What is Balance of Payments (BOP)?

Balance of Payments (BOP) is an accounting system that measures all economic transactions between residents (including government) of one country and residents of all other countries.

Economic transactions include exports and imports of goods and services, capital inflows and outflows, gifts and other transfer payments and changes in a country’s international reserves.

Table of Contents

Balance of Payments (BOP) Definition

Kindleberger defined balance of payments as “a systematic record of all economic transactions between the residents of the reporting country and residents of foreign countries during a given period of time“.

Normally the period is one year. These transactions are between residents of one country with those of other country.

We need to understand the difference between an economic transaction and a commercial transaction.

- An economic transaction is an exchange of value or transfer of a title to a good or an asset; whereas,

- A commercial transaction is an exchange of good or service for money that will result in payment in currency leading to financial flows.

For example, when we buy a share or property, it is transferred to our name but when we buy clothes or food items, we only pay money but there is no transfer of title.

Characteristics of Balance of Payments

Characteristics of a balance of payments are:

- BOP is the systematic record of all economic transactions with the rest of the world.

- BOP is related to period of time.

- BOP includes the Balance of Trade (BOT) in it.

- It includes all transactions current as well as capital.

- It includes the receipts and payments of the country.

- It is just like a balance sheet.

- Balance of Payments is based on double entry book keeping system.

- Is not balanced generally it contains some induced

Components of BOP

The three main components of BOP are:

Current Account

The current account is typically divided into three sub-categories; the merchandise trade balance, the services balance and the balance on unilateral transfers. Entries in this account are “current” in value as they do not give rise to future claims. A surplus in the current account represents an inflow of funds while a deficit represents an outflow of funds.

- The balance of merchandise trade refers to the balance between exports and imports of tangible goods such as automobiles, computers, machinery and so on. A favourable balance of merchandise trade (surplus) occurs when exports are greater in value than imports

An unfavourable balance of merchandise trade (deficit) occurs when imports exceed exports. Merchandise exports and imports are the largest single component of total international payments for most countries. - Services represent the second category of the current account. Services include interest payments, shipping and insurance fees, tourism, dividends and military expenditures. These trades in services are sometimes called invisible trade.

- Unilateral transfers are gifts and grants by both private parties and governments. Private gifts and grants include personal gifts of all kinds and also relief organisation shipments.

For example, money sent by immigration workers to their families in their native country represents private transfer. Government transfers include money, goods and services sent as aid to other countries.

For example, if the United States government provides relief to a developing country as part of its drought-relief programme, this would represent a unilateral government transfer.

Unlike other accounts in the BOP, unilateral transfers have only one-directional flow without offsetting flows. For double entry bookkeeping, unilateral transfers are regarded as an act of buying goodwill from the recipient.

Capital Account

The capital account is an accounting measure of the total domestic currency value of financial transactions between domestic residents and the rest of the world over a period of time. This account consists of loans, investments, other transfers of financial assets and the creation of liabilities.

It includes financial transactions associated with international trade as well as flows associated with portfolio shifts involving the purchase of foreign stocks, bonds and bank deposits.

The capital account can be divided into three categories: direct investment, portfolio investment and other capital flows.

- Direct investment occurs when the investor acquires equity such as purchases of stocks, the acquisition of entire firms, or the establishment of new subsidiaries.

- Foreign Direct Investment (FDI) generally takes place when firms tend to take advantage of various market imperfections. Firms also undertake foreign direct investments when the expected returns from foreign investment exceed the cost of capital, allowing for foreign exchange and political risks.

The expected returns from foreign profits can be higher than those from domestic projects due to lower material and labour costs, subsidised financing, investment tax allowances, exclusive access to local markets, etc.

For example, many US firms are engaged in direct investment in foreign countries. Coca-Cola has built bottling facilities all over the world. b. - Portfolio investments represent sales and purchases of foreign financial assets such as stocks and bonds that do not involve a transfer of management control. A desire for return, safety and liquidity in investments is the same for international and domestic portfolio investors.

International portfolio investments have specifically boomed in recent years due to investors’ desire to diversify risk globally. Investors generally feel that they can reduce risk more effectively if they diversify their portfolio holdings internationally rather than purely domestically. In addition, investors may also benefit from higher expected returns from some foreign markets. - Capital flows represent the third category of capital account and represent claims with a maturity of less than one year. Such claims include bank deposits, shortterm loans, short-term securities, money market investments and so forth. These investments are quite sensitive to both changes in relative interest rates between countries and the anticipated change in the exchange rate.

For example, if the interest rates rise in India, with other variables remaining constant, India will experience capital inflows as investors would like to deposit or invest in India to take advantage of the higher interest rate.

But if the higher interest rate is accompanied by an expected depreciation of the Indian rupee, capital inflows to India may not materialise.

Short-term capital flows are of two types: non-liquid short-term capital and liquid short-term capital.

- Non-liquid short-term capital flows include bank loans and other short-term funds that are very difficult to liquidate quickly without loss.

- Liquid short-term capital flows represent claims such as demand deposits and short-term securities that are easy to liquidate with minimum or no loss.

Short-term capital accounts change for two specific reasons: compensating adjustments and autonomous adjustments.

- Compensating adjustments or accommodating adjustments are short-term capital movements induced by changes due to merchandise trade, services, unilateral transfers and investments. These compensating accounts change so as to finance other items in the balance of payments.

- Autonomous adjustments are short-term capital movements due to differences in interest rates and also expected changes in foreign exchange rate among nations. Autonomous changes take place for purely economic reasons.

Official Reserve Account

Official reserves are government owned assets. The official reserve account represents only purchases and sales by the central bank of the country (e.g., the Reserve Bank of India). The changes in official reserves are necessary to account for the deficit or surplus in the balance of payments.

For example, if a country has a BOP deficit, the central bank will have to either run down its official reserve assets such as gold, foreign exchange, and SDRs or borrow fresh from foreign central banks.

However, if a country has a BOP surplus, its central bank will either acquire additional reserve assets from foreigners or retire some of its foreign debts.

Debit and Credit Entries

BOP is kept on a double entry book-keeping system with credits and debits of equal size. For every transaction, there is a corresponding entry on both credit and debit sides. BOP is neither an income statement nor a balance sheet.

BOP accounting principles regarding debits and credits are as follows:

- Credit transactions (+) are those that involve the receipt of payment from foreigners.

The following are some of the important credit transactions:- Exports of goods or services

- Unilateral transfers (gift) received from foreigners

- Capital inflows

- Debit transactions (–) are those involve the payment of foreign exchange, i.e., transactions that expend foreign exchange.

The following are some of the important debit transactions:- Import of goods and services

- Unilateral transfers (gift) received from foreigners

- Capital inflows

Since the BOP statements is drawn up in terms of debits and credits based on a system of double-entry book-keeping, if all entries are made correctly, the total debits must equal total credits.

The debit or payment side of BOP accounts of a country represents the total of all the uses made out of the total foreign exchange acquired by a country during the given period, while the credit or the receipt side represents the sources from which this foreign exchange was acquired by the country in the same period. The sides as such necessary balance.

Importance of Balance of Payment

- BOP of a country discloses its financial and economic status.

- BOP statement can be used as an indicator to determine whether the country’s currency value is appreciating or depreciating

- BOP statement helps the Government to decide on fiscal and trade policies.

- It provides important information to analyse and understand the economic dealings of a country with other countries.

- With the help of BOP statement and its components, one would be able to identify trends that may be beneficial or harmful to the economy.

Trend in Balance of Payment

The benefits of foreign trade were overlooked year after year. Indian entrepreneurs were withdrawing with low-priced, outdated technology and demolishing subsidies, generating a heavy national burden of large ailing public sector undertakings. Despite acting through an incentive-based approach, government protection in fact damaged our industrial growth.

The New Economic Policy of the nineties targeted for opening up of the economy, permitting free trade and competition and condensing the role of government considerably in foreign trade issues.

Restrictions on international trade were detached, foreign investments were allowed and a completely new Liberalized Exchange Management System was brought in to garner the benefits of competition and offset the drawbacks of a closed, inward-looking trade policy. The alterations towards liberalization and globalization of the Indian economy were conceded out very vigilantly in phases.

Foreign Investment

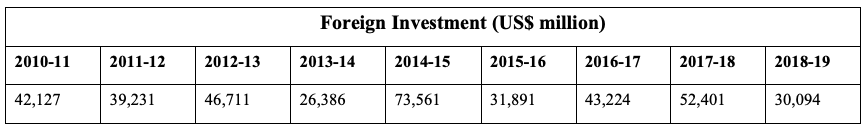

India effectively attracted foreign investors to the country with its earnest positive economic transforms like reduced cumbersome formalities and other paperwork. From a scanty US$ 42,127 million net foreign investment in the year 2010-11, it has grown to US$ 30,094 million in 2018- 19.

Foreign investments kept the country buoyant during the recent global meltdown period. Because the consequences of a recession were worst in the developed countries, the investors turned to the less affected rising economies like China and India.

While initially, foreign investment in the country did slow down significantly due to risk repugnance in the phase of the recession, but it picked up over again because rising economies like India and China were quick to execute corrective procedures to fight recession, showing creditable elasticity to the recession which badly affected the much-developed economies.

As per table, it can be seen from data 2010-11 to 2018-19 that there is no more rise in foreign investment even it decreases over the last years. It can be observed that from these years only in 2014-15 it was maximum 73,561 US$ million after that huge downfall in next year to 31,891 US$ million. If we compare the data of last two years foreign investment decreases from 52,401 US$ million to 30,094 US$ million in the year 2018-19.

Current Account of BOP

The current account of BOP consists of the merchandise trade (export and import) and the invisibles (services, transfers, etc.). The liberalized policy and reasonably hassle free formalities for export and imports have provided a push to our export industries as well as industries catering to domestic demands.

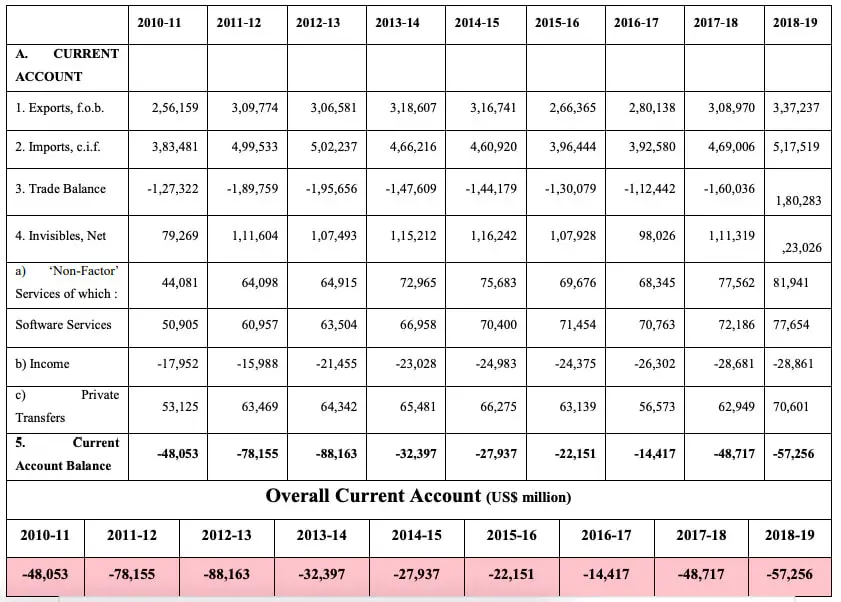

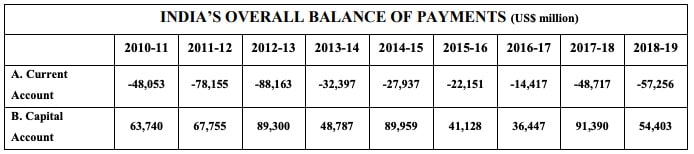

Exports and imports both witnessed double-digit growth rates. As per table, current account balance broadened in 2018-19 (-57,256 US$ million) compared to that of 2010-11 (-48,053 US$ million) attributed to recession, but it was sustainable. The reason for the increasing the current account deficit is an increase in imports continuously as compared to exports.

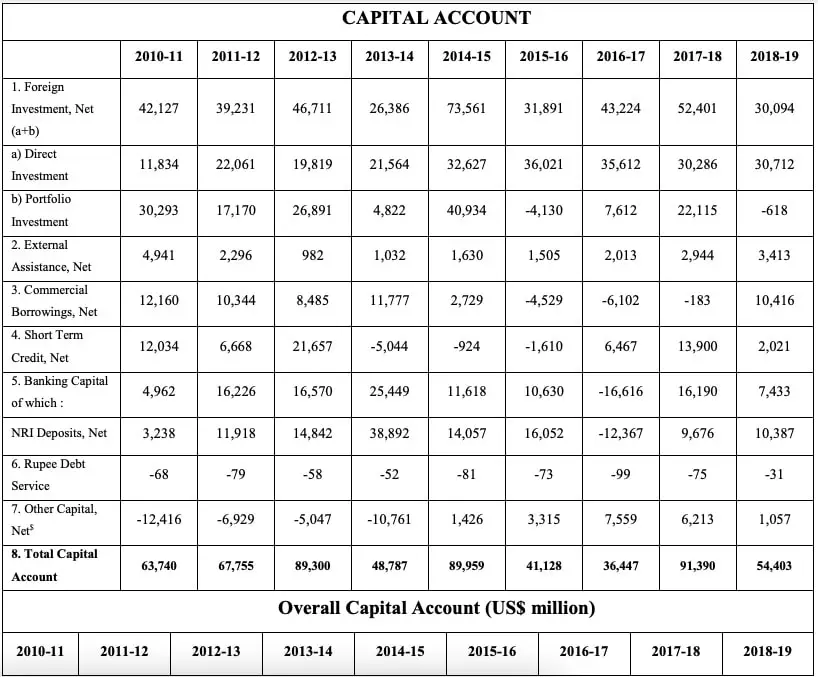

Capital Account of BOP

The current account of BOP consists of foreign investment, (FDI + FPI), external assistance, commercial borrowings, short-term capital, NRIs deposits, banking capital, debt, etc. As per table, it can be observed that foreign investment decreased due to portfolio investment turn in to negative from US$ 30293 million in 2010-11 to US$ -618 million in year 2018-19. FDI is a rise from year 2010-11 to 2014-15, but in later years its speed also become slow.

As per the table capital account balance also reduced in 2018-19 (US$ 54403 million) from (US$ 63740 million) in the year 2010- 11. Major contributors in a capital account are foreign direct investment, commercial borrowings, and NRIs deposits.

India’s overall BOP

With the economy (domestic as well as global) getting its pace of momentum once again, there is hope of shine once again in the trade and financial world. India having cruised reasonably successful through the uneven scrap of recession can look further to garnering greater profit from world market, at least till the time the developed economies which were poorly affected by the recession, revitalize fully. In short, the situation of BOP is quite well administered and contented.

However, lessons from the occurrences of the financial crises taking place in various parts of the world from time to time, we are required to continue our vigilant approach towards BOP management. The country cannot meet the expense of a setback to its economic growth attained through large-scale changes in national economic policies.

India indeed has arrived a long way from the time of the days of the protectionist policies, but there is a lot to be accomplished yet, particularly in the sector of infrastructure, in order to become a strong economy.

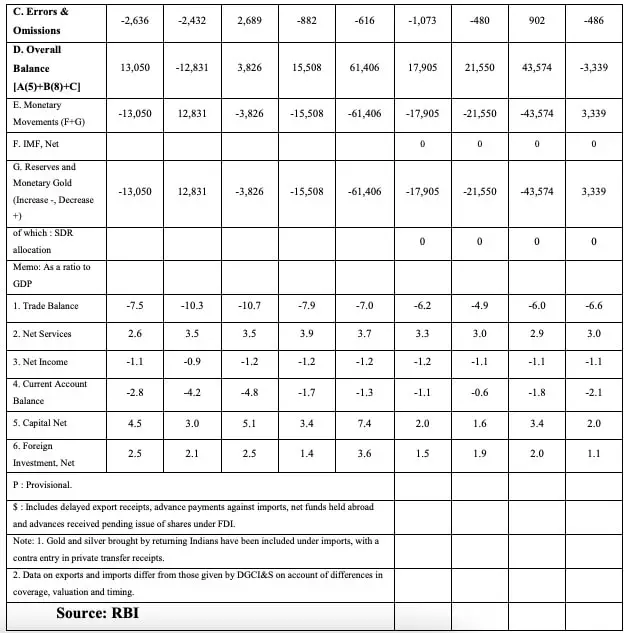

It can be observed from table 9 that India’s BOP was positive US$ 13,050 million in year 2010-11, but in next year 2011-12 in turns in to negative US$ 12,831 million. From 2012-13 to 2014-15 it increased from 3,826 million US$ to 61,406 million US$, but later it decreased and remained positive.

Again BOP increased from 17,905 million US$ in 2015-16 to 43,574 million US$ in year 2017-18. But in year 2018-19 again it turns in to negative 3,339 million US$ due to increase high the negative current account balance.

Causes of Disequilibrium in BOP

Deficit in the balance of payments may be caused due to number of factors. These factors can be divided into three groups:

- Developmental Activities

- High Rate of Inflation

- Cyclical Fluctuations

- Change in Demand

- Import of Services

- Political Factors

- Demonstration Effect

Developmental Activities

Developing countries depend on developed nations for supply of machines, technology and other equipment. This leads to increased levels of imports, thereby, resulting in a deficit in the BOP account.

High Rate of Inflation

When there is inflation in the domestic economy, foreign goods become relatively cheaper as compared to domestic goods. It increases imports which causes a deficit in the BOP.

Cyclical Fluctuations

When the domestic economy is going through a phase of boom, then domestic production may be unable to satisfy the domestic demand. It leads to a deficit in BOP, due to increase in imports.

Change in Demand

Fall in demand for country’s goods in the foreign markets leads to fall in exports and it adversely affects the balance of payments.

Import of Services

Underdeveloped countries import services from developed countries for which, they have to pay huge amounts of money. It leads to a deficit in the BOP.

Political Factors

Political instability may lead to large capital outflows and reduce the inflows of foreign funds, thus, creating disequilibrium in the BOP. Also, frequent changes in the government, inadequate support to the government in parliament also discourage inflows of capital. This leads to a deficit due to higher outflows than inflows.

Demonstration Effect

When the people of underdeveloped countries come in contact with those of advanced countries, they start adopting the foreign pattern of consumption. Due to this reason, their imports increase and it leads to an adverse balance of payments for an underdeveloped country. Change in tastes, preferences, fashion and trends: An unfavorable change for domestic goods leads to a deficit in the balance of payments.

Problems of Balance of Payment in India

The disequilibrium in India’s BOP has been accounted to both internal as well as external factors. The requirement for the development of such a big nation with a large population is one of the main factors resulting in recurring BOP problems. The BOP is always under some pressure and had large deficits due to high level of imports of food grains and capital goods, the profound external borrowings, their payment and poor exports.

- Protectionist Policies

- External Debt

- Export Promotion

- Exchange Rate

- Inadequate Growth of Exports

- Increase in Imports

- Increasing Trade Deficit

Protectionist Policies

The main intention of the Second Five Year Plan (1956-57 to 1960-61) was to achieve self-reliance through industrialization. Self-reliance was to be realized through import substitution. For this, essential industries had to be established which required import of capital goods.

Exports were anticipated to take-off by own with advent of industrialization. It was felt that with advent of industrialization, there will be an increase in production at home that will be reflected in greater export earnings. The approach for import substitution was based on physical- interventionist, non-price policies like quotas, licensing and other physical ceilings on imports.

Heavy capital goods were imported however other imports were relentlessly restricted to shut off competition for promoting domestic industries. Mainly focus was on import substitution, with gross disregard of exports. These inward-looking protectionist policies did resulted in some self-reliance in the consumer goods industries, but most of the capital goods industries remained majorly import intensive

The elevated degree of protection to Indian industries resulted in to inefficiency and poor quality products basically due to lack of competition. The high cost of production further wrinkled our competitive strength. Rise in petroleum products demand, harvest failure, two oil shocks, and all put acute strain on the economy.

The BOP condition remained weak for the period of 1980s, till it arrived at the crisis situation in 1990-91; when India was on the brink of defaulting mainly due to intense debt burden and continually widening trade deficit.

External Debt

India had been an exercising choice to large scale foreign borrowings for its developmental activities in the field of fundamental social and industrial infrastructure. The country’s reserves were very much restricted due to low level of per capita income and savings. The situation aggravated because Government of India resorted to large amounts of foreign borrowings to rectify the BOP situation in the short run out of frightening condition.

With Seventh Five Year Plan, the debt service obligations increased sharply due to stiffer average provisions of external debt, including repayments to the IMF, commercial borrowing, and a drop in concessional aid flow.

Export Promotion

Even though by the Sixth Five Year Plan India had overcome the need of food grain imports and some crude oil was also produced domestically, BOP position was still not at ease attributed to low exports. The essential need for promoting export was realized during the 1960s. The Third Five Year Plan commenced certain promotion policies pertaining to export like tax exemptions, duty drawbacks, cash compensatory schemes, Rupee devaluation etc.

However, it didn’t showed significant improvements in exports. Indian exports depended largely on situation of world trade. India was chiefly primary product exporters, for which fluctuations in prices are very high in entire world market demand.

- Primary products exporting countries generally have unfavourable term of trade. The incomes from primary product exports were unstable and low.

- Secondly, the Indian products were not up to the mark in terms of quality and standard to sustain in world market.

- Third, mainly residue products were exported. The fact that export earnings contribute significantly to economic development was disregarded. Cumbersome procedures, rules and regulations for license etc served as disincentives for exporters. Domestic inflation further diminished the competitiveness of India’s export.

Exchange Rate

The fluctuation in the exchange value of the rupee was another posing problem. The steady devaluations (to promote exports) enhanced the amount of external debt. The value of rupee was administered by the central bank (fixed exchange rate). The considerable gap between official and market exchange rate generated difficulties for the exporters and importers. The stringent foreign exchange controls also persuaded Hawala trade.

Inadequate Growth of Exports

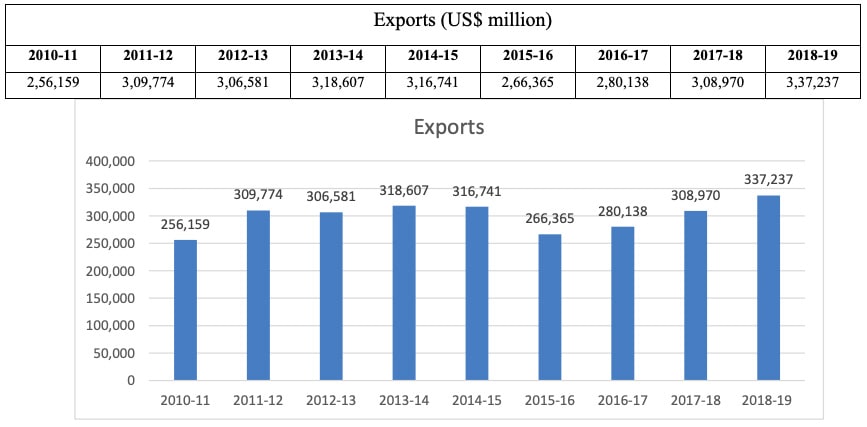

Another very peculiar situation that the country has been facing is a very slow growth in respect of its exports. In the initial period, total value of exports in India rose marginally from US$ 1,269 million in 1950-51 to US$ 2,031 million in 1970-71, showing an increase of only 60 percent.

But since then the growth of exports in the country could not keep pace with the growth in imports. If we from year 2010-11 total value of exports rose gradually to US$ 256,159 million showing an increase of only 33 percent to US$ 337,237 million in 2018-19

Indian exports recorded some increase but this increase in exports was totally inadequate considering the sizeable growth in the value of imports. This has resulted in a persistent and widening trade deficit in the country.

The factors which were mostly responsible for this low growth of exports include un-favourable terms of trade for Indian primary (agro-based) goods, inadequate export surplus, and adoption of the policy of protectionism by developed countries, and a long period of business recession in developed country in recent years.

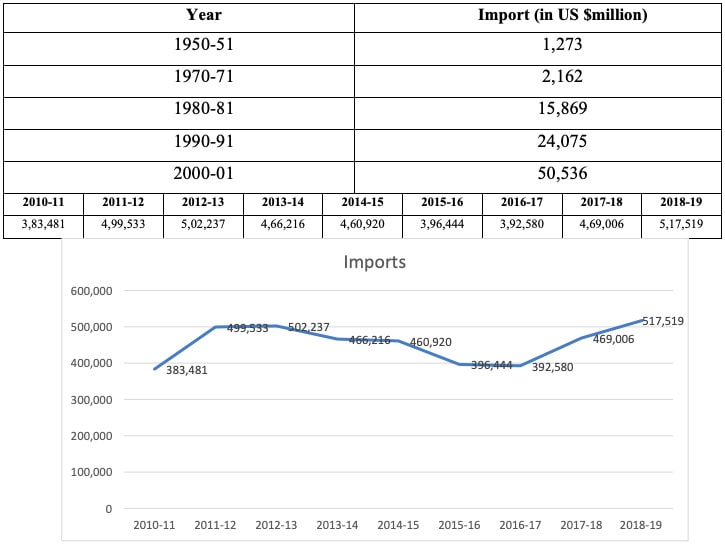

Increase in Imports

As per table 11 it can be observed that Indian import is continuously rising. If we see the data it was 1,273 million US$ in 1950-51 increased to 15,869 million US$ in 1980-81. Further Indian imports rises considerably in recent years from 50,536 million US$ in 2000-01 to 5,17,519 in year 2018-19.

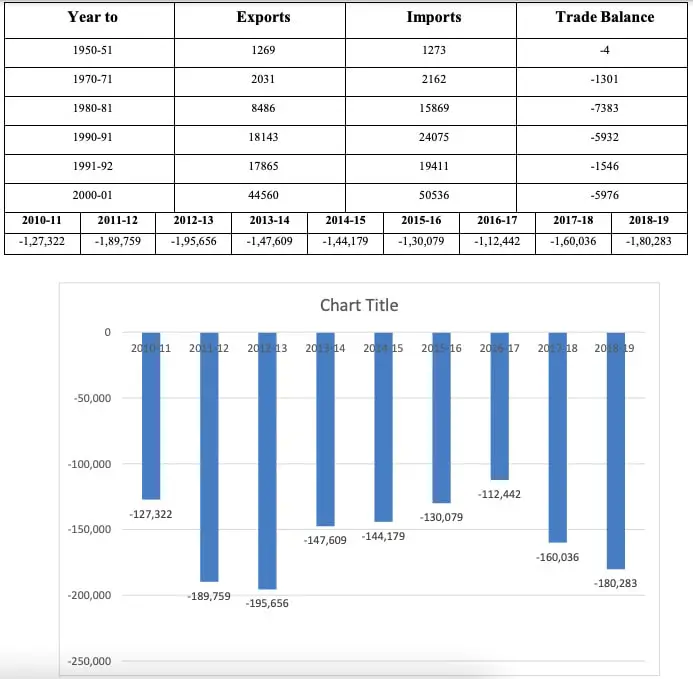

Increasing Trade Deficit

As a result of higher growth of imports and slow growth of exports the country has been experiencing a mounting trade deficit since 1980-81. During the last 45 years period, the country has recorded a small surplus in its trade only in two years (viz., in 1972-73 and in 1976-77)

Due to the adverse balance of trade situation, the extent of trade deficit in India gradually rose from Rs. 78 crore in 1950-51 to Rs. 949 crores in 1965-66. Recording a decline to Rs. 99 crore in 1970-71, the extent of trade deficit rose from Rs. 1,229 crore in 1975-76 to Rs. 5,838 crore in 1980-81 and then considerably to Rs. 10,640 crores in 1990-91. But after the introduction of some changes in the trade policy and due to considerable import compression the extent of trade deficit declined remarkably to Rs. 3,809 crore in 1991-92.

Accordingly, the annual average deficit in balance of trade which was US$ 4 million during 1950-51 gradually rose to US$ 1301 million during 1970-71. In 1981- 82 the extent of trade deficit again rose to US$ 7383 million due to huge increase in import.

But during 1990-91 & 1991-92, the extent of trade deficit declined to US$ 5932 million & US$ 1546 million respectively due to considerable increase in exports. But during 2000-2001, the extent of trade deficit again rose to US$ 5976 million. Again during 2010- 2011 to 2018-19 there is a massive rise in trade deficit from US$ 127,322 million to US$ 180,283 million