What is Commercial Banks?

Commercial Banks is financial Institution that accepts deposits for the purpose of lending. In other words, commercial Banks provide services such as accepting deposits, giving business loans and also allow for variety of deposit accounts.

They collect money from those who have it to spare and lend to those who require it. Commercial Bank is a banker to the general public. Commercial Banks registered under Indian companies Act, 1936 and are also governed by the Indian Banking Regulation Act, 1949.

Table of Contents

Commercial Banks Definition

The accepting, for the purpose of lending or Investment, of deposits of money from public, repayable on demand or otherwise and withdrawable by cheque, draft, order or otherwise. – Charles T. Horngren Indian Companies (Regulation) Act, 1949

According to Prof. Kinley, “A bank is an establishment which makes to individuals such advances of money as may be required and safety made, and to which individuals entrust money when not required by them for use.“

No body can be a banker who does not

- take deposit accounts

- take current accounts

- issue and pay cheques

- Collect cheques- crossed and uncrossed for its customers

Structure of Commercial Banks

Commercial banks are basically of two types.

Scheduled Banks

Scheduled banks are those which have been in II schedule of Reserve Banks of India act, 1934 and following criteria should satisfied.

- Minimum paid up capital Rs. 5 lakh.

- It must be a corporation as co-operative society.

- Any activity of bank will not adversely affect the interest of depositors

- Public Sector Banks: Public banks are those in which 50% of their capital is provided by central government, 15% by concerned state government and 35% by sponsored commercial banks. In India, there are 27 public sector banks.

They includes the state bank of India and its 6 associated banks such as state bank of Hyderabad, state bank of Mysore etc. and 19 nationalized banks and IDBI banks Ltd. Public sector banks mostly situated in rural area than urban area. - Private Sector Banks: Private Banks are those in which majority of share capital kept by business house and individual. After the nationalization, entry of private sector banks is restricted. But some of private banks continued to operate such as Jammu & Kashmir bank Ltd.

To increase the competition spirit and improve the working of public sector banks, RBI permitted the entry of private sector banks in July, 1993. - Foreign Banks: Foreign banks are those which incorporated outside India and open their branches in India. Foreign banks performed all the function like other commercial banks in India.

Foreign banks are superior in technology and management than India banks. They offer different types of products and services such as offshore banking, online banking, personal banks etc.

They provide loans for automobiles, small and large businesses. Foreign banks also provide special types of credit card which are nationally and internationally accepted. These banks earn lots of profit and create new ways of investments in the country. - Regional Rural Banks: Regional rural banks established 1975 with mandate to ensure sufficient credit for agriculture and rural sector. RRB’s are jointly owned by government of India, concerned state government and sponsor bank.

The capital share being 50 %, 15% and 35% respectively. Now these Days, there are 14,475 regional rural banks in India. NABARD control and prepare the policies for Regional Rural Banks.

The basic objective of establishing RRB’s in India was to provide the credit to rural sector especially the small and medium farmers, artisans, agricultural labour and even small entrepreneurs.

Non Scheduled Banks

Non scheduled banks in India define in clause (C) of section 5 of Banks regulation Act 1949. Non scheduled banks are those which are not a schedule bank and their paid up capital and reserves less than Rs.5 lakh and are not included in the 2nd schedule of the Reserve Bank of India Act, 1934

Functions of Commercial Banks

Accepting Deposits

Accepting deposits is one of major function of commercial bank. It is the business of bank to accept deposits so that he can lend it to other and earn interest. Basically, the money is accepted as deposit for safe keeping. Banks also pay interest on these deposits. To attract depositors banks maintain different types of accounts.

These are as following.

- Fixed Deposit Accounts: The account which is opened for fixed period by depositing amount is known as fixed deposit account. The money deposited in this account cannot be withdrawn before expiry of period. A high rate of interest is paid on fixed deposits.

- Current Deposit Account: Current deposit accounts are mostly opened by businessmen and traders who withdraw money number of times a day. Banks dose not pay interest on these types of account. The bank collects certain charges from depositors for services rendered by it.

- Saving Account: Saving account is most suited for those people who want to save money for future needs. This types of account can be opened with a minimum initial deposit. A minimum balance has to be maintained in account as prescribed by bank. Some restrictions are imposed on depositor regarding number of deposit withdrawal and amount to be withdrawn in given period.

- Recurring Deposit Account: The purpose of these accounts is to encourage public for regular saving, particularly by fixed income group. Fixed amount is deposit is deposited at regular intervals for a fixed term and repaid on maturity.

Grant of Loans and Advances

Besides accepting deposit, the second most important function of commercial bank is advancing of loan to the public. After keeping certain part of deposits received by bank as reserve and the rest of balance given as loan. The different types of loan and advances are given by bank as follow.

- Call Money: There are generally short term credit that range from one day to fort night. There are even one nigh call money advances made available to bank with the help of this market. The rate of interest depends upon the conditions prevailing in money market.

- Overdraft: In over draft, a customer can withdraw money from his current account and available balance below zero. When the amount withdrawn is within the authorized limit then rate of interest charged at agreed rate. Overdraft is allowed normally against the security of negotiable Instrument and credit worthy customers without security.

- Cash Credit: In cash credit, Bank advance loan against the customer current asset or personal guarantee. The borrower has option to withdraw the funds as and when required to extent of his needs but he cannot exceed the credit limit allowed to him. The cash credit limit depends on the debtor’s need and as agreed with the bank. The bank charges interest only on money withdrawn from by them.

- Discounting of Bills: Under this type of lending, Bank pay amount before due date of bill after deducting certain rate of discount or commission. The holder of bill get money immediately without waiting for the date of maturity. If bill of exchange dishonored on due date the bank can recover the amount from the customer.

- Direct Loan: A loans granted for a fixed maturity period more then one year. Loans are usually secured against some collateral security. The borrower can withdraw entire money through cheques. The interest is charged on entire amount of loan. Repayment of loan either in installments or in lump sum.

Credit Creation

Credit creation is also an important function of commercial Bank. The process of credit creation is automatically performed when banks accept deposits and provide loans.

Prof Sayers says, “Banks are not merely supply of money but in an important sense, they are manufacturers of money”. In this process, customers deposit their money in bank. Bank keeps certain amount of deposit as cash reserve and rest of balance given as loan and advances.

Banks not required to keep the entire deposits in cash. The amount of loan does not give directly to borrower. The borrower open a account and then bank deposit money in that account. Here, banks lend money and the process of credit creation starts. The current cash reserve ratio is 6% in 2011.

Secondary Functions

Secondary function are as follow:-

- Sale and Purchased of Securities: On the behalf of customer, commercial bank sale and purchase of the securities of private companies as well as government securities.

- Transfer of Funds: Commercial Bank also provide facilities to transfer funds from one place to another place in form Bank draft, cheques, mail transfer etc.

- Collection and Payment of Credit Instrument: Commercial Bank collect and make payment on behalf of their customers Commercial Bank collect and pay negotiable instruments and also pay rent, income tax fees, insurance premium etc.

- Locker Facility: Commercial Banks provides locker facility to their customers. We can keep gold, silver and important documents in locker.

- Letter of Credit: Letter of credit certified the credit worthiness of their customers which issued by commercial banks.

- Collection of Information: Commercial Banks also collect the information relating to Industry, trade, commerce which made available to their customers.

- Traveller’s Cheque ad Credit Card: Commercial Banks issue traveller’s cheques and credit cards to their customers. They can travel without fear of theft and loss of money. Credit card is used to make payment for purchases so that individual does not have to carry cash.

- Foreign Exchange: Commercial banks provide facility to their customers dealing in foreign exchange. Commercial Banks are authorized dealers in India.

- Issuing of Gift Cheques: Commercial Banks issues the gift cheques like Rs 11,51, 101,501 etc.

- Educational Loans: Commercial Banks also provide educational loan to student for higher studies at reasonable rate of interest.

- Consumer Finance: Commercial Banks provide consumer finance facility for purchase consumer durables like televisions, refrigerators etc.

- Automated Teller Machine: Now a days with the help of ATM, we can deposit or withdraw money from our account any time.

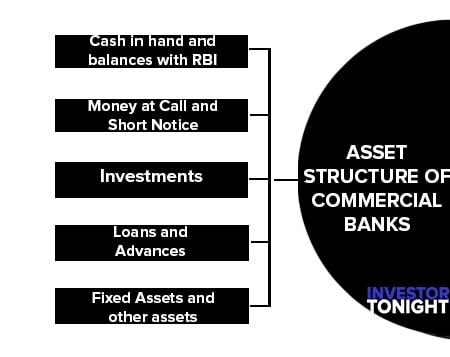

Asset Structure of Commercial Banks

Assets structure will reflect the deployment of sources of funds of commercial banks.

- The main source of funds of commercial banks deposits.

- The other sources of funds are borrowings from other banks, capital, reserves and surplus.

The deposits of commercial banks are from savings deposits, current account deposits and term deposits. These deposits constitute 80 percent of the total sources of funds. Out of the total deposits, term deposits constitute 50 percent. Borrowings are around 5 percent of the total liabilities of commercial banks. These sources are deployed by the commercial banks mainly on their financial assets i.e, loans and advances which constitute 48.6 percent of the total assets of the banks.

Investments are another important component of the assets of commercial banks which is around 40 percent of the total assets of the banks during the year 2005. This is because of pre-emptions like SLR and CRR requirements in the banking sector.

The investments in commercial banks have increased also because of surplus liquidity in Indian banks during this period due to the reduction of SLR and CRR to 25 and 4.5 respectively during that period and less demand for loans and advances from credit-worthy customers. This scenario is changing in India due to increasing demand in credit from industrial, agriculture sectors and also the growth of FMCG market.

Now let us examine each of the important assets of the commercial bank:

- Cash in hand and balances with RBI

- Money at Call and Short Notice

- Investments

- Loans and Advances

- Fixed Assets and other assets

Cash in hand and balances with RBI

From the point of liquidity in the commercial banks, cash in hand is a very important asset but it is idle and it will not fetch any earnings to the banks. Cash in commercial banks depends upon various factors like uncertainty in the economy due to wars, famine, internal disturbance, the growth of the banking system, a network of branches, networking of banks, automation in banks and so on.

The cash reserve requirements in the commercial banks was more during the pre-reform period it was 15 percent during the year 1994- 95. Gradually RBI reduced it to 4 percent based on the requirements of credit and it is now 5 percent on Net Demand and Time Liabilities.

Money at Call and Short Notice

It is the second line of defense of the commercial banks in cases of emergencies. If the call money market is well developed the commercial banks can lend their surplus funds in the call market for a day or up to 14 days it is called call market or overnight market without keeping their surplus money idle. It can also lend for short period, where the borrower has to return the money borrowed from the banks when short notice is given by the banks.

This is becoming a good business in the money market and constitutes around 4 percent of the total assets of the commercial banks. The banks instead of keeping the money idle lend their surplus funds for short periods in the call market.

Investments

Investments constitute one of the important assets of the bank next to loans and advances. A bank makes investments for the purpose of earning profits. First, it keeps primary and secondary reserves to meet its liquidity requirements. Banks invest in securities either for fulfilment of SLR/CRR requirements or for earning a profit on idle funds. Banks invest in “approved securities” (predominantly Government securities) and “others” (shares, debentures and bonds). The values/rates of these securities are subject to change depending on the market conditions.

Some securities are transacted frequently and some are held till maturity. Total investments during the year 2005 by the commercial banks in India were Rs. 8,43,081 crores which is 37 percent of the total assets.

During the month of February and March 2006, the investments in Indian commercial banks have reduced because of heavy demand for credit. Some banks even sold their surplus investments in government securities which was more than SLR requirements and converted them into cash for lending.

Loans and Advances

The commercial banking industry in India has been playing a very important role in intermediating between the economic units, which have surpluses and deficits in their current budgets. By mobilizing financial surpluses in the economy and by channeling these resources into various sectors and segments of the economy, they are guiding the pattern of utilization of a large proportion of the economy.

The Government of India which owns a large segment of the industry, and the RBI, which is the central banking authority of the country, have been persuading the commercial banks to deploy larger and larger volumes of financial resources into certain identified priority sectors, for the purpose of accelerating the growth of these sectors. The total advances of commercial banks include bills purchased and discounted, cash credits, overdrafts, loans, unsecured loans, and priority sector advances.

The component of loans and advances in the total assets of commercial banks is 48 to 50 percent—in fact still growing in India. The management of this asset is a very important aspect in the banking sector. The non-performing assets in banks is increasing. In addition to this banks are exposed to various risks such as credit risk, liquidity risk, market risk and operational risk.

Fixed Assets and other assets

The component of fixed assets and other assets do not form an important aspect in the funds of commercial banks since deals are more in financial assets than real assets.

Role of Banks in Economic Development

Commercial banks are one source of financing for small businesses. The role of commercial banks in economic development rests chiefly on their role as financial intermediaries. In this capacity, commercial banks help drive the flow of investment capital throughout the marketplace. The chief mechanism of this capital allocation in the economy is through the lending process which helps commercial banks.

Risk

One of the most significant roles of commercial banks in economic development is as arbiters of risk. This occurs primarily when banks make loans to businesses or individuals. For instance, when individuals apply to borrow money from a bank, the bank examines the borrower’s finances, including income, credit score and debt level, among other factors.

The outcome of this analysis helps the bank gauge the likelihood of borrower default. By weeding out risky borrowers, commercial banks lessen the risk of financial losses.

Small Business

Commercial banks also finance business lending in a variety of ways. A business owner may solicit a loan to finance the start-up costs of a small business. Once funded, the small business may begin operations and embark on a growth plan. The aggregate effect of small business activity generates a significant portion of employment around the country.

Wealth

Commercial banks also offer types of accounts to hold or generate individual wealth. In turn, the deposits commercial banks attract with account services are used for lending and investment. For example, commercial banks commonly attract deposits by offering a traditional menu of savings and checking accounts for businesses and individuals.

Similarly, banks offer other types of timed deposit accounts, such as money market accounts and certificates of deposit.

Government Spending

Commercial banks also support the role of the federal government as an agent of economic development. Generally, commercial banks help fund government spending by purchasing bonds issued by The Department of the Treasury.

Both long and short-term Treasury bonds help finance government Operations, programs and support deficit spending.

Commercial Banks Problem

The Commercial Banks’ biggest problem at present is the existence of a huge amount of non-performing assets.

According to the stress tests of the RBI, the gross non-performing assets (GNPAs) ratio of scheduled commercial banks may increase to 9.80 percent by March 2022 from 7.48 percent in March 2021 under the baseline scenario; and to 11.22 percent under a severe stress scenario.

All categories of the banks-public sector, private sector and foreign banks face this problem. The Government of India and the Reserve Bank of India have taken various initiatives to reduce the magnitude of NPAs.

These initiatives include:

Establishment of Debts Recovery Tribunals

After the enactment of the Recovery of Debts due to Banks and Financial Institutions Act 1993, twenty-three Debt Recovery Tribunals have been established at various places in India. These Tribunals ensure expeditious adjudication and recovery of debts due to banks and financial institutions. Recently, these Tribunals have been granted more powers for this purpose. These Tribunals deal with claims of banks exceeding Rs. 10 lakhs each.

Proposed Establishment of Asset Reconstruction Companies

Government has issued an ordinance in June 2002 * permitting the setting up of Asset Reconstruction Companies. These companies will take over the non-performing assets from banks and financial institutions and will try to realize them as soon as possible.