The role of public sector banks increased after nationalization of commercial banks. On I July 1955, the government of India took over imperial Bank of India and converted it into the state Bank of India.

In India, the major nationalization of commercial banks was done in July 1969 by Prime Minister Mrs Indira Gandhi. 14 Commercial banks were nationalized in July 1969. In April 1980, 7 more bank were nationalized.

Table of Contents

Need for Nationalization of Commercial Banks

The needs for nationalization of Commercial Banks are given below.

- Commercial Banks were provide loans to large scale Industries and neglected priority sectors.

- Before the nationalization financially strong Bank ignored RBI Directives which adversely effected RBI monetary policy.

- To remove the fear of bank failures from the minds of people.

- To keep means of generating wealth in public control.

- To remove regional imbalances and ensure even distribution of banking facilities.

- To prevent unfair credit distribution by commercial banks

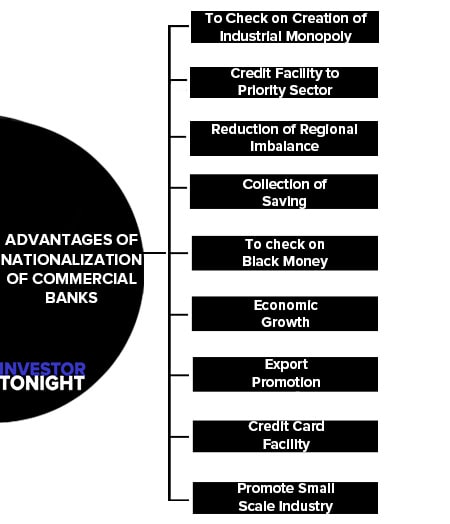

Advantages of Nationalization of Commercial Banks

Some of the advantages of Nationalization of Commercial Banks are as follows:

- To Check on Creation of Industrial Monopoly

- Credit Facility to Priority Sector

- Reduction of Regional Imbalance

- Collection of Saving

- To check on Black Money

- Economic Growth

- Export Promotion

- Credit Card Facility

- Promote Small Scale Industry

To Check on Creation of Industrial Monopoly

Before nationalization of commercial banks credit was concentrated to few hands and this formed Industrial Monopoly. No person except big Industrialist could get loan and advances. This neglected the other smaller industrialist. So, commercial banks were nationalized to curb the monopolizing tendencies.

Credit Facility to Priority Sector

Agriculture sector is backbone of India. This sector was neglected at that time. There was no credit facility available to agriculture sector before nationalization.

Reduction of Regional Imbalance

Regional imbalances had existed in India for a long time in area of banking facilities. After nationalization, branches opened in backward states like Assam, Bihar, Uttar Pradesh than in developed states like Gujarat, Tamil Nadu etc. These banks reduced the Regional Imbalances.

Collection of Saving

Before the Nationalization, the banks did not attract more saving from public. Because people did not trust banking system . But After nationalization of commercial Banks, the deposits were increased. Because public believed in public sector Bank then private sector Banks.

To check on Black Money

In order to avoid income tax, people kept money with banks. For the solution of this problem the banks were nationalized.

Economic Growth

Before nationalization of banks, economy of country was not growing due to antisocial practices, speculation and hoarding. The country’s economy suffered badly. In order to solve this problem banks were nationalized.

Export Promotion

Commercial Banks also promotes export. Because there is need to promote export for earn Foreign exchange. So, Banks give Finance to Exporter at concessional rates.

Credit Card Facility

Credit card facility is provided by these Banks which has made our life easy. people can buy necessary things through credit card an make payment later on.

Promote Small Scale Industry

Nationalized commercial Banks encouraged small scale Industry by granting Loans. These bank grant short term and long term loan to purchase machinery and equipment

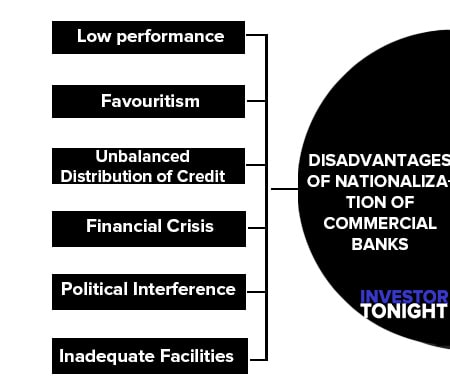

Disadvantages of Nationalization of Commercial Banks

- Low performance

- Favouritism

- Unbalanced Distribution of Credit

- Financial Crisis

- Political Interference

- Inadequate Facilities

Low performance

The biggest problem of nationalized banks has been their low performance. Banks are required to keep minimum capital to risk asset ratio which known as capital adequacy ratio. It should be 9%.Most of public sector banks had negative ratio. Only four banks maintained ratio during 1999-2000.

Favouritism

Another limitation of commercial banks was favouritism in granting loan. They harass certain small industrialist and same time banks grant loan to big industrialist on easy terms and conditions. They follow the policy of partiality which affected the trust of client in banks working.

Unbalanced Distribution of Credit

In initial years, Agriculture sector got priority and other sector were neglected. Bank do not advance loan to weaker section such as laborer, worker and small trader due to lack of security.

Financial Crisis

After nationalization, some banks were operating under losses .This is because banks advance loan without adequate security. Banks grant non performing loans which interest has not been received for 180 days. The recovery of loan was poor which lead to losses. This is main reason for failure of banks.

Political Interference

Another limitation of nationalized commercial banks was increasing the political interference in granting loans, appointment of banks personnel, opening of new branches etc.

Inadequate Facilities

Nationalized commercial banks have failed to provide adequate facilities and services to population living in rural and sub urban area. Banks failed to mobilize rural deposit.