Industry Analysis

The mediocre firm in the growth industry usually outperforms the best stocks in a stagnant industry. Therefore, it is worthwhile for a security analyst to pinpoint a growth industry, which has good investment prospects. The past performance of an industry is not a good predictor of the future- if one looks very far into the future. Therefore, it is important to study industry analysis.

For an industry analyst- industry life cycle analysis, characteristics and classification of the industry is important. All these aspects are enlightened in the following sections:

Table of Contents

- 1 Industry Analysis

- 2 Industry Life Cycle Analysis

- 3 Classification of Industry

- 4 Characteristics of Industry Analysis

- 4.1 Post Sales and Earnings Performance

- 4.2 Nature of Competition

- 4.3 Raw Material and Inputs

- 4.4 Attitude of Government Towards Industry

- 4.5 Management

- 4.6 Labour Conditions and Other Industrial Problems

- 4.7 Nature of Product Line

- 4.8 Capacity Installed and Utilized

- 4.9 Industry Share Price Relative to Industry Earnings

- 4.10 Research and Development

- 4.11 Pollution Standards

- 5 Profit Potential of Industries: Porter Model

- 6 Techniques for Evaluating Relevant Industry Factors

Industry Life Cycle Analysis

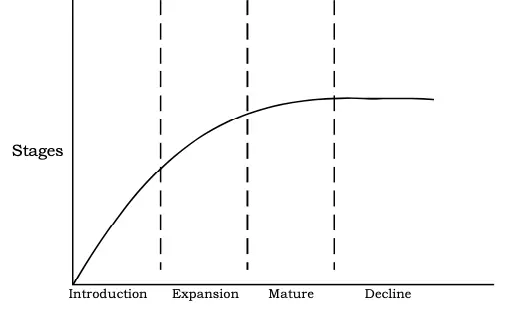

Many industrial economists believe that the development of almost every industry may be analyzed in terms of the following stages (Figure 1):

Pioneering Stage

During this stage, the technology and product is relatively new. The prospective demand for the product is promising in this industry. The demand for the product attracts many producers to produce the particular product. This lead to severe competition and only the fittest companies survive in this stage.

The producers try to develop brand name, differentiate the product and create a product image. This would lead to non-price competition too. The severe competition often leads to change of position of the firms in terms of market share and profit.

Rapid Growth Stage

This stage starts with the appearance of surviving firms from the pioneering stage. The companies that beat the competition grow strongly in sales, market share and financial performance. The improved technology of production leads to low cost and good quality of products. Companies with rapid growth in this stage, declare dividends during this stage. It is always advisable to invest in these companies.

Maturity and Stabilization Stage

After enjoying above-average growth, the industry now enters in maturity and stabilization stage. The symptoms of technology obsolescence may appear. To keep going, technological innovation in the production process should be introduced. Close monitoring at industries events are necessary at this stage.

Decline Stage

The industry enters the growth stage with the satiation of demand, encroachment of new products, and change in consumer preferences. At this stage the earnings of the industry are started declining. In this stage, the growth of industry is low even in the boom period and decline at a higher rate during the recession. It is always advisable not to invest in the share of low growth industry.

Classification of Industry

Industry means a group of productive or profit-making enterprises or organizations that have similar technically substitute goods, services or sources of income.

Besides Standard Industry Classification (SIC), industries can be classified on the basis of products and business cycle i.e. classified according to their reactions to the different phases of the business cycle. These are classified as follows:

Growth Industries

These industries have special features of a high rate of earnings and growth in expansion, independent of the business cycle. The expansion of the industry mainly depends on technological change or an innovative way of doing or selling something.

For example, in the present scenario, the information technology sector have a higher growth rate. There is some growth in electronics, computers, cellular phones, engineering, petrochemicals, telecommunication, energy etc.

Cyclical Industries

The growth and profitability of the industry move along with the business cycle. These are those industries which are most likely to benefit from a period of economic prosperity and most likely to suffer from a period of economic recession.

These especially include consumer goods and durables whose purchase can be postponed until persona; financial or general business conditions improve. For example- Fast Moving Consumer Goods (FMCG) commands a good market in the boom period and demand for them slackens during the recession.

Defensive Industries

Defensive industries are those, such as the food processing industry, which hurt least in the period of an economic downswing. For example- the industries selling necessities of consumers withstands recession and depression.

The stock of defensive industries can be held by the investor for income-earning purpose. Consumer nondurable and services, which in large part are the items necessary for existence, such as food and shelter, are products of defensive industry.

Cyclical Growth Industries

These possess characteristics of both a cyclical industry and a growth industry. For example, the automobile industry experiences period of stagnation, decline but they grow tremendously. The change in technology and the introduction of new models help the automobile industry to resume their growing path.

Characteristics of Industry Analysis

In an industry analysis, the following key characteristics should be considered by the analyst. These are explained as below:

- Post Sales and Earnings Performance

- Nature of Competition

- Raw Material and Inputs

- Attitude of Government Towards Industry

- Management

- Labour Conditions and Other Industrial Problems

- Nature of Product Line

- Capacity Installed and Utilized

- Industry Share Price Relative to Industry Earnings

- Research and Development

- Pollution Standards

Post Sales and Earnings Performance

The two important factors which play an important role in the success of the security investment are sales and earnings. The historical performance of sales and earnings should be given due consideration, to know how the industry have reacted in the past.

With the knowledge and understanding of the reasons of the past behaviour, the investor can assess the relative magnitude of performance in future. The cost structure of an industry is also an important factor to look into. The higher the cost component, the higher the sales volume necessary to achieve the firm’s break-even point, and vice-versa.

Nature of Competition

The numbers of the firms in the industry and the market share of the top firms in the industry should be analyzed. One way to determine competitive conditions is to observe whether any barriers to entry exist. The demand of a particular product, its profitability and price of concerned company scrip’s also determined the nature of competition.

The investor before investing in the scrip of a company should analyze the market share of the particular company’s product and should compare it with other companies. If too many firms are present in the organized sector, the competition would be severe. This will lead to a decline in price of the product.

Raw Material and Inputs

Here, we have to look into the industries, which are dependent upon imports of scarce raw material, competition from other companies and industries, barriers to entry of a new company, protection from foreign competition, import and export restriction etc.

An industry which has a limited supply of materials domestically and where imports are restricted will have dim growth prospects. Labour is also an input and industries with labour problems may have difficulties of growth.

Attitude of Government Towards Industry

It is important for the analyst or prospective investor to consider the probable role government will play in the industry. Will it provide financial support or otherwise? Or it will restrain the industry’s development through restrictive legislation and legal enforcement? The government policy with regard to granting of clearance, installed capacity and reservation of the products for small industry etc. are also factors to be considered for industry analysis.

Management

An industry with many problems may be well managed, if the promoters and the management are efficient. The management likes Tatas, Birlas, Ambanies etc. who have a reputation, built up their companies on strong foundations.

The management has to be assessed in terms of their capabilities, popularity, honesty and integrity. In case of new industries no track record is available and thus, investors have to carefully assess the project reports and the assessment of financial institutions in this regard. Good management also ensures that future expansion plans are put on sound basis.

Labour Conditions and Other Industrial Problems

The labor scenario in a particular industry is of great importance. If we are dealing with a labor-intensive production process or a very mechanized capital intensive process where labor performs crucial operations, the possibility of strike looms as an important factor to be reckoned with.

Certain industries with problems of marketing like high storage costs, high transport costs etc leads to poor growth potential and investors have to careful in investing in such companies.

Nature of Product Line

The position of the industry in the life cycle of its growth- initial stage, high growth stage and maturing stage are to be noted. It is also necessary to know the industries with high growth potential like computers, electronics, chemicals, diamonds, etc., and whether the industry is in the priority sector of the key industry group or capital goods or consumer goods groups. The importance attached by the government in their policy and of the Planning Commission in their assessment of these industries is to be studied.

Capacity Installed and Utilized

The demand for industrial products in the economy is estimated by the Planning Commission and the Government and the units are given licensed capacity on the basis of these estimates. If the demand is rising as expected and market is good for the products, the utilization of capacity will be higher, leading to bright prospects and higher profitability.

If the quality of the product is poor, competition is high and there are other constraints to the availability of inputs and there are labor problems, then the capacity utilization will be low and profitability will be poor.

While making investment the current price of securities in the industry, their risk and returns they promise is considered. If the price is very high relative to future earnings growth, the investment in these securities is not wise. Conversely, if future prospects are dim but prices are low relative to fairly level future patterns of earnings, the stocks in this industry might be an attractive investment.

Research and Development

For any industry to survive in the national and international markets, product and production process have to be technically competitive. This depends upon the research and development in the particular industry. Proper research and development activities help in obtaining economies of scale and a new market for a product. While making an investment in any industry the percentage of expenditure made on research and development should also be considered.

Pollution Standards

These are very high and restricted in the industrial sector. These differ from industry to industry, for example, in the leather, chemical and pharmaceutical industries the industrial effluents are more.

Profit Potential of Industries: Porter Model

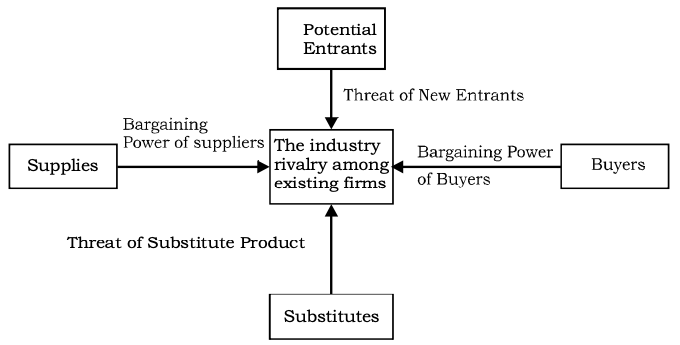

Michael Porter has argued that the profit potential of an industry depends on the combined strength of the following five components as explained below. Figure 2 depicts the forces that drive competition and determine industry profit potential. These are:

- Threat of New Entrants

- Rivalry among the Existing Firms

- Pressure from Substitute Products

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

Threat of New Entrants

New entrants add capacity, inflate costs, push prices down and reduce profitability. Hence, if an industry face threat of new entrants, its profit potential would be limited. The threat from new entrants is low if the entry barriers confer an advantage on existing firms and deter new entrants. Entry barriers are high when:

- The new entrants have to invest substantial resources to enter the industry.

- Economics of scale are enjoyed by the industry.

- The government policy limits or even prevents new entrants.

- Existing firms control the distribution channels, benefit from product differentiation in the form of brand image and customer loyalty, and enjoy some kind of proprietary experience curve.

Rivalry among the Existing Firms

Firms in an industry compete on the basis of price, quality, promotion service, warranties etc. If the rivalry between the firms in an industry is strong, competitive moves and countermoves dampen the average profitability of the industry. The intensity of rivalry in an industry tends to be high when:

- The number of competitors in the industry is large.

- At least a few firms are relatively balanced and capable of engaging in a sustained competitive battle.

- The industry growth is sluggish, prodding firms to strive for a higher market share.

- The industry confronts high exit barriers.

- The industry’s product is regarded as a commodity or near-commodity, stimulating strong price and service competition.

Pressure from Substitute Products

All the firms in an industry face competition from industries producing substitute products. The substitute goods may limit the profit potential of the industry by imposing a ceiling on the prices that can be charged by the firms in the industry. The threat from substitute products is high when:

- The price-performance trade off offered by the substitute products is attractive.

- The switching costs for prospective buyers are minimal.

- The substitute products are being produced by industries earning superior profits.

Bargaining Power of Buyers

Buyer is a competitive force. They can bargain for a price cut, ask for superior quality and better services and induce rivalry among competitors. If they are powerful, they can depress the profitability of the supplier industry. The bargaining power of a buyer group is high when:

- Its purchases are large relative to the sales of the seller.

- Its switching costs are low.

- It poses a strong threat of backward integration.

Bargaining Power of Suppliers

Suppliers, like buyers, can exert a competitive force in an industry as they can raise prices, lower quality and curtail the range of free services they provide. Powerful suppliers can hurt the profitability of the buyer industry. Suppliers have strong bargaining power when:

- Few suppliers dominate and the supplier group is more concentrated than the buyer group.

- There are hardly any viable substitutes for the products supplied.

- The switching costs for the buyers are high.

- Suppliers do present a real threat of forward integration.

Techniques for Evaluating Relevant Industry Factors

The techniques (long term and short term) for evaluating industry factors are explained in the following sections. These are:

End-Use and Regression Analysis

End-use analysis for product demand analysis refers to a process whereby the analyst attempts to diagnose the factors that determine the demand for output of the industry. In a single product firm, units demanded multiplied by price will equal sales revenue. The analyst frequently forecast the factors like disposable income, per capita consumption, price elasticity of demand etc. that influence the demand of the product.

For studying the relationship between various variables simple linear regression analysis and correlation analysis is used. Industry sales against time, industry sales against macroeconomic variables like a gross national product, personal income disposable income and industry earnings overtime may be regressed. When two or more independent variables are better able to explain variability in the dependent variables, multiple regression analysis is used.

Input Output Analysis

It is a way of getting inside demand analysis or end-use analysis. It reflects the flow of goods and services through the economy including intermediate steps in the production process as goods proceed from raw material stage to final consumption stage.

Thus input-output analysis observes patterns of consumption at all stages in order to direct any changing patterns or trends that might indicate the growth or decline on industries. This technique is more appropriate for an intermediate or long-term forecast than for short term forecast.

Growth Rate

The growth rate of different industry should be forecasted by considering historical data. Once the growth rate is estimated, future values of earnings or sales may be forecast. Since the growth rate is such an important factor in determining the stock prices, not only its size but its duration must be estimated.

Sometimes, patents expire, competition within an industry becomes more aggressive because foreign firms begin to compete, economically depressed periods occur or other factors cause growth rate to drop.

Read More Articles