Issue of Shares is the process in which companies allot new shares to shareholders. Shareholders can be either individuals or corporates. The company follows the rules prescribed by Companies Act 2013 while issuing the shares.

Table of Contents

A share has been defined by the Indian Companies Act, under sec.2(46) as “A share is the share in the Capital of the Company”.

A Company can issue two types of shares – Equity and Preference

- Equity Shares: Equity shares means that part of the share capital which is not a Preference share capital. It means all such shares which are not Preference shares. Equity shares are also called as Ordinary Shares.

- Preference Shares: Preference shares are those shares which fulfill both the following two conditions:

- They carry preferential share right in respect of dividend at a fixed rate,

- They also carry preferential right in regard to payment of capital on winding up of the company.

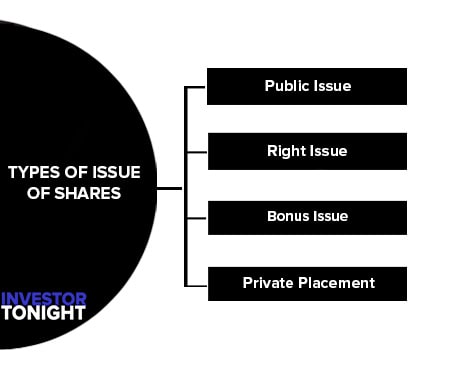

Public Issue

When an issue/offer of securities is made to the public for subscription/purchase, it is called a public issue.

Public issue can be further classified into Initial Public Offer (IPO) and Follow on Public Offer (FPO).

Initial Public Offer (IPO): When an unlisted company makes a fresh issue/first-time issue of securities to the public, it is called an IPO.

Follow on Public Offer (FPO): When an already listed company makes the further issue of securities to the public, it is called a Follow on Public Offer (FPO). Thus, the process of FPO starts after an IPO.

Right Issue

When an issue of securities is made by an issuer to its present/existing shareholders, it is called a right issue. The rights are offered in a particular ratio to the number of securities held as on the record date.

Bonus Issue

When an issuer makes an additional issue of securities to its existing shareholders free of cost, it is called a bonus issue.

Private Placement

A private placement is the sale of securities to a relatively small number of select investors as a way of raising capital. Investors involved in private placements are usually large banks, mutual funds, insurance companies and pension funds. A private placement is different from a public issue.

In public issue, securities are made available for sale on the open market to any type of investor. Private placement of shares or convertible securities by a listed issuer can be of two types:

Preferential Allotment: When a listed issuer issues shares to a selected group of persons as per SEBI guidelines, it is called a preferential allotment. The issuer is required to comply with various provisions which inter-alia include pricing, disclosures in the notice, lock-in etc., in addition to the requirements specified in the Companies Act.

Qualified Institutions Placement (QIP): When a listed issuer issues equity shares to qualified institutions buyers only in terms of provisions as per SEBI guidelines, it is called a QIP. Qualified Institutional Buyers are those institutional investors who generally possess expertise and the financial strength to invest in the capital markets.‘Qualified Institutional Buyer’ include:

- Scheduled commercial banks;

- Mutual funds;

- Foreign institutional investor registered with SEBI;

- Multilateral and bilateral development financial institutions;

- Venture capital funds registered with SEBI.

- Foreign Venture capital investors registered with SEBI.

- State Industrial Development Corporations.

- Insurance Companies registered with the Insurance Regulatory and Development Authority (IRDA)

- Provident Funds with stipulated minimum corpus

- Pension Funds with stipulated minimum corpus

- Public financial institution as defined in Companies Act, 2013

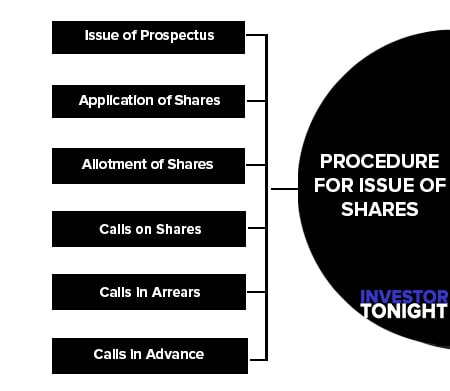

- Issue of Prospectus

- Issue of Prospectus

- Allotment of Shares

- Calls on Shares

- Calls in Arrears

- Calls in Advance

Issue of Prospectus

Whenever shares are to be issued to the public the company must issue a prospectus. Prospectus means an open invitation to the public to take up the shares of the company thus a private company need not issue prospectus. Even a Public Company issuing it‟s shares privately need not issue a prospectus.

However, it is required to file a “Statement in lieu of Prospectus” with the register of companies. The Prospectus contains relevant information like names of Directors, terms of issue, etc. It also states the opening date of subscription list, amount payable on application, on allotment & the earliest closing date of the subscription list.

A person intending to subscribe to the share capital of a company has to submit an application for shares in the prescribed form, to the company along with the application money before the last date of the subscription mentioned in the prospectus.

Over Subscription: If the no. of shares applied for is more than the no. of shares offered to the public then that is called as over Subscription.

Under Subscription: If the no. of shares applied for is less then the no. of shares offered to the public then it is called as Under Subscription.

After the last date of the receipt of applications is over, the Directors, Procide with the allotment work. However, a company cannot allot the shares unless the minimum subscription amount mentioned in the prospectus is collected within a stipulated period.

The Directors pass resolution in the board meeting for allotment of shares indicating clearly the class & no. of shares allotted with the distinctive numbers. Then Letters of Allotment are sent to the concerned applicants. Letters of Regret are sent to those who are not allotted any shares & application money is refunded to them.

Partial Allotment: In partial allotment the company rejects some application totally, refunds their application money & allots the shares to the remaining applicants.

Pro-rata Allotment: When a company makes a pro-rata allotment, it allots shares to all applicants but allots lesser shares then applied for E.g. If a person has applied for three hundred shares he may get two hundred shares.

The remaining amount of shares may be collected in installments as laid down in the prospectus. Such installments are called calls on Shares. They may be termed as “Allotment amount, First Call, Second Call, etc.” (e)

Calls in Arrears

some shareholders may not pay the money due from them. The outstanding amounts are transferred to an account called up as “Calls-in-Arrears” account. The Balance of calls-in-arrears account is deducted from the Called-up capital in the Balance Sheet.

Calls in Advance

According to sec.92 of the Companies Act, a Company may if so authorized by it‟s articles, accept from a shareholder either the whole or part of the amount remaining unpaid on any shares held by them, as Calls in advance. No dividend is paid on such calls in advance. However, interest has to be paid on such calls in advance.

A limited company may issue the shares on following different terms.

- Issue of Shares for Consideration other than cash or for cash or on capitalization of reserves.

- Issue of Shares at par i.e. at face value or at nominal value.

- Issue of Shares at a Premium i.e. at more than face value.

- Issue of Shares at a Discount i.e. at less than the face value.

When the shares are issued at a price higher than the nominal value of the shares then it is called as shares issued at a premium. The amount of premium is decided by the board of Directors as per the guide lines issued by SEBI.

Such share premium collected by the company is credited to a separate A/c called as “Securities Premium A/c”. Although Securities Premium is a profit to the company, it is not a revenue profit, it is treated as capital profit, which can be utilized only for the following purposes as per sec. 78 of the Companies Act.

- Issue of fully paid bonus shares to the existing shareholders.

- Writing off the preliminary expenses of the company.

- Writing off the expenses of issue or the commission paid or discount allowed on any issue of shares / debentures.

- Providing the premium payable on redemption of preference shares or debentures. The company can utilize the security Premium for any other purpose only on obtaining the sanction of the court.

The Companies Act, permits issue of shares at a discount subject to the following conditions. (sec. 79) –

- The issue must be of a class of shares already issued.

- Not less than 1 year has at the date of issue elapsed since the date on which the company became entitled to commence business.

- The issue at a discount is authorized by a resolution passed by the company in the general meeting & sanctioned by the company law board.

- The maximum rate of discount must not exceed 10% or such rate as the company law board may permit.

- The shares to be issued at a discount must be issued within two months of the sanction by the company law board or within such extended time as the company law board may allow.