In the cases of shares quoted in the recognised Stock Exchanges, the prices quoted in the Stock Exchanges are generally taken as the basis of valuation of those shares. However, the Stock Exchange prices are determined generally on the demand-supply position of the shares and on business cycle.

The Stock Exchange may be linked to a scientific recording instrument which registers not its own actions and options but the actions and options of private institutional investors all over the country/world.

Table of Contents

These actions and options are the result of fear, guesswork, intelligent or otherwise, good or bad investment policy and many other considerations. The quotations what result definitely do not represent valuation of a company by reference to its assets and it’s earning potential.

Valuation of share is the most complex of the accounting problems, although various tax laws have made specific provisions for the valuation of share and have laid down the exact procedure to be followed.

The share capital is the most important requirement of a business. It is divided into a ‘number of indivisible units of a fixed amount. These units are known as ‘shares’.

According to Section 2 (46) of the Companies Act, 1956, a share is a share in the share capital of a company and includes stock except where a distinction stock and shares are expressed or implied. The person who is the owner of the shares is called ‘Shareholder’ and the return he gets on his investment is called ‘Dividend’.

The meaning of value may be subjective and objective. Value of a pen for an examinee in the examination hall is subjective, called ‘value-in-use. Its value for a buyer is the monetary value, i.e., its price is objective value, called ‘value-in-exchange’.

Value of a share means the money value attached to the share. It may be the book value (value written in the books of account), or the price at which it can be sold or purchased. The value of a share is first stated in the Articles of Association of the Company.

It is also stated in the Balance sheet of all companies. The value, stated in the Balance Sheet (or in the books of account and Articles of Association) is called ‘book-value of a share. The value of a share (the price) at which it can be sold or purchased is a market value that may be more or less than the book value.

The problems relating to the valuation of shares may be discussed under the following broad heads:

- Valuation of Equity Shares.

- Valuation of Preference Shares.

The importance of valuation of shares can be understood from the following:

- Stock Exchange quoted value often fails to reflect the real worth of share. This is applicable only to ordinary transactions of shares, when a small number of shares are purchased or sold. Quoted price is not suitable for purchase or sale of major or controlling shares.

Further, all shares are not quoted on Stock Exchange. Hence, valuation of unquoted shares is also necessary for transferring shares from one person to another person. - The importance of valuation of shares also arises in case of amalgamation of companies when there is the need for having a fair valuation of shares to settle the purchase price.

- Sometimes preference shares and debentures are converted into equity shares as per the terms of issue. In such case, a fresh valuation method should be adopted for equity shares to calculate the exchange ratio.

- To obtain loans from financial institutions shares and debentures can be offered as security. For such a purpose valuation of shares is essential to assess the real worth of the shares pledged for getting loans.

- When a Public Sector Undertaking is converted into a limited company by means of public issue of shares of such undertaking, valuation of these shares becomes essential.

When the shares of a limited company are taken over by the government under a scheme of nationalisation, it is necessary to value the shares of the concerned company in order to compensate the shareholders.

The need for valuation of shares may be felt by any company in the following circumstances:

- When shares are received as gift, it is necessary to valuation of shares for the purpose of assessing tax on the gift.

- For assessment of Wealth Tax, Estate Duty etc.

- Amalgamations, absorptions, internal reconstruction schemes.

- For purchase and sale of private companies and other unquoted shares.

- For converting one class of shares to another class.

- Advancing loans on the security of shares.

- Compensating the shareholders on acquisition of shares by the Government under a scheme of nationalisation.

- Acquisition of interest of dissenting shareholder under the reconstruction scheme.

- For the valuation of shares held by a trust or an investing company.

The issues relating to the valuation of shares may be discussed under the following broad heads:

Net Asset Method

This method is also called as Assets Backing Method, Real Value Method, Balance Sheet Method or Break-up Value Method. Under this method, the net assets of the company including goodwill and nontrading assets are divided by the number of shares issued to arrive at the value of each share.

If the market value of the assets is available, the same is to be considered and in the absence of such information, the book values of the assets shall be taken as the market value.

Value of Share = Net Assets / Number of Equity Shares

First Method

| Assets at Market Value: | D | |

| Goodwill, Land and Building, Plant and Machinery, Inventory, Sundry Debtors, Bills Receivables etc. | — | |

| Less: Outstanding Liabilities:- | ||

| Debentures | — | — |

| Trade Payables | — | — |

| Other Liabilities | — | — |

| Total | ||

| Less: | ||

| Preference Share Capital | — | |

| Value of Net Assets available for Equity Shareholders | — | |

| Total |

| Equity Share Capital | ||

| Reserve & Surplus | — | |

| Accumulated Profits | — | |

| Profit on revaluation of assets | — | |

| Total | ||

| Less: | ||

| Accumulated Losses | — | |

| Preliminary Expenses | — | |

| Value of Net Assets available for Equity Shareholders | Total |

Points to Note:

- While arriving at the net assets, the fictitious assets such as preliminary expenses, the debit balance in the Profit and Loss A/c should not be considered.

- The liabilities payable to the third parties and to the preference shareholders is to be deducted from the total asset to arrive at the net assets.

- The funds relating to equity shareholders such as General Reserve, Profit and Loss Account, Balance of Debenture Redemption Fund, Dividend Equalisation Reserve, Contingency Reserve, etc. should not be deducted.

Applicability of Net Asset Method method:

- The permanent investors determine the value of shares under this method at the time of purchasing the shares;

- The method is particularly applicable when the shares are valued at the time of Amalgamation, Absorption and Liquidation of companies; and

- This method is also applicable when shares are acquired for control motives.

- Provisions of various tax laws (wealth tax rules) provide for this method valuing the shares.

Disadvantages of Net Asset Method

- This method applicable in case of liquidation of company. Since company is treated as a going concern and where there is no possibility of its liquidation in the near future, this method is far from reality.

- This method does not take into consideration the profit of the company.

- Due to personal bias it is difficult to calculate market value of assets.

- This method ignore various factors such as financial ratios, nature of business, management of company, future prospect of the company which have impact on value of shares.

Dividend Yield Method

Under the dividend yield method, the emphasis goes to the yield that an investor expects from his investment. The yield, here we mean, is the possible return that an investor gets out of his holdings – dividend, bonus shares, right issue. If the return is more, the price of the share is also more.

Under this method, the valuation of shares is obtained by comparing the expected rate of return with a normal rate of return. The formula is:

Value of Share = (Expected Rate of Dividend / Normal Rate of Dividend) × Paid up value of Share

For instance, if paid up value of a share is ₹100 and expected rate of return is 9% while normal rate of return is 6%, then the value of shares will be:

(9/6) ×100 = ₹150

Yield is the effective rate of return on investments which is invested by the investors. It is always expressed in terms of percentage. Since the valuation of shares is made on the basis of Yield, it is called Yield-Basis Method.

For example, an investor purchases one share of ₹ 100 (face value and paid-up value) at ₹ 150 from a Stock Exchange on which he receives a return (dividend) @ 20%.

For calculating value of share under dividend yield method following two elements should be ascertained:

Ascertained Expected Rate of Dividend: For this amount available for distribution among equity shareholders is calculated by following way:

| Profit of the Company | ||

| Less: | ||

| Income Tax | —- | |

| Transfer to Reserve | —- | |

| Transfer to debenture sinking fund | —- | |

| Preference Share dividends | —- | —- |

| Profit available for distribution among equity shareholders | —- |

This amount is divided by the paid up equity capital to ascertain expected rate of dividend:

Expected Rate of Dividend = (Profit available for distribution among equity shareholders/ Paid up equity capital) x 100

Ascertained Normal Rate of Dividend: Normal rate of dividend is no need for calculation as is already stated in the question.

Limitations of Dividend Yield Method

Following are some limitations of dividend yield method:

- This method gives too much weightage to the dividend factor. If a company earns huge profits but not giving dividend the value of share according to this method will be nil.

- Similarly, financially weak company paying high dividend this method will give a higher value to the share of company.

- If this method is used for valuing share, value can be manipulated by increasing or decreasing the rate of dividend by the directors.

- This method not consider assets of the company.

- This method ignore various other factor having impact on value of share such as Govt. policy, future prospects of the company.

- In practice it is very difficult to expected and normal rate of dividend.

Applicability of Dividend Yield Method

- This method is suitable for those investors who wished to hold the shares for short term and the objective is to get dividends.

- Where rate of dividend does not change frequently and dividend declared related with profits.

- When company is regularly paying dividends and having no past losses.

- When company has no plan for liquidation in near future.

- When information related to expected dividend is readily available.

Earning Yield Method

The main drawback of dividend yield method was that valuation of share depends on actual dividend declared by a company and also ignores the earning capacity of the business. Sometimes better managed companies retained their earned and distributed in later in form of bonus shares, so it is appropriate to value the share on the basis of company’s earnings rather than dividend.

Therefore in earning capacity method rate of earning of company is compared with normal rate of return prevailing in a similar industry. The formula is:

Value of Share = (Rate of Earnings / Normal Rate of Return) x Paid up value per share

For calculating the value of share with earning capacity method you have to ascertain following two elements:

Rate of Earnings:Estimated future earnings are expressed as a percentage of capital employed for the company. The formula is:

Rate of Earnings = (Profit Earned / Capital Employed) × 100

Estimated future earning: It is calculated by making certain adjustments in the past profits:-

| Past profits must be adjusted in the light of following future expectations: |

| Add: • Abnormal Loss • Income expected in future • Stoppage of future expenses |

| Less: • Abnormal Gains / Profits • Income from Investments • Non-operating Income • Operating Expenses expected to be incurred in future • Stoppage of future earnings |

| Adjustment: • Managerial Remuneration: It can be added of can be deducted on the basis of managerial remuneration paid in future. If it is estimated to be paid in future is in excess, it should be deducted. If estimated to be paid in future is less, it should be added. • Income Tax: Average profits should be calculated after deducting tax at current rates. |

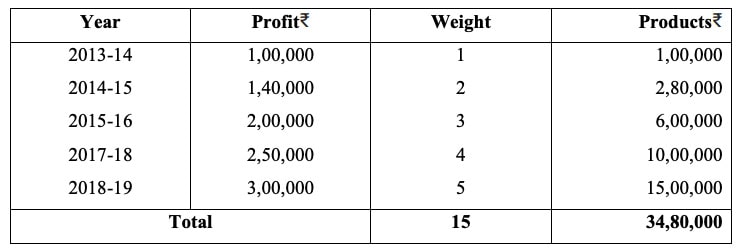

Notes: If past profits are in increasing trend, then calculate Average Profit by weighted average method or otherwise simple average method.

Calculation of Weighted Average Profit: If profits are continuously increasing weighted average profit is calculated for valuing goodwill. For this higher weightage is given to the recent year of profits and lower to the far year’s profit e.g. profit of 2019-20 could be similar to the profits of 2018-19 as compared to 2013-14 profits. Thereafter profits are multiplied by their weight, then after totalling the whole amount and divide by total weight.

Weighted Average Profit = 34,80,000/15 = ₹ 2,32,000

While calculating future maintainable profits following factors must be taken in to consideration:

- Change in management of company

- Change in economic conditions

- Change in structure of company

- Change in government policy

- Change in demand of product of company

Capital Employed: While calculating capital employed following points should be considered on the basis of balance sheet items:

| Calculation of Capital Employed |

| Add All fixed and current assets at current market price: Note: • Fictitious assets such as Share issue expenses, discount of issue of debentures, advertisement expenditure, underwriting commission should not be included. • Investment is the amount invested outside the business and in the nature of non-trading assets, therefore should not be include in assets. |

| Deduct: • Current Liabilities such as Creditors, Bills Payable, Bank Overdraft, Outstanding expenses, Provision for taxation etc. |

| Capital Employed = All Fixed Assets – Current Liabilities |

Note: Profit should be figure before debenture interest and preference dividend. If these are already deducted from profit then same must be added back.

Average Method

None of method discussed earlier give a true and fair value of the share due to much difference in the value of share calculated by different methods. Therefore, it is suggested that valuation may be done by any two methods and be averaged to find out the value of share. This average value is considered Fair Value of the share.

The value of share of a company depends on so many factors such as:

- Earning capacity of the company: In this regard average profit earned by company in past, lowest and highest profit earned in past, average rate of return on capital employed, profit after tax and preference dividends, and events that affect the profits are considered.

- Dividend Policy of the company: Payment of dividend plays an important role in the valuation of share, where an investors hold bulk of shares in a position to influence the rate of dividend. Therefore, distributable profits play an important role in the valuation of shares.

- Financial Ratios: A company having better financial ratios such as Current Ratio, Debt-Equity ratio, ROE is always favoured by the investors.

- Nature of Business: Nature of company’s business affects the value of shares a lot. If company is doing a business having better future growth, have positive impact on value of share of the company.

- Record of efficiency, integrity and honesty of Board of Directors and other managerial personnel of the company.

- Quality of top and middle management of the company and their professional competence.

- Record of performance of the company in financial terms.

- Economic policies of the Government.

- Demand and supply of shares.

- Rate of dividend paid.

- Yield of other related shares in the Stock Exchange, etc.

- Net worth of the company.

- Earning capacity.

- Quoted price of the shares in the stock market.

- Profits made over a number of years.

- Extent of competition

- Future prospects of the company.

- Dividend paid on the shares over a number of years.

- Prospects of growth, enhanced earning per share.

- Availability of reserves and future prospects of the company

- Realisable value of the net assets of the company.

- Current and deferred liabilities for the company

Read More Articles

- What is Accounting?

- Basic Accounting Terminology

- Basic Accounting Concepts

- Accounting Conventions

- Double Entry System

- What is Journal?

- What is Ledger?

- What is Trial Balance?

- What is Activity Based Costing?

- Business, Industry and Commerce

- Shares and Share Capital

- What is Audit of Ledger?

- Forfeiture and Reissue of Shares

- What is Consolidated Financial Statements?

- What are Preference Shares?

- What are Debentures?

- Issue of Bonus Shares

- What is Government Accounting?

- What are Right Shares?

- Redemption of Debentures

- Buy Back of Shares

- Valuation of Goodwill

- What is Valuation of Shares?

- Purchase of Business

- Amalgamation of Companies

- Internal Reconstruction of Company

- What is a Holding company?

- Accounts of Holding Company

- What is Slip System?