What is Marginal Cost?

Marginal Cost is a technique of cost accounting which pays special attention to the behavior of costs with changes in the volume of output.

Table of Contents

Marginal Cost Definition

According to I.C.M.A. London, marginal cost is defined as “The amount at any given volume of output by which aggregate costs are changed if the volume of output is increased or decreased by one unit. In practice this is measured by the total variable attributable to one unit.” In this context, a ‘Unit’ may be single article, a batch of articles, an order, a stage of production capactiy, a man-hour, a process or a department.

According to Blocker and Weltmore, “Marginal cost is the increase or decrease in the total cost which result from producing or selling additional unit of a commodity or from a change in the method of production or distribution.”

Marginal cost is the aggregate of variable costs. It is the cost of producing one additional unit. The marginal cost concept is based on the distinction between fixed and variable costs. Marginal cost is the total of variable costs only and fixed costs only and fixed costs are ignored.

So, after analysing the definition we can say that with the increase in one unit of output, the total cost is increased and this increase in total cost from the existing to the new level is known as ‘Marginal Cost’.

Marginal Cost Meaning

According to the Institute of cost and management accountants, London, Marginal costing is defined as “The ascertainment of marginal cost and of the effect on profit of changes in volume or type of output by differentiating between fixed costs and variable costs. In this technique of costing only variable cost are charged to operations, processes or products, while the fixed costs are to be written off against profits in the period in which they arise.“

Thus, in this context, we can say that marginal costing is a technique which is concerned with the changes in costs and profits result from changes in volume of output. Marginal costing is also known as ‘Variable Costing’.

Marginal Cost Example

For example, for the production of 1,000 units of product, the variable costs per unit is $5 and fixed costs are $5,000 per annum. If the production is increased by one unit, the marginal cost will be:

Total cost of 1,000 units:

Fixed costs = $5,000

Variables costs (1,000 units × 5) = $5,0000

Total cost = Fixed Costs + Variables Costs

= $5,000 + $5,000 = $10, 000

Per unit costs = 10, 000 / 1, 000 = $10/

Total cost of 1,001 units:

Fixed costs = $5,000

Variable costs (1,001 units × 5) $5,005

Total costs = $10,005

Marginal cost = $10,005 – 10,000 = $5

Hence, marginal cost is $5. This is the change in total cost due to change in one unit of output.

Features of Marginal Costing

- Marginal costing is a technique of control or decision making.

- Under marginal costing the total cost is classified as fixed and variable costs.

- Fixed costs are ascertained separately and excluded from cost of products. The fixed costs are charged to Costing Profit and Loss account. The need for apportionment and absorption of overheads does not arise at all.

- The stock of work-in-progress and finished goods stocks are valued at variable cost. Fixed costs will not be included in valuation of the stocks.

- Contribution is ascertained by reducing the marginal cost or variable cost from the selling price.

- The profitability of products, departments or processes is determined on the basis of contribution.

- Profits are ascertained by reducing the fixed cost from the contribution of all the products or departments or processes or divisions, etc.

- The profitability of various levels of activity is ascertained by calculating cost volume-profit analysis.

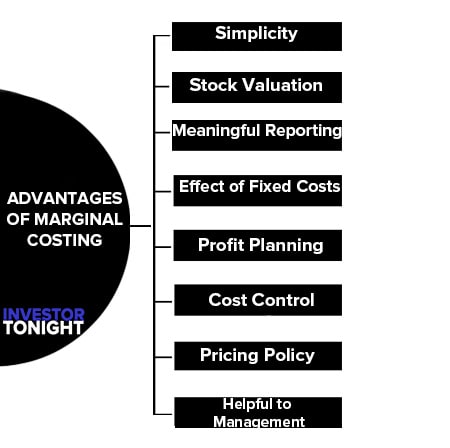

Advantages of Marginal Costing

Following are the advantages of marginal costing:

- Simplicity

- Stock Valuation

- Meaningful Reporting

- Effect of Fixed Costs

- Profit Planning

- Cost Control and Cost Reduction

- Pricing Policy

- Helpful to Management

Simplicity

The statement prepared under marginal costing can be easily followed as it breaks up the costs as variable and fixed.

Stock Valuation

Stock valuation can be easily done and understood as it includes only the variable costs.

Meaningful Reporting

Marginal costing serves as a good basis for reporting to management. The profits are analysed from the point of view of sales rather than production.

Effect of Fixed Costs

The fixed costs are treated as period costs and are charged to P/L account directly. Thus they have practically no effect on decision making.

Profit Planning

The cost-volume-profit relationship is perfectly analyzed to reveal efficiency of products, processes and departments. ‘Break even point’ and ‘Margin of safety’ are the two important concepts helpful in profit planning. Most advantageous volume and cost to maximize profits within the existing limitations can be planned.

Cost Control and Cost Reduction

Marginal costing technique is helpful in preparation of flexible budget as the costs are split into fixed and variable portions. The emphasis is laid on variable cost for control. The fixed costs are also controlled by ascertaining them separately for computing profit and for control. The constant focus on cost and volume, and their effect on profit pave way for cost reduction.

Pricing Policy

Marginal costing is immensely helpful in determination of selling prices under different situations like recession, depression, introduction of new products, etc. correct pricing policy can be developed under the marginal costing technique with the help of the cost information, revealed therein.

Helpful to Management

Marginal costing is helpful to management in exercising decisions regarding make or buy, exporting, key factor and numerous other aspects of business operations.

Disadvantages of Marginal Costing

Following are the disadvantages of marginal costing:

- Difficult to analyze overhead

- Time element is ignored

- Not suitable for external reporting

- Undervaluation of Stocks

- Automation

- Production aspect is ignored

- Not applicable in all types of business

- Misleading Pricing

Difficult to analyze overhead

Separation of costs into fixed and variable is a difficult problem. In marginal costing, semi-variable or semi-fixed costs are not considered.

Time element is ignored

Fixed costs and variable costs are different in the short run; but in the long run, all costs are variable. In the long run all costs change at varying levels of operation. When new plants and equipments are introduced, fixed costs and variable costs will vary. Therefore, it ignores time element and is not suitable for long-term decisions.

Not suitable for external reporting

Since fixed cost is not included in total costs, full cost is not available to outsiders to judge the efficiency.

Undervaluation of Stocks

Under marginal costing only variable costs are considered and the output as well as stocks are undervalued and profit is distorted. When there is loss of stock the insurance cover will not meet the total cost.

Automation

In these days of automation and technical advancement, huge investment are made in heavy machinery which results in heavy amount of fixed costs. Ignoring fixed costs, in this context for decision making is not rational.

Production aspect is ignored

Marginal costing lays too much emphasis on selling function and as such production function has been considered to be less significant. But from the business point of view both the functions are equally important.

Not applicable in all types of business

In contract type of business and job order business, full cost of the job or the contract is to be charged. Therefore, it is difficult to apply marginal costing in these types of business.

Misleading Pricing

Each product is shown at variable costs alone, thus, giving a misleading picture about its costs.

Thus, marginal costing, if applied alone, will not be much in use, unless it is combined with other techniques like standard costing and budgetary control.

Absorption Costing Vs Marginal Costing

Absorption costing is the practice of charging all costs, both fixed and variable to operations, process or products. In marginal costing, only variable costs are charged to productions.

| Basis | Absorption Costing | Marginal Costing |

|---|---|---|

| Charging of costs | Fixed costs form part of total costs of production and distribution. | Variable costs alone form part of cost of production, and sales whereas fixed cost are charged against contribution for determination of profit. |

| Valuation of stocks | Stocks and work-in-progress are valued at both fixed and variable costs i.e., total costs. | Stocks are valued at variable cost only. |

| Variation in profits | When there is no sale the entire stock is carried forward and there is no trading profit or loss. | If there is no sale, the fixed overhead will be treated as loss in the absence of contribution. It is not carried forward as part of stock value. |

| Purpose | Absorption costing is more suitable for long-term decision making and for pricing policy over longterm. | Marginal costing is more useful for short-term managerial decision making. |

| Emphasis | Absorption costing lays emphasis on production. | Marginal costing emphasizes selling and pricing aspects. |

Read More Articles