What is Government Accounting?

Government accounting refers to all the financial documents and records of public institutions that relate to the collection of taxpayers’ money, and the analysis, control of expenditure, administration of trust funds, management of government stores and all the financial responsibilities and duties of the relevant organs.

Table of Contents

Government accounting system is the way of accountability through which the established institutions of the public render stewardship on the revenue of the Nation and how it has been disbursed.

Government accounting includes the process of recording, analysing, classifying, summarizing, communicating and interpreting financial information about Government in aggregate and in details, recording all transactions involving the receipt, transfer and disposition of public funds and property.

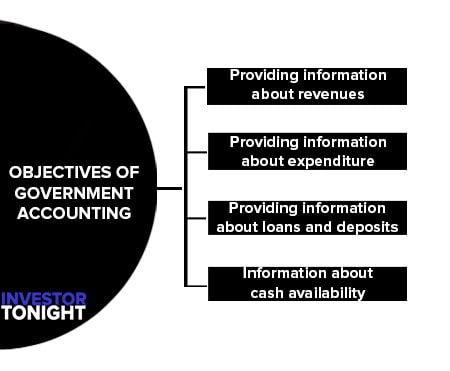

Objectives of Government Accounting

The various objectives of government accounting can be summarised as follows:

- Providing information about revenues

- Providing information about expenditure

- Providing information about loans and deposits

- Information about cash availability

Providing information about revenues

Government accounting aims to provide information about the revenues of the government during the year. The government revenues can be classified into two categories:

- Tax Revenues and

- Non-tax Revenues.

The information about both the types of revenues has to be sufficient in detail to enable the government to estimate the future revenues and decide about the possibility of taking steps for any increase or decrease in revenue. This is possible only when taxes and other revenues are segregated so as to provide information about each one of them with sufficient details.

Providing information about expenditure

Government accounting aims to provide information about the expenditure on different items. This is necessary because Parliament or the State Legislature, as the case may be, will like to know whether the amounts spent by the government on different activities are within the limits sanctioned by it or not.

Providing information about loans and deposits

Government borrows heavy sums from different parties. Similarly it lends money also. Government accounting provides information about the loans and deposits which the government has to pay to its creditors and also debts due by others to the government.

Information about cash availability

This information is necessary to enable the government to run its operations smoothly. Government accounting provides information about the present availability of cash and receipts and payments in the near future. The reconciliation of the government’s bank account with its bankers is also necessary for this purpose.

Difference Between Government Accounting and Commercial Accounting

The Government accounting is different from Commercial accounting because of the difference between the objectives of the government and those of a commercial undertaking.

The main objective of a commercial undertaking is to trade and make profit while the main function of a government is to administer the country and to render various services.

The differences between the two can be summarised as follows:

- System of accounting

- Final accounts

- Classification of accounts

- Independence of accounts and audit function

System of accounting

- The accounts of a commercial concern are usually kept on accrual system and according to the double entry system of bookkeeping. In case of a manufacturing concern appropriate cost records are also maintained to ascertain the cost of production of each product so that its selling price may appropriately be fixed.

Accounts are maintained not only in respect of persons with whom the business has commercial relations but with respect to each asset and liability and each income and expenditure.

The overall objectives of maintaining accounts of a commercial concern is to prepare its Profit and Loss Account and the Balance Sheet. The Profit and Loss Account tells about the profitability while the Balance Sheet discloses the financial position of the business. - The government of a country is more interested in knowing what will be the likely expenditure for administering the country and how it can be collected by way of taxation, loans, etc. so as to impose the least burden on the tax payers. There is no place for profit or loss in government activities.

For example, law and order is not a profit or loss operation nor free education for the children is. Government has, therefore, not to prepare a Profit and Loss Account except for some of its commercial activities carried on by some public sector undertakings.

It is, therefore, of no use to the government to know and record in the books of account the amount of taxes which may be recovered on a distant date in future. It is much more important for the government to know how much cash is available for spending on socially useful activities.

Hence, government accounts are mostly kept on cash basis.

Final accounts

- Every commercial undertaking prepares a Profit and Loss Account and a Balance Sheet at the end of the accounting period. The Profit and Loss Account is a summary of all incomes and expenses including goods purchased and sold for in the business, while the balance sheet contains details of all liabilities and assets of the business.

- In case of Government accounting, no Profit and Loss Account or Balance Sheet is prepared. However, the following two accounts or statements are prepared: (i) Government Account, (ii) Statement of Balancing Accounts.

Government Account is the net result of all income and expenditure including expenditure on capital accounts, while the Statement of Balancing Accounts represents cases where government has either to pay or receive in cash for the amounts already borrowed or loans granted.

Classification of accounts

- In case of commercial accounting, all transactions are classified broadly into three categories of accounts—real, nominal, and personal. However, in case of Government accounting, classification of accounts is in a way more elaborate than Commercial accounting.

In Government accounting there involves broadly three accounts: (i) Consolidated Fund, (ii) Public Account, and (iii) Contingency Fund.

However, there are minute elaborations for recording the financial transactions of the government.

For example, even in the Consolidated Fund there are three main divisions: (i) Revenue and Expenditure Heads, (ii) Capital Receipts and Disbursement Heads, and (iii) Public Debt and Loans and Advances.

Within each division the transactions are grouped into sections which are further divided into major Heads of Account. The major heads are subdivided into minor heads, sub-heads and detailed heads.

Independence of accounts and audit function

In case of Commercial accounting, the audit function is independent of the accounts function; while in case of Government accounting, in most cases, the function both of maintenance of accounts and their audit are handled by the Indian Audit and Accounts Department.

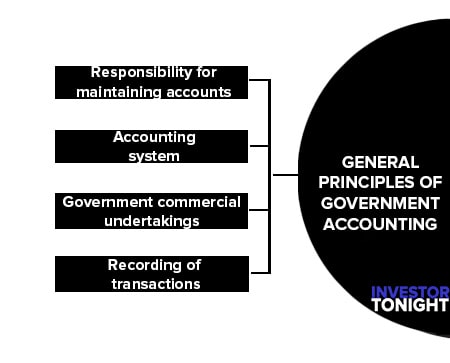

General Principles of Government Accounting

The following are the general principles of Government accounting.

- Responsibility for maintaining accounts

- Accounting system

- Government commercial undertakings

- Recording of transactions

Responsibility for maintaining accounts

The responsibility of maintaining proper government accounts is that of the Indian Audit and Accounts Department except that of the Railways, Defence and transactions outside India. Recently, the practice of maintenance of accounts by the Ministries concerned has also been introduced in some cases.

Accounting system

Government accounts are generally kept according to Single Entry System. However, in respect of those transactions where the government functions as lender, borrower, or remitter, double entry system is also followed to ascertain the exact balances, e.g., accounts relating to public debt, loans and advances, etc.

In case of such transactions, Journal and Ledger are kept and correctness of the balances is verified by preparing a Trial Balance.

Government commercial undertakings

In case of commercial undertakings owned by the government, the accounts are maintained on accrual system and according to the double entry system of book-keeping. The Trading and the Profit and Loss Account and Balance Sheet of the undertaking is also prepared.

In order to have an effective control over costs and profits, appropriate management accounting techniques like budgeting, ratio analysis, funds flow analysis, etc. are also used.

Recording of transactions

In case of Government accounting, the transactions are recorded in the initial accounts and consolidated under different heads in such a form that the information is available about the combined results of all the transactions that had taken place during the period.

For instance, the expenditure under establishment and contingencies head is consolidated, duly analysed under various component units into which allotment under these heads had been split up.

Read More Articles

- What is Accounting?

- Basic Accounting Terminology

- Basic Accounting Concepts

- Accounting Conventions

- Double Entry System

- What is Journal?

- What is Ledger?

- What is Trial Balance?

- What is Activity Based Costing?

- Business, Industry and Commerce

- Shares and Share Capital

- What is Audit of Ledger?

- Forfeiture and Reissue of Shares

- What is Consolidated Financial Statements?

- What are Preference Shares?

- What are Debentures?

- Issue of Bonus Shares

- What is Government Accounting?

- What are Right Shares?

- Redemption of Debentures

- Buy Back of Shares

- Valuation of Goodwill

- What is Valuation of Shares?

- Purchase of Business

- Amalgamation of Companies

- Internal Reconstruction of Company

- What is a Holding company?

- Accounts of Holding Company

- What is Slip System?