What is an Exchange Rate?

An exchange rate is the value of one nation’s currency versus the currency of another nation or economic zone.

Table of Contents

Exchange rates respond quickly to all sorts of events – both tangible and psychological. The movement of exchange rates is the result of the combined effect of a number of factors that are constantly at play.

Economic factors, also called fundamentals, are better guides to how a currency moves in the long run. Short-term changes are affected by a multitude of factors that need to be examined carefully.

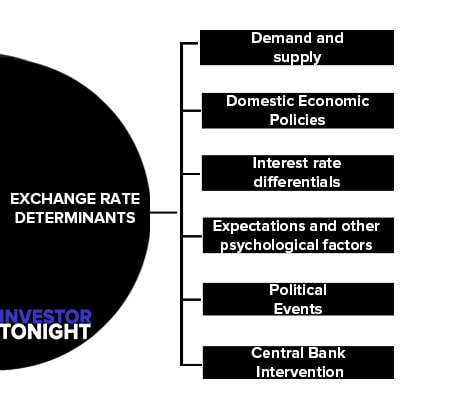

Exchange Rate Determinants

Exchange rate determinants are:

- Demand and supply

- Domestic Economic Policies

- Interest rate differentials

- Expectations and other psychological factors

- Political Events

- Central Bank Intervention

The factors determining exchange rates can be classified into two categories:

- Primary determinants

- Secondary determinants

Primary Determinants

Demand and supply

Demand and supply of a particular currency are the most important factors affecting its exchange rate.

The supply of foreign exchange to a banking system comes from the following:

- Export of goods and services;

- Inflow of foreign capital through foreign direct investment and portfolio investment; profits, interest,

- Dividend and other incomes earned and repatriated to the country by investors abroad;

- Money spent by foreign travellers; expenditure incurred by those involved in foreign diplomatic missions and other international organizations in India; foreign bilateral and multilateral aid, foreign grants and gifts;

- Repayment of loans and interest payments by foreigners.

The demand for foreign exchange comes from the following:

- The import of goods and services;

- Outflow of capital through foreign direct investment and portfolio investment;

- Profits, interest, dividend and other incomes earned by foreigners/corporate bodies and repatriated to their country;

- Indian travellers going abroad for education, medical treatment; pleasure; expenditure incurred by embassies abroad;

- Bilateral loans/aids granted to other countries; subscription payment to international organizations;

- Grants and gifts to other friendly countries; repayment of foreign loans and interest payment; etc.

All these transactions can be classified into three classes which are as follows:

- Purchases and sales for trading purposes

- Speculative deals by professional dealers

- Protective movements by substantial holders

Multinational corporations have certain protective movements in place for their funds to avoid losses. In general, if a country has an import surplus, the exchange rate is likely to depreciate; and in case of export surplus, it is likely to go up.

Example of Factors Affecting Imports and Exports

- Change in the country’s resource endowments, for instance, the discovery of North Sea oil in the UK and natural gas in the Netherlands pushed up the value of the British pound and the Netherlands guilder.

- Change in comparative advantage shift in the demand from the US to Japanese automobiles in the USA and elsewhere pushed up the value of yen.

- Rise in labour cost and loss of competitiveness of a country’s export may erode the value of its currency.

- The demand for a currency can be increased by making it cheaper.

At this stage, it is worthwhile to discuss something about speculative transactions. The speculation involves a conscious assumption of risks.

Speculators take a definite view about currency movements and take an open position. They buy or sell currencies according to their estimates of what the future exchange rate is likely to be from those who want to buy or sell currencies to hedge or to eliminate the speculative element in their transactions.

For example, if the bulls expect the dollar to go up, they purchase dollars forward at current prices to sell later at higher rates. If bears expect the dollar to go down, they sell forward at current rates to purchase later at a lower price. Accounts are usually settled by payment of differences.

A person can choose to behave like a hedger in some cases and like a speculator for some currencies. Thus, there is no watertight compartment between hedgers and speculators. The significance of speculation is that speculators create pressures in the market and may ultimately affect the spot rate as well. Speculative transactions are not permitted in India.

An UNCTAD study shows that the removal of restrictions on financial capital movements and increased financial mobility, have led to the decoupling of currency markets from trade, production and investment, and to the predominance of the speculative component of the market in the determination of exchange rates.

A study by Robert Horde and Andrew Rose also found exchange rates moving with speculators’ expectations for more than economic fundamentals.

Domestic Economic Policies

Policies affecting the internal purchasing power of the currency concerned or, in other words, the relative inflation rates, also affect exchange rates.

A country with a rate of inflation higher than other countries may witness a decline in the value of its currency relative to other currencies, and vice versa. It is based on the purchasing power parity theory (PPP) formalized by Gustav Cassel.

The PPP theory maintains that exchange rates will tend towards the point at which their international purchasing power is equal. Since inflation erodes a currency’s purchasing power, the difference between the inflation rates in two countries will determine how far one currency erodes in terms of the other, i.e., how exchange rates move.

There are two questions that arise in this context.

- Which is the base year when purchasing powers were equal? The choice of the base year is arbitrary in most cases and can make a big difference to the PPP analyst.

- What is the right way to measure inflation in two countries?

Price indices, either of consumer prices or wholesale prices, may not be a good measure as they cover items that are not internationally traded.

There is yet another aspect that affects exchange rates—the increasing importance of capital flows between various countries. As a result, exchange rates are affected not just by the movements of goods.

PPP as a determinant of exchange rates has proved inadequate in explaining exchange rate movements in the short term. Partly, this is because it ignores the importance of transport, insurance and other costs in assessing the relative costs of goods.

But at the same time, the inclusion of relative costs and prices of non-traded goods in the measurement of domestic inflation rates makes the comparison between these inflation rates unreliable in determining the exchange rate equilibrium given that capital flows can influence short-term exchange rate values.

A study of 10 countries for the period 1953–77 showed that countries with higher inflation rates such as the UK and Italy had depreciating currencies whereas those with lower inflation rates such as West Germany and Switzerland had their currencies rising in value.

Secondary Determinants

- Interest rate differentials

- Expectations and other psychological factors

- Political Events

- Central Bank Intervention

Interest rate differentials

Foreign exchange markets and exchange rates are quite sensitive to movements in interest rates. This is because financial markets are becoming more closely linked due to the following:

- The growing interest in international investment.

- The elimination or constraints on the mobility of capital to a large extent.

- More rapid means of communication.

Most investors would like to move their funds from a country having lower interest rates to a country having higher interest rates. Such funds are usually termed as ‘hot money.

If the interest rate in the UK is higher than the interest rate in the USA, investors would find it more profitable to invest funds in the UK and would purchase pounds and sell dollars in the spot market, leading to an upward movement in pound sterling. In fact, the United Kingdom very often uses interest rates as a weapon to push up the ‘pound’.

However, if the rise in the interest rate is due to people expecting a higher inflation rate or bigger budget deficits, there is reason to doubt the strength of the currency as it would not lead to higher investment.

The role of interest rate differences, thus also depends upon what it is caused by. For example, in the early 1980s, interest rates in the UK were pushed way up to reduce demand.

But that led to an exceptionally strong appreciation of sterling, and thus, marked a deterioration in the competitiveness of the UK industry. Similarly, a steady increase of German interest rates between 1988 and 1990 led to a substantial inflow of capital and a rise in the DM.

Expectations and other psychological factors

Very often, these factors have a considerable influence on the exchange rates. Capital flights or short-term capital movements are obvious examples.

The expectations of corporate finance managers, foreign exchange traders and potential speculators do have a profound influence on the exchange rates. These expectations again depend on various factors like the country’s economic policy and economic development, including balance of payments, the discovery of new resources, political stability, movements of capital and so on.

The behaviour of the major participants in the foreign exchange market may make the exchange rate move differently from that determined by economic fundamentals because of their ‘instinct’. Arbitrage and speculative transactions also cause movements in exchange rates, albeit in opposite directions.

Role of Expectations

Current exchange rate, buyers and sellers exert an offsetting influence and the exchange rate remains reasonably stable. But something may happen to change the expectations, such as a change in the government policy and the import policy or a civil disturbance like the Kargil conflict.

Once the balance of expectations is upset, everybody tries to adjust their position by bidding or offering the affected currency. As more of them expect the currency to rise, commercial purchases of that currency speed up and sales are delayed.

As more expect the currency to fall, purchases are delayed and sales speed up. The dynamics of the subsequent changes in the interest rate depend upon market reactions to the factor that stimulate the initial rate movement and the speed and sharpness of the rate change.

If the sentiment about the future exchange rate is predominantly bearish, it will have its impact on the spot exchange rate as well, leading to its depreciation. If the sentiment about the future exchange rate is bullish, the spot rate is likely to go up. If for some reason or the other, trading becomes one-sided, central banks may intervene to provide the counterweight that may not be forthcoming from the market itself.

Political Events

Events such as a change in the government can have a dramatic impact on the exchange rate even before any change in the government policies actually takes place. This occurs on the assumption that changes will be made because of previous experience with the particular party, or because of certain stated intentions in their pre-election platform.

Political stability induces confidence in the investors and encourages capital inflow into the country. This has the positive effect of strengthening the currency of the country. On the other hand, if the political situation in the country is unstable, it makes the investors withdraw their investments.

The resultant outflow of capital from the country weakens the currency. News of political disturbance in different parts of the world often causes the US dollar to appreciate as investors buy dollars, seeking a safe haven for the money in the world’s largest economy.

Central Bank Intervention

The foreign exchange market is of great importance to central bankers because of the impact that exchange rates have on a country’s balance of payments and its competitive position in world markets. Hence, very often, central banks find it necessary to intervene or influence market conditions or exchange rate movements.

Intervention of the Central bank has two kinds of effects:

- Ordinary demand and supply effect: They have the same impact on exchange rate as a purchase or sale by any other market participant.

- In addition, the central bank intervention or its absence may have a continuing influence on market expectations.

It is through the timing and visibility of their operations that the monetary authorities provide indirect information about official attitudes towards current exchange market conditions although market participants may interpret them in different ways while taking their own decisions whether to buy or sell a currency.