What is Goodwill?

Goodwill of a business means reputation, popularity, or image of the business in the market. Goodwill of a business is earned by the entrepreneur by delivering good quality production, honesty of the businessman, harmonious relations with labourers, pricing of the product and availability of technical knowledge, etc.

Table of Contents

- 1 What is Goodwill?

- 2 Why do we Need for Valuation of Goodwill?

- 3 Nature of Goodwill

- 4 Characteristics of Goodwill

- 5 Factors Affecting Goodwill

- 6 Methods for Valuation of Goodwill

- 7 Need for Valuation of Goodwill

The goodwill of a business attracts more customers towards itself like a magnet. As a result, the business earns more or excess profit over the normally-earned profit on the same capital employed by the other concerns engaged in the same business.

Why do we Need for Valuation of Goodwill?

Goodwill is valued when the business is disposed of because no one would like to buy the goodwill i.e., the firm’s name and other advantages on the condition that the old business would continue to run. This is generally so in the case of a sole proprietorship business.

But in the case of partnership and company, valuation of goodwill may be required during the running business:

In the Case of a Joint-stock Company

The valuation of goodwill may be required in the following cases:

- When the business of a company is purchased by another company or when two companies of the same nature amalgamate.

- When a company wants to acquire the controlling interest in another company.

- When government takes over the business of another company.

- When valuation of shares is done for taxation purposes – estate duty, gift tax etc., in case stock exchange quotation is not available.

- When one class of shares is converted into another.

In the Case of Partnership Firm

Valuation of goodwill is required in the following cases:

- When the existing partners have agreed to change the profit-sharing ratio.

- When a partner retires or expires.

- When the business is sold to a company.

- When firm is dissolved or amalgamated with another firm.

In Case of Sole Proprietorship

Valuation of goodwill is required in the following cases:

- When business is sold.

- When estate duty is levied at the time of death of the proprietor.

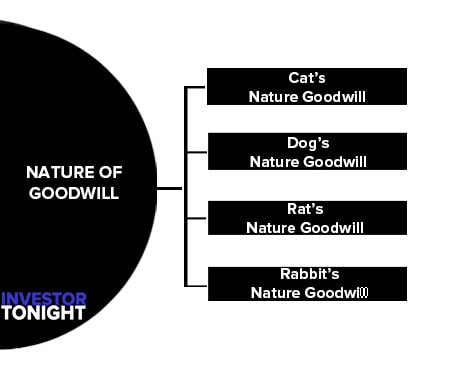

Nature of Goodwill

For the determination of the nature of goodwill, it would be better to discuss the case Whiteman Smith Motor Company vs. Chaplin in which types of goodwill were zoologically classified by Justice Rich into four as:

Cat’s Nature Goodwill

One of the characteristics of a cat is that it likes to live in one place and does not change its living place occasionally. Therefore, it is said that a cat prefers a place to a person. It represents the customer who goes to a particular place to the person who keeps it.

Thus, the nature of some business is like the nature of a cat. Good-will of such type of business does not change due to the change of ownership of the business. The value of goodwill of such types of business is always higher due to its stability.

Dog’s Nature Goodwill

A dog is famous for its faithfulness towards its owner. A dog is always attached to its owner rather than a place. The goodwill of some businesses depends on the owner of the business. If the owner of the business is changed, the goodwill of that business will vanish. In other words, customers are attached to the owner.

Such a type of goodwill of the business is called dog’s nature goodwill.

Rat’s Nature Goodwill

One of the characteristics of the rat is that it does not have any attachment to a place. It moves from place to place. If the goodwill of a business often changes, such type of goodwill is rat’s nature goodwill.

Rabbit’s Nature Goodwill

One of the characteristics of a rabbit is propinquity. Propinquity means nearness in a time and places relationship. Due to this nature, it is trouble-some for a rabbit to go elsewhere. If the goodwill of a business has such a type of nature, it is known as rabbit’s nature goodwill.

Characteristics of Goodwill

- It is an intangible asset: Goodwill is an intangible asset. It is non-visible but it is not a fictitious asset.

- Valuable only where entire business sold: It cannot be separated from the business and therefore cannot be sold like other identifiable and separable assets, without disposing off the business as a whole.

- It cannot be built by amount invested or cost incurred: The value of goodwill has no relation to the amount invested or cost incurred in order to build it.

- Valuation of goodwill is subjective: Valuation of goodwill is subjective and is highly dependent on the judgment of the valuer.

- It is subject to fluctuation: Goodwill is subject to fluctuations. The value of goodwill may fluctuate widely according to internal and external factors of business.

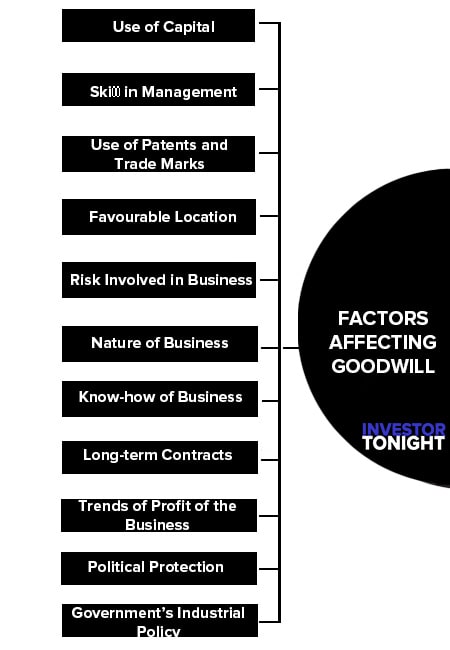

Factors Affecting Goodwill

The capacity to earn more profit over normal profits in the future is the main factor in determining the value of goodwill of a business. But there are some other factors that affect the value of goodwill. Some important factors are given below:

- Use of Capital

- Skill in Management

- Use of Patents and Trade Marks

- Favourable Location

- Risk Involved in Business

- Nature of Business

- Know-how of the Business

- Long-term Contracts

- Trends of Profit of the Business

- Political Protection

- Government’s Industrial Policy

Use of Capital

The amount of capital used in the business will affect the value of its goodwill. If there are two business units that are earning the same profits but their capital employed are different, that business unit will enjoy more goodwill which utilises the lesser amount of capital.

Skill in Management

In some businesses or professions, the personal skill of the owner in the management plays an important role e.g., the success of the firm of a chartered accountant depends upon the personal skill and ability of its owner. In these cases, the goodwill of the firm will not be higher.

If the success of the business depends upon the skill of the employees and its officials, there will be more value of goodwill.

Use of Patents and Trade Marks

If a firm possesses valuable patents and trademarks and has a reputation due to these it will enjoy valuable goodwill. Here, the period for which patents and trademarks will be used in future must be considered at the time of valuation of goodwill.

The longer the future period for the use of patents or trademarks, the more will be the value of goodwill.

Favourable Location

Favourable Location or Site of the Business: A favourable location or site of a business is sometimes more important than all other factors put together. If the business is established in the main market of the city, the site of the business will play an important role in assessing the value of goodwill.

The favourable site may be with respect to the availability of raw materials or of selling or of both, enabling the business to enjoy substantial economies through saving in freight or through the facility in the sale.

Risk Involved in Business

If there is greater risk in a business, the amount of goodwill will be less than those businesses in which risks are less.

Nature of Business

The nature of business involves the following:

Nature of Goods in Business

The profit of a business depends upon the nature of goods. If a business deals in the domestic articles of daily use, profit of such business will be near about constant due to constant demand of the articles of daily use. The more constant the profits, the more is the goodwill and vice versa.

Monopolised Business

If the previous profits of a business are good which are due to the monopolistic nature of the business, the value of goodwill would depend upon the fact whether such a monopolistic benefit is likely to continue or not. If such a benefit will continue in the future, the value of goodwill will be more.

Import Licence

If a business is based upon the licence, new persons cannot enter into this business easily, and the existing company will enjoy the monopoly and earn profits. In such a case, the period of the licence is an important factor for the determination of the value of goodwill.

Know-how of the Business

Here, know-how means the knowledge to solve a particular problem relating to the production or marketing of the business. Generally, this knowledge is acquired through foreign collaboration, experience in the business, sound thinking or systematic research etc.

If the business unit obtains such knowledge to face all its problems, its goodwill will be greater.

Long-term Contracts

If a business unit has favourable long-term contracts for the supply of raw materials or components or as regards sales, these will help in raising the value of goodwill. If these contracts are obtained due to the personal skill of the proprietor, the value to goodwill will not be affected by such existing contracts.

Trends of Profit of the Business

If the trend of profits of a business is steadily increasing, this will increase the value of goodwill. If the trend of profit is decreasing or has been stable in the previous years, the value of goodwill will decrease.

Political Protection

If political protection is being provided to a business or is expected to be given in future, the value of goodwill of that business will be higher.

Government’s Industrial Policy

If the attitude of the government’s industrial policy is to promote a specific line of trade or industry, such a favourable future prospect for industry increase the value of goodwill i.e., computer industry, cement industry etc.

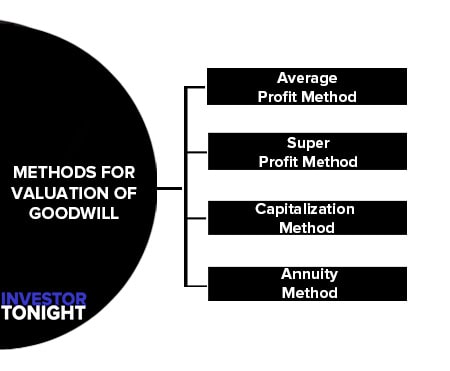

Methods for Valuation of Goodwill

The following four methods are used for the valuation of goodwill, namely:

Average Profit Method

This method is also called the Year’s Purchase of Past Profit Method which is the most commonly used method in partnership firms. Under this method, the average profit of the immediate past few years is multiplied by a certain number. Generally, three to five years average profit is taken for the purpose.

The procedure is applied in the following manner:

- First, average profit of last three or five years is calculated.

- Second, the average profit determined as above is multiplied by a certain number of year’s purchase, e.g. 2,3,4,5 etc.

- The result is the value of Goodwill.

Example: The profits of a firm for the last three years were as follows: 60,000, 70,000, and ` 50,000. Calculate the goodwill of the firm taking 5 year’s purchase of the average profits.

Solution:

Average Profit = (60,000 + 70,000 + 50,000) ÷ 3 = 60,000

Therefore, the Value of Goodwill at 5 years’ purchase of average profit

= Average profit x 5

= 60,000 x 5

= 3, 00, 000

Thus, the formula for Goodwill is as follows: Goodwill = Average Profits × No. of years’ Purchase

Advantages of Average Profit Method

- This method is simple and easy to understand and apply.

- As the average profits are considered to find out the value of goodwill, there is the possibility that result will be satisfactory. Average profits are more reliable than one year’s profit to know the future earning capacity.

- Generally, this method is adopted when a partner retires or expires.

Disadvantages of Average Profit Method

- Only profits are considered to ascertain the value of goodwill. No account is taken for capital employed while that is an important factor affecting the goodwill.

- There is uncertainty regarding the number of years for finding out the average profits and number of years’ purchase. Therefore, results arrived are far from satisfactory.

Super Profit Method

Super profit method, goodwill is determined by multiplying the super-profits by a certain number of years’ purchase. Super profit means the excess of the average profits which is earned by a business over normal profit, based on the normal rate of return for the representative firm in the industry.

Super Profit = Average Profit – Normal Profit

- Average Profit = Total Normal Profit ÷ No. of years

- Normal Profits = Average Capital Employed × Normal Rate of Return ÷ 100

- Super Profit = Average maintainable profits – Normal Profits

- Goodwill = Super Profit × No. Of Year’s Of Purchase

Capitalization Method

This method goodwill is valued by capitalizing the future maintainable profits (average profits) applying the normal rate of return. In the capitalization method, it is estimated that much amount of capital will be needed for earning a definite amount of profit at the normal rate of return. There are two methods to find out the value of goodwill:

- Capitalisation of Super Profit Method

- Capitalisation of Future Maintainable Profits (Average Profit) Method

Capitalisation of Super Profit Method

In this method, it is attempted to assess the capital required to earn the amount of super profit. The capitalised value of super profit (excess of future maintainable profits over normal profit on capital employed) is called goodwill.

To ascertain the value of goodwill under this method, Super Profit of the business and Normal Rate of Return is required and then the following formula is used.

Goodwill as per Capitalisation Method = SuperProfit x 100 ÷ Normal Rate of Return

Capitalisation of Future Maintainable Profits (Average Profit) Method

This method, goodwill is determined by deducting the actual capital employed in the business from the capitalised value of future maintainable profits (adjusted average profits) applying the normal rate of return.

To ascertain the value of goodwill under this method, the following steps are adopted:

- Compute the Future Maintainable Profits (average profits) as per the method explained in Average Profit Method earlier.

- Compute the Capitalised Value of these Future Maintainable Profits (average profits) apply in the following formula:

= FutureMaintainableProfits(AverageProfits) x 100 ÷ Normal Rate of Return - Compute the Actual Capital Employed in the Business (Net Assets of the Business) according to the method explained in the Super Profit Method earlier.

- Compute the value of goodwill as under.

Goodwill = Capitalised Value of Future Maintainable profits – Actual Capital Employed

The value of goodwill is equal to the goodwill computed in the capitalisation of super profit.

Annuity Method

When a purchaser acquires a business, he pays some amount for goodwill along with the amount for net assets of the business. At the time of purchase of a business, the purchaser thinks that amount paid for goodwill would be recouped by him during the coming three or four years in the form of super profit.

But super profits are made in future and he pays for goodwill immediately upon purchase of a business.

Goodwill = Super Profit × Reference to Annuity Table

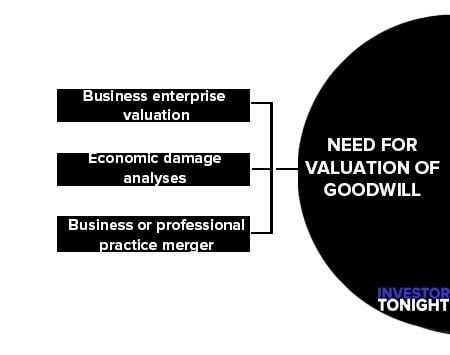

Need for Valuation of Goodwill

Generally, goodwill may be valued at the time of disposal of business of the firm. But in many cases the goodwill may be valued to find out value of the firm. In the case of proprietorship business it will be valued at the time of disposal of business, in case of firm it may be calculated at the time of addition, resignation and disposal of firm.

Now in case of companies the need for valuation of goodwill arises in the following circumstances;

Business enterprise valuation

The identification and quantification of goodwill is one procedure of the asset-based approach to business valuation. An asset-based approach is often used in the valuation of an industrial or commercial company or professional service business.

Such business valuations are routinely performed for taxation, ownership transition, financing, bankruptcy, corporate governance, litigation, and other purposes.

Economic damage analyses

When a business has suffered a breach of contract or a tort (such as an infringement, breach of a fiduciary duty, or interference with business opportunity), one measure of the damages suffered is the reduction in the value of the entity’s goodwill due to the wrongful action.

This analysis may encompass the comparative valuation of the entity’s goodwill before and after the breach of contract or tort. This before and after a method is also useful for quantifying the economic effects of a prolonged labour strike, a natural disaster, or a similar phenomenon.

Business or professional practice merger

When two businesses merge, the equity of the merged entity typically is to be allocated to the merger partners. One common way to allocate equity in the merged entity is in proportion to the relative value of the assets contributed, including the contributed goodwill.

Read More Articles

- What is Accounting?

- Basic Accounting Terminology

- Basic Accounting Concepts

- Accounting Conventions

- Double Entry System

- What is Journal?

- What is Ledger?

- What is Trial Balance?

- What is Activity Based Costing?

- Business, Industry and Commerce

- Shares and Share Capital

- What is Audit of Ledger?

- Forfeiture and Reissue of Shares

- What is Consolidated Financial Statements?

- What are Preference Shares?

- What are Debentures?

- Issue of Bonus Shares

- What is Government Accounting?

- What are Right Shares?

- Redemption of Debentures

- Buy Back of Shares

- Valuation of Goodwill

- What is Valuation of Shares?

- Purchase of Business

- Amalgamation of Companies

- Internal Reconstruction of Company

- What is a Holding company?

- Accounts of Holding Company

- What is Slip System?