What is Foreign Exchange Market?

The foreign exchange market or currency market is a global decentralized market for the trading of currencies. The main participants in this market are the larger international banks. Financial centers around the world function as anchors of trading between a wide range of different types of buyers and sellers around the clock, with the exception of weekends.

Table of Contents

The foreign exchange market works through financial institutions, and it operates on several levels. Behind the scenes banks turn to a smaller number of financial firms known as “dealers,” who are actively involved in large quantities of foreign exchange trading.

Most foreign exchange dealers are banks, so this behind-the-scenes market is sometimes called the “interbank market”, although a few insurance companies and other kinds of financial firms are involved.

Introduction to Foreign Exchange Markets

The 17th century saw the start of the depositing of coins and bullion with money changers and goldsmiths. The first people to start the system of money by book-entry were the goldsmiths in England. This development further led to the expansion of banking services and the people started gaining the confidence that they can receive certain commodities against the banknote they possessed.

Thus, the history of foreign exchange can be traced back to the time when the moneychangers in the Middle East would exchange money from all over the world. In 1880, the practice of using gold as the standard of value started whose main aim was to guarantee any currency against a set amount of gold.

Under the gold standard exchange rates, currency was backed by gold and was measured in ounces.

There emerged avoid due to the abolishment of the gold standard and to discuss this concern, a convention was held in July 1944 at Bretton Woods, New Hampshire.

The new Bretton Woods monetary system led to a changed forex market which put forward the following solutions:

- A new method was to be established in order to obtain a fixed foreign exchange rate.

- The US dollar is to replace the gold standard as the new final exchange currency.

- The US dollar will be the only currency which will be backed by gold.

- Three international authorities will be founded who would guard over all the foreign transactions.

However, the Bretton Woods monetary system also failed after a period of 25 years and on 15 August 1971, the US announced the end of the exchange of gold for US dollar

Fixed and Floating Rates

The currency system in which the regulator tries to keep the exchange rate constant between the domestic currency and foreign currencies is known as the fixed exchange rate system. In this system, the government of a country determines the value of its currency against a fixed amount of another currency.

The gold standard is the oldest fixed exchange rate regime. The gold standard functioned till the beginning of World War I and even few years after that.

According to the gold standard, the currency in circulation is convertible into gold at a fixed rate. Therefore, the exchange rate between any two currencies is determined by the value of the currencies in terms of gold.

After the fall of the gold standard, the world monetary system was in chaos and the volume of international trade fell considerably. Thus, in place of the gold standard, the gold exchange standard, popularly known as the Bretton Woods System, was put up after the World War II by the victorious allies of the war.

Advantages of Fixed Rates System

- The system provides exchange rates stability by eliminating uncertainty.

- Volatility of exchange rate is controlled as it insulates the economy from external disturbances.

- Foreign investors are encouraged to invest in countries without the fear of exchange rate fluctuations.

- Poorer nations could get foreign exchange for development purposes at low costs.

Disadvantages of Fixed Rates System

- The system required regular rigorous control and monitoring by the monetary authorities.

- The system is not self equilibrating therefore over-valuation and undervaluation existed.

- Since the realignment was to be done only when all other avenues to correct the balance of payment were exhausted, therefore the burden accumulated and the economies which resorted to devaluation faced a lot of economic problems.

- The system required regular rigorous control and monitoring by the monetary authorities.

Floating Exchange Rate System

Floating exchange rates can be broadly classified into two types: clean float and dirty float. In the clean float exchange rate system, the exchange rate is determined by the forces of demand and supply without any intervention from the central authorities.

But when the central banks intervene to either raise or lower the exchange rate in the floating exchange rate system, it is referred to as dirty float or managed float.

In the dirty float, there are two main reasons why the central banks and other authorities intervene in the exchange rate system. The reasons are as follows:

- To stabilize fluctuations in the exchange rate.

- To reverse the growth of trade deficit

In the pure float, the system is close to a free float, whereas in the dirty float system, it is close to an adjustable peg. There are various other substitutes between the two extremes of fixed and floating exchange rate regimes and these substitutes try to incorporate the good features of both the regimes.

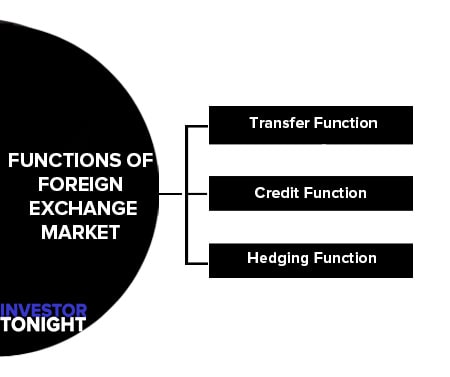

Functions of Foreign Exchange Market

Following are the functions of foreign exchange market:

Transfer Function

To facilitate transfer of power of purchasing between countries: The primary function of the foreign exchange market is to help the transformation of a currency into other currency, which means to accomplish the to and fro movement of power of purchasing between two countries.

This to and fro movement of the power of purchasing is affected by a range of credit instruments, e.g., bank drafts and foreign bills.

Credit Function

To provide credit for foreign trade: Foreign exchange market also functions to provide national credit and international credit to promote foreign trade. Obviously, when payments of international level use foreign bills of exchange, a credit for about 3 months is required, till it matures.

Hedging Function

To furnish facilities for hedging the risks of foreign exchange: In a free-exchange market when exchange rates change, that is, when there is a change in the price of one currency in terms of another, the party concerned may either suffer a loss or a gain.

In such circumstances, a company or a person may take high exchange risks in case of high values of net claims or net liabilities, which are to be met in foreign money. It is best to either avoid or reduce the exchange risks. To enable this, facilities for expected hedging or actual claims or liabilities are provided by foreign exchange markets through forwarding contracts.

For this exchange market provides facilities for hedging anticipated or actual claims or liabilities through forward contract in exchange.

Foreign Currency and Foreign Exchange

- Foreign currency: Any currency other than the Indian rupee is a foreign currency, or in simple terms, the currency of another country.

- Foreign exchange: It includes foreign currency, drafts, bills, letters of credit and travelers cheques that are denominated and payable eventually in foreign currency.

The places where currencies of different countries are bought and sold against each other are called foreign exchange market

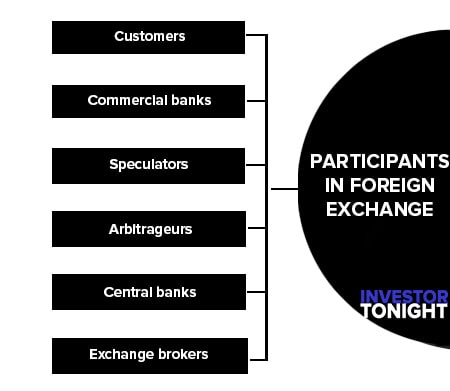

Participants in Foreign Exchange Market

Anyone who exchanges the currency of one country for the currency of another currency will have to participate in the foreign exchange market. The main players in the foreign exchange market can be classified as follows:

Customers

The firms engaged in foreign trade participate in foreign exchange markets by availing the services of banks. An exporter requires the services of a bank for converting his foreign exchange receipts into home currency. An importer requires foreign currency for making payment for the goods imported by him.

Commercial banks

They have been authorized by the central banks to undertake the activity of conversion of one currency into another. They are the most active players in the forex market.

They act as an intermediary between the importers and exporters who are situated in different countries. Commercial banks speculate in foreign currencies, and this is known as trading in the forex market.

Speculators

They buy and sell currencies to make a profit from price movements.

Arbitrageurs

They take advantage of the price differences to make profits in different forex markets.

Central banks

They have the responsibility of maintaining the external value of the currency of a country. If a country is maintaining the fixed exchange rate system, then its central bank has to take the necessary steps for maintaining the rate.

Exchange brokers

They make the parties come together and are governed by the rules of the regulatory body of the country

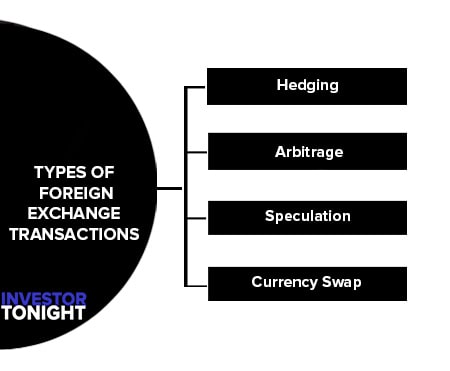

Types of Foreign Exchange Transactions

Types of foreign exchange transactions are:

Hedging

An important feature of the forward exchange market is hedging. Hedging is a method of covering risk arising from a change in the exchange rate. In fact, hedging means settling the exchange rate by agreement 90 days in advance for forwarding transactions with a view to avoiding the loss due to exchange rate fluctuations.

The contract between exporters and importers to sell and buy goods at some future date takes place at current prices and the current exchange rate. There is always a time lag between the deal and the final delivery of goods.

Under a flexible exchange-rate system, it is quite likely that the exchange rate fluctuates and this may reduce profits or altogether wipe them out. The country whose currency depreciates due to exchange rate fluctuations suffers losses. Such losses can be avoided if there is a forward exchange market.

The existence of such a market enables exporters to hedge against risks arising from currency depreciation. Through hedging, the exporter is assured of the value of his exports at the current exchange rate.

Similarly, an importer who enters an agreement to import in future because of anticipated exchange rate fluctuation buys in advance the foreign exchange for payment abroad.

Hedging has certain important advantages:

- It protects against uncertainty in international transactions.

- It ensures the free and regular flow of goods and services between trading partners.

- It prevents loss due to depreciation of the currency of the exporting country.

Arbitrage

Arbitrage is an act of simultaneous purchase and sale of different currencies in two or more exchange markets. The objective is to make profits by taking advantage of exchange rate differentials in the different markets.

The significance of arbitraging lies in the fact that it equalizes the foreign exchange rates in all major foreign exchange markets. Arbitrage operations play a leading role in the transferring of foreign exchange from the markets where the exchange rate is low to the markets where it rate is high.

Thus, arbitrage equalizes the demand for foreign exchange with its supply. It works as a stabilizing factor in foreign exchange markets.

Arbitrage is, however, possible only when the foreign exchange market is free from controls or when controls, if any, are of limited significance. When the purchase and sale of foreign exchange is subject to severe and effective controls, arbitrage becomes impossible.

Speculation

Speculation is the opposite of hedging. In hedging, buyers and sellers try to avoid risk, if any, due to fluctuations in the exchange rate.

Speculative dealers assume risk with a view to making a profit from the fluctuations.

Similarly, speculation is different from arbitraging. In arbitraging, foreign exchange dealers take advantage of two different exchange rates between any two currencies and indulge in the simultaneous buying and selling of currencies. Speculation in foreign exchange is a deliberate assumption of risk to make profits from fluctuations in the exchange rate.

- There are some speculators who expect the exchange rate to decline in the foreseeable future. These speculators with pessimistic expectations are called bears.

- On the other hand, there are other speculators who expect the exchange rate to increase. They are called bulls.

Since bears expect the foreign exchange rate to decline, they sell their currency holding to avoid loss. The bulls, on the other hand, expect the exchange rate to rise, so they buy foreign currency with a view to selling it when the exchange rate increases in the future. Whether bulls and bears gain or lose depends on how correct they are in their expectations about the exchange rate.

Currency Swap

Currency swap is a kind of foreign exchange transaction in which there is a spot sale of a currency and a forward purchase of the same currency in a single sale-purchase transaction.

The currency swap type of foreign exchange transactions are usually made by the banks. It is essentially an interbank transaction.

To explain it further, let us suppose that HDFC bank receives a payment of $1 million which it will need after three months. It spot sells it to SBI against the Indian currency from whom it will make a forward purchase after three months. Both spot sale and forward purchase deals are made under a single transaction. This is known as currency swap.

Foreign Exchange Reserve

Foreign exchange reserves, also known as forex reserves or FX reserves, refers to the supply of foreign currency held by a central bank or other monetary authorities. These reserves are comprised of a variety of international currencies, mostly the United States dollar, the EU’s euro, the British pound, and Japanese yen.

A country needs foreign exchange reserves mainly because of two reasons; (i) to withstand occasional speculative raid by the dealers in the foreign exchange market; and (ii) to synchronize its receipt and payments with the rest of the world.

Holding large foreign exchange reserves is considered beneficial because this gives the country more power to ensure the stability of its economy. In general, the increase of foreign direct investment (FDI) will lead to an increase of the country’s foreign exchange reserves (FER).

Determinates of Foreign Exchange Reserves

The following are the factors that affect foreign exchange reserves in India.

Current Account Balance

The net flow of capital out of a country is equal to domestic saving minus domestic investment; it is also equal to the current account (Higgins and Klitgaard, 2004). A current account surplus then translates into net capital inflows into the country.

Net capital inflows would strengthen the domestic currency. Under a fixed exchange rate system such capital flows must be counterbalanced to maintain the peg, under a flexible exchange rate system the currency would appreciate. If a country wishes to maintain its fixed exchange rate or just wishes to maintain a weaker currency in order to be more competitive, it has to balance the net capital inflows with capital out- flows.

Exchange Rate

Beaufort and Kapteyn (2001) point out that the type of exchange rate system influences reserve demand. Frenkel (1983) found evidence that after the collapse of the Bretton Woods agreement the move to floating exchange rates decreased the level of reserves. In a fixed exchange rate scenario market forces will still act to change the real exchange rate. Therefore, the government will have to intervene to keep the nominal peg.

Marginal Propensity to Import

The marginal propensity to import reflects the openness of the economy. A more open economy is more vulnerable to shock than a closed economy. If reserves are held as a precautionary measure to insulate against shock, it follows that the higher the marginal propensity to import the higher the level of reserves that are needed.