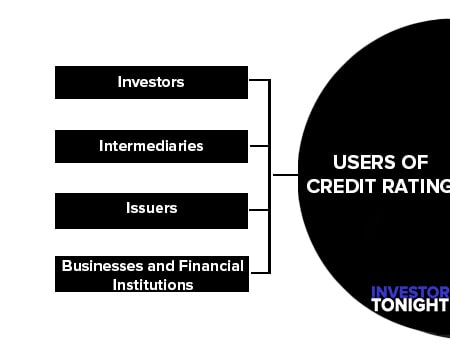

Users of Credit Rating

There are broadly four users of credit rating:

Investors

Investors are the prime users of credit rating. They often use credit ratings to assess credit risk and to compare different issuers and debt issues when making investment decisions. Individual investors, for example, may use credit ratings in evaluating the purchase of a municipal or corporate bond from a risk tolerance perspective.

Institutional investors, including mutual funds, pension funds, banks, and insurance companies often use credit ratings to supplement their own credit analysis of specific debt issues.

Intermediaries

Intermediaries like Investment bankers help to facilitate the flow of capital from investors to issuers. They may use credit ratings to benchmark the relative credit risk of different debt issues, as well as to set the initial pricing for individual debt issues and to help determine the interest rate these issues will pay.

Intermediaries that structure special types of debt issues may look to a rating agency’s criteria when making their own decisions about how to configure different debt issues, or different tiers of debt

Issuers

Issuers use credit ratings to provide independent views of their creditworthiness and the credit quality of their debt issues. Issuers may also use credit ratings to help communicate the relative credit quality of debt issues, thereby expanding the universe of investors. In addition, credit ratings may help them anticipate the interest rate to be offered on their new debt issues.

As a general rule, if creditworthiness is more the issuer need to pay lower interest rate to attract investors and issuer with lower creditworthiness will typically pay a higher interest rate to offset the greater credit risk assumed by investors.

Businesses and Financial Institutions

Businesses and financial institutions may use credit ratings to assess counterparty risk, which is the potential risk that a party to a credit agreement may not fulfill its obligations. For example, in deciding whether to lend money to a particular organization or in selecting a company that will guarantee the repayment of a debt issue in the event of default, a business may wish to consider the counterparty risk.

A credit rating agency’s opinion of counterparty risk can therefore help businesses analyze their credit exposure to financial firms that have agreed to assume certain financial obligations and to evaluate the viability of potential partnerships and other business relationships.

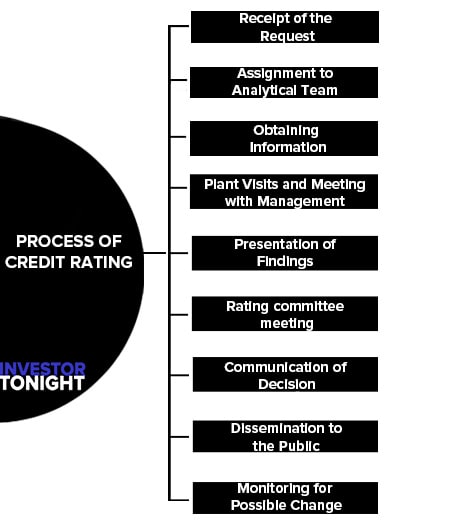

Process of Credit Rating

The rating process begins with the receipt of formal request from a company desirous of having its issue obligations rated by credit rating agency. A credit rating agency constantly monitors all ratings with reference to new political, economic and financial developments and industry trends.

The process/ procedure followed by all the major credit rating agencies in the country is almost similar and usually comprises of the following steps.

- Receipt of the Request

- Assignment to Analytical Team

- Obtaining Information

- Plant Visits and Meeting with Management

- Presentation of Findings

- Rating committee meeting

- Communication of Decision

- Dissemination to the Public

- Monitoring for Possible Change

Receipt of the Request

The rating process begins, with the receipt of formal request for rating from a company desirous of having its issue obligations under proposed instrument rated by credit rating agencies. An agreement is entered into between the rating agency and the issuer company. The agreement spells out the terms of the rating assignment and covers the following aspects:

- It requires the CRA (Credit Rating Agency) to keep the information confidential.

- It gives right to the issuer company to accept or not to accept the rating.

- It requires the issuer company to provide all material information to the CRA for rating and subsequent surveillance.

Assignment to Analytical Team

On receipt of the above request, the CRA assigns the job to an analytical team. The team usually comprises of two members/analysts who have expertise in the relevant business area and are responsible for carrying out the rating assignments

Obtaining Information

The analytical team obtains the requisite information from the client company. Issuers are usually provided a list of information requirements and broad framework for discussions. These requirements are derived from the experience of the issuers business and broadly confirms to all the aspects which have a bearing on the rating.

The analytical team analyses the information relating to its financial statements, cash flow projections and other relevant information.

Plant Visits and Meeting with Management

To obtain classification and better understanding of the client’s operations, the team visits and interacts with the company’s executives. Plants visits facilitate understanding of the production process, assess the state of equipment and main facilities, evaluate the quality of technical personnel and form an opinion on the key variables that influence level, quality and cost of production.

A direct dialogue is maintained with the issuer company as this enables the CRAs to incorporate non-public information in a rating decision and also enables the rating’ to be forward looking. The topics discussed during the management meeting are wide ranging including competitive position, strategies, financial policies, historical performance, risk profile and strategies in addition to reviewing financial data.

Presentation of Findings

After completing the analysis, the findings are discussed at length in the Internal Committee, comprising senior analysts of the credit rating agency. All the issue having a bearing on rating are identified. An opinion on the rating is also formed. The findings of the team are finally presented to Rating Committee.

Rating committee meeting

This is the final authority for assigning ratings. The rating committee meeting is the only aspect of the process in which the issuer does not participate directly. The rating is arrived at after composite assessment of all the factors concerning the issuer, with the key issues getting greater attention.

Communication of Decision

The assigned rating grade is communicated finally to the issuer along with reasons or rationale supporting the rating. The ratings which are not accepted are either rejected or reviewed in the light of additional facts provided by the issuer. The rejected ratings are not disclosed and complete confidentiality is maintained.

Dissemination to the Public

Once the issuer accepts the rating, the credit rating agencies disseminate it through printed reports to the public.

Monitoring for Possible Change

Once the company has decided to use the rating, CRAs are obliged to monitor the accepted ratings over the life of the instrument. The CRA constantly monitors all ratings with reference to new political, economic and financial developments and industry trends.

All this information is reviewed regularly to find companies for ,major rating changes. Any changes in the rating are made public through published reports by CRAs.

Rating Methodology

Rating methodology used by the major Indian credit rating agencies is more or less the same. The rating methodology involves an analysis of all the factors affecting the creditworthiness of an issuer company e.g. business, financial and industry characteristics, operational efficiency, management quality, competitive position of the issuer and commitment to new projects etc.

A detailed analysis of the past financial statements is made to assess the performance and to estimate the future earnings. The company’s ability to service the debt obligations over the tenure of the instrument being rated is also evaluated.

In fact, it is the relative comfort level of the issuer to service obligations that determine the rating. While assessing the instrument, the following are the main factors that are analysed into detail by the credit rating agencies.

- Business Risk Analysis

- Financial Analysis

- Earnings Potential

- Cash Flow Analysis

- Management Evaluation

- Geographical Analysis

- Regulatory and Competitive

- Fundamental Analysis

Business Risk Analysis

Analysis Business risk analysis aims at analysing the industry risk, market position of the company, operating efficiency and legal position of the company. This includes an analysis of industry risk, market position of the company, operating efficiency of the company and legal position of the company.

Industry Risk

The rating agencies evaluates the industry risk by taking into consideration various factors like strength of the industry prospect, nature and basis of competition, demand and supply position, structure of industry, pattern of business cycle etc.

Industries compete with each other on the basis of price, product quality, distribution capabilities etc. Industries with stable growth in demand and flexibility in the timing of capital outlays are in a stronger position and therefore enjoy better credit rating.

Market position of the Company

Rating agencies evaluate the market standing of a company taking into account:

- Percentage of market share

- Marketing infrastructure

- Competitive advantages

- Selling and distribution channel

- Diversity of products

- Customers base

- Research and development projects undertaken to identify obsolete products

- Quality Improvement programs etc

Operating Efficiency

Favorable locational advantages, management and labor relationships, cost structure, availability of raw-material, labor, compliance to pollution control programs, level of capital employed and technological advantages etc. affect the operating efficiency of every issuer company and hence the credit rating.

Legal Position

Legal position of a debt instrument is assessed by letter of offer containing terms of issue, trustees and their responsibilities, mode of payment of interest and principal in time, provision for protection against fraud etc.

Size of Business

The size of business of a company is a relevant factor in the rating decision. Smaller companies are more prone to risk due to business cycle changes as compared to larger companies. Smaller companies operations are limited in terms of product, geographical area and number of customers.

Whereas large companies enjoy the benefits of diversification owing to wide range of products, customers spread over larger geographical area. Thus, business analysis covers all the important factors related to the business operations over an issuer company under credit assessment.

Financial Analysis

Financial analysis aims at determining the financial strength of the issuer company through ratio analysis, cash flow analysis and study of the existing capital structure. This includes an analysis of four important factors namely: a. Accounting quality b. Earnings potential/profitability c. Cash flows analysis d. Financial flexibility

Financial analysis aims at determining the financial strength of the issuer company through quantitative means such as ratio analysis. Both past and current performance is evaluated to comment the future performance of a company. The areas considered are explained as follows.

Accounting Quality

As credit rating agencies rely on the audited financial statements, the analysis of statements begins with the study of accounting quality. For the purpose, qualification of auditors, overstatement/ understatement of profits, methods adopted for recognising income, valuation of stock and charging depreciation on fixed assets are studied.

Earnings Potential

Profits indicate company’s ability to meet its fixed interest obligation in time. A business with stable earnings can withstand any adverse conditions and also generate capital resources internally. Profitability ratios like operating profit and net profit ratios to sales are calculated and compared with last 5 years figures or compared with the similar other companies carrying on same business.

As a rating is a forward-looking exercise, more emphasis is laid on the future rather than the past earning capacity of the issuer.

Cash Flow Analysis

Cash flow analysis is undertaken in relation to debt and fixed and working capital requirements of the company. It indicates the usage of cash for different purposes and the extent of cash available for meeting fixed interest obligations. Cash flows analysis facilitates credit rating of a company as it better indicates the issuer’s debt servicing capability compared to reported earnings.

Financial Flexibility

Existing Capital structure of a company is studied to find the debt/equity ratio, alternative means of financing used to raise funds, ability to raise funds, asset deployment potential etc. The future debt claims on the issuer’s as well as the issuer’s ability to raise capital is determined in order to find issuer’s financial flexibility

Management Evaluation

Evaluation Any company’s performance is significantly affected by the management goals, plans and strategies, capacity to overcome unfavorable conditions, staff’s own experience and skills, planning and control system etc. Rating of a debt instrument requires evaluation of the management strengths and weaknesses.

Geographical Analysis

Geographical analysis is undertaken to determine the locational advantages enjoyed by the issuer company. An issuer company having its business spread over large geographical area enjoys the benefits of diversification and hence gets better credit rating.

A company located in backward area may enjoy subsidies from government thus enjoying the benefit of lower cost of operation. Thus geographical analysis is undertaken to determine the locational advantages enjoyed by the issuer company.

Regulatory and Competitive

Environment Credit rating agencies evaluate structure and regulatory framework of the financial system in which it works. While assigning the rating symbols, CRAs evaluate the impact of regulation/ deregulation on the issuer company.

Fundamental Analysis

Fundamental analysis includes an analysis of liquidity management, profitability and financial position, interest and tax rates sensitivity of the company. This includes an analysis of liquidity management, profitability and financial position, interest and tax rates sensitivity of the company

- Liquidity management involves study of capital structure, availability of liquid assets corresponding to financing commitments and maturing deposits, matching of assets and liabilities.

- Asset quality covers factors like quality of company’s credit risk management, exposure to individual borrowers and management of problem credits etc.

- Profitability and financial position covers aspects like past profits, funds deployment, revenues on non-fund based activities, addition to reserves.

- Interest and tax sensitivity reflects sensitivity of company following the changes in interest rates and changes in tax law.

Fundamental analysis is undertaken for rating debt instruments of financial institutions, banks and non-banking finance companies.

Credit Rating Agency in India

- Credit Rating Information Services of India Limited (CRISIL): CRISIL is the largest and first credit rating agency of India and a global leader in research, ratings and risk & policy advisory services.

- Investment Information and Credit Rating Agency of India Limited (ICRA): CRA was promoted by Industrial Finance Corporation of India jointly with other leading financial/ investment institutions, commercial banks and financial services companies as an independent and professional investment Information and Credit Rating Agency.

- Credit Analysis & Research Ltd. (CARE): CARE was incorporated in April 1993 as a credit rating information and advisory services company. t is a credit rating and information services company promoted by the Industrial Development Bank of India (IDBI) jointly with financial institutions, public / private sector banks and private finance companies.

- Fitch India Limited: With the acquisition of Duff and Phelps Credit Company in April 2000 by Fitch Ratings, Duff and Phelps Rating India Private Limited became Fitch India Limited. Duff and Phelps Credit Rating India Private Ltd was the first joint venture rating company promoted by JM Financials, Alliance Group and the international rating agency Duff and Phelps.

- ONICRA Credit Rating Agency of India Limited: ONICRA Credit Rating Agency is one of the leading Credit and Performance Rating agencies in India. The company is based in Gurgaon and founded in 1993. It provides ratings, risk assessment and analytical solutions to Individuals, MSMEs and Corporates.

- Brickwork Ratings India Pvt. Limited (BWR): Brickwork Rating India Pvt. Ltd. was founded in 2007 by group of professionals to provide rating of public issues and others to help investors take information decisions.

- SME Rating Agency of India Limited (SMERA): SMERA is a joint venture started by Small Industrial Development Bank of India (SIDBI), Dun & Brand Street Information Services India Private Limited (D& B) and several leading banks in India.

Read More Articles