What is Consolidated Financial Statements?

A consolidated financial statement is financial statement, which represents the financial information of holding company and its subsidiary company as a single entity. It is presented by a parent company for its subsidiary under its control. It intended to show the assets and liabilities of all the companies of a holding company.

Table of Contents

ICAI had issued Accounting Standard -21 in respect of ‘Consolidated Financial Statement’ which came into effect of accounting periods commencing on or after 1.4.2001. A parent company should prepare and present these financial statements in addition to its regular financial statements as per this standard.

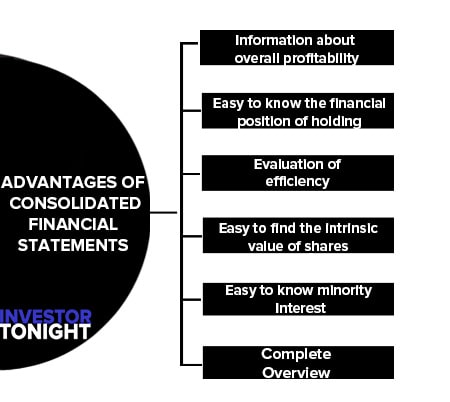

Advantages of Consolidated Financial Statements

The followings are the advantages of consolidated financial statements:

- Information about overall profitability

- Easy to know the financial position of holding and its subsidiaries

- Evaluation of efficiency

- Easy to find the intrinsic value of shares

- Easy to know minority Interest

- Complete Overview

Information about overall profitability

There can be some mutual indebtedness in holding and its subsidiaries. Profitability of holding and all its subsidiaries can be determined by consolidation. Here internal and external users of financial information can make their judgement about the company that they should invest or not.

Easy to know the financial position of holding and its subsidiaries

True financial position of holding and each of its subsidiaries can be determined with consolidation of financial statement.

Evaluation of efficiency

Efficiency of holding and its subsidiaries can be evaluated with the help of consolidation of financial statements. Investors can use these information to know the past trend and future trends.

Intrinsic value of shares of holding company can be found by the consolidated financial statements.

Easy to know minority Interest

minority Interest of outsider shareholders of subsidiaries can be found by the consolidated financial statements.

Complete Overview

Consolidated statements allow investors, financial analysts, business owners and other interested parties to get a complete overview of the parent company. At a glance, they can view the overall health of the business and how each subsidiary impacts the parent company.

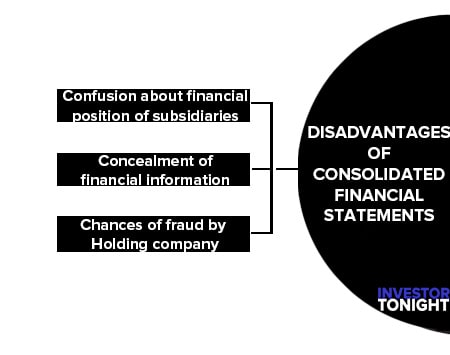

Disadvantages of Consolidated Financial Statements

The followings are the disadvantages of consolidated financial statements:

- Confusion about true financial position of subsidiaries

- Concealment of financial information

- Chances of fraud by Holding company

Confusion about true financial position of subsidiaries

After consolidation, the assets and liability are shown in single entity. So here it is difficult to know the true financial position of subsidiaries of a holding company.

Concealment of financial information

For the growth and to reduce the risk of holding company after aggregation of financial statement of holding and its subsidiaries may conceal some important financial information from investors.

Chances of fraud by Holding company

Sometimes the holding company doesn’t disclose the true financial position, it can mislead the users.

Read More Articles

- What is Accounting?

- Basic Accounting Terminology

- Basic Accounting Concepts

- Accounting Conventions

- Double Entry System

- What is Journal?

- What is Ledger?

- What is Trial Balance?

- What is Activity Based Costing?

- Business, Industry and Commerce

- Shares and Share Capital

- What is Audit of Ledger?

- Forfeiture and Reissue of Shares

- What is Consolidated Financial Statements?

- What are Preference Shares?

- What are Debentures?

- Issue of Bonus Shares

- What is Government Accounting?

- What are Right Shares?

- Redemption of Debentures

- Buy Back of Shares

- Valuation of Goodwill

- What is Valuation of Shares?

- Purchase of Business

- Amalgamation of Companies

- Internal Reconstruction of Company

- What is a Holding company?

- Accounts of Holding Company

- What is Slip System?