What is Securitisation?

Securitization is the process of pooling and packaging Financial Assets, usually relatively illiquid, into liquid marketable securities.

Securitization is an array of conversion of nonmarketable assets into marketable securities. Nonmarketable assets may be in the form of existing assets or future cash flows which are translated into marketable securities.

The conversion of existing assets into marketable securities is known as asset-backed securitisation and the conversion of future cash flows into marketable securities is known as future-flows securitization.

Security means a financial claim in the form of a document which is marketable.

Table of Contents

Securitisation Example

- Car loans, Housing loans etc. – Asset Backed Securities

- Ticket sales, Credit card payments, Car rentals etc. – Future-Flows Securitization

Brief History of Securitisation

During 1970, securitization technique was originated in the US. Initially, the market for securitisation was dominated by home mortgages only. Subsequently, credit cards, home equity loans, student loans and small business loans also came into the picture.

The second-largest market for securitisation is in the UK and it is dominated by residential mortgages, credit cards, consumer loans, commercial real estate and student loans. The Bank of England has played a leading role in evolving guidelines for banking and other authorized institutions in loan transfers and securitisation. Now, the Financial Services Authority (FSA) sets out the policy on securitization and loan transfers.

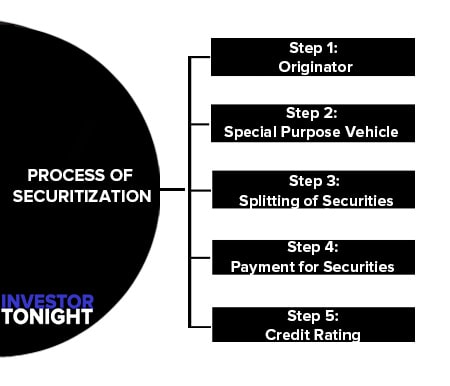

Process of Securitization

The following steps are involved in the process of securitization:

- Step 1: Originator

- Step 2: Special Purpose Vehicle

- Step 3: Splitting of Securities

- Step 4: Payment for Securities

- Step 5: Credit Rating

Step 1: Originator

In the first step, the banker or financial institution is called the originator. The originator segregates loans/lease/receivables into pools which are relatively homogenous in regard to types of credit, maturity and interest rate risk.

Step 2: Special Purpose Vehicle

The pools of assets are transferred to a Special Purpose Vehicle (SPV) usually constituted as a trust. It may be floated either as a subsidiary in the form of a limited company or jointly by the originator/individuals/banks/institutions (merchant bankers) who are interested in the securitization deal.

Step 3: Splitting of Securities

The SPV splits various assets and issues asset-backed securities (pass-through certificate or pay through certificate) in the form of debt, certificates of beneficiary ownership and other instruments with or without recourse according to their maturity date and interest rate.

Step 4: Payment for Securities

Interest and principal payments on the loans, leases and receivables in the underlying pool of assets are collected by the servicer (who could also be the originator) and transmitted to the investors.

Step 5: Credit Rating

A pass through certificates or pay-through certificates are to be rated by credit rating agency when issued to the public. It is mandatory in some countries. This debt instruments can also be traded in the secondary market particularly for interest swap.

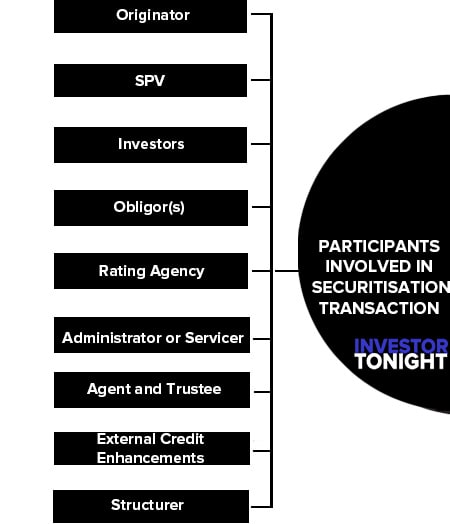

Participants Involved in Securitisation Transaction

Primarily, three parties are involved in the process of securitization transaction namely originator, SPV and investor.

- Originator

- SPV

- Investors

- Obligor(s)

- Rating Agency

- Administrator or Servicer

- Agent and Trustee

- External Credit Enhancements

- Structurer

Originator

This is the entity on whose books the assets to be securitised exist and is the prime mover of the deal. The entity designs the necessary structures to execute the deal. In a true sale of the assets, the Originator transfers both the legal and the beneficial interest in the assets to the SPV.

SPV

This entity is the issuer of the bond/security paper and is typically a low-capitalized entity with narrowly defined purposes and activities. It usually has independent trustees/directors. The SPV buys the assets to be securitised from the Originator, holds the assets in its books and makes an upfront payment to the Originator.

Investors

The investors could be either individuals or institutions like financial institutions (FIs), mutual funds, pension funds, insurance companies, etc. The investors buy a participating interest in the total pool of assets and receive their payments in the form of interest and principal as per an agreed pattern.

Apart from these three primary players, others involved in a securitisation transaction include:

Obligor(s)

The obligor is the Originator’s debtor or the borrower of the original loan. The credit standing of the Obligor is very important in a securitisation transaction, as the amount outstanding from the Obligor is the asset that is transferred to the SPV.

Rating Agency

The rating process assesses the strength of the cash flows and the mechanism designed to ensure full and timely payment. In this regard the rating agency plays an important role as it assesses the process of selection of loans of appropriate credit quality, the extent of credit and liquidity support provided and the strength of the legal framework.

Administrator or Servicer

Also called as the receiving and paying agent, it collects the payment due from the Obligor(s) and passes it to the SPV. It also follows up with delinquent borrowers and pursues legal remedies available against defaulting borrowers.

Agent and Trustee

It oversees that all the parties involved in the securitisation transaction perform in accordance with the securitisation trust agreement. Its principal role is to look after the interests of the investors.

External Credit Enhancements

Underwriters sometimes resort to external credit enhancements to improve the credit profile of the instruments. There are various types of external credit enhancements such as surety bonds, third-party guarantees, letters of credit (LC) etc.

Structurer

Normally, an investment banker is responsible for bringing together the Originator, credit enhancer, the investors and other partners to a securitisation deal. He also helps in structuring the deals along with the Originator.

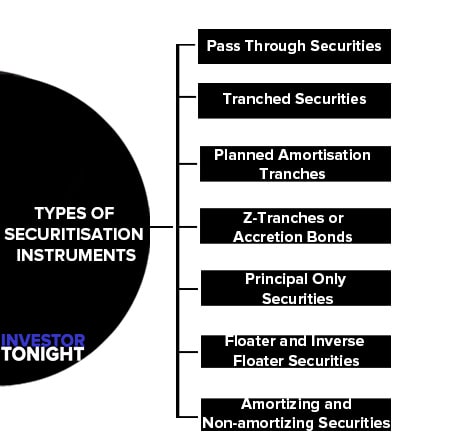

Types of Securitisation Instruments

- Pass Through Securities

- Tranched Securities

- Planned Amortisation (PAC) Tranches

- Z-Tranches or Accretion Bonds

- Principal Only (PO) Securities

- Floater and Inverse Floater Securities

- Amortizing and Non-amortizing Securities

Pass Through Securities

Also known as participation certificates, it represents direct ownership interest in the underlying asset pool. All the periodic payments of principal and interest are collected by the servicer and passed on to the investors. In this structure there is no modification of the cash flow as it is received from the obligor(s).

Tranched Securities

In this type of security, the cash flows from the obligors are prioritized into tranches. The first tranche receives the first priority of payment followed by subsequent tranches.

Planned Amortisation (PAC) Tranches

A principal sinking fund is created that takes care of prepayments beyond a certain band. This ensures the stability of cash flows and hence offers lower yields compared to similar tranches without a sinking fund.

Z-Tranches or Accretion Bonds

No interest is paid during a certain period (lockout period) during which the face value of the bond increases due to accrued interest. After the lock-out period, the tranche holders start receiving interest and principal payments.

Principal Only (PO) Securities

The PO investors receive only the principal component of the underlying loans. These bonds are usually issued at a deep discount to their face value and redeemed at face value. f) Interest Only (IO) Securities: The IO investors receive only the interest component of the underlying loans. These securities have no face or par value and its cash flow diminishes as the principal is repaid or prepaid.

Floater and Inverse Floater Securities

The floater and inverse floaters are instruments that pay a variable interest rate linked to an index such as LIBOR. The Floater pays an interest rate in the same direction of interest rate movements while a reverse floater pays an interest rate in the opposite direction of the interest rate movements.

Amortizing and Non-amortizing Securities

The principal repayment for instruments issued could be done either by a) repaying the total amount at maturity, or b) throughout the life of the security. The latter refers to a schedule of payments called amortisation schedule and securities issued under this are called amortizing securities. Loans having this feature include car & home loans.

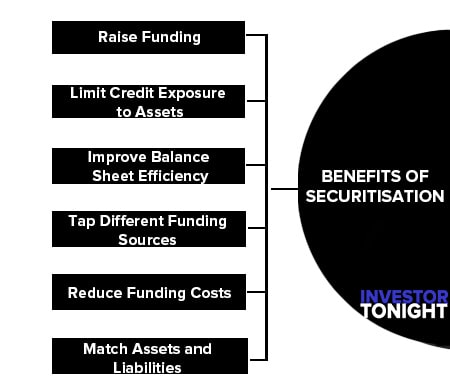

Benefits of Securitisation

- Raise Funding

- Limit Credit Exposure to Assets

- Improve Balance Sheet Efficiency

- Tap Different Funding Sources

- Reduce Funding Costs

- Match Assets and Liabilities

Benefits of Securitisation to Originators

Originators – including corporates, banks and public sector entities—securitize their assets for a variety of different reasons. The following is a non-exhaustive list of common reasons for securitisation:

Raise Funding

Raise funding in the form of the purchase price to be paid by the SPV upon the sale and transfer of the securitized assets;

Limit Credit Exposure to Assets

Typically, following securitisation the Originator’s credit exposure will be limited to any credit enhancement it may provide. In the case of banks, this may allow them to obtain regulatory capital relief. At the same time, the Originator usually retains the ability to extract future profits from the assets;

Improve Balance Sheet Efficiency

A true sale securitisation may move the assets off the Originator’s balance sheet, contributing to an improvement of the relevant balance sheet ratios. For instance, to the extent that proceeds of the securitisation are used to repay existing liabilities, this may reduce the Originator’s leverage;

Tap Different Funding Sources

Securitisation allows the Originator to diversify its funding sources away from banks and tap the capital markets (almost) directly, without having to issue securities on its own. Originators who already have established direct access to the capital markets (e.g., companies who have already issued corporate bonds) sometimes enter into securitisations to demonstrate to the capital markets that securitisation is available to them as a source of funding and to access different types of investors;

Reduce Funding Costs

The weighted average cost of the securitisation may be lower than the cost of the Originator’s current bank or other debt. Notably, this is often the case if the credit quality of the securitised assets is higher than the credit quality of the Originator’s balance sheet as a whole;

Match Assets and Liabilities

Securitisation provides a more flexible method by which assets and liabilities can be matched).

Benefits of Asset-backed Securities to Investor

Investors in asset-backed securities can benefit in a number of ways, including the following:

- Through assed-backed securities, they can invest in asset classes and risk tranches of their choice and generate the associated returns. This offers investors the opportunity to optimise the structure their portfolios and access markets which otherwise they could not invest in;

- asset-backed securities have historically often been less volatile as compared to corporate bonds;

- asset-backed securities have been known to offer a yield premium over comparably rated government, bank and corporate bonds;

- asset-backed securities are usually not susceptible to event risk or the risk of a rating downgrade of a single borrower.

It is worthwhile to note that securitisation is generally not specifically perceived as a tax-efficient structure. Typically, the parties seek to keep the effects of securitisation on the participants’ tax position (including income and value-added tax neutral.

Read More Articles