A share is the interest of a shareholder in the company measured by a sum of money, for the purpose of liability in the first place and of interest in the second, but also consisting of mutual covenants entered into by all the shareholders in terms of the Act and the Articles.

Table of Contents

Share capital is the amount of ‘investment in shares of a company’ made by the promoters and members of that company. A share is a unit of account for various financial instruments, and more particularly for the total share capital.

In simple words, a share is a small part of the total share capital of a company. The capital of a company is divided into a large number of equal parts/units of small denomination.

Each part or unit is called a share. For example, a company has total capital of Rs. 20,00,000 divided into 2, 00,000 equal parts/units of the denomination of Rs. 10. Each unit/ part will be known as a share of Rs. 10 each.

As the total capital of the company is divided into shares, the capital of the company is termed as share capital. In ordinary parlance, share capital means the capital raised by the company by the issue of shares. A company collects its capital by issuing shares.

When a share is issued and allotted to a person by a company, it also issued a document by which the person is entitled to be one of the owners of the company. The person to whom shares are allotted is called a shareholder. A share is issued by a company or can be purchased from the stock market.

In this regard the provision of the Companies Act, 2013, is noteworthy. According to Section 43 of the Companies Act, 2013, the new issue of the share capital of a company limited by shares shall be of two kinds only, namely.

Generally, there are two types of shares:

Equity share is also called ordinary share or nominal share or common share. The holders of these shares are the real owners, risk-takers, and care-takers of the company and they have control over the affairs of the company and enjoy the right of voting.

Equity Share Capital

- With voting rights.

- With differential rights as to dividend, voting or otherwise in accordance with such rules and subject to such conditions as may be prescribed.

A preference share is that share that has certain preferential rights over the equity share. These preferential rights are given in two respects, (a) as regards the payment of dividend either as a fixed amount or at a fixed rate; and (b) to the payment of the paid-up capital.

However, the provision of this section does not apply to a private limited company that is not a subsidiary of a Public Company. This means that a private company may have other kinds of shares such as deferred shares or founder shares in addition to Preference and Equity Shares.

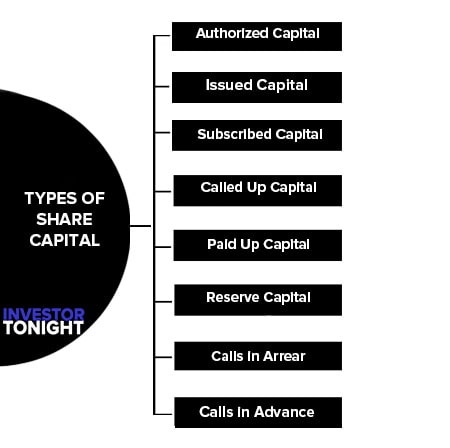

The term ‘capital’ means a specific amount of money required for starting a business. In the context of the company form of business, capital means share capital. As per Schedule III to the Companies Act, 2013 the share capital of a company is divided into the following categories:

- Authorized or Nominal or Registered Capital

- Issued Capital

- Subscribed Capital

- Called Up Capital

- Paid Up Capital

- Reserve Capital

- Calls in Arrear

- Calls in Advance

Authorized capital is the capital with which a company is registered. This amount is clearly mentioned in the capital clause of the Memorandum of Association. Therefore, the amount of capital which is mentioned in the Memorandum of Association of the company is the authorized capital.

Authorized share capital is the maximum amount of share capital that the company is empowered to issue. For example, H Ltd. is registered with a capital of Rs. 8, 00,000 divided into shares of Rs. 10 each. Here the authorized, nominal or registered capital of the company is Rs. 8, 00,000.

A company cannot issue shares more than the nominal or authorized capital. But the company may change this limit by observing the required statutory provisions.

Issued Capital

Issued capital is that portion of authorized share capital that is issued for the subscription. In other words, it is the nominal value of shares that have been offered for public subscriptions. That portion of authorized share capital for which offers have not been invited for subscription is called unissued share capital.

For example, H Ltd. has Rs. 8, 00,000 authorized capital of Rs. 10 each out of which it invited applications for the issue of 50,000 shares of Rs. 10 each. In this case, the issued capital will be Rs. 5,00,000 (50, 000 X 10). The remaining 30, 000 shares are unissued share capital.

Issued capital also includes any share or shares issued for consideration other than cash. The issued capital can never exceed its authorized capital.

Subscribed Capital

Subscribed capital represents that part of the issued share capital which has actually been subscribed and allotted to the public.

For example, out of the above 50,000 shares of Rs. 10 each, 48,000 shares are applied for and allotted by the company, the subscribed capital will be Rs. 4,80,000. Again, if the whole of the 50,000 shares is applied for and allotted by the company, the subscribed capital will be Rs. 5, 00,000.

It must be noted that the subscribed capital can be equal to or less than the issued capital but it cannot be more than the issued capital.

Called Up Capital

Called-up capital is that part of the subscribed share capital which the company actually demanded from the shareholders. The amount of subscribed capital and called-up capital may vary in case the amount due on a share is collected in installments and all the installments have not been demanded by the company.

For example, for a share of Rs. 10, the company called Rs. 8 on 50,000 shares, the called-up capital shall be Rs. 4, 00,000 and if the whole amount has been called, the called-up capital would be Rs. 5, 00,000. The called-up capital of the company cannot exceed the subscribed capital. The portion of the capital which has not been called is known as uncalled capital.

Paid Up Capital

Paid-up share capital is that part of the subscribed share capital which has been actually paid by the shareholders. Sometimes some of the subscribers of the shares may fail to pay the amount due from them on account of a call. The paid-up capital may be either equal to or less than the called-up capital.

The amount of call money that has not been paid by the shareholders is termed as calls-in-arrear.

Reserve Capital

Reserve capital is the special portion of the subscribed capital that is not called up under ordinary situations. A company by special resolution may resolve that a certain portion of the subscribed capital can be called up only in the event of the company being wound up.

This capital cannot be called for payment from the shareholders except in the case of winding-up.

Calls in Arrear

It is the amount that has been called for by the company but has not been paid by the shareholders. In other words, it is the amount remaining unpaid on allotted shares, although it has been called up.

Calls in Advance

Sometimes some shareholders may pay a part or whole of the amount due on a share before the amount is called up. Such amount paid in advance is known as ‘Calls-in-Advance’.

As discussed earlier the capital of a public limited company is raised from the issue of shares to the public. Issue of shares means the process through which the capital, required for carrying the objects of the company, is collected or raised.

The share capital of a public company is raised by the issue of either (i) equity shares; or (ii) both equity and preference shares.

Securities and Exchange Board of India (SEBI) has defined ‘issue’ under clause 3(da) as “issue” means an offer of sale or purchase of securities by any body corporate or by any other person or group of persons on his or its or their behalf, as the case may be, to or from the public, or the holders of securities of such body corporate or person or group of persons;”

There are various methods for the issue of shares. These may be discussed from two different viewpoints:

From the point of view of Price of Issue

From this point of view, shares may be issued: at par, at a premium, and at a discount:

At Par

Issue of shares at par means the issue of shares at face value. In other words, when the shareholders are required to pay an amount equal to the nominal or face value of the shares, it is called the issue of shares at par.

For example, if the face value of a share is Rs.10 and the same is issued at Rs.10, it means that the shares have been issued at par.

Issue of shares at a premium means the issue of shares at a price higher than its face value. For example, if the face value of a share is Rs.10 and the same is issued at Rs.11, it means that the shares have been issued at a premium.

The amount of premium is Re.1.00. Thus, in a premium issue, a subscriber of a share is required to pay an amount that is equal to the nominal value of shares plus the amount of premium.

At a Discount

Issue of shares at a discount means the issue of shares at a price lower than its face value. For example, if the face value of a share is Rs.10 and the same is issued at Rs. 9, it means that the shares have been issued at a discount.

The amount of discount being Re. 1.00 which is the difference between the face value and issue price. It may be mentioned here that there are legal restrictions imposed on the company under Section 53 of the Companies Act, 2013 for the issue of shares at a discount.

As per section 53 of the companies Act, 2013 a company cannot issue shares at discount except for in case of sweat equity shares, and therefore any issue on discount by the company will be void with the company being punishable with a fine.

From the point of view of Consideration

From the point of view of consideration, the shares may be issued:

For Cash

For cash: Issue of shares for cash means collection of cash either in a lump sum or in installments against the issue of shares.

For consideration other than cash

Sometimes shares may be issued for consideration other than cash. This means that the company has received some benefit in kind or services and shares have been issued against that benefit.

For example, a company purchased some assets from the vendor and instead of making payment to the vendor in cash, the company may allot shares in the discharge of purchase consideration. The issue of shares to vendors is known as the issue of shares for consideration other than cash.

Issue of bonus shares by a company to its existing shareholders is another example of this kind.

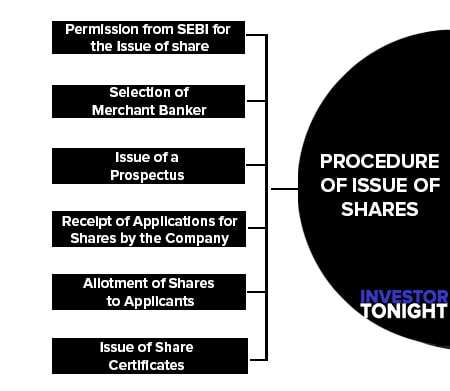

The procedure of issue of shares consists of the following steps:

- Permission from SEBI for the Issue of share

- Selection of Merchant Banker

- Issue of a Prospectus

- Receipt of Applications for Shares by the Company

- Allotment of Shares to Applicants

- Issue of Share Certificates

The Securities and Exchange Board of India (SEBI) has framed some rules and guidelines for the public issue of shares. The companies issuing securities offered through an offer document shall satisfy certain conditions at the time of filing the draft offer document with SEBI (unless specified otherwise in the Chapter) and also at the time of filing the final offer document with the Registrar of Companies/ Designated Stock Exchange:).

No issuer company shall make any public issue of securities unless a draft Prospectus has been filed with the Board through a Merchant Banker, at least 30 days prior to the filing of the Prospectus with the Registrar of Companies.

Selection of Merchant Banker

The next step of the issuing company is to select a Merchant Banker to manage its issue. A merchant banker is a financial institution engaged in rendering financial services relating to advising on and arranging for the share issues. The Merchant Banker may also be the Lead Manager of the issue.

Issue of a Prospectus

Generally, a part of the share capital of a public limited company is contributed by the promoter directors and financial institutions. But a large amount of share capital is raised from the public. This is done by inviting offers for purchase or subscription of shares from the general public through the issue of the prospectus.

Before its issue to the public, it must be : (1) dated : (2) signed by every director or proposed director or his authorized agent; and (3) filed with the Registrar of Companies. A prospectus incorporates necessary information about the company to the prospective investors and encourages them to purchase its shares.

The prospectus provides details as to the nature of share capital in terms of kinds of shares and the exact terms on which the shares are to be issued to the applicants, the opening and closing dates of subscription lists, the amount payable on application, and allotment of shares respectively and whether other installments, if any, are payable on stated dates or when called upon by the directors.

The fourth step is to receive applications for shares from the public. After the publication of a prospectus, a prospective shareholder is required to collect a copy of the prospectus which contains a printed application form.

Properly filled-in application forms must be forwarded to the company or to the bankers to the issue along with necessary application money.

The application is required to be submitted before the closing of the subscription. After the last date of receiving applications, the collecting banker sends all applications to the company along with a draft for the application money collected by the bank.

The company deposits all the drafts in a separate bank account opened for the purpose of a scheduled bank. As per section 39 of the companies Act, 2013, application money must be at least 5% of the nominal value of shares. A company cannot proceed to allot shares unless a minimum subscription is received by the company.

The allotment of shares means acceptance by the company of the offer made by the applicants to take up the shares applied for. Until the allotment is done, the company cannot use the application money for its day-to-day activities.

The company categorizes the applications received into different groups according to the number of shares applied for. After all the conditions and formalities are fulfilled, the Board of Directors can proceed to allot shares as per SEBI guidelines after obtaining permission from the stock exchange.

In this way, a contract is entered into between the company and the applicants. ‘Letter of Regret’ is sent to those applicants to whom no shares have been allotted and the application money paid by them is refunded along with the ‘Letters of Regret’.

A Share Certificate is a document that provides evidence of ownership of shares in a limited company. The certificate bears the name of the shareholder and the number and the class of shares owned by the shareholder. It is serially numbered, stamped by the common seal of the company, and signed by the authorized signatory.

The authorized signatory is at least one director of the company and the company secretary. It is not a negotiable instrument. On allotment of shares, share certificates are issued to the successful applicants.

Read More Articles

- What is Accounting?

- Basic Accounting Terminology

- Basic Accounting Concepts

- Accounting Conventions

- Double Entry System

- What is Journal?

- What is Ledger?

- What is Trial Balance?

- What is Activity Based Costing?

- Business, Industry and Commerce

- Shares and Share Capital

- What is Audit of Ledger?

- Forfeiture and Reissue of Shares

- What is Consolidated Financial Statements?

- What are Preference Shares?

- What are Debentures?

- Issue of Bonus Shares

- What is Government Accounting?

- What are Right Shares?

- Redemption of Debentures

- Buy Back of Shares

- Valuation of Goodwill

- What is Valuation of Shares?

- Purchase of Business

- Amalgamation of Companies

- Internal Reconstruction of Company

- What is a Holding company?

- Accounts of Holding Company

- What is Slip System?