Foreign market entry is the most important decision of a business unit. The future of business unit depends on this decision whether it will survive or not. Mainly three modes of entry into foreign markets can be exercise. These are trade mode, investment mode and contractual entry mode. Organization will make in the light cost, risk and the degree of control which can be exercised over them.

The simplest form of entry strategy is exporting using either a direct or indirect method. Indirect method selling of goods and services directly in a foreign market. In indirect are sold by an agent or countertrade.

Table of Contents

Globalization made whole world a small village where anyone can easily contact with another. It brings the domestic economy close with world economies. It promotes foreign trade in various nations. It not only brings economies like free trade, cheap labor, availability of capital etc. but new technological products also.

More complex forms include involves joint ventures, or export processing zones. Having decided on the form of export strategy, decisions have to be made on the specific channels. Many agricultural products of a raw or commodity nature use agents, distributors or involve Government, whereas processed materials, whilst not excluding these, rely more heavily on more sophisticated forms of access.

In the era of globalization, MNC’s are playing very important role because free movement of capital, labor, technology goods and services are now possible. With the improvement of infrastructure like transportation, communication technology, power, ports, tourism etc. it is possible to work with the link of world economies.

With the liberalized approach, tariff-free trade and ease of doing business in India, MNC’s are entering with a fast rate. So for entry into foreign, it is necessary to give a boost to globalization. Globalization includes:

- Integration of Indian economy with other economies;

- Free flow of factor of production i.e. labor, capital, technology etc;

- Elimination of trade barriers i.e. tariff and non-tariff barriers to ensure free flow of goods & services; and

- Expansion of MNC’s.

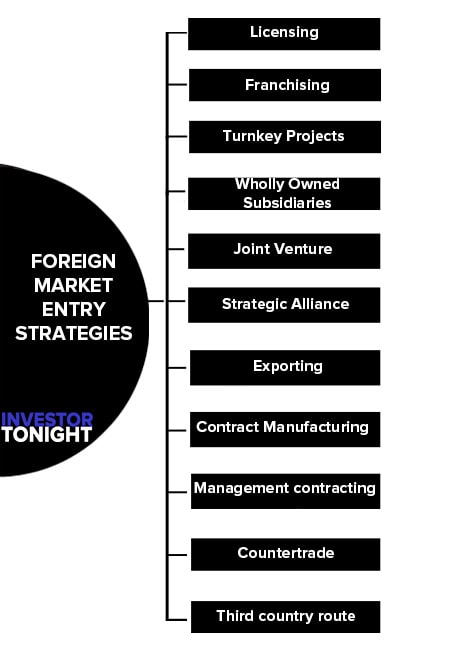

Foreign Market Entry Strategies

The main strategies to entry into foreign market are as follows:

- Licensing

- Franchising

- Turnkey Projects

- Wholly Owned Subsidiaries

- Joint Venture

- Strategic Alliance

- Exporting

- Contract Manufacturing

- Management contracting

- Countertrade

- Third country route

Licensing

In an international licensing agreement one business unit of a country (licensor) allows the business unit of other country (licensee) or foreign firms, either exclusively or non-exclusively to use manufacturer know-how for a fixed term in a specific market.

In this foreign market entry mode, a licensor in the home country makes limited rights or resources available to the licensee in the host country. The rights or resources may include patents, trademarks, managerial skills, technology, and others that can make it possible for the licensee to manufacture and sell in the host country a similar product to the one the licensor has already been producing and selling in the home country without requiring the licensor to open a new operation overseas.

The licensor earnings usually take forms of one time payments, technical fees and royalty payments usually calculated as a percentage of sales. For example 5 percent of sales or 7 percent of sales.

As in this mode of entry the transference of knowledge between the parental company and the licensee is strongly present, the decision of making an international license agreement depend on the respect the host government show for intellectual property and on the ability of the licensor to choose the right partners and avoid them to compete in each other market.

Licensing is a relatively flexible work agreement that can be customized to fit the needs and interests of both, licensor and licensee.

Advantages of Licensing

- Obtain extra income for technical know-how, copy rights, patents.

- Reach new markets not accessible by export from existing facilities.

- Quickly expand without much risk and large capital investment.

- Pave the way for future investments in the market.

- Retain established markets closed by trade restrictions.

- Political risk is minimized as the licensee is usually 100% locally owned.

- Is highly attractive for companies that are new in international business.

Disadvantages of Licensing

- Lower income than in other entry modes.

- Loss of control of the licensee manufacture and marketing operations and practices leading to loss of quality.

- Risk of having the trademark and reputation ruined by an incompetent partner.

- The foreign partner can also become a competitor by selling its production in places where the parental company is already in.

Franchising

In the franchising system one nation business unit grants the right to do business in a particular manner to the business unit of the other nation. It can be defined as: “A system in which semi-independent business owners (franchisees) pay fees and royalties to a parent company (franchiser) in return for the right to become identified with its trademark, to sell its products or services, and often to use its business format and system.”

Compared to licensing, franchising agreements tends to be longer and the franchisor offers a broader package of rights and resources which usually includes: equipment, managerial systems, operation manual, initial trainings, site approval and all the support necessary for the franchisee to run its business in the same way it is done by the franchisor.

For example Domino provides the key part of their product to the franchisees in the other nations. Consider an example soft drink manufacturers like Pepsi and Coca-cola provide the key parts of their product to the franchisees in the other nations. The franchisees have their own bottling plants where they make soft drinks but they sell the same under the brand name of the franchiser.

In addition to that, while a licensing agreement involves things such as intellectual property, trade secrets and others while in franchising it is limited to trademarks and operating know-how of the business.

Advantages of Franchising

- Low political risk.

- Low cost i.e. royalty or a fixed percentage.

- Allows simultaneous expansion into different regions of the world.

- Well selected partners bring financial investment as well as managerial capabilities to the operation.

Disadvantages of Franchising

- Maintaining control over franchisee may be difficult due to the foreign country.

- Conflicts with franchisee are likely, including legal disputes.

- Preserving franchisor’s image in the foreign market may be challenging.

- Requires monitoring and evaluating performance of franchisees, and providing ongoing assistance.

- Franchisees may take advantage of acquired knowledge and become competitors in the future.

Turnkey Projects

A turnkey project refers to a project in which business unit of one nation agrees to construct the entire plant for the business unit of the other nation. In other words, when clients pay contractors to design and construct new facilities and train personnel.

A turnkey project is a way for a foreign company to export its process, expertise, experience and technology to other countries by building a plant in that country. Industrial companies that specialize in complex production technologies normally use turnkey projects as an entry strategy.

Business unit of one nation agrees to construct the entire plant is called the licensor and the business unit of the other nation for which the plant has been constructed is called licensee.

Advantages of turnkey projects

- The possibility for a company to establish a plant and earn profits in a foreign country.

- Take benefits of foreign direct investment opportunities

- Take benefits of expertise in a specific area exists.

Disadvantages of a turnkey project

- Risk of revealing companies secrets to rivals.

- Takeover of their plant by the host country.

- Entering a market with a turnkey project can prove that a company has no long-term interest in the country which can become a disadvantage if the country proves to be the main market for the output of the exported process

Wholly Owned Subsidiaries

MNC’s now a day’s prefer to set up their subsidiaries in other nations instead of entering into any agreement of licensing or franchising or joint ventures etc. In this strategy, a parent company set a subsidiary which is known as a wholly-owned subsidiary company to control the overall manufacturing activities of said subsidiary.

For example, LG electronics have set up a wholly-owned subsidiary in India called LG India. It has its own manufacturing and marketing setup in India. A wholly owned subsidiary has two types of strategies:

- Greenfield investment

- Acquisition

Greenfield Investment

Greenfield investment is the establishment of a new wholly owned subsidiary. It is often complex and potentially costly, but it is able to provide full control to the firm and has the most potential to provide an above-average return. “Wholly owned subsidiaries and expatriate staff are preferred in service industries where close contact with end customers and high levels of professional skills, specialized know-how, and customization is required.”

Greenfield investment is more likely preferred where physical capital-intensive plants are planned. This strategy is attractive if there are no competitors to buy or transfer competitive advantages that consist of embedded competencies, skills, routines, and culture.

Acquisition

The acquisition has become a popular mode of entering foreign markets mainly due to its quick access. Acquisition strategy offers the fastest, and the largest, initial international expansion of any of the alternatives. The acquisition has been increasing because it is a way to achieve greater market power. The market share usually is affected by market power.

Therefore, many multinational corporations apply acquisitions to achieve their greater market power, which require buying a competitor, a supplier, a distributor, or a business in highly related industry to allow exercise of core competency and capture competitive advantage in the market.

Joint Venture

In joint venture agreement foreign partners makes an arrangement with local unit of the other country in which ownership and management are shared by local unit and foreign partner. Local unit have full knowledge of local conditions and foreign partner provide advanced technology, capital etc.

There are five common objectives in a joint venture: market entry, risk/reward sharing, technology sharing, joint product development, and conforming to government regulations. Profit and loss in joint venture is shared between foreign partner and local unit in the pre-determined ratio in the agreement.

The key issues to consider in a joint venture are ownership, control, length of the agreement, pricing, technology transfer, local firm capabilities and resources, and government intention.

Advantages of Joint Venture

- Political connections and distribution channel access.

- Introduction of advanced technology.

- Proper utilization of the local resources for example raw material, labor, infrastructure.

- Shared ownership between foreign partner and local unit.

Disadvantages of Joint Venture

- Conflict over asymmetric new investments.

- Mistrust over proprietary knowledge.

- Lack of parent firm support.

- Cultural clashes.

Joint ventures have conflicting pressures to cooperate and compete:

- Strategic imperative: the partners want to maximize the advantage gained for the joint venture, but they also want to maximize their own competitive position.

- The joint venture attempts to develop shared resources, but each firm wants to develop and protect its own proprietary resources.

- The joint venture is controlled through negotiations and coordination processes, while each firm would like to have hierarchical control.

Strategic Alliance

Strategic alliance is an agreement in which two countries make an arrangement or alliance to complete a specific task.

For example, a common customer cares number for grievances handling or common godown for storage. It is a type of cooperative agreement between different firms, such as shared research, formal joint ventures, or minority equity participation.

The modern form of strategic alliances is becoming increasingly popular and has three distinguishing characteristics:

- They are frequently between firms in industrialized nations.

- The focus is often on creating new products and/or technologies rather than distributing existing ones.

- They are often only created for short term duration, non-equity based agreement in which companies are separated and are independent

Advantages of Strategic Alliance

- Technology exchange: This is a major objective for many strategic alliances. The reason for this is that many breakthroughs and major technological innovations are based on interdisciplinary and/or interindustry advances. Because of this, it is increasingly difficult for a single firm to possess the necessary resources or capabilities to conduct their own effective R&D efforts.

- Global competition: There is a growing perception that global battles between corporations be fought between teams of players aligned in strategic partnerships. Strategic alliances will become key tools for companies if they want to remain competitive in this globalized environment, particularly in industries that have dominant leaders, such as cell phone manufactures, where smaller companies need to ally in order to remain competitive.

- Industry convergence: As industries converge and the traditional lines between different industrial sectors blur, strategic alliances are sometimes the only way to develop the complex skills necessary in the time frame required. Alliances become a way of shaping competition by decreasing competitive intensity, excluding potential entrants, and isolating players, and building complex value chains that can act as barriers.

- Economies of scale and reduction of risk: Pooling resources can contribute greatly to economies of scale, and smaller companies especially can benefit greatly from strategic alliances in terms of cost reduction because of increased economies of scale.

In terms on risk reduction, in strategic alliances, no one firm bears the full risk, and cost of, a joint activity. This is extremely advantageous to businesses involved in high-risk/cost activities such as R&D. This is also advantageous to smaller organizations which are more affected by risky activities. - Alliance as an alternative to merger: Some industry sectors have constraints to cross-border mergers and acquisitions, strategic alliances prove to be an excellent alternative to bypass these constraints. Alliances often lead to full-scale integration if restrictions are lifted by one or both countries.

Exporting

Exporting is the most traditional and well-established form of operating in foreign markets. Initially a business unit starts its international business by exporting to one nation. Exporting can be defined as the marketing of goods produced in one country and sell them into another.

Whilst no direct manufacturing is required in an overseas country, significant investments in marketing are required. The tendency maybe not to obtain as much detailed marketing information as compared to manufacturing in a marketing country; however, this does not negate the need for a detailed marketing strategy.

Advantages of Exporting

- Manufacturing is home based thus, it is less risky than overseas based.

- Gives an opportunity to “learn” overseas markets before investing in bricks and mortar.

- Reduces the potential risks of operating overseas.

The disadvantage of exporting is mainly that one can be at the “mercy” of overseas agents and so the lack of control has to be weighed against the advantages. For example, in the exporting of African horticultural products, the agents and Dutch flower auctions are in a position to dictate to producers.

Contract Manufacturing

In this type of agreement business unit of one nation allow to the manufacturer of other nation to manufacture the goods at their own, but right to market these goods retained by the parent foreign enterprises. In this form a foreign business unit can expand its business without setting up the plant into another country.

Whenever the foreign business unit thinks that marketing into another country is unprofitable then it can have easy exit from that nation because it has not yet set any plant there. Under this a company doing international marketing contracts with firms in foreign countries to manufacturing or assemble the products while retaining the responsibility of marketing the product. This is a common practice in international business.

Advantages of Contract Manufacturing

- The company does not have to commit resources for setting up production facilities.

- It frees the company from the risks of investing in foreign countries.

- If idle production capacity is readily available in the foreign country, it enables the marketer to get started immediately.

- In many cases, the cost of the product obtained by contract manufacturing is lower than if it were manufactured by international firm.

- Contract manufacturing also has the advantage that it is a less risky way to start with.

- Contract manufacturing may enable the international firm to enlist national support.

Disadvantages of Contract Manufacturing

- There will be the loss of potential profits from manufacturing.

- Less control over the manufacturing process.

- Contract manufacturing also has the risk of developing potential competitors.

- It would not be suitable in cases of high-tech products and cases which involve technical secrets etc.

Management contracting

In this agreement, parent enterprises of one nation sets-up management agencies into other nation. These agencies are managed or controlled without any ownership or capital in them. A parent enterprise provides expertise to another country and gets back the fees or a fixed percentage.

In other words under this contract, the firm providing the management know-how may not have any equity stake in the enterprise being managed. In a management contract the supplier brings together a package of skills that will provide an integrated service to the client without incurring the risk and benefit of ownership.

Countertrade

By far the largest indirect method of exporting is countertrade. Counter trade is a trade agreement that has a requirement to import as a condition to export. The UN defines countertrade as “commercial transactions in which provisions are made, in one of a series of related contracts, for payment by deliveries of goods and/or services in addition to, or in place of, financial settlement”.

Competitive intensity means more and more investment in marketing. In this situation, the organization may expand operations by operating in markets where competition is less intense but the currency-based exchange is not possible. Also, countries may wish to trade in spite of the degree of competition, but currency again is a problem.

Countertrade can also be used to stimulate home industries or where raw materials are in short supply. It can, also, give a basis for reciprocal trade or bilateral trade between two business units under a business unit imports from other nations on the condition that the other business unit will also import the products of same value from the first.

The main advantage of this trade is that it does not involve any foreign exchange so there is no burden on balance of payment. Countertrade is the modem forms of barter, except contracts, are not legal and it is not covered by GATT.

Third country route

This strategy of taking entry into foreign markets is used to take advantage of friendly relations between two nations. In this method one country does not make direct investment in another nation, rather an investment is made in a third nation. Through the third nation, the investment is routed to the destination country.

For example, India has tax concessions with Mauritius. So, to take advantage of these concessions many investors from advanced countries who want to invest in India, instead of investing in India directly they invest from the route of Mauritius to avail these concessions.

These are the essential conditions entry into a new market:

- Country should be liberalized i.e. less trade& business restrictions.

- There should be multilateral trade and investment agreement between countries.

- Availability of required resources i.e. raw material, labor, capital etc.

- Economies of scale should be available in the particular country.

- Availability of required infrastructure for example transportation, banking and insurance, power, ports etc.

- Globally accepted currency must be for foreign trade.

- Political ideology and policies should be in consonance with business organization.

- Chances of growth opportunities must be available there.

- Product and services should be according to taste and preferences of foreign customer.