What is Tax Planning?

Tax planning is the analysis of one’s financial situation from a tax efficiency point of view so as to plan one’s finances in the most optimized manner. Tax planning allows a taxpayer to make the best use of the various tax exemptions, deductions and benefits to minimize their tax liability over a financial year.

Table of Contents

This process varies from person to person and depends, among many factors, taxable income, time schedule for investments, risk-bearing inclination, existing investment pattern, expected returns etc.

Over the years, the tax planning scenario has become more dynamic and complicated, due to constant changes in the tax laws and falling interest rates. Further tax planning cannot be done in isolation; it should be a part of overall Financial Planning.

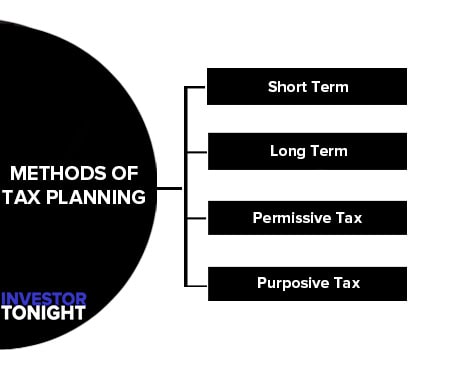

Methods of Tax Planning

Various methods of tax planning may be classified as follows:

Short Term Tax Planning

Short-range Tax Planning means the planning thought of and executed at the end of the income year to reduce taxable income in a legal way.

Example: Suppose, at the end of the income year, an assessee finds his taxes have been too high in comparison with last year and he intends to reduce it. Now, he may do that, to a great extent by making proper arrangements to get the maximum tax rebate u/s 88. Such a plan does not involve any long term commitment, yet it results in substantial savings in tax.

Long Term Tax Planning

Long-range tax planning means a plan called out at the beginning of the income year to be followed around the year. This type of planning does not help immediately as in the case of short-range planning but is likely to help in the long run; e.g.

If an assessee transferred shares held by him to his minor son or spouse, though the income from such transferred shares will be clubbed with his income u/s 64, yet is the income is invested by the son or spouse, then the income from such investment will be treated as income of the son or spouse. Moreover, if the company issued any bonus shards for the shares transferred, that will also be treated as income in the hands of the son or spouse.

Permissive Tax Planning

Permissive Tax Planning means making plans which are permissible under different provisions of the law, such as planning of earning income covered by Sec.10, especially by Sec. 10(1), Planning of taking advantage of different incentives and deductions, planning for availing different tax concessions etc.

Purposive Tax Planning

It means making plans with the specific purpose to ensure the availability of maximum benefits to the assessee through correct selection of investment, making suitable programme for replacement of assets, varying the residential status and diversifying business activities and income etc.

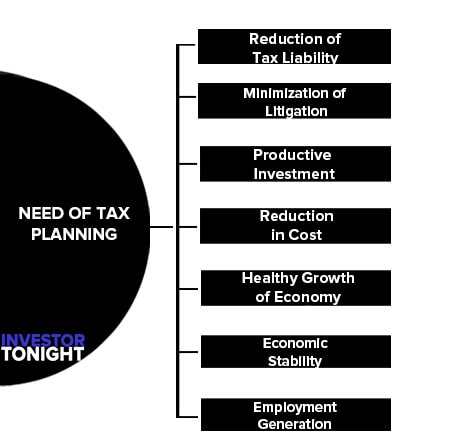

Need of Tax Planning

Tax Planning is the honest and rightful activity to minimize the tax burden of various persons. The needs and significances of tax planning were discussed below:

- Reduction of Tax Liability

- Minimization of Litigation

- Productive Investment

- Reduction in Cost

- Healthy Growth of Economy

- Economic Stability

- Employment Generation

Reduction of Tax Liability

The basic need of tax planning is to reduce tax liability by arranging his affairs in accordance with the requirements of the law, as contained in the fiscal statutes. In many cases, a taxpayer may suffer heavy taxation not on account of the dosage of tax administered by the Act, but, because of his lack of awareness of the legal requirements.

Minimization of Litigation

There is always a tug-of-war between taxpayers and tax administrators. Taxpayers try to pay the least tax and the tax administrators attempt to levy higher amounts of tax. Where proper tax planning is adopted by the taxpayer in conformity with the provisions of the taxation laws, the incidence of litigation is minimized.

Productive Investment

Channelization, of taxable income to the various investment schemes, is one of the prime purposes of tax planning as it is aimed to attain twin objectives of:

- Harnessing the resources for socially productive projects.

- Relieving the tax payer from the burden of taxation, converting the earnings into means of further earnings.

Reduction in Cost

The reduction of tax by tax planning reduces the overall cost. It results in more sales, more profit and more tax revenue.

Healthy Growth of Economy

Healthy growth of economy: The growth of a nation’s economy is synonymous with the growth and prosperity of its citizens. In this context, a saving of earnings by legally sanctioned devices fosters the growth of both.

Tax-planning measures are aimed at generating white money having a free flow and generation without reservations for the overall progress of the nation. On the other hand tax evasion results generation of black money, the evils of which are obvious. Tax planning thus assumes a great significance in this context.

Economic Stability

Tax planning results in economic stability by way of:

- Availing of avenues for productive investments by the tax payers.

- Harnessing of resources for national projects aimed at general prosperity of the national economy.

- Reaping of benefits even by those not liable to pay tax on their incomes.

Employment Generation

Tax planning creates employment opportunities in different ways. Firstly, efficient tax planning requires some sort of expertise that creates job opportunities in the form of advisory services. Secondly, the amount saved through tax planning is generally invested in the commencement of new business or the expansion of existing business. This creates new employment opportunities.

Precautions in Tax Planning

Successful tax planning techniques should have following attributes:

- It should be based on up to date knowledge of tax laws. Assessees must have an up to date knowledge of the statute he must also be aware of judgments of the courts, the circulars, notifications, clarifications and Administrative instructions issued by the CBDT from time to time.

- The disclosure of all material information and furnishing the same to the income-tax department is an absolute pre-requisite of tax planning the concealment in any form would attract the penalty often ranging from 100 to 300% of the amount of tax sought to be evaded. Section 271(1)(c) read together with explanations there to.

- Foresight is the essence of a business and the tax planning should also reflect this essence. Tax regimeis flexible in nature and tax planning model must also be flexible so that it could be scrutinized in relative situations.

- Tax planning should not be based on tax avoidance.

- Tax planning cannot be attempted in isolation. While doing tax planning we have to consider the violation of other laws.

Types of Tax Planning

The types tax planning exercise ranges from devising a model for the specific transaction well as for systematic corporate planning. These are:

Short Range Planning and Long Range Planning

Short Range

Short range planning refers to year to year planning to achieve some specific or limited objective. For example, an individual assessee whose income is likely to register unusual growth in a particular year as compared to the preceding year may plan to subscribe to the PPF/NSC’s within the prescribed limits in order to enjoy substantive axe relief.

By investing in such a way, he is not making a permanent commitment but is substantially saving in the tax. It is one of the examples of short-range planning.

Long Range

Long range planning on the other hand, involves entering into activities, which may not pay off immediately. For example, when an assessee transfers his equity shares to his minor son he knows that the Income from the shares will be clubbed with his own income. But clubbing would also cease after the minor attains the majority.

Permissive Tax Planning

Permissive tax planning: Permissive tax planning is tax planning under the expressed provisions of tax laws. Tax laws of our country offer many exemptions and incentives.

Purposive Tax Planning

Purposive Tax planning: Purposive tax planning is based on measures that circumvent the law. The permissive tax planning has the express sanction of the Statute while the purposive tax planning does not carry such sanction.

For example, under Sections 60 to 65 of the Income-tax Act, 1961 the income of the other persons is clubbed in the income of the assessee. If the assessee is in a position to plan in such a way that these provisions do not get attracted, such a plan would work in favour of the taxpayer because it would increase his disposable resources. Such a tax plan could be termed as ‘Purposive Tax Planning.

Difference Between Tax Avoidance and Tax Evasion

Tax Avoidance

Tax avoidance is a method of reducing tax incidence by availing of certain loopholes in the law. The Royal Commission on Taxation for Canada has explained the concept of tax avoidance as under:

For our purposes, the expression “Tax Avoidance” will be used to describe every attempt by legal means to prevent or reduce tax liability which would otherwise be incurred, by taking advantage of some provisions or lack of provisions of law. It excludes fraud, concealment or other illegal measures.

Tax Evasion

It refers to a situation where a person tries to reduce his tax liability by deliberately suppressing the income or by inflating the expenditure showing the income lower than the actual income and resorting to various types of deliberate manipulations.

An assessee guilty of tax evasion is punishable under the relevant laws. Under direct tax laws provisions have been made for the imposition of heavy penalty and institution of prosecution proceeding against tax evaders.

The tax evaders reduce his taxable income by one or more of the following steps:

- Non-disclosure of capital gains on sale of asset.

- Non-disclosure of income from ‘Binami transactions’.

- Willfully unrecording or partial recording of incomes. Eg: sales, rent, fees, etc.

- Charging personal expenses as business expenses. Eg: car expenses, telephone expenses, medical expenses incurred for self or family recorded in business books.

- Submission of bogus receipts for charitable donations under section 80 G.

Difference Between Tax Avoidance and Tax Evasion

| Basis | Tax Planning | Tax Avoidance | Tax Evasion |

| Meaning | Way of minimizing tax liability by availing full advantages of the Act through exemptions, deductions, rebates and relief. | The assessee legally takes advantage of loopholes in the tax laws | Illegal way reducing tax liability by deliberately suppressing incomes or hiking expenditures. |

| Aim of Practice | Saving of tax. | Hedging of tax | Concealment of tax. |

| Nature | Moral in nature. | Immoral in nature and bends the law without breaking it. | llegal and objectionable. |

| Result | Advantages arise in the long run. | Advantages arise in the short run. | Penalty and Prosecution. |

| Legal Implications | Uses benefits of the law. | Loopholes in the law. | Overrules the law. |

Tax Management

Tax management refers to compliance with income tax rules and regulations. Tax management covers matters relating to:

- Taking steps to avail various tax incentives.

- Compliance with tax rules and regulations (including timely filing of return).

- Protecting from consequences of non-compliance of tax rules and regulations. i.e. penalties, prosecution etc.

- Review of departments orders and if need apply for rectification of mistake, filing appeal, tax revision or settlement of tax cases.

Areas of Tax Management

Important areas of tax management are discussed below:

- TDS (Tax Deducted at Source)

- Payment of Tax

- Maintenance of Books of Accounts

- Audit of Books of Accounts

- Furnishing Return of Income

- Documentation and Maintenance of Tax Records

- Review of Orders of Income Tax Department

TDS (Tax Deducted at Source)

TDS (Tax Deducted at Source): Persons responsible for deducting tax at source should deduct from the income and that should be paid to the central government on time. Moreover, he should issue a deduction certificate to the deductee’s and file it on the income tax website.

Collection of Tax at Source

Collection of tax at source: In some special cases, some persons are responsible for collecting the tax at the source from the buyers (sec 206C). They should comply with those formalities.

Payment of Tax

Payment of tax: It includes (a) Payment of advance tax, (b) Payment of tax on self-assessment. (c) Payment of tax on demand (payment after receiving notice from authorities).

Maintenance of Books of Accounts

Maintenance of books of accounts: Every businessman or a professional must maintain books of accounts and other relevant documents so that the tax can be computed accurately and verified by the Assessing Officer. Maintenance of account books, vouchers, bills, correspondence and agreements, etc. is a part of tax management.

Audit of Books of Accounts

Audit of books of accounts: If the turnover of the business for the previous year 2015-16 exceeds one crore rupees, the audit of books of accounts is compulsory as per income tax rules. (w.e.f P.Y 2016-17 – 50 lakh). In the case of professional audit is compulsory if the gross receipts are more than 25 lakhs.

Furnishing Return of Income

Furnishing the return of income: The tax manager must ensure that the return of income is furnished on time otherwise the assessee will lose the right to carry forward and set off the losses and become liable to pay interest, penalty, prosecution or fine or both.

Documentation and Maintenance of Tax Records

Documentation and maintenance of tax records: An assessee should keep complete and updated tax files so that the documentary evidence can be made available in case of all queries. Tax files include filed returns, Form 16, documentary evidence in support of deductions, rebate and relief, court orders, etc.

Review of Orders of Income Tax Department

Review of orders of Income Tax Department: Review the assessment orders and other orders received from the tax department is an important function of tax management. If there is any mistake in the order, an application for rectification can be made.

If the order is prejudicial to the interest of the assessee he can file an appeal, revision or application for settlement of the case can be made.

Difference Between Tax Management and Tax Planning

| Tax Planning | Tax Management |

| It is a wider term than tax management. | It is the first step towards tax planning. |

| The aim of tax planning is to minimize tax burden. | The aim of tax management is compliance with legal formalities. |

| It is a guide in decision making. | It is a regular activity. |

| It is not essential for every assessee. | It is essential for every individual. |

| It looks at future benefits out of present actions. | It relates to the past, present and future. |

Read More Articles