What is Employee Provident Fund?

The Employee Provident Fund scheme is a retirement benefit model wherein an equal contribution is made by the employee and the employer towards a secure future. The objective of EPF is to indulge the young generation in long term disciplined investing and reap the benefits in future.

EPF comes under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 and is managed by Employees’ Provident Fund Organization (EPFO). This is mandatory for all organizations with more than 20 employees, whether government or private. It is also mandatory for employees earning a monthly salary of less than ₹15000.

Table of Contents

- 1 What is Employee Provident Fund?

- 2 What is Employee Provident Fund Organization (EPFO)?

- 3 Employee Provident Fund Eligibility

- 4 What is Employee Provident Fund Contribution Rate?

- 5 Employee Provident Fund Benefits

- 6 How to open Employee Provident Fund Account?

- 7 Tax on Employee Provident Fund

- 8 Employee Provident Fund Withdrawal

The Schemes under Employee Provident Fund:

- Employee Provident Fund Scheme, 1952

- Employee Pension Scheme, 1995

- Employees Deposit Linked Insurance Scheme, 1976

The employee’s contribution of 12% goes towards his/her EPF amount. Whereas employers 12% is bifurcated in the above two schemes. It goes like: 3.67% in EPF, and 8.33% in EPS. An additional 1% is contributed by the employer, which is 0.5% in EDLI and 0.5% towards EPF administration charges.

What is Employee Provident Fund Organization (EPFO)?

Employee Provident Fund Organization (EPFO) is the non-constitutional body that manages the EPF scheme. It promotes investing and saving for retirement. The organization was launched in 1951, by the Ministry of Labour and Employment.

EPFO regulates all the functions related to this retirement saving tool. It ensures smooth and transparent functioning of the same. All the queries and problems under EPF can be resolved here.

Employee Provident Fund Eligibility

- Any Indian employee working in the private or public sector in a company of more than 20 employees is eligible to register under the EPF scheme.

- It is even mandatory for people earning a salary of less than ₹15000.

- Employees earning more than ₹15000 have to take permission from the employer and assistant PF commissioner to benefit from the EPF scheme.

What is Employee Provident Fund Contribution Rate?

As mentioned above, the contribution is made by the employer as well as the employee. So, 12% of the salary is deducted from both these accounts separately. For government employees, dearness allowance is also included in the salary.

Although this is the basic math behind the deduction of EPF amount, but let’s look at the two possible ways for contribution calculation:

- If your salary is less than ₹15000, then 12% will only be deducted from your and your employer’s account.

- If your salary is more than ₹15000, then you can choose from any of the two choices given below:

- This is the minimum investment option i.e. 12% of ₹15000 = ₹1800. And the same amount will be contributed from the company’s side too.

- The second option is you choose to deduct 12% of your actual salary amount.

- This is the minimum investment option i.e. 12% of ₹15000 = ₹1800. And the same amount will be contributed from the company’s side too.

The company can either choose to deposit the minimum amount of ₹1800 or 12% of your salary. These terms are discussed between both parties before the PF amount starts getting deducted from your accounts.

You should choose your option wisely and contribute the maximum amount towards EPF because, although your in-hand salary would be a little less, but you will be able to create a pool of money for future or after retirement life.

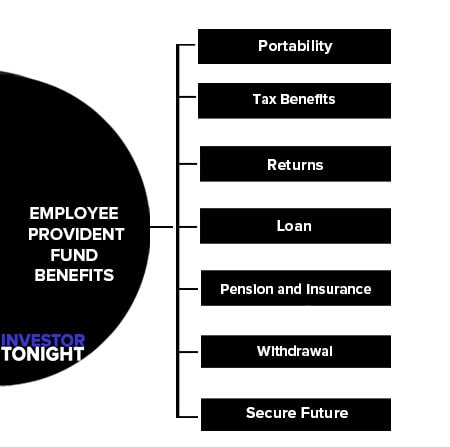

Employee Provident Fund Benefits

Following are the benefits of Employee Provident Fund scheme, offered to the subscribers:

Portability

If you wish to change your job, then there is no need to open a new EPF account or close the previous one. The EPF account can simply be shifted from one employer to another.

Tax Benefits

The scheme falls under the Exempt-Exempt-Exempt category hence, the investment, interest or withdrawals are free from taxes.

Returns

The scheme offers high interest rates which are revised quarterly. Also, whatever interest rate is prevailing, the subscriber will receive the whole benefit without having to pay it in taxes.

Loan

A loan can be taken against your PF account for 3 years during emergency cases and the interest rate can be as low as 1%.

Pension and Insurance

The employer contributes towards the employee’s pension as well as insurance. The life insurance coverage can be up to 7 lakhs.

Withdrawal

In case of emergencies, there are some provisions for withdrawal as well. (Discussed in detail later)

Secure Future

This investment later helps people to lead a better life and use the money for unforeseen circumstances.

How to open Employee Provident Fund Account?

Follow the given steps to open an EPF account:

- Step 1: Visit the official EPFO website.

- Step 2: Under “Established Registration”, sign up in Unified Shram Suvidha Portal.

- Step 3: Fill the registration form by attaching all the necessary documents including Digital Signature Certificate.

Documents Required

- PAN card and ADHAAR card

- Address Proof and GST certificate of registered office

- License Proof

- Cancelled Cheque under your name

Universal Account Number (UAN)

Universal Account Number is required to access or view your EPF account. You need the EPF number and UAN number to activate this account. Follow the steps to activate your UAN:

- Step 1: Visit the official EPFO website.

- Step 2: Go to the “Activate UAN” option and enter the required details.

- Step 3: After filling in all the information click on “Get PIN” to receive a PIN on your mobile number.

- Step 4: Enter this PIN on the portal to create a new user ID and password to access your UAN services.

Tax on Employee Provident Fund

EPF account holders enjoy tax benefits because this scheme falls under the Exempt-Exempt-Exempt (EEE) category. This induces, that the accumulated amount, the interest and the withdrawals are exempt from taxes.

There are certain conditions where the account holder is supposed to bear tax liability which will be discussed under Withdrawals head.

Employee Provident Fund Withdrawal

- You can withdraw your full EPF amount on attaining the age of 58 years i.e. at retirement.

- You can shift your EPF account to your new employer in case of a job change, but if you wish to withdraw the amount on leaving the job, the accumulated amount will be taxed.

- You can withdraw the full amount after completing 5 years of service at one place.

- In case of medical emergencies, one can withdraw the amount accumulated in 6 months of opening the PF account.

- In the case of children’s marriage or higher education you can withdraw up to 50% of the sum but you should’ve served for a minimum of 84 months.

- It can also be withdrawn if you face unemployment for more than 2 months.