What is Holding Company?

A holding company is a company or limited liability company (LLC) which has control over another company. When a company acquires all or majority of shares carrying voting rights or controls the composition of Boards of Directors (BOD), then the acquiring company is known as Holding Company. The company whose shares have been acquired is known as subsidiary company.

Table of Contents

Typically, a holding company doesn’t manufacture anything, sell any products or services, or conduct any other business operations. Rather, holding companies hold the controlling stock in other companies. Although a holding company owns the assets of other companies, it often maintains only oversight capacities.

So while it may oversee the company’s management decisions, it does not actively participate in running a business’s day-to-day operations of these subsidiaries. A Holding Company is also sometimes called an “umbrella” or parent company.

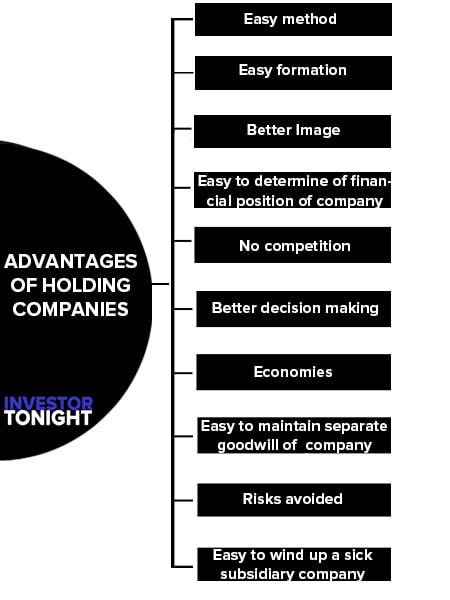

Advantages of Holding Companies

The followings are the advantages to holding companies:

- Easy method

- Easy formation

- Better Image

- Easy to determine of financial position of every company

- No competition

- Better decision making

- Economies

- Easy to maintain separate goodwill of every company

- Risks avoided

- Easy to wind up a sick subsidiary company

Easy method

In this method, with a small investment, a company can acquire control over other company.

Easy Formation

It is quite easy to form a holding company. The promoters can buy the shares in the open market. The consent of the shareholders of the subsidiary company is not required.

Better Image

When holding and subsidiary company work together then their image improve in market. Further more customers will attach with the company.

Easy to determine of financial position of every company

In this method every company i.e. holding company & subsidiary company has to prepare their own accounts. Hence, the determination of financial position of every company becomes easy.

No Competition

Competition between holding and subsidiary companies can be avoided if they are in the same line of business.

Better Decision Making

Working with staff of different company can evaluate the available alternatives with full cost benefits analysis which further increase the decision-making capacity of a company.

Economies

The buying and selling of the holding company and the subsidiaries can be centralized. It can enjoy the advantage of quantity discount and better credit terms because of bulk purchases. It can also get better terms from buyers in case of sales.

Easy to maintain separate goodwill of every company

As every company maintains their separate accounts hence their identities are also different. With different identity it becomes easy to maintain separate goodwill of every company.

Risks Avoided

In case the subsidiaries undertake risky business and fail, the loss does not affect the holding company. It can sell its stakes in the subsidiary company.

Easy to wind up a sick subsidiary company

if any of the subsidiary company continuously facing difficulty in reviving or running in losses, then it can be easily wind up.

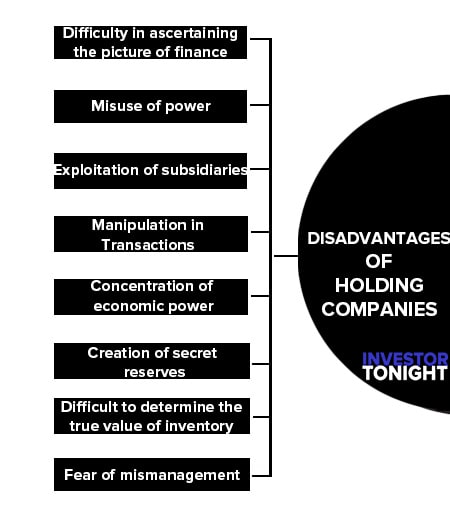

Disadvantages of Holding Companies

The following are the disadvantages of holding companies:

- Difficulty in ascertaining the true picture of financial statement

- Misuse of power

- Exploitation of subsidiaries

- Manipulation in Transactions

- Concentration of economic power

- Creation of secret reserves

- Difficult to determine the true value of inventory

- Fear of mismanagement

Difficulty in ascertaining the true picture of financial statement

All the stakeholder like shareholders of holding company, creditors and outside shareholders in subsidiary company sometimes not aware about the true financial position of the company.

Misuse of power

Sometimes holding company forcefully appoints the directors and other officers into the subsidiary company and fixed their remuneration high. The financial liability of the members of a holding company is insignificant in comparison to their financial power. It may lead to irresponsibility and misuse of power.

Exploitation of subsidiaries

The holding company often compels their subsidiaries to buy goods from the holding at high prices. They might be forced to sell their products to the holding company as very low prices.

Manipulation in Transactions

Information about subsidiaries may be used for personal gains. For example, transaction entered into books at a value either too high or too low as suitable to holding company. Information of the financial performance of subsidiary companies may be misused to indulge in speculative activities.

Concentration of economic power

There is a concentration of economic power in the hands of those who manage the holding company. Such concentration of economic power is harmful to the general economic welfare.

Creation of secret reserves

Secret reserves can be easily created by some directors to detriment the interest of minority shareholders.

Difficult to determine the true value of inventory

As holding and subsidiary companies does so many inter-company transactions related to goods. So, high quantity of goods remains lying in these transactions. It has become difficult to determine the true value of inventories.

Fear of mismanagement

When there are a sharp-minded person working into companies for their self-purpose then the fear of mismanagement increases. They can ruin all the company.

Read More Articles

- What is Accounting?

- Basic Accounting Terminology

- Basic Accounting Concepts

- Accounting Conventions

- Double Entry System

- What is Journal?

- What is Ledger?

- What is Trial Balance?

- What is Activity Based Costing?

- Business, Industry and Commerce

- Shares and Share Capital

- What is Audit of Ledger?

- Forfeiture and Reissue of Shares

- What is Consolidated Financial Statements?

- What are Preference Shares?

- What are Debentures?

- Issue of Bonus Shares

- What is Government Accounting?

- What are Right Shares?

- Redemption of Debentures

- Buy Back of Shares

- Valuation of Goodwill

- What is Valuation of Shares?

- Purchase of Business

- Amalgamation of Companies

- Internal Reconstruction of Company

- What is a Holding company?

- Accounts of Holding Company

- What is Slip System?